Saudi Arabia Smart Meters Market

Saudi Arabia Smart Meters Market By Technology (Automatic Meter Reading (AMR) and Advanced Metering Infrastructure (AMI)), By Type (Energy, Water and Gas), By Application (Industrial, Commercial and Residential), By Region, Competition, Forecast and Opportunities, 2019-2029

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

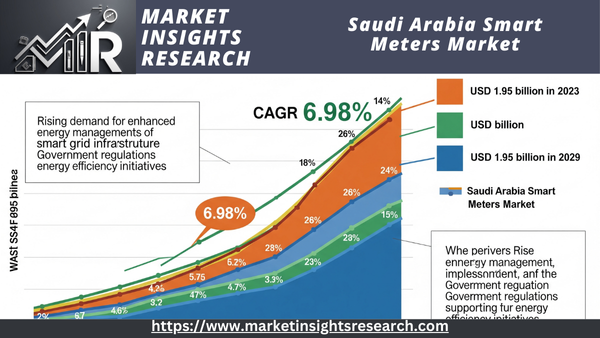

| Market Size (2023) | USD 1.95 Billion |

| Market Size (2029) | USD 2.95 Billion |

| CAGR (2024-2029) | 6.98% |

| Fastest Growing Segment | Industrial |

| Largest Market | Riyadh |

Market Overview

The Saudi Arabian smart meter market, which was estimated to be worth USD 1.95 billion in 2023, is expected to grow rapidly over the course of the forecast period, with a compound annual growth rate (CAGR) of 6.98% through 2029.

Download Free Sample Ask for Discount Request Customization

Key Market Drivers

Government Initiatives and Regulations

Strong governmental backing and the enforcement of regulations are key drivers propelling the Saudi Arabian smart meter market forward. The Saudi Arabian government has been actively promoting the installation of smart meters as part of broader initiatives to modernize the nation's energy infrastructure and encourage energy efficiency. The government recognizes the crucial role of smart meters in the country's transition to a more efficient and sustainable energy system.

To encourage the adoption of smart meters, the government has initiated several programs and regulations. For instance, the Electricity and Cogeneration Regulatory Authority (ECRA) mandates the installation of smart meters in residential, commercial, and industrial buildings. These regulations ensure compliance from both utility companies and consumers, fostering an environment conducive to smart meter deployment. The government has also provided incentives and subsidies to utility companies to accelerate the rollout of smart meters.

Furthermore, the government's commitment to Vision 2030 has accelerated the deployment of smart meters, aiming to diversify the Saudi economy and reduce its dependence on oil. The sustainability goals of Vision 2030 align with the enhanced energy efficiency enabled by smart metering, which also helps to conserve resources and lower carbon emissions.

Growing Demand for Energy Efficiency

Another significant aspect driving the Saudi Arabian smart meter industry is the rising demand for energy efficiency. The country's economy and population are growing at the same time that energy consumption is rising. Since the current energy infrastructure is under stress from the rise in energy demand, more efficient management of energy resources is essential.

Smart meters are crucial in assisting in the resolution of this issue since they enable consumers to monitor their energy consumption in real time. By having access to thorough information about their energy usage, customers may make informed decisions to reduce their energy use during peak hours, minimize their costs, and assist system stability. Growing consumer awareness of energy consumption is driving demand for smart meters among residential and commercial clients.

Businesses in Saudi Arabia are increasingly prioritizing sustainability and environmental responsibility. They are searching for ways to reduce their carbon impact and energy waste. Smart meters enable them to monitor their energy consumption and optimize their processes for enhanced energy efficiency. Because of this, smart meters are a popular choice for businesses trying to meet their sustainability goals and are consistent with worldwide trends in corporate social responsibility.

Download Free Sample Ask for Discount Request Customization

Technological Advancements and Innovation

The rapid advancement of technology has led to a major growth in the Saudi Arabian smart meter market. Smart meters are becoming more sophisticated and potent due to their enhanced features and benefits. The appeal of these technological developments to both utility companies and consumers drives adoption rates.

One important technological advancement is the establishment of advanced metering infrastructure (AMI). AMI allows two-way communication between the meter and the utility company, enabling remote monitoring and control. In addition to opening up possibilities for demand response systems, dynamic pricing, and real-time outage monitoring, this feature streamlines the meter reading process.

The incorporation of smart meters with other smart devices and home automation systems is another significant advancement. Consumers can now monitor their overall energy consumption and remotely operate their appliances. By setting thermostats or lights to adjust automatically based on usage patterns, users can contribute to energy conservation.

Thanks to advancements in data analytics and artificial intelligence, utility companies can now glean valuable insights from the vast volumes of data collected by smart meters. This data can be used to improve grid dependability, optimize energy distribution, and predict and prevent energy theft or tampering.

The Saudi Arabian smart meter industry is being driven by consistent technology developments, increased demand for energy efficiency, and government backing. These factors are also promoting the use of smart meters and making the country's energy infrastructure more modern, efficient, and sustainable.

Key Market Challenges

Initial Infrastructure Investment

One of the greatest challenges facing the Saudi Arabian smart meter market is the significant upfront infrastructure investment required for the implementation of these state-of-the-art metering devices. Communication networks, data management systems, cybersecurity, and smart meters must be deployed in lieu of the existing conventional meters to implement a large-scale smart metering infrastructure. Because these installations can be costly, both the government and energy corporations face financial difficulties.

Utility companies may need to secure significant capital to begin the implementation of smart meters, and the return on investment is not necessarily immediate. The initial expenses of smart meters can be a significant barrier to entry, especially for smaller utility companies, and may delay or restrict their implementation.

The government and utility companies might investigate financing methods and public-private partnerships to circumvent this barrier and make it more feasible for businesses to engage in smart meter technology by spreading out the expenses over a longer period of time. We can also overcome this financial barrier by utilizing foreign capital and exploring innovative financing solutions.

Privacy and Security Concerns

In Saudi Arabia, the deployment of smart meters presents new privacy and security issues. The acceptance and uptake of this technology are seriously hampered by these worries. Smart meters gather detailed information about energy use, which may compromise consumer privacy if handled improperly. One significant issue that must be resolved is the concern over identity theft, illegal access to this data, and surveillance.

Additionally, it is crucial to guarantee the security of the communication networks that link smart meters to the data centers of utility companies. Malicious actors could potentially take advantage of any weakness in these networks, resulting in data breaches or even the power grid going down. In light of regional geopolitical tensions and cyberattacks, this worry may be especially pressing.

Strong data protection regulations, encryption techniques, and cybersecurity measures are needed to address these privacy and security issues. To safeguard customer information and the integrity of the smart grid, the government, utility companies, and technology providers must collaborate to create and execute robust data security and privacy policies.

Consumer Education and Acceptance

Despite the significant advantages of smart meters, consumers frequently lack knowledge and comprehension of these technologies. The adoption of smart meters may encounter opposition or skepticism as a result of this ignorance. Customers might be worried about data privacy, the accuracy of billing, or the possible health risks associated with radiofrequency emissions.

Although difficult, consumer education and acceptance efforts are crucial. It is essential to allay these worries and prove the benefits of smart meters in terms of financial savings and energy conservation. To educate consumers about the benefits and safety precautions of smart meters, utility companies and the government must launch massive public outreach and education initiatives.

The adoption of smart meters is also influenced by consumer preferences and cultural considerations. It's critical to modify the messaging to specifically address the worries of Saudi Arabian customers and to offer them resources and assistance in order to allay their worries and address their inquiries.

The Saudi Arabian market for smart meters faces a number of obstacles, such as the requirement for consumer acceptance and education, initial infrastructure investment, and privacy and security concerns. In order to overcome these obstacles and guarantee a seamless transition to a more sustainable and efficient energy infrastructure, cooperation between the government, utility companies, and technology providers will be necessary.

Key Market Trends

Integration of Advanced Technologies

The growing integration of cutting-edge technologies to improve the functionality and capabilities of smart meters is one noteworthy trend in the Saudi Arabian market. Smart meters are becoming essential parts of a larger smart grid ecosystem, going beyond simple data collection and remote monitoring tools. The desire to fully utilize these devices and the need for more effective energy management are the driving forces behind this trend.

One key technology trend in the smart meters market is the integration of Internet of Things (IoT) capabilities. Smart meters are now being designed to connect to a wider range of IoT devices and sensors within homes, businesses, and the grid infrastructure. Such integration allows for more granular data collection, improved load management, and enhanced automation. For example, smart meters can communicate with smart thermostats, appliances, and lighting systems, enabling consumers to optimize their energy consumption and reduce costs.

Artificial Intelligence (AI) and data analytics are being incorporated into the smart metering infrastructure. These technologies enable utility companies to process and analyze the vast amount of data generated by smart meters more efficiently. AI can help predict energy demand patterns, detect anomalies, and optimize grid operations. For consumers, AI-driven applications can provide personalized energy management recommendations based on their historical consumption and behavior.

Another prominent technological trend is the use of blockchain for data security and transparency. Blockchain technology ensures the integrity and security of data exchanged between smart meters, utility companies, and consumers. It can also support innovative billing and payment solutions, such as peer-to-peer energy trading, where consumers can sell excess energy directly to their neighbors, further enhancing the value proposition of smart meters.

Overall, the integration of advanced technologies in smart meters is transforming them from simple data collection tools into sophisticated energy management systems, contributing to greater energy efficiency and sustainability.

Demand Response and Time-of-Use Pricing

Another significant trend in the Saudi Arabia smart meters market is the increasing adoption of demand response programs and time-of-use pricing. These initiatives are being launched to optimize energy consumption, reduce peak demand, and improve grid reliability. Smart meters play a pivotal role in enabling these programs, making them a key driver of this trend.

Demand response programs involve adjusting energy consumption based on signals from the utility company. When the grid is under stress, consumers can voluntarily reduce their energy usage during peak hours or in response to price signals. Such behavior helps in avoiding blackouts, reducing electricity costs, and lowering the need for new power plants. Smart meters facilitate such actions by providing real-time data to consumers and utility companies, allowing for more precise demand management.

Time-of-use (TOU) pricing is another aspect of this trend. Under TOU pricing, the cost of electricity varies depending on the time of day, with higher rates during peak hours and lower rates during off-peak periods. Smart meters enable accurate measurement of energy consumption at different times, enabling consumers to adjust their energy usage patterns to take advantage of lower rates. TOU pricing not only benefits consumers by lowering their electricity bills but also incentivizes energy conservation and load-shifting, reducing pressure on the grid during peak times.

Both demand response and TOU pricing are aligned with the Saudi government's goals to enhance energy efficiency and grid sustainability. As these programs gain traction and as smart meter adoption grows, they are likely to become more commonplace in Saudi Arabia, helping to balance energy supply and demand, reduce energy costs for consumers, and promote a more efficient and environmentally friendly energy sector.

The integration of advanced technologies and the growth of demand response and TOU pricing programs are two significant trends in the Saudi Arabia smart meters market. These trends are shaping the future of energy management and consumption in the country, driving efficiency and sustainability in the energy sector.

Segmental Insights

Type Insights

The Energy segment dominated the market in 2023. The energy sector in Saudi Arabia has been undergoing significant changes, with a growing focus on efficiency, sustainability, and technological advancements. Smart meters play a crucial role in this transformation.

The deployment of smart meters is closely tied to the development of a smart grid in Saudi Arabia. Smart meters enable two-way communication between utilities and consumers, facilitating demand response, load management, and real-time data collection for grid optimization.

Regional Insights

Riyadh dominated the market in 2023. Riyadh, being the economic and administrative center of Saudi Arabia, is a prime location for the deployment of smart meters. The city's growing population and energy consumption provide a substantial market for smart meter technologies.

Utility companies operating in Riyadh have been actively investing in smart meters to improve their metering and billing processes. Smart meters can provide accurate real-time data, reducing the need for manual meter reading and helping utilities operate more efficiently.

Download Free Sample Ask for Discount Request Customization

Recent Development

- In May 2024, Oakter, a prominent consumer electronics brand, introduced Oakmeter, its latest smart energy meter. This innovative device integrates cutting-edge technologies, including Advanced Metering Infrastructure, real-time data analytics, and Internet of Things (IoT) capabilities.

- In May 2024, Polaris, an energy solutions provider, announced on Wednesday that it has won a contract valued at USD 268.52 million to deploy 2.2 million smart meters in West Bengal. With this contract, Polaris has now secured orders exceeding USD 920.55 million across various regions, including Uttar Pradesh, West Bengal, Manipur, Bihar, and Ladakh.

- In February 2024, Salzer Group inaugurated its new smart meter manufacturing facility in India. The plant initially has an annual production capacity of 4 million smart energy meters, with plans to ramp up to 10 million smart energy meters in Phase 2.

- In January 2024, Adani Energy Solutions Limited (AESL), a private company specializing in transmission and distribution, announced a joint venture with Esyasoft Holdings. Under this partnership, AESL holds a 49% stake while Esyasoft Holdings owns 51%, focusing on implementing smart metering projects in India and globally.

Key Market Players

- Landis+Gyr Group AG

- Kamstrup A/S

- Itron Inc.

- Iskraemeco d.d.

- ELEKTROMED Smart Metering

- Holley Technology Ltd. (Holley Group)

- Hexing Electrical Co., Ltd

- Xylem Inc.

|

By Technology |

By Type |

By Application |

By Region |

|

|

|

|

Related Reports

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

- Europe Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), ...

- Electric Boiler Market Size By Voltage Rating (Low, Medium), By Application (Residential, Commercial, Industrial, Food P...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Developments and Trends

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Objectives and Scope of the Report

-

2.2 Definitions and Market Segmentation

-

2.3 Research Methodology

-

2.4 Assumptions and Limitations

-

-

Market Overview

-

3.1 What Are Smart Meters?

-

3.2 Evolution and Adoption in Saudi Arabia

-

3.3 Role in Saudi Vision 2030 and Smart Grid Initiatives

-

3.4 Market Ecosystem and Value Chain

-

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Government Mandates for Digital Infrastructure

-

4.1.2 Energy Efficiency and Demand-Side Management

-

4.1.3 Rapid Urbanization and Smart City Projects

-

-

4.2 Restraints

-

4.2.1 High Installation and Maintenance Costs

-

4.2.2 Integration Challenges with Legacy Systems

-

-

4.3 Opportunities

-

4.3.1 AI and IoT Integration for Grid Optimization

-

4.3.2 Customer Engagement and Billing Accuracy

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 AMR vs. AMI Technologies

-

5.2 Smart Electricity Meters

-

5.3 Smart Water and Gas Meters

-

5.4 Communication Technologies (RF, PLC, Cellular, NB-IoT)

-

5.5 Cybersecurity in Smart Metering Systems

-

-

Market Segmentation

-

6.1 By Type

-

6.1.1 Smart Electricity Meters

-

6.1.2 Smart Water Meters

-

6.1.3 Smart Gas Meters

-

-

6.2 By Technology

-

6.2.1 AMR (Automatic Meter Reading)

-

6.2.2 AMI (Advanced Metering Infrastructure)

-

-

6.3 By Phase

-

6.3.1 Single-Phase

-

6.3.2 Three-Phase

-

-

6.4 By End-User

-

6.4.1 Residential

-

6.4.2 Commercial

-

6.4.3 Industrial

-

6.4.4 Utilities and Municipal

-

-

-

Regional and City-Level Analysis

-

7.1 Riyadh

-

7.2 Jeddah

-

7.3 Dammam

-

7.4 Mecca and Medina

-

7.5 Other Regions

-

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Volume Forecast

-

8.2 Segment-Wise Forecast

-

8.3 Growth Outlook and Investment Opportunities

-

-

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Profiles of Key Players

-

9.2.1 Huawei

-

9.2.2 Siemens

-

9.2.3 Landis+Gyr

-

9.2.4 Honeywell

-

9.2.5 Saudi Electricity Company Initiatives

-

-

9.3 Joint Ventures, Local Integrators, and Partnerships

-

-

Policy and Regulatory Framework

-

10.1 Regulatory Bodies and Smart Metering Guidelines

-

10.2 Data Privacy and Security Compliance

-

10.3 Utility Incentives and Funding Programs

-

-

Future Trends and Innovation

-

11.1 Integration with Smart Grids and DERs

-

11.2 Demand Response and Time-of-Use Tariffs

-

11.3 Real-Time Analytics and Predictive Maintenance

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary of Terms

-

13.2 Research Methodology

-

13.3 Data Sources and References

-

To get a detailed Table of contents/Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

To get a detailed Table of contents/Table of figures/Methodology Please contact our salesperson at chris@marketinsightsresearch.com.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy