Lithium Iron Phosphate High Voltage Battery Market

Lithium Iron Phosphate High Voltage Battery Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Stationary, Portable), By Application (Automotive, Industrial, Energy Storage Systems, Consumer Electronics, Others), By Region, By Competition, 2018-2028

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2024-2028 |

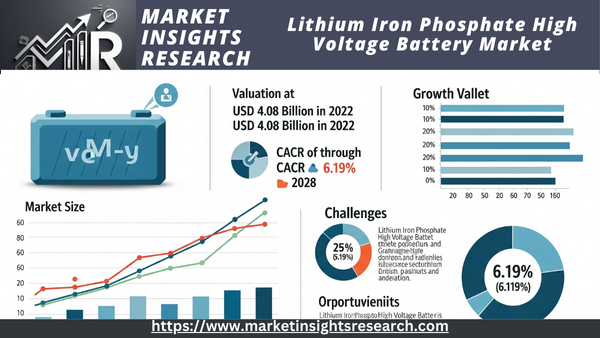

| Market Size (2022) | USD 4.08 Billion |

| CAGR (2023-2028) | 6.19% |

| Fastest Growing Segment | Industrial |

| Largest Market | Asia Pacific |

Market Overview

The global Lithium Iron Phosphate High Voltage Battery Market reached a valuation of USD 4.08 billion in 2022. Projections indicate strong growth in the coming years, with an anticipated Compound Annual Growth Rate (CAGR) of 6.19% through 2028.

Download Free Sample Ask for Discount Request Customization

These high-voltage LiFePO4 batteries are distinguished by their outstanding safety features, extended cycle life, and strong thermal stability. They have garnered considerable attention and market presence due to their suitability for a wide range of applications, including electric vehicles (EVs), renewable energy storage systems, telecommunications infrastructure, uninterruptible power supplies (UPS), and more.

Key aspects of the LiFePO4 High Voltage Battery market include its role in reducing carbon emissions, improving grid stability through the integration of renewable energy, and facilitating the electrification of transportation. As the world moves towards sustainable energy solutions, the LiFePO4 High Voltage Battery market is crucial in meeting the increasing demand for high-performing, safe, and dependable energy storage solutions across numerous industries and applications.

Key Market Drivers

Rising Demand for Electric Vehicles (EVs)

Because of the growing demand for electric vehicles (EVs), the market for lithium iron phosphate high voltage batteries is expanding significantly on a global scale. EVs have become incredibly popular as the world moves toward more environmentally friendly modes of transportation. LiFePOâ‚„ batteries' high energy density, extended cycle life, and improved safety features have made them a popular option for EV producers.

LiFePO4 batteries' exceptional safety profile is one of the main factors propelling their acceptance in the EV market. LiFePO4 batteries are a safer alternative for EVs than conventional lithium-ion batteries since they are less likely to overheat and experience thermal runaway. Consumer trust in EVs has increased as a result of this safety feature, which has also prompted automakers to include LiFePO4 batteries in their car designs.

Additionally, governments around the world are implementing strict emissions laws and offering financial incentives to promote the adoption of electric cars. The need for LiFePOâ‚„ high-voltage batteries is being further fueled by these regulatory actions, which are forcing automakers to create more electric cars.

Renewable Energy Integration

The incorporation of renewable energy sources into the power grid is another significant factor propelling the global market for LiFePOâ‚„ high-voltage batteries. The need for effective energy storage systems has skyrocketed as nations work to cut carbon emissions and switch to cleaner energy.

LiFePOâ‚„ batteries' capacity to deliver consistent power production over long periods of time makes them ideal for energy storage applications. They can store extra energy produced by renewable resources like solar and wind, guaranteeing a steady supply of electricity even in the absence of the sun or wind. To meet the increasing demand for renewable energy and preserve grid stability, this dependability is essential.

Download Free Sample Ask for Discount Request Customization

Energy Storage in Remote and Off-Grid Areas

In isolated and off-grid areas where a dependable power grid is scarce, LiFePO4 high-voltage batteries are proving essential for providing electricity. These batteries can store surplus energy produced by local renewable sources or diesel generators and release it as required, guaranteeing a consistent power supply.

LiFePOâ‚„ batteries are especially well-suited for these remote applications thanks to their durability and minimal maintenance requirements. They can endure tough environmental conditions and offer a reliable power source for off-grid communities, telecommunications infrastructure, and industrial facilities in faraway locations.

Advancements in Battery Technology

The market is expanding due to ongoing developments in LiFePOâ‚„ battery technology. Improvements to LiFePOâ‚„ batteries' energy density, cycle life, and charging capabilities are ongoing efforts by manufacturers and researchers. These developments are increasing the spectrum of uses for LiFePOâ‚„ batteries and making them more competitive with other varieties of lithium-ion batteries.

LiFePO4 batteries are becoming a more appealing option for various high-voltage applications due to advancements in electrode materials, manufacturing processes, and design optimizations that result in increased energy density and quicker charging periods.

Increasing Renewable Energy Capacity

LiFePOâ‚„ high-voltage batteries and other energy storage solutions are in enormous demand as nations throughout the world invest more in renewable energy generation. To balance supply and demand, large-scale renewable energy projects, such as wind and solar farms, need effective energy storage systems.

LiFePO4 batteries are perfect for storing extra energy produced by these renewable sources and providing it when needed because of their outstanding energy efficiency and quick reaction times. This process facilitates a more consistent and dependable clean energy source, which speeds up the energy industry's adoption of LiFePOâ‚„ batteries.

Growth of Telecommunications and Data Centers

The telecommunications and data center sectors are seeing explosive growth, fueled by the ever-increasing need for high-speed internet, cloud computing, and mobile connectivity. These industries rely on uninterruptible power supplies (UPS) to guarantee continuous operation and the protection of valuable data.

LiFePOâ‚„ high-voltage batteries are increasingly becoming the top pick for UPS applications because of their reliability, extended cycle life, and lower maintenance expenses when compared to conventional lead-acid batteries. As the demand for these critical infrastructure services continues to rise, so too does the demand for LiFePOâ‚„ batteries, establishing them as a crucial driving force in the global market.

In summary, the global Lithium Iron Phosphate High Voltage Battery market is being propelled by a host of factors, including the growing appetite for electric vehicles, the integration of renewable energy, energy needs in remote and off-grid areas, continuous advancements in battery technology, increasing renewable energy capacity, and the expansion of telecommunications and data centers. These drivers collectively contribute to the expanding role of LiFePOâ‚„ batteries across various sectors and firmly establish their position as a key player in the future of energy storage.

Download Free Sample Ask for Discount Request Customization

Government Policies are Likely to Propel the Market

Electric Vehicle Incentives and Subsidies

The LiFePO4 High Voltage Battery market is significantly impacted by government policies that promote the use of electric vehicles (EVs). To lower the cost of EVs for customers, numerous nations have introduced incentives and subsidies. Tax credits, refunds, lower registration costs, and exemptions from tolls and congestion fees are common examples of these incentives.

Governments may provide EV manufacturers and suppliers with financial assistance to encourage the development of electric vehicles and LiFePOâ‚„ batteries, which would benefit consumers as well. Reduced greenhouse gas emissions, better air quality, and the expansion of the clean transportation industry are the goals of these initiatives.

The federal government and some states in the United States provide tax credits of up to several thousand dollars to increase the appeal of electric vehicles with LiFePO4 batteries.

Renewable Energy Targets and Mandates

Government policies pertaining to renewable energy targets and mandates significantly impact the market for LiFePO4 High Voltage Batteries. Numerous nations have set lofty targets to raise the proportion of renewable energy in their energy mix. Governments frequently offer monetary incentives, subsidies, and preferential treatment to renewable energy projects that employ LiFePOâ‚„ batteries for energy storage to meet these goals.

These policies support the expansion of the LiFePO4 battery business in addition to promoting the installation of renewable energy systems. Large-scale renewable energy projects utilizing LiFePOâ‚„ battery storage are encouraged by China's Renewable Energy Law, which mandates that grid operators buy all electricity produced from renewable sources.

Environmental Regulations and Battery Recycling

The market for LiFePOâ‚„ high-voltage batteries is heavily influenced by government rules that are intended to protect the environment and promote sustainability. The recycling and disposal of lithium-ion batteries, especially LiFePO4 batteries, are subject to stringent laws in many nations. These rules mandate that battery producers and consumers handle and recycle batteries in an environmentally responsible manner at the end of their useful lives.

Such regulations encourage a circular economy for LiFePOâ‚„ batteries by giving recycling businesses options and motivating battery makers to design products with recycling in mind. The Battery Directive of the European Union, for instance, mandates that manufacturers label batteries with recycling information and establishes recycling targets.

Energy Storage Procurement and Grid Integration

Government strategies that encourage the acquisition of energy storage and its integration into the power grid are vital for the LiFePO4 High Voltage Battery market. Numerous governments acknowledge the crucial role of energy storage in stabilizing the grid and incorporating renewable energy sources. To foster the deployment of LiFePOâ‚„ batteries for large-scale grid applications, governments might establish procurement programs and offer financial incentives for energy storage projects.

As an example, in the United States, the Federal Energy Regulatory Commission (FERC) has issued directives aimed at promoting the integration of energy storage into the grid. These directives create opportunities for LiFePOâ‚„ battery manufacturers to provide energy storage solutions that enhance grid reliability and flexibility.

Research and Development Funding

The market for LiFePO4 High Voltage Batteries is directly impacted by government financing for battery technology research and development (R&D). Governments frequently provide funding to promote research and development projects that enhance battery price, performance, and safety. These programs stimulate creativity and hasten the commercialization of advanced LiFePOâ‚„ battery technology.

The Advanced Research Projects Agency-Energy (ARPA-E) of the U.S. Department of Energy, for instance, funds high-risk, high-reward battery research initiatives. LiFePOâ‚„ battery technology has advanced as a result of these efforts, increasing its competitiveness and appeal for a range of uses.

Trade Tariffs and Export Restrictions

The global supply chain and market dynamics are two areas where trade regulations and export restrictions can have a big impact on the LiFePO4 High Voltage Battery market. As part of trade disputes or national security concerns, governments may impose trade restrictions or tariffs on lithium-ion batteries, including LiFePOâ‚„ batteries.

For instance, shifts in trade regulations between the main producing nations may cause supply chain disruptions and variations in the cost and accessibility of LiFePOâ‚„ batteries. Additionally, by affecting manufacturing costs, export limitations on vital raw materials used in battery manufacture might impact the worldwide LiFePO4 battery market.

In conclusion, the global market for LiFePO4 High Voltage Batteries is significantly impacted by government policies, including trade tariffs, environmental restrictions, energy storage procurement programs, incentives for electric vehicles, renewable energy targets, and R&D funding. These regulations impact customer behavior, mold market dynamics, and spur advancements in LiFePO4 battery technology. In this quickly changing economy, it is essential for investors and industry players to comprehend and adjust to these policies.

Key Market Challenges

Cost and Competitive Pricing Pressure

A major hurdle for the global LiFePO4 High Voltage Battery market is the ongoing issue of cost and the pressure of competitive pricing. While LiFePOâ‚„ batteries boast several benefits like safety, long cycle life, and stability, their manufacturing has historically been more expensive compared to other lithium-ion battery chemistries, such as lithium cobalt oxide (LiCoOâ‚‚) or lithium manganese oxide (LiMnâ‚‚Oâ‚„).

This cost challenge stems from several areas

- Raw Materials Producing LiFePO4 batteries requires key raw materials, including lithium, iron, phosphorus, and other elements. The availability and prices of these materials can fluctuate, affecting the overall cost of battery production.

- Manufacturing Complexity LiFePO4 batteries are more intricate to manufacture than some other battery types due to the need for precise control during the synthesis of the cathode material and the overall electrode assembly process.

- Scale of Production Achieving economies of scale in LiFePOâ‚„ battery production has been a challenge. While mass production can help lower costs, reaching high-volume production has historically been difficult due to slower adoption compared to other lithium-ion chemistries.

- Competitive Pressure Fierce competition within the lithium-ion battery market, along with advancements in other battery technologies, has pushed LiFePO4 battery manufacturers to maintain competitive prices.

To tackle this cost challenge, battery manufacturers are continuously investing in research and development to streamline production processes, lower material costs, and enhance energy density. Furthermore, economies of scale are gradually being realized as LiFePOâ‚„ batteries gain broader acceptance in various applications, especially electric vehicles and renewable energy storage.

Another strategy being used to lessen cost issues is the development of hybrid battery systems that combine LiFePOâ‚„ cells with other advanced lithium-ion chemistries. This approach aims to capitalize on the safety and stability of LiFePOâ‚„ with the higher energy density of other chemistries to offer competitive and cost-effective solutions.

Energy Density and Range Limitations

The energy density and range constraints of LiFePOâ‚„ batteries, particularly in relation to electric vehicles (EVs), represent a major obstacle for the global LiFePO4 High Voltage Battery market. EV driving range may be impacted by LiFePOâ‚„ batteries' lower energy density when compared to some other lithium-ion chemistries, despite their extended cycle life and reputation for safety.

Since it has a direct impact on how far an EV can go on a single charge, energy density is an important factor. LiFePO4 batteries usually have a lower specific energy (Wh/kg) compared to the chemistries commonly found in higher-end EVs, such as lithium nickel manganese cobalt oxide (Li-NMC) or lithium nickel cobalt aluminum oxide (Li-NCA).

This problem can be divided into several important parts

Driving RangeCompared to EVs with higher-energy-density alternatives, EVs with LiFePO4 batteries may have a shorter driving range. This restriction may deter potential EV purchasers who require longer driving ranges.

WeightCompared to other lithium-ion chemistries with comparable energy capacities, LiFePO4 batteries often weigh more. Vehicle performance and economy may suffer as a result of the additional weight.

Charging SpeedIn comparison to certain other chemistries, LiFePOâ‚„ batteries may charge more slowly. For EVs, faster charging is essential, particularly when traveling long distances.

Manufacturers of LiFePO4 batteries are spending money on research and development to improve the performance of LiFePO4 cells to overcome these energy density and range constraints. This effort entails creating novel electrode materials, refining cell architectures, and investigating cutting-edge production methods.

To partially overcome the energy density issue, automakers are also attempting to increase the overall efficiency of EVs. This work covers developments in regenerative braking, lightweight materials, and aerodynamics.

In conclusion, even though LiFePOâ‚„ batteries have a lot to offer in terms of safety and cycle life, the global market for LiFePO4 High Voltage Batteries needs to overcome major obstacles like cost and energy density restrictions, particularly when it comes to electric vehicles. Ongoing research and development are crucial for overcoming these obstacles and increasing the use of LiFePOâ‚„ batteries in more applications.

Segmental Insights

Portable Insights

In 2022, the portable segment had the biggest market share. Consumer electronics like computers, tablets, and smartphones may use portable LiFePOâ‚„ batteries more frequently. Customers who are worried about battery safety and the endurance of their gadgets may find them more appealing because of their stability, safety, and extended lifespan. Mobile power banks are becoming more and more popular as a way to charge portable electronics while on the road. LiFePOâ‚„ batteries may become more well-liked in this market niche if they provide advantages over competitors. Outdoor and recreational devices like electric bicycles, drones, and camping gear may use portable LiFePOâ‚„ batteries more frequently. These applications frequently call for power sources that are dependable, strong, and long-lasting. Because of their dependability and safety, LiFePO4 batteries can be used in medical equipment such as portable oxygen concentrators and medical monitors, which could increase demand in the healthcare industry. Adoption in portable and mobile contexts may be fueled by applications that particularly benefit from LiFePOâ‚„ batteries' properties as new technologies and breakthroughs are developed. Because LiFePOâ‚„ batteries have a lower danger of thermal runaway and are made of ecologically acceptable materials, changes to safety laws or environmental standards may promote their adoption in portable devices.

Automotive Insights

The automotive segment held the biggest market share in 2022. LiFePO4 batteries are renowned for having an outstanding safety record. In contrast to certain other lithium-ion chemistries, they are less likely to experience thermal runaway and overheating. Safety is a top priority in the automobile industry, which makes LiFePO4 batteries a desirable option for hybrid and electric cars. Compared to many other types of lithium-ion batteries, LiFePO4 batteries have a longer cycle life. In the automobile sector, where longevity and durability are crucial for guaranteeing the dependability and resale value of EVs, this longer lifespan is especially advantageous. In the automobile industry, where battery packs may encounter higher operating temperatures during extended usage or rapid charging, LiFePOâ‚„ batteries' increased resilience at high temperatures is a crucial factor. Environmental concerns and strict emissions laws are driving the adoption of electric cars. Since LiFePOâ‚„ batteries don't contain any harmful substances and have a smaller environmental effect than some other battery chemistries, they support these objectives. Despite being somewhat more costly to produce in the past, LiFePOâ‚„ batteries have been getting cheaper over time. They are financially feasible for automakers due to their competitive cost-performance ratio. To encourage the use of EVs, numerous governments throughout the world have introduced incentives, subsidies, and regulatory requirements. The demand for LiFePOâ‚„ batteries in the automobile industry has increased as a result of these policies.

Download Free Sample Report

Regional Insights

Asia Pacific

In 2022, the Asia-Pacific region dominated the LFP high-voltage battery market, representing over 80% of the global market share. The region's increasing demand for Electric Vehicles (EVs) and Energy Storage Systems (ESS) is largely responsible for this significant portion.

Within the Asia-Pacific region, China stands out as the largest market for LFP high-voltage batteries, followed by Japan and South Korea.

The expansion of this market in the Asia-Pacific region is primarily fueled by the growing adoption of both EVs and ESS.

Furthermore, governments across Asia and the Pacific are actively supporting this growth by providing subsidies and other incentives to encourage the adoption of EVs and ESS.

Download Free Sample Ask for Discount Request Customization

North America

Okay, I understand. Here's the rewritten content without the extra spacing between paragraphs

In 2022, North America held the position of the second-largest market for LFP high-voltage batteries, accounting for over 10% of the global market. The expansion of this market in North America is fueled by the increasing adoption of Electric Vehicles (EVs) and Energy Storage Systems (ESS), along with government initiatives aimed at promoting renewable energy.

Within North America, the United States constitutes the largest market for LFP high-voltage batteries.

The growth observed in North America is driven by the rising popularity of EVs and ESS, combined with governmental efforts to encourage the adoption of renewable energy.

Specifically, the US government has set a target of achieving net-zero emissions by 2050.

Download Free Sample Ask for Discount Request Customization

Europe

In 2022, Europe emerged as the third-largest market for LFP high-voltage batteries, accounting for over 5% of the global market. The expansion of this market in Europe is driven by the increasing adoption of Electric Vehicles (EVs) and Energy Storage Systems (ESS), as well as the European Union's Green Deal initiative, which aims to achieve net-zero emissions by 2050.

Within Europe, Germany represents the largest market for LFP high-voltage batteries.

The growth observed in Europe is driven by the rising popularity of EVs and ESS, combined with the ambitious goals of the European Union's Green Deal.

Specifically, the European Union has set a target of having 30 million EVs on its roads by 2030.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In August 2023, CATL announced an investment of USD 5 billion to build a new LFP battery factory in China.

- In July 2023, BYD announced it would invest USD 1 billion to build a new LFP battery factory in the United States.

- In June 2023, LG Chem announced it would invest USD 1.3 billion to expand its LFP battery production capacity in Poland.

- In May 2023, Samsung SDI announced an investment of USD 2.2 billion to build a new LFP battery factory in South Korea.

Key Market Players

- Contemporary Amperex Technology Co., Limited

- BYD Company Ltd.

- LG Chem Ltd.

- Samsung SDI Co., Ltd.

- China Aviation Lithium Battery Co., Ltd

- Northvolt AB

- SVOLT Energy

- Sunwoda Electronic Co Ltd

- Gotion High-Tech Co. Ltd

- Farasis Energy Inc

|

By Type |

By Application |

By Region |

|

|

|

Related Reports

- Electric Boiler Market Size By Voltage Rating (Low, Medium), By Application (Residential, Commercial, Industrial, Food P...

- Europe Boiler Market By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Residential Boiler Market Size By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural Gas, Oil,...

- Commercial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity, By Product (Hot Water,...

- Combi Boiler Market - By Fuel (Natural Gas, Oil), By Technology (Condensing, Non-Condensing) & Forecast, 2024-2032

Table of Content

-

Executive Summary

-

1.1 Market Overview

-

1.2 Key Highlights and Trends

-

1.3 Strategic Recommendations

-

Introduction

-

2.1 Scope of the Report

-

2.2 Research Methodology

-

2.3 Definitions and Assumptions

-

Market Overview

-

3.1 What is an LFP High Voltage Battery?

-

3.2 Performance Characteristics and Use Cases

-

3.3 Benefits Over Other Chemistries in High-Voltage Applications

-

3.4 Evolution of LFP in EVs, ESS, and Industrial Power Systems

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Rise in Electric Vehicles and Demand for Long-Range Solutions

-

4.1.2 Growth in Utility-Scale and Commercial Energy Storage Projects

-

4.1.3 Cost-Effectiveness and Thermal Stability of LFP Chemistry

-

4.2 Restraints

-

4.2.1 Lower Energy Density Compared to NMC Batteries

-

4.2.2 Space Constraints in Compact Applications

-

4.3 Opportunities

-

4.3.1 Use in Heavy-Duty Commercial Vehicles and Buses

-

4.3.2 Deployment in Off-Grid and Microgrid Systems

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

-

Technology Landscape

-

5.1 Battery Cell Construction and Voltage Scaling

-

5.2 LFP vs. Other High Voltage Chemistries

-

5.3 Battery Management Systems (BMS) for High-Voltage LFP Packs

-

5.4 Innovations in Fast Charging and Lifecycle Enhancement

-

Market Segmentation

-

6.1 By Voltage Range

-

6.1.1 400–600V

-

6.1.2 Above 600V

-

6.2 By Application

-

6.2.1 Electric Vehicles (Passenger & Commercial)

-

6.2.2 Grid Energy Storage Systems

-

6.2.3 Industrial Equipment

-

6.2.4 Marine and Rail

-

6.3 By End-User

-

6.3.1 Automotive OEMs

-

6.3.2 Energy Utilities

-

6.3.3 Logistics and Mining Operators

-

6.3.4 Others

-

Regional Market Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue and Installed Capacity Forecast

-

8.2 Regional Market Trends

-

8.3 Segment-Wise Growth Outlook

-

Competitive Landscape

-

9.1 Market Share of Leading Companies

-

9.2 Key Company Profiles

-

9.2.1 CATL

-

9.2.2 BYD

-

9.2.3 LG Energy Solution

-

9.2.4 EVE Energy

-

9.2.5 Others

-

9.3 Strategic Developments, Joint Ventures, and Investments

-

Regulatory and Environmental Framework

-

10.1 Battery Safety Regulations for High-Voltage Applications

-

10.2 Import/Export and Compliance Standards

-

10.3 Environmental and Recycling Regulations

-

Innovation and Future Outlook

-

11.1 Advances in Solid-State LFP Technologies

-

11.2 Integration in V2G and Bidirectional Charging Systems

-

11.3 Role in Renewable-Backed Decentralized Energy Systems

-

Conclusion and Strategic Recommendations

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Data Sources

Executive Summary

-

1.1 Market Overview

-

1.2 Key Highlights and Trends

-

1.3 Strategic Recommendations

Introduction

-

2.1 Scope of the Report

-

2.2 Research Methodology

-

2.3 Definitions and Assumptions

Market Overview

-

3.1 What is an LFP High Voltage Battery?

-

3.2 Performance Characteristics and Use Cases

-

3.3 Benefits Over Other Chemistries in High-Voltage Applications

-

3.4 Evolution of LFP in EVs, ESS, and Industrial Power Systems

Market Dynamics

-

4.1 Drivers

-

4.1.1 Rise in Electric Vehicles and Demand for Long-Range Solutions

-

4.1.2 Growth in Utility-Scale and Commercial Energy Storage Projects

-

4.1.3 Cost-Effectiveness and Thermal Stability of LFP Chemistry

-

-

4.2 Restraints

-

4.2.1 Lower Energy Density Compared to NMC Batteries

-

4.2.2 Space Constraints in Compact Applications

-

-

4.3 Opportunities

-

4.3.1 Use in Heavy-Duty Commercial Vehicles and Buses

-

4.3.2 Deployment in Off-Grid and Microgrid Systems

-

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

Technology Landscape

-

5.1 Battery Cell Construction and Voltage Scaling

-

5.2 LFP vs. Other High Voltage Chemistries

-

5.3 Battery Management Systems (BMS) for High-Voltage LFP Packs

-

5.4 Innovations in Fast Charging and Lifecycle Enhancement

Market Segmentation

-

6.1 By Voltage Range

-

6.1.1 400–600V

-

6.1.2 Above 600V

-

-

6.2 By Application

-

6.2.1 Electric Vehicles (Passenger & Commercial)

-

6.2.2 Grid Energy Storage Systems

-

6.2.3 Industrial Equipment

-

6.2.4 Marine and Rail

-

-

6.3 By End-User

-

6.3.1 Automotive OEMs

-

6.3.2 Energy Utilities

-

6.3.3 Logistics and Mining Operators

-

6.3.4 Others

-

Regional Market Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue and Installed Capacity Forecast

-

8.2 Regional Market Trends

-

8.3 Segment-Wise Growth Outlook

Competitive Landscape

-

9.1 Market Share of Leading Companies

-

9.2 Key Company Profiles

-

9.2.1 CATL

-

9.2.2 BYD

-

9.2.3 LG Energy Solution

-

9.2.4 EVE Energy

-

9.2.5 Others

-

-

9.3 Strategic Developments, Joint Ventures, and Investments

Regulatory and Environmental Framework

-

10.1 Battery Safety Regulations for High-Voltage Applications

-

10.2 Import/Export and Compliance Standards

-

10.3 Environmental and Recycling Regulations

Innovation and Future Outlook

-

11.1 Advances in Solid-State LFP Technologies

-

11.2 Integration in V2G and Bidirectional Charging Systems

-

11.3 Role in Renewable-Backed Decentralized Energy Systems

Conclusion and Strategic Recommendations

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Data Sources

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy