Saudi Arabia Automotive Lead Acid Battery Market

Saudi Arabia Automotive Lead Acid Battery Market By Vehicle Type (Passenger Car, LCV, M&HCV and OTR), By Type (Starter Battery, EV Battery), By Battery Capacity (Less than 50 Ah, 51-75 Ah, Above 75 Ah), Regional, Competition, Forecast & Opportunities, 2019-2029F

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

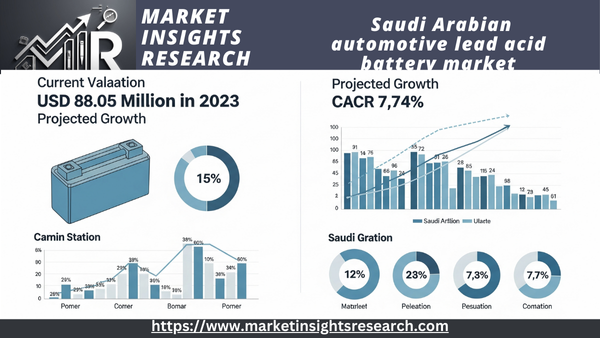

| Market Size (2023) | USD 88.05 Million |

| CAGR (2024-2029) | 7.74% |

| Fastest Growing Segment | Passenger Car |

| Largest Market | Northern & Central |

| Market Size (2029) | USD 137.71 Million |

Market Overview

The Saudi Arabian automotive lead acid battery market was valued at USD 88.05 million in 2023 and is expected to grow at a strong rate of 7.74% over the course of the forecast period.

Download Free Sample Ask for Discount Request Customization

Key Market Drivers

Automotive Sector Growth

One of the main drivers is the Saudi Arabian automobile industry's explosive growth, which is fueled by efforts at economic diversification. The need for lead-acid batteries to power a variety of vehicles has increased due to increased vehicle production and ownership. With Saudi Arabia leading the regional market, the Middle East/North Africa (MENA) region is predicted to grow at a rate of 36%. Over 52% of cars sold in the Gulf Cooperation Council (GCC) and 35% in the Middle East and North Africa (MENA) were sold in Saudi Arabia in 2020. In 2019 and 2020, Saudi Arabia sold a total of 556,000 and 436,000 automobiles. By 2025, sales are predicted to reach 543,000 units, of which only 32,000 will be electric vehicles (EVs).

Rising Vehicle Ownership

The number of Saudi Arabians who own personal vehicles has significantly increased as a result of the country's expanding population and improving economic conditions. Demand is increased because lead-acid batteries are the most widely used energy storage option in these cars. Saudi Arabia's dominant market share of almost 50% makes it the biggest automotive market in the GCC. In 2021, the nation's new car sales increased by 23% year over year, surpassing the growth rates of Kuwait and the United Arab Emirates. Initiatives like the National Industrial Development and Logistics Program (NIDLP) and the opening of Lucid Motors' auto manufacturing facility demonstrate Saudi Arabia's efforts to grow its automotive sector and demonstrate the country's progress toward becoming a manufacturing hub.

Download Free Sample Ask for Discount Request Customization

Focus on Road Safety

Reliable batteries are now required to power safety features like airbags and anti-lock braking systems (ABS) as a result of the Saudi government's emphasis on road safety and the installation of advanced driver assistance systems (ADAS).

Environmental Standards

Particularly when it comes to electric and hybrid vehicles, lead-acid batteries are essential to the automotive sector. Their ability to adhere to strict emission control regulations and environmental standards makes them extremely valuable. The demand for cars with lower carbon footprints is rising as the world grows more conscious of the effects that conventional combustion engines have on the environment. This change has sparked the creation of battery technologies that are more sustainable and efficient. Known for their dependability and affordability, lead-acid batteries have been modified to address these novel issues. They are a popular option for environmentally conscious consumers and manufacturers trying to adhere to environmental regulations because they provide a balance between performance and environmental sustainability. Lead-acid batteries are essential to the ongoing evolution of the automotive industry toward more environmentally friendly options. Their ongoing innovation is crucial to advancing the automotive sector's dedication to lessening its impact on the environment and opening the door for more environmentally friendly forms of transportation. Improvements in battery technology hold promise for even higher efficiency and environmental friendliness.

Local Manufacturing Initiatives

Saudi Arabia is promoting the production of batteries and other automotive parts domestically. Battery manufacturers now have the chance to establish a presence in the area thanks to this emphasis on local production, which is propelling the market. The National Industrial Development Centre (NIDC) aims to draw in three to four Original Equipment Manufacturers from the ICE and EV value chains in order to meet the Kingdom's Vision 2030 targets of producing 300,000 vehicles annually with 40% local content by 2030. Through tariff exemptions, tax breaks, and loans, NIDC promotes industry. The Kingdom offers potential for U.S. companies looking to enter into joint ventures because of the high demand for vehicle body panels, wheel components, tires, seats, fuel pumps, seat belts, rear indication light covers, headlights, bumpers, and engine covers.

Industrial Applications

In addition to being utilized in automobiles, lead-acid batteries are also employed in a number of industrial fields, such as renewable energy storage, backup power systems, and telecommunications. The demand for lead-acid batteries is driven by the expansion of these industries.

Affordability and Reliability

Lead-acid batteries are renowned for being dependable and reasonably priced. They are a popular option for the Saudi automotive market because of their affordability when compared to other battery technologies, which continues to draw in both automakers and consumers.

In conclusion, the Saudi Arabian automotive lead acid battery market is growing rapidly due to a number of factors, including the country's growing automobile industry, rising car ownership, emphasis on environmental and traffic safety regulations, local manufacturing projects, a burgeoning aftermarket, industrial uses, and the dependability and affordability of lead-acid batteries. All of these factors work together to support the kingdom's booming lead-acid battery market.

Key Market Challenges

Environmental Concerns

It is true that lead-acid batteries pose serious environmental risks. As a strong neurotoxin, lead can have detrimental effects on the environment and human health. Lead leaks into the soil and water as a result of improper disposal and recycling methods, contaminating ecosystems and getting into the food chain. Strict laws governing battery production, recycling, and disposal are necessary to reduce these risks. Campaigns for public education can also encourage recycling and appropriate disposal. Battery technology advancements that lower or do away with lead content may also be a sustainable way to meet energy storage demands without sacrificing environmental integrity.

Rise of Alternative Technologies

With the introduction of lithium-ion and nickel-metal hydride batteries, which have longer lifespans and a higher energy density than conventional lead-acid batteries, the battery industry is undergoing a dramatic change. In the electric vehicle industry, where efficiency and performance are crucial, this development has a particularly significant impact. Lead-acid battery producers must spend money on R&D to stay competitive, investigating novel materials and technologies to improve the functionality, durability, and environmental sustainability of their products. Innovation is essential as the market shifts to more sophisticated, affordable, and environmentally friendly energy storage options. Lead-acid batteries are in a race to adapt or face obsolescence.

Limited Energy Density

The lower energy density of lead-acid batteries in comparison to more recent battery technologies restricts their use in some applications, especially in electric vehicles where longer range is crucial. A recurring problem is increasing energy density while preserving cost effectiveness.

Shorter Lifespan

In general, lead-acid batteries don't last as long as some other technologies. Lead-acid battery longevity is essential for lowering replacement costs and increasing overall performance.

Charging Infrastructure

The accessibility and availability of charging infrastructure limit the demand for lead-acid batteries in electric vehicles. For electric vehicles and the lead-acid batteries that power them to become widely used, a comprehensive and dependable charging network must be established.

Economic and Market Fluctuations

The supply and cost of lead, a crucial component of lead-acid batteries, can be impacted by market and economic volatility. Such variations can lead to price volatility and supply chain challenges.

Heavyweight

The relative weight of lead-acid batteries has an impact on overall vehicle performance and fuel economy, especially in cars with traditional internal combustion engines. For automakers to meet fuel economy requirements, weight-related issues must be resolved.

Technology Advancements

It's never easy to keep up with the latest developments in technology. For lead-acid battery manufacturers to stay competitive in the quickly changing automotive market, they must make research and development investments to increase efficiency, lower maintenance needs, and improve safety features.

In conclusion, the Saudi Arabian automotive lead acid battery market is confronted with issues such as the need for constant technological advancements, limited energy density, shorter lifespan, charging infrastructure, environmental impact, competition from alternative technologies, and heavy weight. For the lead-acid battery industry in the Saudi automotive sector to grow and remain sustainable, these obstacles must be overcome.

Key Market Trends

Advanced Battery Technologies

One important trend is the incorporation of cutting-edge technologies into lead-acid batteries. To increase performance, longevity, and dependability, manufacturers are creating enhanced flooded batteries (EFB) and absorbent glass mats (AGM). These developments improve battery performance and compatibility with contemporary automotive electrical systems.

Electric Vehicle (EV) Applications

The increasing global use of electric vehicles is having an effect on the lead-acid battery market. Lead-acid batteries are commonly used to provide start-stop capabilities in mild-hybrid and micro-hybrid vehicles. This trend aligns with the growing emphasis on fuel efficiency and emissions reduction.

Recycling and Sustainability

Recycling batteries using sustainable methods is becoming more popular. The effects of lead-acid batteries on the environment are becoming more widely recognized among manufacturers and consumers. To create a more sustainable battery life cycle, efficient recycling techniques are being developed to cut waste and extract valuable materials.

Maintenance-Free Batteries

Lead-acid batteries that require no maintenance are becoming more and more popular. Because these batteries are made to be sealed and maintenance-free, they require less care and don't require frequent fluid checks or water refills. Customers looking for dependable and hassle-free power solutions are catered to by this trend.

Remote Monitoring and IoT Integration

Remote monitoring and Internet of Things (IoT) capabilities are becoming more and more common in lead-acid batteries. These technologies are appropriate for a range of applications, from industrial to automotive, because they enable users to optimize battery performance, monitor battery health, and receive alerts about possible problems.

Increased Charging Efficiency

The efficiency of lead-acid battery charging is increasing thanks to technological advancements. For electric vehicles, where quick charging and a longer range are important factors, this trend is especially pertinent. Improved battery performance and user convenience are being facilitated by improved charging techniques.

Diversified Industrial Applications

Lead-acid batteries are used in many different industrial sectors in addition to the automotive industry. Lead-acid batteries' adaptability is resulting in a wide range of applications, from renewable energy storage to backup power systems, opening up new markets for battery producers.

Customized Battery Solutions

Manufacturers are providing lead-acid battery solutions that are tailored to the needs of particular users. Customization is gaining popularity as a way to improve performance and efficiency, whether it be for batteries used in industrial machinery, renewable energy systems, or particular car models.

In summary, the Saudi Arabian automotive lead acid battery market is characterized by a number of trends, including increased charging efficiency, a variety of industrial applications, maintenance-free solutions, remote monitoring and IoT integration, advanced battery technologies, applications in electric vehicles, sustainability initiatives, and customized battery solutions. The lead-acid battery market in Saudi Arabia's automotive and industrial sectors is shaped by these trends taken together, which meet the changing needs for dependable, economical, and environmentally friendly power sources.

Segmental Insights

By Vehicle Type

Passenger cars, light commercial vehicles (LCVs), medium and heavy commercial vehicles (M&HCVs), and off-the-road (OTR) vehicles are some of the vehicle types that significantly influence the demand for lead acid batteries in the Saudi Arabian automotive lead acid battery market.

By Battery Capacity

The "Less than 50 Ah" segment of the Saudi Arabian automotive lead acid battery market refers to a lower capacity battery category. Usually, these batteries are found in smaller automobiles like motorcycles and compact cars. They work well in cars with less demanding electrical systems because of their lower capacity. They are necessary to power fundamental electrical components and guarantee the engine starts reliably. These batteries are renowned for being lightweight and small, which makes them the perfect option for smaller cars that are frequently used in Saudi Arabia for short-distance and city commuting.

Batteries with a medium capacity range are included in the "51-75 Ah" segment of the Saudi Arabian automotive lead acid battery market. Numerous automobiles, such as SUVs, mid-sized sedans, and certain light commercial vehicles, heavily rely on these batteries. The 51-75 Ah batteries balance meeting the electrical needs of cars with more sophisticated features while still offering enough power to start bigger engines. This battery segment is in high demand due to the nation's varied automotive landscape and the preference for larger vehicles. They are a necessary part of cars used for longer trips and daily commuting because of their dependability and moderate capacity.

The high-capacity batteries in the Saudi Arabian automotive lead acid battery market are represented by the "Above 75 Ah" segment. These batteries are made to withstand the demands of larger vehicles, such as buses, off-road equipment, and heavy-duty trucks. They can supply a significant amount of power to start large engines and support extensive electrical systems because of their capacity, which exceeds 75 Ah. Given the significance of Saudi Arabia's logistics and transportation industries, these high-capacity batteries are essential to maintaining the continuous operation of commercial and industrial vehicles, particularly in the face of the region's harsh climate. The success of heavy-duty applications depends on their strong performance and longevity.

Regional Insights

An important center for the Saudi automobile industry is the Central Region, which includes the capital city of Riyadh. Due to the region's high population, thriving economy, and wide variety of vehicles on the road, there is a significant demand for lead acid batteries. The scorching desert climate in this area places a particular emphasis on the need for reliable batteries, as extreme temperatures can negatively impact battery performance. The Central Region is also at the forefront of the transition to more energy-efficient technologies, including Electric Vehicles (EVs), which will shape the future of the lead-acid battery market.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In July 2023, SNB Capital, a Saudi Arabian investment firm, committed to a $100 million investment in the South Korean company SK On, which specializes in manufacturing car batteries. This investment aligns with SK On's intentions to expand its production capacity, aiming to double it.

- In 2024, Exide Industries Ltd., a leading battery manufacturer, is poised to launch a new Absorbent Glass Mat (AGM) battery for starting, lighting, and ignition (SLI) applications in the automotive sector. These AGM-based lead-acid batteries are considered a superior performance solution, providing enhanced starting power, superior durability, and the potential for a longer lifespan compared to traditional lead-acid batteries. Exide is collaborating with East Penn Manufacturing in the USA to develop these SLI-AGM batteries for both domestic and international markets. We anticipate the new offering to be available in the MEA market in the coming years.

- In 2023, Lucid, an American electric vehicle (EV) maker, opened its first international manufacturing plant in Saudi Arabia, with an initial production capacity of 5,000 vehicles per year. This move is part of Saudi Arabia's strategic goal to diversify its economy and ensure that 30% of new car sales in the kingdom are electric by 2030. The facility, located in King Abdullah Economic City (KAEC), received significant support from the Saudi government and is expected to play a key role in the country's push toward the EV industry.

Key Market Players

- Exide Technologies

- Hankook & Company Co., Ltd.

- GS Yuasa Corporation

- PT Nipress Tbk

- Leoch International Technology Limited Inc.

- CSB Energy Technology Co., Ltd

- Crown Battery Manufacturing Company

- Johnson Controls Inc.

- Middle East Battery Company (MEBCO)

- C&D Technologies, Inc.

|

By Vehicle Type |

By Type |

By Battery Capacity |

By Region |

|

|

|

|

Related Reports

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

- North America & Europe Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), By Application (Re...

- North America Residential Boiler Market Size - By Fuel (Natural Gas, Oil, Electric), By Technology (Condensing {Natural ...

- U.S. Commercial Boiler Market – By Product (Hot Water, Steam), Application (Offices, Healthcare Facilities, Educationa...

Table of Content

-

Executive Summary

-

1.1 Market Overview

-

1.2 Key Insights and Trends

-

1.3 Strategic Recommendations

-

Introduction

-

2.1 Objectives and Scope

-

2.2 Methodology and Data Sources

-

2.3 Definitions and Assumptions

-

Market Overview

-

3.1 Lead Acid Battery Fundamentals

-

3.2 Role in Saudi Arabia’s Automotive Sector

-

3.3 Battery Supply Chain and Distribution Channels

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Large Vehicle Parc and High Vehicle Replacement Rate

-

4.1.2 Climate Conditions Favoring Robust Battery Demand

-

4.1.3 Government Support for Auto Parts Localization

-

4.2 Restraints

-

4.2.1 Growing Popularity of Lithium-Ion Batteries in EVs

-

4.2.2 Environmental and Recycling Concerns

-

4.3 Opportunities

-

4.3.1 Expansion of Aftermarket Services

-

4.3.2 Growing Demand for Start-Stop Batteries

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

Technology Landscape

-

5.1 Flooded Lead Acid Batteries

-

5.2 Enhanced Flooded Batteries (EFB)

-

5.3 Absorbent Glass Mat (AGM) Batteries

-

5.4 Cold Cranking Amps (CCA) and Battery Performance Metrics

-

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Flooded

-

6.1.2 AGM

-

6.1.3 EFB

-

6.2 By Vehicle Type

-

6.2.1 Passenger Vehicles

-

6.2.2 Light Commercial Vehicles

-

6.2.3 Heavy Commercial Vehicles

-

6.3 By Sales Channel

-

6.3.1 OEMs

-

6.3.2 Aftermarket

-

Regional Analysis

-

7.1 Riyadh

-

7.2 Jeddah

-

7.3 Dammam

-

7.4 Other Key Cities and Regions

-

Market Size and Forecast (2020–2030)

-

8.1 Market Revenue Forecast

-

8.2 Unit Sales Forecast

-

8.3 Forecast by Battery Type and Vehicle Segment

-

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Profiles of Leading Companies

-

9.2.1 Exide

-

9.2.2 AC Delco

-

9.2.3 Panasonic

-

9.2.4 VARTA

-

9.2.5 Local Saudi Manufacturers and Distributors

-

9.3 Strategic Partnerships and Distribution Expansions

-

Regulatory and Environmental Considerations

-

10.1 Import Duties and Local Manufacturing Incentives

-

10.2 Battery Disposal and Recycling Laws

-

10.3 Quality Certifications and Standards

-

Consumer Insights

-

11.1 Buying Behavior and Brand Preferences

-

11.2 Price Sensitivity and Warranty Expectations

-

11.3 Service and Replacement Trends

-

Innovation and Future Outlook

-

12.1 Dual Battery Systems in New Vehicle Models

-

12.2 Potential for Hybridization and EV Transition

-

12.3 Digital Battery Monitoring and Smart Diagnostics

-

Conclusion and Strategic Outlook

-

Appendices

-

14.1 Glossary

-

14.2 Research Methodology

-

14.3 References

Executive Summary

-

1.1 Market Overview

-

1.2 Key Insights and Trends

-

1.3 Strategic Recommendations

Introduction

-

2.1 Objectives and Scope

-

2.2 Methodology and Data Sources

-

2.3 Definitions and Assumptions

Market Overview

-

3.1 Lead Acid Battery Fundamentals

-

3.2 Role in Saudi Arabia’s Automotive Sector

-

3.3 Battery Supply Chain and Distribution Channels

Market Dynamics

-

4.1 Drivers

-

4.1.1 Large Vehicle Parc and High Vehicle Replacement Rate

-

4.1.2 Climate Conditions Favoring Robust Battery Demand

-

4.1.3 Government Support for Auto Parts Localization

-

-

4.2 Restraints

-

4.2.1 Growing Popularity of Lithium-Ion Batteries in EVs

-

4.2.2 Environmental and Recycling Concerns

-

-

4.3 Opportunities

-

4.3.1 Expansion of Aftermarket Services

-

4.3.2 Growing Demand for Start-Stop Batteries

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

Technology Landscape

-

5.1 Flooded Lead Acid Batteries

-

5.2 Enhanced Flooded Batteries (EFB)

-

5.3 Absorbent Glass Mat (AGM) Batteries

-

5.4 Cold Cranking Amps (CCA) and Battery Performance Metrics

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Flooded

-

6.1.2 AGM

-

6.1.3 EFB

-

-

6.2 By Vehicle Type

-

6.2.1 Passenger Vehicles

-

6.2.2 Light Commercial Vehicles

-

6.2.3 Heavy Commercial Vehicles

-

-

6.3 By Sales Channel

-

6.3.1 OEMs

-

6.3.2 Aftermarket

-

Regional Analysis

-

7.1 Riyadh

-

7.2 Jeddah

-

7.3 Dammam

-

7.4 Other Key Cities and Regions

Market Size and Forecast (2020–2030)

-

8.1 Market Revenue Forecast

-

8.2 Unit Sales Forecast

-

8.3 Forecast by Battery Type and Vehicle Segment

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Profiles of Leading Companies

-

9.2.1 Exide

-

9.2.2 AC Delco

-

9.2.3 Panasonic

-

9.2.4 VARTA

-

9.2.5 Local Saudi Manufacturers and Distributors

-

-

9.3 Strategic Partnerships and Distribution Expansions

Regulatory and Environmental Considerations

-

10.1 Import Duties and Local Manufacturing Incentives

-

10.2 Battery Disposal and Recycling Laws

-

10.3 Quality Certifications and Standards

Consumer Insights

-

11.1 Buying Behavior and Brand Preferences

-

11.2 Price Sensitivity and Warranty Expectations

-

11.3 Service and Replacement Trends

Innovation and Future Outlook

-

12.1 Dual Battery Systems in New Vehicle Models

-

12.2 Potential for Hybridization and EV Transition

-

12.3 Digital Battery Monitoring and Smart Diagnostics

Conclusion and Strategic Outlook

Appendices

-

14.1 Glossary

-

14.2 Research Methodology

-

14.3 References

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy