Battery Additives Market

Battery Additives Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Conductive Additives, Porous Additives, Nucleating Agents, Others), By Application (Lead-Acid Batteries, Lithium-Ion Batteries, Others), By End-Use Industry (Automotive, Electronics, Industrial, Others), By Region, By Competition, 2019-2029

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

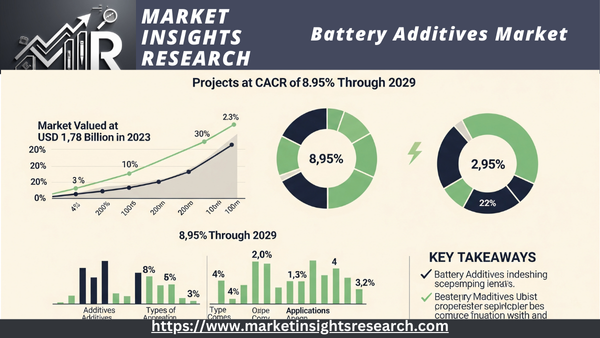

| Market Size (2023) | USD 1.78 billion |

| Market Size (2029) | USD 3.0 billion |

| CAGR (2024-2029) | 8.95% |

| Fastest Growing Segment | Industrial |

| Largest Market | Asia Pacific |

Market Overview

Global Battery Additives market has experienced tremendous growth recently and is poised to maintain strong momentum through 2029. The market was valued at USD 1.78 billion in 2023 and is projected to register a compound annual growth rate of 8.95% during the forecast period.

Download Free Sample Ask for Discount Request Customization

The global Battery Additives market has experienced substantial growth in recent years, driven by its widespread adoption across industries.

Several factors are driving the market for battery additives, positioning it for significant growth. Firstly, there is an escalating demand for high-performance batteries in sectors like electric vehicles, consumer electronics, and renewable energy storage. This demand pushes for advanced battery technologies, where additives play a crucial role in optimizing battery performance.

Furthermore, advancements in nanotechnology, materials science, and chemical engineering are driving innovation in battery additives. Research efforts focus on enhancing the stability, compatibility, and scalability of additives while reducing costs and environmental impact. As a result, the battery additives market is expected to experience robust growth, fueled by the increasing demand for high-performance batteries and the ongoing quest for more sustainable and efficient energy storage solutions.

Key Market Drivers

Increasing Demand for High-Energy Density Batteries

The increasing demand for high-energy-density batteries that can provide longer-lasting power solutions drives the battery additives market. Industries such as automotive, consumer electronics, and renewable energy require batteries with higher energy densities to support their evolving needs. Battery additives play a crucial role in enhancing the performance and capacity of batteries, enabling them to store more energy and deliver longer runtimes.

The rapid growth of the electric vehicle (EV) market is a significant driver for battery additives. As the automotive industry shifts toward electrification, there is a growing need for batteries that can offer extended driving ranges and faster charging capabilities. Battery additives help improve the efficiency and performance of lithium-ion batteries used in EVs, enabling them to meet the demands of consumers and support the widespread adoption of electric vehicles.

The increasing use of portable electronics such as smartphones, tablets, and laptops has fueled the demand for high-performance batteries. Consumers expect their devices to have longer battery life and faster charging times. Battery additives enable manufacturers to develop batteries with improved energy storage capacity, allowing portable electronics to operate for longer durations without the need for frequent recharging.

Stringent Environmental Regulations and Sustainability Initiatives

Stringent environmental regulations and sustainability initiatives have become key drivers for the battery additives market. Governments and regulatory bodies are imposing stricter regulations on battery manufacturing processes to reduce the environmental impact of battery production and disposal. Battery additives that enhance the efficiency and lifespan of batteries contribute to the development of more sustainable battery solutions.

The global shift toward renewable energy sources, such as solar and wind power, has created a demand for energy storage solutions. Batteries play a crucial role in storing and delivering renewable energy. Battery additives help improve the performance and reliability of energy storage systems, enabling a smoother integration of renewable energy sources into the power grid.

The focus on recycling and the circular economy has also driven the demand for battery additives. As the number of batteries reaching the end of their life cycle increases, there is a growing need for additives that can enhance the recyclability of batteries and minimize waste. Battery additives that improve the durability and stability of batteries contribute to the development of a more sustainable and circular battery ecosystem.

Download Free Sample Ask for Discount Request Customization

Technological Advancements and Research & Development

Technological advancements and ongoing research and development efforts have led to the discovery of new battery chemistries and materials. Battery additives play a crucial role in optimizing the performance of these advanced battery technologies. Additives help enhance the stability, conductivity, and overall efficiency of batteries, enabling the commercialization of new and improved battery chemistries.

The growing emphasis on battery safety and reliability is driving the market for battery additives. As batteries are used in various critical applications, including electric vehicles and energy storage systems, ensuring their safety and reliability is of utmost importance. Battery additives that improve thermal stability, prevent short circuits, and enhance overall battery performance contribute to the development of safer and more reliable battery solutions.

Key Market Challenges

Regulatory Hurdles and Compliance

The Battery Additives Market faces a significant challenge in traversing the confusing landscape of regulatory requirements and ensuring compliance with evolving standards. As the industry continues to innovate and develop new additives to enhance battery performance, it must grapple with a multitude of regulatory agencies and standards organizations, each with their set of rules and guidelines. This challenge poses a substantial barrier to market entry and growth.

One of the primary challenges in the Battery Additives Market is the increasing stringency of regulations governing battery components. Regulatory bodies like the Environmental Protection Agency (EPA) in the United States and the European Chemicals Agency (ECHA) in Europe are imposing stricter requirements on the use of certain chemicals in battery additives. For instance, restrictions on the use of heavy metals such as cadmium and lead are becoming more stringent, necessitating alternative additives that meet these regulatory criteria.

The Battery Additives Market operates on a global scale, which means that manufacturers and suppliers must contend with a wide range of regulatory frameworks in different countries. For instance, a battery additive that is compliant with regulations in one country may not meet the requirements in another, making it challenging for businesses to create standardized products that can be sold across multiple markets. This variability adds complexity to the supply chain and increases compliance costs.

Balancing innovation in battery additives with compliance to regulatory standards is a constant challenge. Battery manufacturers are pressured to develop additives that can improve energy density, extend battery life, and enhance safety. However, they must also ensure that these innovations comply with environmental and safety regulations. Striking the right balance between innovation and regulation is a delicate and resource-intensive process that requires continuous monitoring and adaptation

The evolving nature of battery technology and the lack of a unified global regulatory framework create market uncertainty. Companies investing heavily in research and development of new battery additives may face the risk of regulatory changes that render their products non-compliant or obsolete. This uncertainty can deter investment and slow down the pace of innovation in the industry.

Supply Chain Vulnerabilities

Supply chain vulnerabilities confront the Battery Additives Market, potentially disrupting the production and distribution of battery additives. These vulnerabilities stem from various factors, including the dependence on critical raw materials, geopolitical tensions, and logistical challenges. Addressing these issues is critical for guaranteeing a stable and resilient supply chain in this competitive market.

One of the primary challenges in the Battery Additives Market is the heavy reliance on critical raw materials, such as lithium, cobalt, and rare earth elements. These materials are essential for the production of battery additives, and their availability can be affected by factors like geopolitical tensions, mining regulations, and supply-demand imbalances. As a result, fluctuations in the prices and availability of these raw materials can disrupt the supply chain and impact production costs.

Geopolitical tensions and trade disputes can have a significant impact on the Battery Additives Market. Many key raw material sources are concentrated in a handful of countries, leading to supply chain vulnerabilities. Political instability, export restrictions, or trade disputes in these supplier nations can lead to sudden disruptions in the supply of critical materials, affecting the entire industry's ability to meet demand.

The Battery Additives Market is global in scope, with manufacturers, suppliers, and customers located around the world. This geographical dispersion presents logistical challenges in terms of transportation, warehousing, and distribution. Delays in shipping, customs issues, or disruptions in global logistics networks can result in delays in the delivery of battery additives to manufacturers, impacting production schedules and customer satisfaction.

Ensuring the resilience of the supply chain is critical for the Battery Additives Market. Companies must explore alternative sources for critical raw materials, diversify their supplier base, and implement robust risk management strategies. Developing contingency plans and building strategic stockpiles of key materials can help mitigate the impact of supply chain disruptions.

In addition to supply chain vulnerabilities, the Battery Additives Market faces growing scrutiny over environmental and sustainability concerns. Consumers and regulatory bodies are increasingly demanding eco-friendly and sustainable practices throughout the supply chain. Companies must adapt by adopting sustainable sourcing practices, reducing waste, and minimizing the environmental footprint of their operations to remain competitive in the market.

In conclusion, the Battery Additives Market faces formidable challenges related to regulatory compliance, supply chain vulnerabilities, and the need for sustainability. Overcoming these challenges will require a combination of innovation, collaboration, and adaptability to ensure the long-term success of this dynamic industry.

Key Market Trends

Increasing Demand for Sustainable and Environmentally Friendly Battery Additives

One of the prominent trends in the battery additives market is the increasing demand for sustainable and environmentally friendly additives. With growing concerns about climate change and the need to reduce carbon emissions, industries are actively seeking battery additives that have minimal environmental impact throughout their lifecycle. This trend is driven by the shift toward green energy solutions, such as renewable energy storage and electric vehicles, where the entire value chain is expected to be environmentally sustainable.

Another trend in the battery additives market is the focus on the circular economy and recycling. As the demand for batteries continues to rise, there is a growing need to develop additives that can be easily recovered and recycled at the end of their life cycle. Battery additives that enable efficient recycling processes and minimize waste generation are gaining traction in the market. Manufacturers are exploring innovative solutions to ensure the sustainability of battery additives and contribute to a circular economy.

The trend toward sustainability has also led to the development of bio-based and non-toxic battery additives. Companies are investing in research and development to create additives derived from renewable sources, such as plant-based materials or bio-waste. These bio-based additives offer a more sustainable alternative to traditional additives derived from fossil fuels. Additionally, there is a growing emphasis on non-toxic additives that do not pose health risks to workers or end-users. The development of bio-based and non-toxic additives aligns with the increasing focus on environmental stewardship and responsible manufacturing practices.

Advancements in Nanotechnology and Material Science

Advancements in nanotechnology and material science are driving significant developments in the battery additives market. Nanomaterials, such as nanoparticles and nanocomposites, are being incorporated into battery additives to enhance their performance. These nanomaterials offer unique properties, such as high surface area, improved conductivity, and enhanced stability, which can significantly improve battery efficiency and lifespan. The use of nanotechnology in battery additives is expected to revolutionize the energy storage industry by enabling the development of high-performance batteries with superior characteristics.

The integration of advanced materials, such as graphene, carbon nanotubes, and ceramic coatings, is another trend in the battery additives market. These materials offer exceptional properties, including high electrical conductivity, mechanical strength, and chemical stability. By incorporating these advanced materials into battery additives, manufacturers can enhance the performance and safety of batteries. Lithium-ion batteries' energy density and charge-discharge efficiency, for instance, can be enhanced by graphene-based additives. The integration of advanced materials in battery additives is expected to drive innovation and enable the development of next-generation batteries with superior performance.

Solid-state batteries are gaining attention as a promising alternative to traditional lithium-ion batteries. These batteries use solid electrolytes instead of liquid electrolytes, offering advantages such as higher energy density, improved safety, and longer lifespan. The development of solid-state battery additives is a significant trend in the market, as these additives play a crucial role in enhancing the performance and stability of solid-state batteries. Researchers and manufacturers are looking into new materials and mixtures to improve the connections between the electrolyte and electrodes in solid-state batteries, which is helping to advance solid-state battery additives.

Increasing Emphasis on Performance and Safety

The battery additives market is witnessing an increasing emphasis on improving battery performance and efficiency. Manufacturers are developing additives that can enhance the energy density, power output, and cycle life of batteries. These additives help optimize the electrochemical reactions within the battery, resulting in improved overall performance. The focus on performance enhancement is driven by the growing demand for high-performance batteries in various applications, including electric vehicles, renewable energy storage, and portable electronics.

Safety is a critical aspect of battery technology, particularly in applications where batteries are subjected to extreme conditions or high-power demands. The battery additive market is experiencing a trend toward the development of additives that enhance battery safety. These additives help mitigate risks associated with thermal runaway, short circuits, and other safety hazards. By improving the stability and reliability of batteries, these additives contribute to the overall safety of battery-powered devices and systems.

The integration of smart and self-monitoring additives is gaining traction in the battery additives market. These additives incorporate sensors or other monitoring mechanisms that can detect and report battery performance parameters in real time. By offering information regarding battery health, state of charge, and other critical parameters, these additives enable proactive maintenance and optimize battery performance. The integration of smart additives aligns with the growing trend of digitalization and the Internet of Things (IoT) in various industries.

In conclusion, the battery additives market is witnessing significant trends such as the increasing demand for sustainable and environmentally friendly additives, advancements in nanotechnology and material science, and the emphasis on performance and safety enhancements. These trends are shaping the development of innovative battery additives that can meet the evolving needs of industries and contribute to the advancement of energy storage technologies.

Segmental Insights

By Type Insights

In 2023, the Conductive Additives segment dominated the Battery Additives Market and is expected to maintain its dominance during the forecast period. Conductive additives play a crucial role in improving the performance and efficiency of batteries by enhancing their conductivity and reducing internal resistance. These additives are widely used in various battery chemistries, including lithium-ion batteries, lead-acid batteries, and nickel-metal hydride batteries. The dominance of the Conductive Additives segment can be attributed to the increasing demand for high-performance batteries in applications such as electric vehicles, renewable energy storage, and portable electronics. The growing adoption of electric vehicles, in particular, has been a significant driver for the Conductive Additives segment. Electric vehicles require batteries with high energy density and fast charging capabilities, and conductive additives help optimize the electrochemical reactions within the battery, resulting in improved overall performance. Additionally, the Conductive Additives segment is expected to maintain its dominance due to ongoing research and development activities aimed at improving the conductivity and stability of battery materials. Manufacturers are investing in the development of advanced conductive additives, such as carbon-based additives, graphene, and conductive polymers, to further enhance battery performance. Furthermore, the increasing focus on sustainability and environmental regulations is driving the demand for conductive additives derived from renewable sources or with reduced environmental impact. These factors are expected to contribute to the continued dominance of the Conductive Additives segment in the Battery Additives Market during the forecast period.

By Application Insights

In 2023, the Lithium-Ion Batteries segment dominated the Battery Additives Market and is expected to maintain its dominance during the forecast period. Lithium-ion batteries have gained significant traction in various industries, including automotive, consumer electronics, and energy storage because of their high energy density, longer lifespan, and faster charging capabilities. The dominance of the Lithium-Ion Batteries segment can be attributed to the increasing demand for lithium-ion batteries in applications such as electric vehicles, smartphones, laptops, and grid energy storage systems. The rapid growth of the electric vehicle market, driven by government initiatives and the shift toward sustainable transportation, has been a major driver for the lithium-ion battery segment. Electric vehicles require high-performance lithium-ion batteries that can deliver longer driving ranges and faster charging times, and battery additives play a crucial role in enhancing the performance and efficiency of these batteries. Additionally, the Lithium-Ion Batteries segment is expected to maintain its dominance due to ongoing advancements in lithium-ion battery technology and the continuous development of new battery chemistries. Manufacturers are investing in research and development activities to improve the safety, energy density, and lifespan of lithium-ion batteries, and battery additives are integral to achieving these improvements. Furthermore, the increasing demand for portable electronic devices and the growing adoption of renewable energy storage systems are driving the demand for lithium-ion batteries, further bolstering the dominance of the Lithium-Ion Batteries segment in the Battery Additives Market. As industries continue to prioritize energy-efficient and high-performance battery solutions, we expect the segment to witness continued growth...

Download Free Sample Report

Regional Insights

In 2023, the Asia-Pacific region dominated the battery additive market, and it is expected to maintain its dominance during the forecast period. The Asia Pacific region has emerged as a key player in the battery additives market due to several factors that have contributed to its strong position. The dominance of the Asia Pacific region can be attributed to the presence of major battery manufacturers, increased investments in the electric vehicle industry, and the growing demand for consumer electronics in countries like China, Japan, and South Korea. These countries have witnessed significant growth in the production and adoption of electric vehicles, which has driven the demand for high-performance batteries and, in turn, battery additives. Additionally, the Asia Pacific region has a robust manufacturing base for consumer electronics, including smartphones, laptops, and tablets, which further fuels the demand for batteries and battery additives. The region's strong focus on renewable energy and energy storage systems also contributes to its dominant position in the Asia-Pacific region's battery additives market. Governments in countries like China and Japan have implemented favorable policies and incentives to promote the adoption of renewable energy sources and energy storage technologies, leading to increased demand for batteries and battery additives. Furthermore, the Asia Pacific region is experiencing rapid urbanization and industrialization, which drives the need for reliable backup power solutions and energy storage systems. Battery additives play a crucial role in enhancing the performance, efficiency, and lifespan of batteries, making them an essential component in ensuring uninterrupted power supply. Looking ahead, the Asia Pacific region is expected to maintain its dominance in the Battery Additives Market during the forecast period. The region's strong industrial base, technological advancements, and emphasis on sustainability will continue to drive the demand for battery additives across various sectors, solidifying its position as the leading region in the market.

Download Free Sample Ask for Discount Request Customization

Recent Developments

-

In September 2022, Cabot Corporation, a global specialty chemicals and performance materials company, opened a new manufacturing facility for its battery materials product line in Shenzhen, China. The facility will produce battery-grade carbon black and other additives to support the growing lithium-ion battery market.

Key Market Players

- Cabot Corporation

- Hammond Group

- Imerys

- 3M

- Borregaard

- PENOX

- SGL Carbon

- Orion Engineered Carbons

- Borregaard

|

By Type |

By Application |

By End-Use Industry |

By Region |

|

|

|

|

Related Reports

- Industrial Boiler Market Size - By Product (Fire-Tube, Water-Tube), By Capacity, By Application (Food Processing, Pulp &...

- Commercial Boiler Market - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non-Conde...

- Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), By Appl...

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

Table of Content

-

Executive Summary

-

1.1 Market Overview

-

1.2 Key Trends and Insights

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Scope and Objectives

-

2.2 Research Methodology

-

2.3 Definitions and Assumptions

-

-

Market Overview

-

3.1 What Are Battery Additives?

-

3.2 Role in Enhancing Battery Performance

-

3.3 Types and Functions of Additives

-

3.4 Industry Value Chain Analysis

-

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Growth in Electric Vehicles and Energy Storage Systems

-

4.1.2 Demand for Longer Cycle Life and Efficiency

-

4.1.3 Innovations in Electrode and Electrolyte Chemistry

-

-

4.2 Market Restraints

-

4.2.1 Cost and Compatibility Concerns

-

4.2.2 Regulatory Challenges on Additive Composition

-

-

4.3 Market Opportunities

-

4.3.1 Advanced Materials for Next-Gen Batteries

-

4.3.2 Tailored Additives for Solid-State and Sodium-Ion Batteries

-

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Cathode Additives (e.g., Coatings, Conductive Agents)

-

5.2 Anode Additives (e.g., Binders, SEI Stabilizers)

-

5.3 Electrolyte Additives (e.g., Flame Retardants, Film Formers)

-

5.4 Separator and Conductive Polymer Additives

-

5.5 Additive Manufacturing and Nanotechnology Applications

-

-

Market Segmentation

-

6.1 By Type

-

6.1.1 Conductive Additives

-

6.1.2 Porous Additives

-

6.1.3 Electrolyte Stabilizers

-

6.1.4 Others

-

-

6.2 By Battery Chemistry

-

6.2.1 Lithium-Ion

-

6.2.2 Lead-Acid

-

6.2.3 Nickel-Based

-

6.2.4 Others

-

-

6.3 By Application

-

6.3.1 Automotive Batteries

-

6.3.2 Consumer Electronics

-

6.3.3 Industrial and Grid Storage

-

6.3.4 Aerospace and Defense

-

-

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue Forecast

-

8.2 Segment-Wise Revenue Outlook

-

8.3 Regional Growth Projections

-

-

Competitive Landscape

-

9.1 Market Share of Key Players

-

9.2 Company Profiles

-

9.2.1 Cabot Corporation

-

9.2.2 3M

-

9.2.3 Orion Engineered Carbons

-

9.2.4 Arkema

-

9.2.5 Others

-

-

9.3 Strategic Developments and R&D Initiatives

-

-

Regulatory and Environmental Considerations

-

10.1 Material Safety and Handling Regulations

-

10.2 REACH, RoHS, and Battery Directive Compliance

-

10.3 Environmental Impact and Waste Management

-

-

Innovation and Future Outlook

-

11.1 High-Performance Additives for Fast-Charging Batteries

-

11.2 AI and Data-Driven Formulation Optimization

-

11.3 Additives for Next-Generation Battery Chemistries

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 Data Sources and References

-

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy