Battery Manufacturing Equipment Market

Battery Manufacturing Equipment Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Machine Type (Coating and Dryer, Calendaring, Slitting, Mixing, Electrode Stacking, Assembly and Handling Machine, Formation and Testing Machine), By End User (Automotive, Industrial, and Other), By Battery Type (Lead Acid, Lithium Ion, Nickel Metal Hydride, Nickel Cadmium, Others)

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

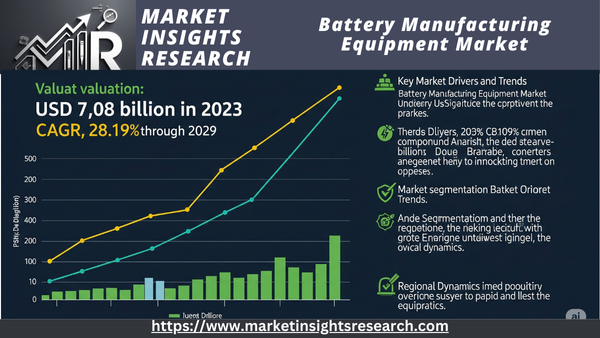

| Market Size (2023) | USD 7.08 Billion |

| Market Size (2029) | USD 31.70 Billion |

| CAGR (2024-2029) | 28.19% |

| Fastest Growing Segment | Lithium Ion |

| Largest Market | North America |

Market Overview

The Global Battery Manufacturing Equipment Market was valued at USD 7.08 billion in 2023 and is projected to experience strong growth in the forecast period, with an anticipated Compound Annual Growth Rate (CAGR) of 28.19% through 2029.

Download Free Sample Ask for Discount Request Customization

The Battery Manufacturing Equipment market encompasses the industry segment focused on the design, production, and distribution of machinery and technology crucial for the manufacturing of batteries. This market plays a vital role in supporting the global energy storage and electric vehicle sectors by providing specialized equipment for the efficient and precise production of battery cells and packs. Key components of the Battery Manufacturing Equipment market include machinery for electrode manufacturing, cell assembly, testing, and quality control processes.

As the demand for electric vehicles and renewable energy storage solutions continues to surge, the Battery Manufacturing Equipment market is witnessing significant growth and innovation. Manufacturers in this market are tasked with developing advanced equipment that aligns with the evolving landscape of battery technologies, including lithium-ion, solid-state batteries, and emerging chemistries. The market's dynamics are influenced by factors such as government policies, technological advancements, and the need for sustainable and scalable production processes to meet the increasing global demand for high-performance and eco-friendly energy storage solutions.

Key Market Drivers

Growing Demand for Electric Vehicles (EVs) Driving Battery Manufacturing Equipment Market

The global Battery Manufacturing Equipment market is receiving a significant impetus from the escalating demand for electric vehicles (EVs). As the automotive industry undergoes a transformative shift toward sustainable and eco-friendly alternatives, the production of EVs has surged, creating a substantial market for battery manufacturing equipment.

Environmental awareness is rising, and stringent regulations aimed at reducing carbon emissions are prompting automakers to invest heavily in electric mobility. This surge in EV production directly impacts the demand for advanced battery technologies, driving the need for state-of-the-art battery manufacturing equipment. From electrode manufacturing to cell assembly, the entire battery production process relies on specialized machinery, and as EV adoption continues to rise globally, the market for battery manufacturing equipment is poised for substantial growth.

In addition to personal electric vehicles, the demand for electric buses, trucks, and two-wheelers is also increasing. This diversification within the electric vehicle segment further contributes to the growing market for battery manufacturing equipment. As governments worldwide encourage the adoption of EVs through incentives and subsidies, manufacturers are compelled to scale up their production capacities, thereby driving the demand for advanced battery manufacturing equipment.

Technological Advancements in Battery Chemistry

Continuous a Continuous advancements in battery chemistry significantly shape the Battery Manufacturing Equipment market. her energy density, longer cycle life, and faster charging times drive ongoing research and development in battery technologies. Innovations like lithium-sulfur batteries, solid-state batteries, and next-generation cathode materials are transforming the energy storage landscape.

These technological advancements create both challenges and opportunities for equipment manufacturers. They necessitate the development of advanced manufacturing equipment capable of handling new materials and production processes. Simultaneously, they generate demand for upgrading existing facilities and investing in state-of-the-art machinery. This dynamic landscape of evolving battery chemistries acts as a strong driver for the Battery Manufacturing Equipment market, as manufacturers aim to remain competitive by adopting the latest technologies.

Download Free Sample Ask for Discount Request Customization

Increasing Energy Storage Applications

The increasing adoption of renewable energy sources, such as solar and wind power, has indeed driven the demand for energy storage solutions. Batteries are essential for storing surplus energy generated during peak production times for use when production is low or demand is high. This trend is noticeable across residential, commercial, and industrial sectors, where energy storage systems contribute to grid stability and reliability.

As the deployment of these energy storage systems continues to grow, the Battery Manufacturing Equipment market is experiencing a corresponding increase. The manufacturing equipment required for the large-scale batteries used in energy storage applications needs to be robust, efficient, and capable of meeting the specific demands of grid-scale projects. This rising demand for energy storage, both on and off the grid, serves as a significant driver propelling the growth of the Battery Manufacturing Equipment market worldwide.

Government Policies are Likely to Propel the Market

Incentivizing Research and Development for Battery Manufacturing Equipment Innovation

Governments globally are acknowledging the vital role of battery technology in shaping the trajectory of clean energy and sustainable transportation. To stimulate innovation within the Battery Manufacturing Equipment market, governments are implementing policies that incentivize research and development (R&D) activities. These policies aim to encourage manufacturers to invest in leading-edge technologies, materials, and processes that enhance the efficiency, reliability, and sustainability of battery manufacturing equipment.

These incentives can include tax credits, grants, and subsidies for companies involved in R&D for battery manufacturing equipment. These financial aids reduce the financial burden on manufacturers and promote collaboration among the private sector, research institutions, and academia. By nurturing a culture of innovation, governments aim to accelerate the development of advanced battery manufacturing equipment capable of meeting the evolving demands of the global energy storage and electric vehicle markets.

Governments may also establish research consortia or partnerships to facilitate knowledge sharing and collaborative R&D endeavors. These initiatives help create a synergistic ecosystem where stakeholders collectively contribute to the advancement of battery manufacturing technologies. Consequently, the Battery Manufacturing Equipment market benefits from the development of state-of-the-art equipment that supports the broader transition to a low-carbon economy.

Environmental Regulations and Standards for Sustainable Battery Manufacturing

In response to the increasing environmental concerns linked to battery production, governments are establishing stringent regulations and standards to ensure the sustainability of battery manufacturing processes. These policies aim to tackle issues such as resource depletion, waste management, and the carbon footprint of battery manufacturing operations.

Environmental regulations may impose limits on the use of specific materials, chemicals, or manufacturing processes that have negative environmental impacts. Furthermore, governments may encourage the adoption of eco-friendly practices through incentives such as tax breaks for companies that implement sustainable manufacturing technologies. These policies promote environmental responsibility and drive innovation within the Battery Manufacturing Equipment market, as manufacturers strive to develop equipment that complies with or surpasses these regulations.

Governments may also introduce certification programs or labels for environmentally friendly battery manufacturing equipment. Such legislation provides a clear indication to consumers and industry stakeholders regarding the environmental performance of the equipment, encouraging the adoption of sustainable practices throughout the supply chain.

Download Free Sample Ask for Discount Request Customization

Supportive Infrastructure Development for Battery Manufacturing Clusters

Acknowledging the strategic importance of the Battery Manufacturing Equipment industry in advancing clean energy and electric mobility, governments are implementing policies to support the development of specialized manufacturing clusters. These hubs allow manufacturers, suppliers, and research institutions to come together, encouraging collaboration, the exchange of knowledge, and economies of scale.

Governments may offer financial incentives, tax breaks, or grants for infrastructure development to attract battery manufacturing companies to specific regions. These policies aim to create a favorable environment for the growth of the Battery Manufacturing Equipment market, fostering synergy among industry players and streamlining the supply chain.

Supportive infrastructure policies can include the establishment of research and development centers, testing facilities, and training institutes within these clusters. This strategy accelerates innovation in battery manufacturing equipment and addresses the workforce.

By strategically developing battery manufacturing clusters, governments aim to enhance the global competitiveness of their domestic industries, stimulate economic growth, and position their countries as leaders in the rapidly evolving clean energy and electric transportation sectors.

Key Market Challenges

Technological Obsolescence and Rapid Evolution of Battery Chemistry

A key challenge for the global Battery Manufacturing Equipment market is the continuous evolution of battery chemistry and the associated risk of technological obsolescence. The rapid innovation in battery technologies, driven by the pursuit of higher energy density, longer cycle life, and faster charging, presents a significant hurdle for manufacturers of battery manufacturing equipment.

As new battery chemistries emerge and gain traction, existing manufacturing equipment can become outdated and unsuitable for the production demands of advanced batteries. Manufacturers making substantial investments in cutting-edge equipment may face rapid depreciation and the constant need for upgrades to keep up with evolving technologies.

The variety of battery chemistries, including lithium-ion, lithium-sulfur, solid-state batteries, and others, necessitates adaptable manufacturing processes and specialized equipment. The challenge lies in developing versatile manufacturing equipment capable of handling the specific requirements of different battery technologies without sacrificing efficiency or production quality.

The dynamic nature of the battery industry requires that manufacturers of battery manufacturing equipment remain agile and responsive to technological advancements. Continuous research and development are essential to design equipment that can handle the complexities of new materials, processes, and formats. Companies in the Battery Manufacturing Equipment market must navigate this challenge by investing in flexible and future-proof designs, anticipating industry trends, and collaborating closely with battery researchers and developers to ensure the compatibility and effectiveness of their equipment.

The risk of technological obsolescence is closely tied to the uncertainties about which battery chemistries will ultimately dominate the market. This shifting landscape creates challenges not only for equipment manufacturers but also for investors, as decisions regarding the selection of manufacturing equipment become increasingly complex amid the ongoing evolution of battery technologies.

Supply Chain Disruptions and Raw Material Availability

A significant challenge confronting the global Battery Manufacturing Equipment market is the issue of supply chain disruptions and the availability of raw materials crucial for battery production. The rapid increase in demand for batteries, primarily driven by the electric vehicle revolution and the growing adoption of renewable energy storage solutions, is putting significant strain on the supply chains that support the production of battery manufacturing equipment.

A primary concern is the availability and sustainability of key raw materials, including lithium, cobalt, nickel, and rare earth elements. Specific regions concentrate the mining and processing of these materials, potentially creating. Governments and industries are grappling with the need to secure a stable and diversified supply chain for these critical components to mitigate risks associated with price volatility, geopolitical tensions, and potential shortages.

Supply chain disruptions, whether caused by geopolitical events, natural disasters, or unforeseen economic factors, can have ripple effects throughout the Battery Manufacturing Equipment market. Manufacturers may experience delays in receiving essential components or face increased costs due to fluctuations in raw material prices. Such disruptions can impede the timely delivery of equipment to battery manufacturers, impacting their production schedules and, consequently, the global supply of batteries.

Environmental and ethical concerns related to the extraction and processing of raw materials, particularly in the case of cobalt and other minerals, add another layer of complexity to the supply chain challenge. Increased scrutiny and demand for responsible sourcing practices necessitate careful considerations by manufacturers in the Battery Manufacturing Equipment market to ensure compliance with ethical and sustainable standards.

To address these challenges, strategic investments in diversifying the raw material supply chain, exploring alternative materials, and promoting recycling and circular economy practices are imperative. Collaboration between governments, industry stakeholders, and international organizations is necessary to create sustainable sourcing strategies and necessary to create strategies associated with supply chain disruptions, ensuring the resilience and stability of the Battery Manufacturing Equipment market in the face of evolving global dynamics.

Key Market Trends

That's a fantastic overview of the technological advancements and fantastic innovation in the Battery Manufacturing Equipment market! You've highlighted key areas like

- Advanced Materials Focus on higher performance and sustainability.

- Process Optimization Through automation, robotics, and advanced manufacturing techniques like 3D printing.

- Smart Technologies and Data Analytics For real-time monitoring, predictive maintenance, and enhanced quality control.

This trend is indeed crucial for meeting the growing demand for high-performance batteries across various sectors. Would you like to read more about any of these specific areas of technological advancement? For example, we could discuss the impact of automation on production efficiency or the role of new materials in battery performance.

Segmental Insights

Battery Type Insights

The Lead Acid segment held the largest Market share in 2023. Lead-acid batteries have been in use for over a century, and the technology is well-established. Manufacturers have refined production processes, and there is a profound understanding of the materials and manufacturing methods required for lead-acid batteries.

Regional Insights

North America held the largest market share in 2023.

North America's strong technological infrastructure and vast R&D capabilities are among the main factors contributing to its dominance. Leading battery producers and equipment suppliers in the area use state-of-the-art technologies and creative manufacturing techniques to increase production efficiency and product quality. North American businesses constantly work to create cutting-edge battery manufacturing machinery that satisfies the changing demands of the market, placing a high priority on research and innovation.

The development of the battery manufacturing industry is aided by North America's established supply chain ecosystem and benevolent regulatory framework. Because of the region's advanced logistics infrastructure, raw materials and completed goods can be transported with ease, allowing for effective operations and prompt delivery to clients around the globe. North America is positioned as a leader in this developing market thanks to regulatory initiatives that support clean energy and sustainable practices. These initiatives also encourage investment in battery manufacturing equipment.

North America's dominance in the global market is a result of its strategic partnerships and cooperative efforts with important battery industry players. Collaborations among manufacturers, academic institutions, and governmental organizations promote information exchange, technology transfer, and cooperative innovation, propelling improvements in battery production machinery. By extending their market reach and breaking into new regions, these strategic alliances also help North American businesses solidify their position as market leaders for battery manufacturing equipment worldwide.

The region's robust economic growth and rising demand for renewable energy storage and electric vehicles (EVs) are driving the growth of the battery manufacturing industry. There will likely be a sharp increase in demand for high-performance batteries and sophisticated manufacturing machinery as North America moves toward a low-carbon economy and cleaner energy sources. For North American businesses, this expanding market demand offers profitable chances to take advantage of new trends and keep their competitive advantage in the global market for battery manufacturing equipment.

North America's technological superiority, strong supply chain infrastructure, benevolent regulatory climate, strategic partnerships, and rising market demand for cutting-edge battery solutions are all factors contributing to its dominance in the global market for battery manufacturing equipment. Together, these elements put the area in a leading position to influence battery manufacturing in the future, with lots of room for expansion and innovation.

Download Free Sample Ask for Discount Request Customization

Recent Developments

-

In March 2024, RCRS Innovations Ltd., the parent company of lithium-ion battery pack manufacturer EXEGI, allocated USD 6 million to expand its production capacity beyond the previous 300 MWh. This investment supports the introduction of new product lines to meet the anticipated surge in demand for clean energy storage solutions.

Key Market Players

- ABB Ltd

- Robert Bosch GmbH

- Bühler AG

- Durmazlar Machinery Inc

- Eisenmann GmbH

- Engis Corporation

- Ficep S.p.A.

- Foshan Golden Milky Way Intelligent Equipment Co., Ltd.

- Hegenscheidt MFD GmbH

- Hitachi, Ltd

|

By Machine Type |

By End User |

By Battery Type |

By Region |

|

|

|

|

Related Reports

- Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), By Appl...

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

- North America & Europe Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), By Application (Re...

- North America Residential Boiler Market Size - By Fuel (Natural Gas, Oil, Electric), By Technology (Condensing {Natural ...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Developments and Trends

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Research Methodology

-

2.3 Definitions and Assumptions

-

-

Market Overview

-

3.1 Overview of Battery Manufacturing Processes

-

3.2 Role of Equipment in Quality and Throughput

-

3.3 Industry Value Chain and Stakeholder Analysis

-

3.4 Emerging Trends in Automation and Smart Manufacturing

-

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Growth in EV Production and Energy Storage Systems

-

4.1.2 Technological Advancements in Cell Formats and Chemistries

-

4.1.3 Government Support for Gigafactory Establishments

-

-

4.2 Restraints

-

4.2.1 High Capital Investment and Operational Complexity

-

4.2.2 Equipment Customization and Integration Challenges

-

-

4.3 Opportunities

-

4.3.1 Rising Demand for Solid-State Battery Equipment

-

4.3.2 Expansion of Regional Battery Supply Chains

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Electrode Manufacturing Equipment

-

5.1.1 Mixing, Coating, and Drying

-

5.1.2 Calendering and Slitting

-

-

5.2 Cell Assembly Equipment

-

5.2.1 Stacking, Winding, and Tab Welding

-

5.2.2 Cell Insertion and Sealing

-

-

5.3 Formation, Aging, and Testing Equipment

-

5.4 Pack Assembly and Quality Control

-

5.5 Smart Automation, Robotics, and AI Integration

-

-

Market Segmentation

-

6.1 By Equipment Type

-

6.1.1 Electrode Preparation

-

6.1.2 Cell Assembly

-

6.1.3 Formation & Testing

-

6.1.4 Pack Assembly

-

-

6.2 By Battery Type

-

6.2.1 Lithium-Ion

-

6.2.2 Solid-State

-

6.2.3 Lead-Acid

-

6.2.4 Flow Batteries

-

-

6.3 By Application

-

6.3.1 Electric Vehicles

-

6.3.2 Consumer Electronics

-

6.3.3 Grid Storage

-

6.3.4 Industrial and Defense

-

-

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue Forecast

-

8.2 Regional and Segmental Growth Analysis

-

8.3 Capacity Expansion Trends

-

-

Competitive Landscape

-

9.1 Market Share of Leading Equipment Providers

-

9.2 Company Profiles

-

9.2.1 Wuxi Lead

-

9.2.2 Hitachi High-Tech

-

9.2.3 Manz AG

-

9.2.4 Shenzhen Yinghe Tech

-

9.2.5 Others

-

-

9.3 Strategic Alliances, M&A, and Technological Advancements

-

-

Regulatory and Safety Standards

-

10.1 Manufacturing Safety Compliance

-

10.2 Environmental Regulations for Battery Plants

-

10.3 Regional Guidelines for Automation and Worker Safety

-

-

Innovation and Future Outlook

-

11.1 Digital Twins and Predictive Maintenance

-

11.2 Vertical Integration and Factory-as-a-Service Models

-

11.3 Role of MES (Manufacturing Execution Systems)

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References and Sources

-

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy