Iron Flow Batteries Market

Iron Flow Batteries Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Redox, Hybrid), By Application (Utilities, Commercial & Industrial, EV Charging Stations, Microgrids), By Material (Vanadium, Zinc Bromine), By Region & Competition, 2019-2029

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

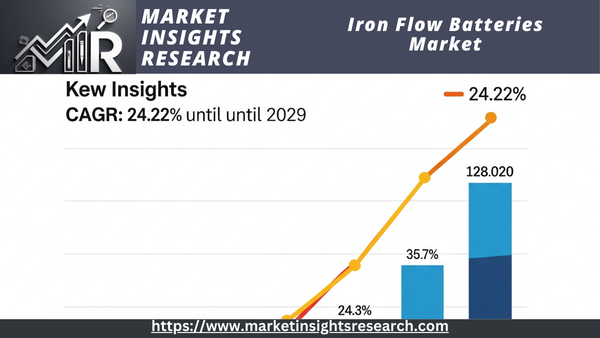

| Market Size (2023) | USD 30.27 Million |

| Market Size (2029) | USD 112.22 Million |

| CAGR (2024-2029) | 24.22% |

| Fastest Growing Segment | Vanadium |

| Largest Market | North America |

Market Overview

The market for iron flow batteries was estimated to be worth USD 30.27 million in 2023 and is expected to grow at a strong rate during the forecast period, with a compound annual growth rate (CAGR) of 24.22% through 2029.

The industry devoted to the advancement, manufacturing, and use of iron flow battery technology is known as the Iron Flow Batteries market. Iron flow batteries are a kind of rechargeable flow battery that stores and releases electrical energy using electrolyte solutions based on iron. Low material costs, high safety, and environmental sustainability are just a few of the potential benefits of this technology.

Download Free Sample Ask for Discount Request Customization

Two electrolyte tanks filled with iron salts that are pumped through an electrochemical cell make up iron flow batteries. An electrochemical reaction releases electrical energy during discharge, and the reaction is reversed during charging to store the energy. Large-scale energy storage applications like emergency power supply, renewable energy integration, and grid stabilization are appropriate for this technology.

Research and development, manufacturing, distribution, and end-use applications are just a few of the many facets that make up the market. It is impacted by things like government regulations that encourage renewable energy, technological developments, and the growing need for sustainable and effective energy storage solutions. The market for iron flow batteries is anticipated to grow as the world moves more quickly toward clean energy, propelled by advancements and rising energy storage system adoption.

Key Market Drivers

Technological Advancements and Innovations

Innovations and technological developments are key factors propelling the Iron Flow Batteries market. Iron flow batteries' performance, efficiency, and affordability have all significantly improved as a result of ongoing battery technology research and development. These batteries' energy density, cycle life, and operational stability have all been improved by advancements in materials, electrode design, and electrolyte formulations.

Since iron-based materials are plentiful and less expensive than other battery technologies, recent developments have concentrated on maximizing their use. Efficiency gains and lower operating costs have also been attributed to advancements in electrolyte chemistry and flow control. Iron flow batteries are now more competitive with other energy storage options, like lithium-ion and vanadium flow batteries, thanks to these technological advancements.

Research is still being done to find ways to make iron flow batteries even more flexible and scalable so they can be used in a greater variety of applications. More modular and compact systems that are simple to integrate into the current energy infrastructure have been developed as a result of advancements in battery design and manufacturing techniques.

The market for Iron Flow Batteries is anticipated to gain from lower prices and better performance as technology advances. These developments not only make iron flow batteries more appealing for energy storage applications, but they also help the technology expand and become more widely used.

Environmental Sustainability and Safety Concerns

The market for Iron Flow Batteries is largely driven by concerns about safety and environmental sustainability. The adoption of green technologies that reduce ecological footprints is becoming more and more important as the world struggles with the effects of climate change and environmental degradation. Because iron flow batteries employ plentiful and non-toxic materials like iron salts, they are by nature more environmentally friendly than many traditional battery technologies.

Rare earth elements and dangerous heavy metals, which are frequently present in other battery types, are absent from iron flow batteries. This feature lessens the negative effects that battery material extraction, processing, and disposal have on the environment. Iron flow batteries are also a safer choice for large-scale energy storage because they are less likely than lithium-ion batteries to experience thermal runaway and other safety problems.

Iron flow batteries have environmental advantages throughout their whole lifecycle. Since fewer batteries need to be changed and disposed of over time, their extended cycle life and slow rates of degradation help to reduce their environmental impact. This feature fits in with consumers' increasing desire for recyclable and sustainable technologies.

Environmental sustainability and safety are becoming more and more important to governments and organizations around the world when making energy-related decisions and investment choices. Iron flow batteries are becoming more and more popular as a safer and more environmentally friendly energy storage option due to the emphasis on lowering carbon footprints and improving safety features. It is anticipated that the increased focus on safety and sustainability will propel market expansion and promote additional developments in iron flow battery technology.

Download Free Sample Ask for Discount Request Customization

Supportive Government Policies and Incentives

The worldwide market for iron flow batteries is largely driven by supportive government policies and incentives. In order to achieve energy security, improve grid reliability, and aid in the shift to a low-carbon economy, many governments understand the significance of energy storage technologies. They have therefore put in place a number of laws and incentives to encourage the creation and uptake of energy storage technologies, such as iron flow batteries.

The financial obstacles related to the implementation of energy storage technologies are frequently reduced through the use of subsidies, grants, and tax incentives. Businesses and utilities can now invest in iron flow batteries more affordably thanks to these financial incentives, which speeds up market expansion. Governments may also provide funds for research and development in order to encourage creativity and lower the price of cutting-edge technologies.

Market expansion is further supported by regulatory frameworks that require or promote the grid integration of energy storage devices. Regulations requiring utilities to integrate energy storage into their infrastructure, for instance, may increase demand for iron flow batteries. Similar to this, policies that encourage the production of renewable energy frequently incorporate energy storage provisions, which foster the adoption of iron flow batteries.

The market is growing as a result of incentives for lowering greenhouse gas emissions and increasing energy efficiency. Iron flow batteries benefit from a favorable policy environment that places a high priority on sustainable energy solutions by being in line with national and international climate goals. The market for iron flow batteries is anticipated to grow and develop further as governments continue to reaffirm their commitments to energy storage and clean energy.

Key Market Challenges

High Initial Capital Costs

The high upfront capital costs of implementing these systems are one of the major obstacles confronting the global iron flow batteries market. Iron flow batteries are cost-effective and have long-term advantages, but their integration and installation still require a significant initial outlay of funds. This difficulty is especially noticeable for large-scale energy storage projects, which necessitate a substantial financial investment for both the infrastructure development and the purchase and installation of the batteries.

A number of factors contribute to the high initial costs. First, the cost of producing iron flow batteries is increased by the use of specialized materials and advanced technology. Iron is comparatively cheap, but the cost of producing the required parts, like flow systems and electrolyte solutions, increases due to sophisticated engineering and manufacturing procedures. Furthermore, significant infrastructure upgrades are necessary for the integration of iron flow batteries into the current energy infrastructure, which raises the total capital expenditure even more.

The fact that iron flow battery technology is still in its infancy when compared to more well-established energy storage options like lithium-ion batteries is another factor driving up costs. Iron flow batteries are a relatively new technology and do not enjoy the economies of scale enjoyed by more established technologies. Potential investors and adopters may be put off by the higher unit costs brought on by the lower production volumes and restricted market penetration.

Without significant financial support or incentives, it is challenging to justify the investment in iron flow batteries due to the high initial capital costs and the thin profit margins of many energy storage projects. Ongoing research and development initiatives seek to lower production costs and increase the iron flow batteries' cost-effectiveness in order to address this issue. Additionally, supportive government policies, subsidies, and financing mechanisms can help mitigate the impact of high upfront costs and make iron flow batteries more accessible to a broader range of applications.

Technical and Performance Limitations

Limitations in performance and technology present yet another major obstacle for the global market for iron flow batteries. Although iron flow batteries have many benefits, including low material costs and environmental sustainability, they also have some technical limitations that may affect their competitiveness and performance.

The energy density of iron flow batteries is a major drawback. Iron flow batteries typically have lower energy densities than other energy storage technologies like lithium-ion and vanadium flow batteries. In applications where space is limited or where compact energy storage solutions are preferred, this can be a drawback because they need larger volumes and more space to store the same amount of energy. The system's overall effectiveness and cost-effectiveness may also be impacted by the lower energy density, especially in situations where a small form factor and high energy storage capacity are required.

Controlling the battery's electrolyte flow and electrochemical reactions presents another technical difficulty. Keeping the electrolyte flowing consistently and effectively is essential to preserving peak performance and prolonging the battery's useful life. Changes in temperature, electrolyte composition, or flow rates can affect the system's stability and efficiency. Advanced control systems and monitoring technologies are needed to address these problems, which can make the battery system more complicated and expensive.

Iron flow batteries may experience issues with electrode and electrolyte deterioration over time. Iron-based materials can deteriorate and perform worse due to corrosion and electrolyte impurities, despite the fact that they are generally more resilient than some other battery materials. This may result in a shorter cycle life and more maintenance needs, which would impact the technology's long-term dependability and affordability.

Ongoing research and development efforts are concentrated on enhancing the energy density, flow management, and material durability of iron flow batteries in order to get around these technical and performance constraints. It is anticipated that technological and innovative developments will solve these issues and improve iron flow batteries' overall performance and competitiveness in the global energy storage market.

Download Free Sample Ask for Discount Request Customization

Such degradation Market Trends

Growing Focus on Large-Scale Energy Storage Solutions

The growing emphasis on large-scale energy storage solutions is a notable trend in the global iron flow battery market. The need for large energy storage systems to handle the intermittent nature of renewable energy sources, like solar and wind power, is increasing as the world's energy landscape moves toward a greater reliance on these sources. Iron flow batteries are becoming more and more acknowledged as a practical option for large-scale applications due to their capacity to store and release energy over prolonged periods of time.

Numerous factors are driving the trend toward large-scale energy storage. First, in order to maintain grid stability and dependability as renewable energy generation increases, supply and demand must be balanced. With the ability to be installed in modular units that can be expanded as necessary to meet energy storage needs, iron flow batteries provide a scalable solution. They are a desirable choice for utilities and energy suppliers looking to incorporate significant amounts of renewable energy into the grid because of their scalability.

Large-scale energy storage system deployment aids in the shift to more resilient and decentralized energy infrastructures. Iron flow batteries help create a more adaptable and responsive energy system by allowing excess energy to be stored during high production periods and released during high demand periods. In light of rising energy demand and climate variability, this trend is consistent with larger initiatives to improve energy security and dependability.

The rise in projects and investments in iron flow battery technology is indicative of the growing emphasis on large-scale energy storage solutions. To overcome the difficulties of incorporating renewable energy sources and improving grid stability, utilities, grid operators, and energy developers are spending money on the study, creation, and implementation of large-scale iron flow battery systems.

Advancements in Iron Flow Battery Technology

One important trend in the global market for iron flow batteries is technological advancements. Iron flow battery technology is evolving due to ongoing research and development initiatives, which are improving cost-effectiveness, performance, and efficiency. These developments are making iron flow batteries more competitive in the energy storage market by addressing some of their drawbacks and difficulties.

Improvements in flow management systems and electrolyte chemistry are examples of recent developments. In order to improve energy density, stability, and cycle life, researchers are investigating novel formulations and additives for the electrolyte solutions. Improved performance and efficiency are also being facilitated by advancements in electrode design and flow management. For instance, improvements in electrode coatings and materials can lower energy losses and raise the battery's overall efficiency.

The creation of smaller, modular iron flow battery designs is another area of emphasis. Smaller, more adaptable systems that are simple to integrate into a range of applications, from large-scale grid storage to residential energy storage, are being made possible by advancements in battery architecture and packaging. These developments are increasing the adaptability and versatility of iron flow batteries to meet the demands of various markets.

Iron flow batteries should become more affordable as technology advances, increasing their competitiveness even more. A mix of industry cooperation, R&D investment, and scholarly research is propelling the trend toward technological innovation in iron flow batteries. These initiatives are essential to maximizing iron flow batteries' potential and increasing their use in various industries.

Increasing Investment and Funding in Energy Storage Technologies

One significant trend influencing the global Iron Flow Batteries market is the rise in funding and investment in energy storage technologies. The public and private sectors are investing a lot of money in the creation and marketing of different energy storage technologies, such as iron flow batteries, as the value of energy storage becomes more recognized.

Investment in energy storage technologies is largely driven by government policies and initiatives. Subsidies, grants, and tax breaks are being provided by numerous governments worldwide to encourage the installation of energy storage devices. These financial incentives promote investment in R&D and assist in lowering the initial capital costs related to iron flow batteries.

Due to the recognition of the potential of iron flow batteries and other energy storage technologies by corporate entities, private equity investors, and venture capital firms, private sector investment is also increasing. Research, development, and commercialization of iron flow battery technology are being advanced by investments in new and existing businesses. Iron flow batteries' market presence is growing, and their deployment is accelerating thanks to this investment.

Partnerships and collaborations between technology providers, utilities, and research institutions are increasingly prevalent in addition to direct investments. These partnerships speed up innovation and market expansion by facilitating the exchange of information, assets, and experience. The energy storage industry can overcome obstacles and promote the use of iron flow batteries by utilizing the advantages of different stakeholders.

The growing understanding of the vital role energy storage plays in the shift to a sustainable energy future is demonstrated by the rising funding and investment in energy storage technologies. It is anticipated that this trend will continue, spurring additional developments and iron flow battery adoption on the international market.

Download Free Sample Ask for Discount Request Customization

Segmental Insights

Type Insights

In 2023, the Redox segment had the biggest market share. Redox flow batteries have a proven track record in energy storage, including those that use electrolytes based on iron. They are a dependable option for grid-scale applications because of their reputation for providing steady performance over long stretches of time. Stakeholders are confident in the performance and longevity of their technology because it has undergone extensive testing and validation.

The high scalability of redox flow batteries is essential for satisfying the fluctuating requirements of large-scale energy storage projects. They can easily be expanded by adding more electrolyte tanks and cells to increase storage capacity thanks to their modular design. Because of their adaptability, they are perfect for controlling variations in the supply and demand for energy as well as integrating with renewable energy sources.

The extended cycle life of redox flow batteries is one of their main benefits. Their ability to withstand thousands of cycles of charging and discharging with little deterioration is crucial for lowering the overall cost of ownership over time. Additionally, their long-lasting design guarantees dependability and lowers maintenance requirements, both of which are critical for utility-scale applications.

Redox flow batteries can be expensive initially, but overall costs are reduced by their cheap material costs, especially for iron-based systems. Furthermore, redox flow batteries are becoming more economically feasible due to cost reductions brought about by economies of scale and technological advancements. Their dominance in the market is a result of their long-term cost-effectiveness and operational advantages.

Regional Insights

In 2023, the largest market share was held by the North American region. Energy storage technology research and development is concentrated in North America, especially in the US and Canada. Numerous universities, businesses, and research facilities in the area are at the forefront of iron flow battery technology development. Iron flow battery development and commercialization have been propelled by North America's leading position in the market due to substantial investments in R&D and technological innovation.

The governments of North America have put in place encouraging laws and financial incentives to encourage the use of energy storage and renewable energy sources. For instance, the U.S. Department of Energy (DOE) provides grants and funding for energy storage research, and the implementation of advanced storage technologies is supported by a number of state-level incentives. By lowering the cost of adoption, these policies promote the incorporation of iron flow batteries into the energy infrastructure.

An advantageous market environment for iron flow batteries has been produced by the growing need for dependable and scalable energy storage solutions in North America, which is being driven by an increase in the installation of renewable energy sources and the requirement for grid stability. Furthermore, the development and implementation of iron flow battery technologies in the area have been expedited by sizeable investments from corporate entities and venture capital firms.

Iron flow batteries were first used in commercial installations and pilot projects in North America. Iron flow batteries' market position has been further strengthened by the development of supply chains and supporting infrastructure as a result of this early adoption. North America's market leadership is strengthened by the experience gained from these early projects, which results in lower costs and better performance.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- Under the direction of the US Army Corps of Engineers (USACE) Engineer Research and Development Center (ERDC) at Fort Leonard Wood, Missouri, ESS announced in January 2024 that an Energy Warehouse (EW) system had been successfully commissioned at the Contingency Base Integration Training Evaluation Center (CBITEC). Long Duration Energy Storage (LDES), specifically iron flow batteries, is essential for reducing fuel consumption at contingency bases, such as Forward Operating Bases and temporary locations used for disaster relief or humanitarian aid. This benefit is demonstrated by the integration of the EW system into a tactical microgrid at CBITEC. This expansion of ESS's market presence in California comes after the recent installation of EW systems at Burbank Water and Power (BWP) and the Turlock Irrigation District (TID).

- Queensland's battery strategy was formally unveiled in February 2024 as a crucial part of the state's industrial revitalization programs and overall Energy and Jobs Plan. The "multi-technology" strategy, which was initially planned for mid-2023, intends to improve Queensland's standing in the creation, production, and application of energy storage technologies. Over the next five years, the strategy outlines a plan to invest USD 375.29 million in the industry.

- Energy storage pioneer Redflow signed a Memorandum of Understanding (MoU) with Queensland's Stanwell Corporation on July 2, 2024, marking an important milestone in local manufacturing. This partnership will mainly focus on developing and implementing Redflow's X10 battery solution for a significant project with a 400 MWh capacity. that this project will be a significant anchor order for Redflow's future Queensland manufacturing facility. Zinc-bromine flow batteries have been acknowledged by the federal government as one of the few battery technologies that are suitable for large-scale energy storage systems, offer a long cycle life, and are also reasonably priced at scale.

Key Market Players

- Redflow anticipates this project as a key anchor order for its

- American Battery Technology Company

- Infinity Energy Systems

- LIVENT Corporation

- Scale Microgrid Solutions Operating LLC

- Hydrostor Inc

- Sungrow Power Supply Co., Ltd

- Eos Energy Storage LLC

- Ganfeng Lithium Group Co., Ltd

- STMicroelectronics International N.V

|

By Type |

By Application |

By Material |

By Region |

|

|

|

|

Related Reports

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Trends and Takeaways

-

1.3 Strategic Recommendations

-

Introduction

-

2.1 Objectives of the Report

-

2.2 Scope and Methodology

-

2.3 Definitions and Assumptions

-

Market Overview

-

3.1 What are Iron Flow Batteries?

-

3.2 Working Principle and Components

-

3.3 Advantages over Lithium-Ion and Other Flow Batteries

-

3.4 Industry Value Chain and Ecosystem

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Demand for Long-Duration Energy Storage

-

4.1.2 Safety, Scalability, and Sustainability Benefits

-

4.1.3 Renewable Energy Integration Needs

-

4.2 Market Restraints

-

4.2.1 Low Energy Density for Mobile Applications

-

4.2.2 Technology Maturity and Commercialization Pace

-

4.3 Market Opportunities

-

4.3.1 Hybrid Energy Projects (Solar + Iron Flow)

-

4.3.2 Increasing Investment in Grid Flexibility

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

-

Technology Landscape

-

5.1 Overview of Iron Flow Battery Architecture

-

5.2 Electrolyte Chemistry and System Efficiency

-

5.3 Innovations in Membranes and Electrodes

-

5.4 Comparison with Vanadium, Zinc, and Hybrid Flow Batteries

-

Market Segmentation

-

6.1 By System Type

-

6.1.1 Modular Containerized Systems

-

6.1.2 Customized On-Site Installations

-

6.2 By Application

-

6.2.1 Utility-Scale Energy Storage

-

6.2.2 Commercial & Industrial Energy Management

-

6.2.3 Microgrids and Rural Electrification

-

6.3 By End-User

-

6.3.1 Power Utilities

-

6.3.2 Independent Power Producers (IPPs)

-

6.3.3 Government and Municipal Authorities

-

6.3.4 Renewable Energy Developers

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue Forecast

-

8.2 Installed Capacity Forecast by Region

-

8.3 Segment-Wise Growth Outlook

-

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Key Company Profiles

-

9.2.1 ESS Inc.

-

9.2.2 Enervenue

-

9.2.3 Energy Storage Systems Inc.

-

9.2.4 Others

-

9.3 Funding, Partnerships, and Project Announcements

-

Regulatory and Policy Landscape

-

10.1 Energy Storage Incentives and Programs

-

10.2 Long-Duration Storage Targets

-

10.3 Safety and Environmental Standards

-

Innovation and Future Outlook

-

11.1 AI and Real-Time Monitoring Integration

-

11.2 Role in Net-Zero Grids and Decentralized Energy

-

11.3 Future Chemistry and Cost Trends

-

Conclusion and Strategic Recommendations

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 Sources and References

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Trends and Takeaways

-

1.3 Strategic Recommendations

Introduction

-

2.1 Objectives of the Report

-

2.2 Scope and Methodology

-

2.3 Definitions and Assumptions

Market Overview

-

3.1 What are Iron Flow Batteries?

-

3.2 Working Principle and Components

-

3.3 Advantages over Lithium-Ion and Other Flow Batteries

-

3.4 Industry Value Chain and Ecosystem

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Demand for Long-Duration Energy Storage

-

4.1.2 Safety, Scalability, and Sustainability Benefits

-

4.1.3 Renewable Energy Integration Needs

-

-

4.2 Market Restraints

-

4.2.1 Low Energy Density for Mobile Applications

-

4.2.2 Technology Maturity and Commercialization Pace

-

-

4.3 Market Opportunities

-

4.3.1 Hybrid Energy Projects (Solar + Iron Flow)

-

4.3.2 Increasing Investment in Grid Flexibility

-

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

Technology Landscape

-

5.1 Overview of Iron Flow Battery Architecture

-

5.2 Electrolyte Chemistry and System Efficiency

-

5.3 Innovations in Membranes and Electrodes

-

5.4 Comparison with Vanadium, Zinc, and Hybrid Flow Batteries

Market Segmentation

-

6.1 By System Type

-

6.1.1 Modular Containerized Systems

-

6.1.2 Customized On-Site Installations

-

-

6.2 By Application

-

6.2.1 Utility-Scale Energy Storage

-

6.2.2 Commercial & Industrial Energy Management

-

6.2.3 Microgrids and Rural Electrification

-

-

6.3 By End-User

-

6.3.1 Power Utilities

-

6.3.2 Independent Power Producers (IPPs)

-

6.3.3 Government and Municipal Authorities

-

6.3.4 Renewable Energy Developers

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue Forecast

-

8.2 Installed Capacity Forecast by Region

-

8.3 Segment-Wise Growth Outlook

Competitive Landscape

-

9.1 Market Share Analysis

-

9.2 Key Company Profiles

-

9.2.1 ESS Inc.

-

9.2.2 Enervenue

-

9.2.3 Energy Storage Systems Inc.

-

9.2.4 Others

-

-

9.3 Funding, Partnerships, and Project Announcements

Regulatory and Policy Landscape

-

10.1 Energy Storage Incentives and Programs

-

10.2 Long-Duration Storage Targets

-

10.3 Safety and Environmental Standards

Innovation and Future Outlook

-

11.1 AI and Real-Time Monitoring Integration

-

11.2 Role in Net-Zero Grids and Decentralized Energy

-

11.3 Future Chemistry and Cost Trends

Conclusion and Strategic Recommendations

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 Sources and References

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy