Lighting Contactor Market

Lighting Contactor Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Mechanically Held, Electrically Held), By Application (Indoor, Outdoor), By End-User (Commercial, Industrial, Municipal, Smart Residential Complexes) By Region & Competition, 2019-2029

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

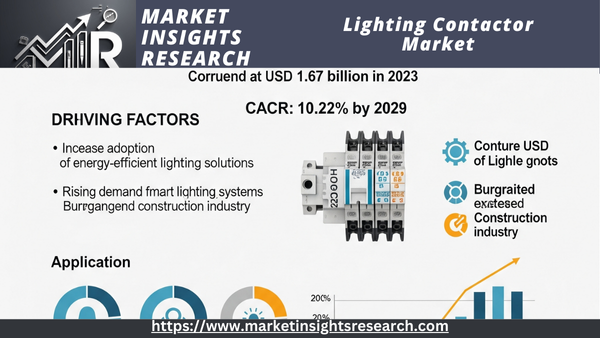

| Market Size (2023) | USD 1.67 Billion |

| Market Size (2029) | USD 3.02 Billion |

| CAGR (2024-2029) | 10.22% |

| Fastest Growing Segment | Smart Residential Complexes |

| Largest Market | North America |

Market Overview

With a CAGR of 10.22%, Global Lighting Contactor Market is expected to show a strong increase in the forecast period and be valued at USD 1.67 billion in 2023.

The market for Lighting Contactor refers to the sector driven by the manufacturing, distribution, and application of lighting contactors. In commercial, industrial, and home environments, lighting contactors—electrically operated switches—manage and automate lighting systems. These devices enable remote control of large lighting loads, thereby promoting effective energy management, enhanced safety, and operational convenience. Designed to meet different voltage and current needs, the market includes a wide spectrum of contactor kinds, including mechanically held and electrically held contactors.

Download Free Sample Ask for Discount Request Customization

Growing energy efficiency, increased acceptance of smart lighting solutions, and the growing requirement for automation in building management systems are the main drivers of the Lighting Contactor market. Further driving demand for sophisticated lighting contactors suited to support smart grids and intelligent building infrastructures are developments in IoT and smart technology integration.

The competitive scene of several firms presenting different product ranges defines the market. Maintaining market relevance and satisfying changing consumer needs depend much on innovation and technical developments. Driven by the ongoing push towards energy-efficient solutions and smart building technology, the Lighting Contactor market is overall expected to grow.

Key Market Drivers

Growing Emphasis on Energy Efficiency

The worldwide quest for energy efficiency has grown to be a major determinant of the lighting contractor business. Reducing energy usage is of more and more importance for governments and companies all around in order to fight climate change and advance sustainability. In this context, lighting contactors play a crucial role because they enable the automatic control of lighting systems, which significantly reduces energy waste.

Especially in business and industrial environments, lighting systems account for a significant share of total energy usage. Facilities can use lighting contactors to ensure that lights only activate during designated business hours or in response to occupancy sensors. This degree of control helps reduce unnecessary energy consumption and thereby lower electricity bills.

People around the world adhere to various energy efficiency criteria and laws. For example, the Energy Performance of Buildings Directive (EPBD) of the European Union mandates energy-efficient building management techniques, therefore promoting the acceptance of lighting contactors. Programs like Energy Star in the United States promote the usage of energy-efficient items incorporating sophisticated lighting control systems.

Technological developments have also made lighting contactors more effective and simpler to fit with current building management systems. Modern contactors sometimes include remote control and real-time monitoring, which allow for even more exact management of lighting loads. Companies trying to improve their sustainability credentials and cut running expenses find these developments especially appealing.

The Lighting Contactor market is driven in great part by the focus on energy efficiency since governments and companies both understand the financial and environmental advantages of using cutting-edge lighting control systems.

Rising Adoption of Smart Lighting Solutions

Growing acceptance of smart lighting solutions drives the global Lighting Contactor market. Smart lighting systems—which combine sensors, wireless connectivity, and modern technologies such as the Internet of Things (IoT)—need dependable and effective control systems to run as best they might. The required control infrastructure supplied by lighting contacts helps support these complex systems.

Among the several advantages smart lighting systems provide are energy savings, more user convenience, and better illumination quality. Using IoT and sensor technology, smart lighting systems may change brightness depending on occupancy, daylight availability, and user preferences. Lighting contactors allow for the automated switching and dimming of lights, thereby facilitating dynamic management of the lighting system.

Smart homes—where voice assistants and cellphones can control lighting systems—are becoming increasingly popular in the residential market. Commercial and industrial environments are embracing smart lighting systems to create intelligent buildings that enhance occupant comfort and energy efficiency. These systems depend on lighting contactors, which guarantees consistent performance and flawless integration with other smart devices.

Growing demand for smart city projects is pushing more extensive acceptance of smart lighting technologies. Cities worldwide are utilizing smart street lighting systems with sensors and network connectivity to optimize energy consumption and enhance public safety. In these systems, lighting contactors are essential components that provide the necessary control and automation capabilities.

The fast developments in IoT and wireless communication technologies are driving the smart lighting industry even further. Adoption of smart lighting solutions is predicted to rise as these technologies become more reasonably priced and accessible, thereby increasing the demand for advanced lighting contactors. Manufacturers are reacting to this trend by creating contactors with improved characteristics, like support for wireless communication protocols and compatibility with smart home systems.

Download Free Sample Ask for Discount Request Customization

Key Market Challenges

High Initial Costs and Installation Complexity

The high starting costs and installation complexity connected with modern lighting control systems present one of the main obstacles confronting the worldwide Lighting Contactor market. Although lighting contactors provide significant advantages in terms of energy savings and automation, many possible users—especially small and medium-sized businesses (SMEs) and residential consumers—may find the initial outlay needed for buying and installing these systems excessive.

Particularly for those connected with IoT and smart technologies, advanced lighting contactors often have a higher cost than conventional contactors. This cost covers not only the contractor's expenses but also the ones connected to integrating it with current building management systems and lighting systems. The financial outlay needed for these improvements might be a major obstacle to acceptance for companies with strict budgets.

Complicating installation further is this difficulty. Technically challenging, the process of including sophisticated lighting contactors into a building's lighting system calls for both specialized expertise and professional work. Higher installation costs and longer downtime resulting from this complexity might interrupt business operations by way of disturbance. Many times, companies may have to pay for outside experts or contractors to oversee the installation procedure, therefore increasing the overall expenses.

Regular maintenance and possible troubleshooting of modern lighting contactors present continuous difficulties. Ensuring their dependability as these systems get more complex could require regular updates and maintenance, which can be expensive and require technical knowledge. For certain companies, especially those without specific teams for site management, this continuous upkeep can be a major load.

The apparent danger involved in investing in new technology adds still another difficulty. Concerns about the technology becoming outdated or the lack of common protocols across many devices and systems may make potential customers reluctant to embrace advanced lighting contactors. This uncertainty might discourage market development and lower investments.

Manufacturers and industry players must concentrate on lowering prices by means of economies of scale, enhancing ease of installation, and offering complete user support and training if they are to meet these difficulties. Establishing consistent procedures and guaranteeing interoperability between several systems and devices can also help to inspire acceptance and confidence.

Regulatory and Compliance Challenges

For the worldwide lighting contractor market, regulatory and compliance issues provide a major obstacle. Manufacturers have to negotiate a complicated web of regional, national, and worldwide rules to guarantee their products are compatible, as the terrain of rules controlling environmental standards, electrical safety, and energy efficiency is constantly changing.

The necessity to satisfy diverse criteria depending on different areas presents one of the main regulating difficulties. For instance, the Energy Performance of Buildings Directive (EPBD) and the Restriction of Hazardous Substances (RoHS) directive include rigorous rules on energy efficiency and the lowering of dangerous elements. By contrast, the United States has its set of rules, including the Occupational Safety and Health Administration's (OSHA) requirements and the Energy Policy Act. For manufacturers, especially those trying to operate in several markets, negotiating these various criteria can be challenging and expensive.

Following these rules sometimes calls for significant research and development expenditure to create goods either meeting or beyond the required criteria. Such expenditures can raise manufacturing expenses and stretch the time needed to get fresh goods into the market. Furthermore, guaranteeing compliance calls for thorough testing and certification procedures, which can be costly and time-consuming. Ignoring these rules could cause major fines, product recalls, and reputation damage for a business.

Environmental rules create still another level of complication. Many nations are enforcing tougher regulations on the disposal of electrical and electronic equipment; hence, producers must create and apply sustainable strategies for lifetime management of their goods. This strategy covers designing simpler recyclable contractors and minimizing the usage of hazardous materials. Following these environmental rules can be difficult, especially for smaller producers with lower budgets.

New regulatory challenges surface as technology develops. For example, data privacy and cybersecurity are raised by the IoT's and wireless communication technologies' incorporation into lighting contactors. Manufacturers have to make sure their goods follow current electrical and safety guidelines and handle the developing needs for data security and safe communication.

Manufacturers that want to properly handle these regulatory and compliance issues must stay current with legal changes and make investments in compliance knowledge. Furthermore, helping to create advantageous regulatory environments and encourage the use of harmonized standards is cooperation with industry associations, government agencies, and other stakeholders.

Key Market Trends

Download Free Sample Ask for Discount Request Customization

Integration with Smart Building Technologies

One major obstacle facing the worldwide lighting contactor market is regulatory and compliance issues. Manufacturers must negotiate a complicated web of regional, national, and international requirements to make sure their products are consistent with the constantly changing legislation governing energy efficiency, electrical safety, and environmental standards.

The requirement to adhere to disparate regional standards is one of the main regulatory obstacles. For instance, the Energy Performance of Buildings Directive (EPBD) and the Restriction of Hazardous compounds (RoHS) directive are two of the strictest laws pertaining to energy efficiency and the decrease of hazardous compounds in the European Union. In contrast, the United States has its set of rules, such as the Occupational Safety and Health Administration's (OSHA) requirements and the Energy Policy Act. For manufacturers, especially those looking to operate in several markets, navigating these conflicting standards can be difficult and expensive.

To design products that reach or surpass the required requirements, compliance with these regulations frequently necessitates a significant investment in research and development. Such expenditures can lengthen the time it takes to launch new items and raise production expenses. Furthermore, strict testing and certification procedures—which can be costly and time-consuming—are necessary to ensure compliance. Significant fines, product recalls, and reputational harm to a business may arise from noncompliance with these rules.

Environmental rules introduce another level of complexity. Manufacturers must create and apply sustainable procedures for the lifecycle management of their products as a result of many nations enforcing stricter regulations governing the disposal of electrical and electronic equipment. This entails using fewer hazardous components and creating contactors that are simpler to recycle. It can be difficult to comply with these environmental laws, especially for smaller enterprises with less resources.

New regulatory issues arise as technology develops. For instance, the integration of IoT and wireless communication technologies with lighting contactors raises cybersecurity and data privacy issues. In addition to meeting current electrical and safety regulations, manufacturers must make sure that their products take into account the changing needs for secure communication and data protection.

Manufacturers must invest in compliance knowledge and keep up with regulatory advancements to handle these regulatory and compliance issues. The adoption of harmonized standards and the creation of advantageous regulatory environments can also be facilitated by cooperation with industry associations, regulatory agencies, and other stakeholders.

Adoption of Energy-Efficient Lighting Solutions

The adoption of energy-efficient lighting solutions is a key trend driving the global Lighting Contactor market. As concerns about energy consumption and environmental sustainability grow, there is a strong push toward using lighting systems that consume less power and have a lower environmental impact. This trend is particularly evident in commercial and industrial sectors, where lighting represents a significant portion of energy usage.

Lighting contactors are integral to energy-efficient lighting solutions, as they enable precise control over lighting systems, ensuring that lights are used only when necessary. Advanced contactors can be programmed to turn lights on and off based on occupancy sensors, daylight availability, and predefined schedules, significantly reducing energy wastage. Additionally, these contactors can be integrated with dimming controls to adjust lighting levels according to specific requirements, further enhancing energy savings.

Government regulations and initiatives aimed at promoting energy efficiency are also driving the adoption of energy-efficient lighting solutions. For example, the European Union’s Energy Performance of Buildings Directive (EPBD) and the United States’ Energy Policy Act encourage the use of energy-efficient technologies in buildings. Compliance with these regulations often necessitates the use of advanced lighting control systems, including lighting contactors.

Technological advancements in lighting, such as the development of LED lighting, are also contributing to this trend. LEDs are more energy-efficient and have a longer lifespan compared to traditional lighting sources. Lighting contactors that are compatible with LED technology are in high demand, as they help maximize the energy-saving potential of LED lighting systems.

In addition to regulatory drivers, there is growing awareness among businesses and consumers about the financial benefits of energy-efficient lighting. Reduced energy bills, lower maintenance expenses, and potential tax incentives make the adoption of these solutions economically attractive. As a result, the market for energy-efficient lighting contractors is expanding.

Increasing Focus on Sustainability and Green Building Certifications

Sustainability and green building certifications are becoming increasingly important in the worldwide lighting contractor industry. The design and construction of buildings that reduce their environmental impact are becoming increasingly important as environmental concerns gain traction. Sustainable construction techniques are greatly aided by green building certifications like BREEAM (construction Research Establishment Environmental Assessment Method) and LEED (Leadership in Energy and Environmental Design).

By facilitating effective lighting system control, cutting down on energy use, and minimizing greenhouse gas emissions, lighting contractors support sustainability. To maximize energy use, these gadgets can be combined with advanced systems for lighting control, such as occupancy sensing and daylight harvesting. Lighting contactors help buildings satisfy the strict requirements of green building certifications and obtain greater energy efficiency ratings by making sure that lights are only operated when necessary and at the right levels.

Green building certifications offer a system for assessing and identifying structures that satisfy particular sustainability requirements. These certifications take into account several variables, such as sustainable materials, indoor environmental quality, water conservation, and energy efficiency. To meet the energy efficiency and lighting quality standards specified by these certifications, lighting control systems—including contactors—are essential.

Both market demand and regulatory regulations are fueling the sustainability trend. Around the world, governments are putting laws and incentives into place to promote the creation of green structures. For instance, the European Union's Green Deal places a high priority on sustainable building methods and seeks to make Europe climate neutral by 2050. The federal government and several states in the United States provide similar incentives and tax credits to buildings that obtain green certifications.

Businesses and consumers are becoming more conscious of the financial and environmental advantages of sustainable building practices. Improved tenant well-being, increased property prices, and reduced running costs are all linked to green buildings. To improve their sustainability credentials and draw in eco-aware renters and buyers, property developers, building owners, and facility managers are consequently looking for green building certifications more and more.

Segmental Insights

Type Insights

In 2023, the sector with the biggest market share was Electrically Held. The global lighting contactor market is dominated by electrically held contactors because of several significant benefits that make them the go-to option for various applications. Their dependable and steady performance is one of the main causes of their dominance. As long as control power is applied, electrically held contactors stay engaged, guaranteeing the lighting system runs continuously. In commercial and industrial environments, continuous lighting is very important for ensuring operating efficiency, productivity, and safety.

The energy efficiency of electrically held contactors is yet another important benefit. Even though they need power to stay operational, sophisticated control techniques and integration with smart building systems can optimize overall energy consumption. Significant energy savings can be achieved by simply integrating these contactors into automated lighting management systems that modify illumination according to occupancy, daylight availability, and preset schedules. In light of the growing emphasis on sustainability and energy efficiency, electrically held contactors are very appealing due to their smooth integration with contemporary building management systems.

The prevalence of electrically held contactors is also largely due to technological improvements. Current electrically held contactors include improved functionality like real-time monitoring, remote control, and interoperability with wireless and Internet of Things protocols. These developments support the growing trend toward smart buildings and intelligent infrastructure by enabling more accurate and adaptable control over lighting systems.

Compared to mechanically held contactors, electrically held contactors often last longer and are simpler to repair. They require less frequent maintenance and repair because of their design, which reduces mechanical wear and tear. End users' preference for them is further supported by their dependability and longevity, especially in large-scale commercial and industrial applications where minimizing maintenance expenses and operating disruptions is crucial.

Regional Insights

The North American region held the biggest market share in 2023. Leading the way in technical innovation is North America, especially the US and Canada. Modern lighting contactors and other sophisticated lighting control systems are in high demand due to the region's sophisticated infrastructure and high rates of adoption of cutting-edge technologies. Advanced lighting solutions that improve automation and energy efficiency are in high demand due to the integration of IoT, AI, and smart building technologies in North American markets.

Download Free Sample Ask for Discount Request Customization

Strict energy efficiency laws and guidelines that encourage the use of cutting-edge lighting solutions benefit the North American industry. Energy-efficient modifications, including the adoption of sophisticated lighting contactors, are encouraged by policies like the Energy Policy Act and Energy Star programs in the United States. This trend is further supported by comparable laws and programs in Canada, which promote the use of energy-efficient lighting options in both new and existing buildings.

In North America, the movement toward sustainable and intelligent buildings is especially noticeable. To satisfy sustainability targets and save operating costs, businesses and real estate developers in the area are investing more in smart technologies and green building certifications. The need for sophisticated lighting contactors that provide precise control, energy efficiency, and interaction with other building systems is fueled by the desire for smart building solutions.

Numerous top producers and suppliers of lighting contactors are based in North America. These businesses are at the forefront of innovation, consistently creating new goods to satisfy changing consumer needs. These major firms' presence maintains the region's dominance in the global market and guarantees a consistent supply of cutting-edge lighting contractors.

Recent Developments

- In 2023, Halonix Technologies, a leading electrical company in India, introduced the country’s first 'UP-DOWN GLOW' LED Bulb, reflecting its dedication to innovation and enhancing consumer experiences. This groundbreaking product features dual illumination, with the upper dome and lower stem emitting distinct colors, providing users with multiple lighting effects through three selectable modes. The 10W 'UP-DOWN GLOW' LED Bulb is available in two versionsthe first variant offers white, warm, and mixed lighting options, while the second variant includes white, blue, and mixed modes. In the initial mode, the top dome emits a bright 10-watt light, while subsequent modes enable the stem to glow in either blue or warm white, casting a soothing light on surrounding surfaces. The final mode combines bright white illumination from the dome with a calming blue or warm yellow light from the stem, creating a unique ambiance for any room.

- In 2023, Surya Roshni Limited, a prominent manufacturer of lighting and consumer durables, unveiled a new product lineup designed for the festive season. In addition to the Platina LED bulb, the company introduced a diverse range of indoor and outdoor lighting solutions. The indoor selection includes the Profile Strip light, Slim Trim, and Shine Nxt Downlighter, while the outdoor range features the Jag Mag String light and Sparkle Rope light.

- In January 2024, Halonix Technologies introduced the 'Wall De-Light – Spiritual Series' LED lights, an innovative collection inspired by spiritual symbolism and honoring the historical and cultural significance of the ‘Ram Mandir’ project. Designed with an eye for detail, the Spiritual Series lights incorporate inscriptions of Lord Ram’s name, the sacred image of Lord Ganesh, and the Om symbol, merging traditional spirituality with modern design aesthetics. This series is available in two contemporary styles—Round and Square—both featuring 12W LED illumination.

Key Market Players

- Schneider Electric SE

- Siemens AG

- Eaton Corporation plc

- ABB Limited

- General Electric Company

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Signify N.V.

- Panasonic Corporation

- Rockwell Automation, Inc.

- Lutron Electronics Co., Inc.

- Ideal Industries, Inc.

|

By Type |

By Application |

By End-User |

By Region |

|

|

|

|

Related Reports

- Gas Fired Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/...

- Europe Residential Boiler Market Size - By Technology (Condensing {Natural Gas, Oil, Electric}, Non-Condensing {Natural ...

- U.S. Boiler Market Size By Fuel (Natural Gas, Oil, Coal), Capacity, By Technology (Condensing, Non-Condensing), By Produ...

- Commercial Hot Water Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Technology (Condensing, Non-Con...

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

Table of Content

-

Executive Summary

-

1.1 Market Overview

-

1.2 Key Trends and Developments

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Purpose of the Report

-

2.2 Scope and Market Definition

-

2.3 Methodology and Data Sources

-

2.4 Assumptions and Limitations

-

-

Market Overview

-

3.1 What is a Lighting Contactor?

-

3.2 Evolution and Industry Applications

-

3.3 Role in Lighting Control and Automation Systems

-

3.4 Industry Value Chain and Ecosystem

-

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Rising Demand for Smart and Energy-Efficient Lighting

-

4.1.2 Growth of Commercial and Industrial Infrastructure

-

-

4.2 Market Restraints

-

4.2.1 Cost Sensitivity in Emerging Markets

-

4.2.2 Compatibility and Installation Complexity

-

-

4.3 Market Opportunities

-

4.3.1 Integration with Smart Grids and IoT Platforms

-

4.3.2 Green Building Regulations and Retrofits

-

-

4.4 Market Challenges

-

4.5 Porter’s Five Forces Analysis

-

-

Technology Landscape

-

5.1 Mechanically Held vs. Electrically Held Contactors

-

5.2 Enclosed vs. Open Contactors

-

5.3 Innovations in Smart Lighting Control

-

5.4 IoT and Remote Monitoring Integration

-

-

Market Segmentation

-

6.1 By Type

-

6.1.1 Electrically Held

-

6.1.2 Mechanically Held

-

-

6.2 By Mounting Type

-

6.2.1 Panel Mounted

-

6.2.2 DIN Rail Mounted

-

6.2.3 Others

-

-

6.3 By Application

-

6.3.1 Indoor Lighting

-

6.3.2 Outdoor Lighting

-

6.3.3 Smart Lighting Systems

-

-

6.4 By End-User

-

6.4.1 Commercial

-

6.4.2 Industrial

-

6.4.3 Municipal

-

6.4.4 Residential

-

-

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Global Market Revenue and Volume

-

8.2 Segment-Wise Forecast

-

8.3 Regional Growth Outlook

-

-

Competitive Landscape

-

9.1 Market Share of Leading Players

-

9.2 Key Player Profiles

-

9.2.1 Eaton

-

9.2.2 ABB

-

9.2.3 Siemens

-

9.2.4 Schneider Electric

-

9.2.5 Hubbell

-

9.2.6 Others

-

-

9.3 Recent Developments and Innovations

-

-

Regulatory and Standards Framework

-

10.1 Electrical and Safety Standards

-

10.2 Energy Efficiency Regulations

-

10.3 Smart Building Codes and Certifications

-

-

Trends and Future Outlook

-

11.1 Wireless and App-Controlled Contactors

-

11.2 Integration with Building Management Systems (BMS)

-

11.3 Sustainable and Modular Product Designs

-

-

Conclusion and Strategic Outlook

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References

-

To get a detailed Table of contents/Table of figures/Methodology Please contact our salesperson at chris@marketinsightsresearch.com.

To get a detailed Table of contents/Table of figures/Methodology Please contact our salesperson at chris@marketinsightsresearch.com.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy