Advanced Battery Technology Market

Advanced Battery Technology Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Technology (Solid-State Batteries, Lithium-Sulfur Batteries, Magnesium-Ion Batteries, Next-Generation Flow Batteries, Metal-Air Batteries), By End User (Automotive, Consumer Electronics, Industrial, Energy Storage) By Region & Competition, 2019-2029F

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

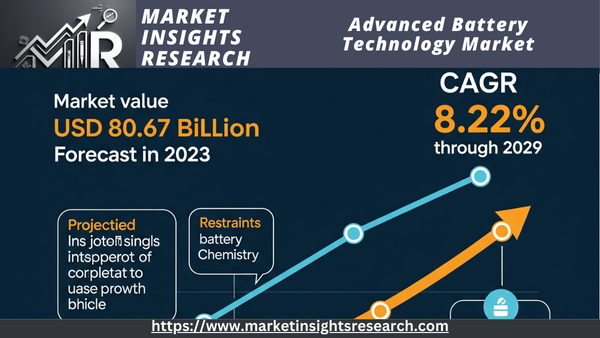

| Market Size (2023) | USD 80.67 Billion |

| Market Size (2029) | USD 130.94 Billion |

| CAGR (2024-2029) | 8.22% |

| Fastest Growing Segment | Energy Storage |

| Largest Market | Asia Pacific |

Market Overview

The market for advanced battery technology was estimated to be worth USD 80.67 billion in 2023 and is expected to grow at a strong rate during the forecast period, with a compound annual growth rate (CAGR) of 8.22% through 2029.

The industry devoted to the creation, production, and use of next-generation battery technologies that outperform conventional energy storage options is included in the market for advanced battery technology. Lithium-ion, solid-state, and flow batteries are among the innovations in this market that are intended to increase energy density, boost safety, and prolong battery life.

Download Free Sample Ask for Discount Request Customization

Portable electronics, renewable energy storage, and electric vehicles (EVs) are just a few of the industries that depend heavily on advanced batteries. Compared to traditional batteries, they are distinguished by their superior performance characteristics, such as quicker charging times, longer cycle lives, and higher energy efficiency. Growing environmental concerns and the shift to greener technologies are driving the market for high-performance, sustainable energy storage solutions. To get around current obstacles and seize new opportunities, major players in this market are constantly conducting research and development. Technological developments, regulatory frameworks, and changes in consumer preferences toward environmentally friendly and highly efficient energy solutions all have an impact on the market's growth.

Important Market Factors

Increasing Interest in Electric Cars (EVs)

One major factor propelling the global market for advanced battery technology is the rise in the use of electric vehicles (EVs). High-performance batteries that can support longer driving ranges and quick charging are becoming more and more in demand as governments around the world impose stricter emissions regulations and offer incentives for EV purchases. Compared to conventional lead-acid or nickel-metal hydride batteries, modern EVs require batteries with greater energy density, longer cycle life, and enhanced safety features.

Lithium-ion, solid-state, and lithium-sulfur batteries are examples of advanced battery technologies that are essential to fulfilling these changing demands. Lithium-ion batteries, for example, are widely used in many modern EV models due to their high energy density and affordable price. Solid-state batteries, which promise to offer higher energy densities, improved safety, and better thermal stability, are one type of battery that is becoming more and more necessary as the automotive industry develops.

Consumer preferences for environmentally friendly modes of transportation and the growing selection of EV models from different automakers are also factors contributing to the trend toward electric mobility. The demand for cutting-edge batteries that can satisfy the requirements of both high performance and long-term durability is growing along with the market for electric vehicles. As a result, developments in battery technology are stimulating innovation and investment in the battery industry itself in addition to helping the EV market expand.

Developments in the Storage of Renewable Energy

The market for advanced battery technology has been greatly impacted by the global push for renewable energy sources like solar and wind power. The production of renewable energy is frequently sporadic, depending on the time of day and the weather. Advanced energy storage technologies that effectively store and manage renewable energy are becoming more and more necessary to meet this challenge and guarantee a steady and dependable energy supply.

Because they have the capacity to store excess energy produced during periods of peak production and release it during periods of low production, advanced batteries are essential to renewable energy storage systems. Because of their high energy density and scalability, technologies like flow and lithium-ion batteries are especially well-suited for this use. For instance, flow batteries are well-known for their long-duration discharge and high energy storage capacity, which makes them perfect for grid-scale energy storage applications.

The need for cutting-edge battery technologies that can support large-scale energy storage solutions is anticipated to increase as governments and corporations make investments in renewable energy infrastructure and work to lessen dependency on fossil fuels. Improvements in battery chemistry and manufacturing techniques are speeding up this trend by improving the efficiency and affordability of energy storage devices. As a result, the market for advanced battery technology is growing due in large part to the renewable energy sector, which also encourages innovation and industry expansion.

Download Free Sample Ask for Discount Request Customization

Innovations in Technology and Research and Development

The global market for advanced battery technology is largely driven by ongoing research and development (R&D) as well as technological advancements. Battery technologies must continue to advance in order to satisfy the growing needs of a variety of applications, such as consumer electronics, renewable energy storage, and electric vehicles. The development of next-generation batteries with enhanced performance, safety, and cost-effectiveness is being propelled by advancements in battery chemistry, materials science, and manufacturing techniques.

At the forefront of this innovation is research into alternative battery technologies, including sodium-ion, lithium-sulfur, and solid-state batteries. For example, solid-state batteries are being developed to use solid electrolytes instead of conventional liquid electrolytes, which can improve safety and energy density. The potential of lithium-sulfur batteries to offer greater energy capacities at reduced costs in comparison to traditional lithium-ion batteries is being investigated. Academic research, industry cooperation, and investments from the public and private sectors all contribute to these developments.

The scalability and affordability of advanced batteries are being facilitated by improvements in quality control procedures and automated production lines, among other manufacturing technology advancements. The cost of advanced battery technologies is anticipated to decline with the development of new materials and production methods, opening them up to a greater range of applications and propelling market expansion.

Addressing current battery performance constraints and creating solutions that can satisfy future energy storage demands require a strong emphasis on research and development as well as technological innovation. As a result, the ongoing development of battery technologies is a key factor propelling the global market for advanced battery technology, creating a dynamic and competitive business environment.

Important Market Difficulties

Expensive Production Costs

The high manufacturing costs of cutting-edge battery technologies are one of the main obstacles facing the global market for advanced battery technology. The high cost of advanced batteries, including solid-state, lithium-sulfur, and flow batteries, is a result of their frequent need for specialized materials and intricate manufacturing procedures.

Solid-state batteries, for example, are still in the early phases of commercialization despite their promise of greater energy density and enhanced safety compared to conventional lithium-ion batteries. Advanced materials that are costly and challenging to process, like high-purity lithium and solid electrolytes, are used in the manufacturing of solid-state batteries. Production costs are further raised by the need for precise and regulated manufacturing environments for the fabrication of these batteries.

Although lithium-sulfur batteries have the potential to have higher energy densities at lower material costs than lithium-ion batteries, their manufacturing processes present certain difficulties. Sulfur is used in the relatively cheap production of lithium-sulfur batteries, but the intricate procedures needed to incorporate sulfur into the battery structure and guarantee steady performance are expensive. Furthermore, sophisticated engineering methods are needed to guarantee the long cycle life and stability of these batteries, which raises the total cost.

One major obstacle to the broad use of advanced battery technologies is their high manufacturing costs. These expenses are reflected in the final costs of products like renewable energy storage systems and electric cars. Because of this, the high cost of advanced batteries may prevent them from being widely available and may hinder their uptake.

Ongoing research and development initiatives are concentrated on streamlining manufacturing procedures, cutting material costs, and increasing production in order to overcome this obstacle. Making advanced battery technologies more affordable requires advancements in battery design and increased manufacturing efficiency. It is hoped that these costs will come down as the industry develops and production increases, making advanced batteries more accessible and affordable for a greater range of uses.

Restricted Access to Raw Materials and Supply Chain Issues

The restricted supply of essential raw materials and related supply chain limitations present another major obstacle in the global market for advanced battery technology. Because advanced batteries frequently depend on particular materials that are both limited and concentrated in a small number of geographic areas, supply constraints and price volatility may result.

For instance, the high energy density and performance of lithium-ion batteries are largely dependent on lithium, cobalt, and nickel. Australia, Chile, and China are the main suppliers of lithium, whereas the Democratic Republic of the Congo is the primary mining location for cobalt. Because these resources are concentrated in a small number of areas, the supply chain may become vulnerable to trade disputes, environmental regulations, and geopolitical tensions.

These raw materials' extraction and processing can have a big impact on the environment and society, which raises questions about ethical sourcing and sustainability. Companies are under more scrutiny and pressure to ensure responsible sourcing practices because, for example, cobalt mining has been linked to environmental degradation and human rights issues.

The overall cost of advanced battery technologies may be impacted by price fluctuations brought on by the limited supply of raw materials. The economic feasibility of new battery technologies can be impacted by price volatility for essential materials, which can also cause uncertainty for both consumers and manufacturers.

A multifaceted strategy is needed to address these supply chain issues, including initiatives to develop alternative materials, enhance recycling procedures, and diversify raw material sources. It's also critical to conduct research on novel battery chemistries that use less problematic and more plentiful materials. The market for advanced battery technology can more effectively handle these difficulties and encourage the ongoing development and uptake of cutting-edge energy storage solutions by strengthening supply chain resilience and lowering reliance on essential raw materials.

Download Free Sample Ask for Discount Request Customization

Important Market Trends

Solid-State Batteries' Ascent

Growing interest in solid-state batteries is a major trend in the global market for advanced battery technology. Because they have the potential to provide notable enhancements over conventional lithium-ion batteries, these batteries are becoming more and more popular. Solid-state batteries utilize a solid electrolyte instead of the liquid or gel electrolytes found in conventional batteries, which enhances safety by reducing the risk of leaks and fires.

Solid-state batteries have advantages beyond their safety. Higher energy densities they also provide can translate into longer battery life and more range for portable devices, including electric vehicles (EVs). Furthermore, solid-state batteries are projected to have a higher cycle life than conventional batteries, allowing for more charging and discharging cycles before their performance suffers.

Notwithstanding these benefits, production scalability and material prices remain issues for solid-state batteries. The complicated manufacturing techniques for solid-state batteries call for specialized materials, which might raise expenses. Still, efforts at continuous research and development center on conquering these challenges. Solid-state batteries should get increasingly commercially feasible and common as manufacturing methods advance and economies of scale are attained.

Particularly the automobile sector is highly interested in solid-state technology to raise the performance and safety of electric cars. Investing extensively in the creation of solid-state batteries, major automakers and technology firms are pointing to a clear trend toward their eventual acceptance.

Expansion of Lithium-Sulfur Batteries

The growth of lithium-sulfur (Li-S) batteries is yet another important trend in the Advanced Battery Technology market. Compared to conventional lithium-ion batteries, lithium-sulfur batteries are being more and more appreciated for their possible higher energy densities and reduced cost. These batteries are appealing for reasonably priced energy storage since sulfur is plentiful and relatively cheap.

Lithium-sulfur batteries could be quite beneficial for several uses, including grid energy storage and electric cars, and are particularly helpful for lightweight and high-energy-density applications. Predictions indicate that they will provide more specific energy, thereby enabling more energy per unit weight.

Though their potential benefits are great, lithium-sulfur batteries suffer from stability and cycle life. Although sulfur is inexpensive, it typically has low conductivity and poor cycle stability. New cathode materials and electrolyte composition optimization are two of the answers researchers are actively working on to improve the performance and lifetime of these batteries.

Lithium-sulfur batteries are probably going to become more common on the market as technologies develop and their maturity increases. They are a major development in the field of battery technology since their ability to reduce costs and enhance energy storage capacity influences everything.

Segmental Insights

Technology Insights

In 2023, the lithium-sulfur sector will have the biggest market share.

Further major benefits of lithium-sulfur batteries are their reduced material cost. Compared to cobalt and nickel—essential components in lithium-ion batteries—sulfur is plentiful and cheap. As technology develops and scales, Li-S batteries become increasingly financially appealing since these benefits could result in lower total battery costs.

Despite these advantages, lithium-sulfur batteries struggle to dominate the market. These cover matters of cycle life, stability, and efficiency. Over repeated charge-discharge cycles, sulfur has a tendency to degrade rapidly; hence, producers and researchers have had considerable difficulty guaranteeing reliable performance. Through developments in materials and battery design, efforts are continuous to solve these problems.

Regional Insights

In 2023, the Asia-Pacific region will have the largest market share.

Innovations in battery technology are led by Asia-Pacific. Major technology corporations and research institutes in this area heavily invest in developing next-generation batteries, including solid-state and lithium-sulfur batteries. This emphasis on research and development propels technological developments and establishes the area as a pioneer in the change of battery technologies.

Download Free Sample Ask for Discount Request Customization

Governments in Asia-Pacific countries have implemented supportive policies and incentives to promote the adoption of advanced battery technologies. For example, China has launched policies to encourage the development and use of electric vehicles, including subsidies and tax incentives. Similarly, Japan and South Korea offer support for research and development in battery technologies and renewable energy integration.

The rapid growth of the electric vehicle market and the expansion of renewable energy sources in Asia-Pacific drive significant demand for advanced battery technologies. Countries like China are leading in EV adoption, creating a strong market for advanced batteries. Additionally, the region's commitment to increasing renewable energy capacity further fuels the need for efficient energy storage solutions.

Companies in Asia-Pacific are actively forming strategic partnerships and investing in global battery technology ventures. These investments enhance their technological capabilities and market reach, consolidating the region's dominant position in the global battery market.

Recent Developments

- On 4th July 2024, Exide Industries Ltd. launched a new high-performance Absorbent Glass Mat (AGM) battery specifically for starting, lighting, and ignition (SLI) applications in response to the growing need for advanced battery solutions in the automotive industry. This innovative lead-acid battery, featuring AGM technology, is engineered to deliver exceptional starting power, improved durability, and an extended lifespan compared to conventional lead-acid batteries. Recognized for its superior performance, the AGM battery is tailored to meet the demanding requirements of four-wheel vehicles.

- In May 2024, Jaguar Land Rover (JLR) entered into a multi-year agreement with Fortescue to integrate Fortescue’s advanced battery intelligence software, Elysia, into its next-generation electric vehicles. This collaboration aims to enhance JLR’s luxury electric vehicles by improving battery longevity, safety, and performance. Fortescue’s Elysia software will be implemented across all future JLR electric vehicle models, beginning with the new Range Rover Electric, which is set to launch later this year. This integration is designed to deliver an exceptional ownership experience, characterized by faster charging, increased reliability, and extended driving range. Elysia software monitors battery health throughout its lifecycle, contributing to JLR's sustainability initiatives by enabling the transition of batteries from electric vehicles to second-life applications. The software uses advanced digital models and smart AI to find and fix battery problems, improving how well and safely the batteries work. This partnership aligns with JLR’s Reimagine strategy, which targets the electrification of all its brands by 2030 and achieving carbon neutrality by 2039. Concurrently, Fortescue is committed to its decarbonization goals, including eliminating emissions from its operations by 2030.

- In March 2024, SiAT, a leading Taiwanese producer of advanced nanomaterials for batteries, announced a strategic partnership with Taiwan C.S. Aluminum Corporation (CSAC). This collaboration introduces a new carbon nanotube-coated aluminum foil, engineered to meet the growing demand for faster charging and longer-lasting performance in lithium-ion batteries, sodium batteries, and supercapacitors. The innovative product features a carbon nanotube (CNT) coating, which offers conductivity ten times higher than traditional carbon black. This CNT coating not only enhances the aluminum foil’s resistance to corrosion but also improves the adhesion between electrode materials and the current collector. As a result, the battery's lifespan is extended. Furthermore, the CNT coating reduces interface contact resistance, leading to improved discharge rates and overall battery performance.

Key Market Players

- Tesla Inc.

- Panasonic Corporation

- LG Energy Solution Ltd.

- Samsung SDI Co., Ltd.

- General Motors

- Siemens AG

- Toshiba Corporation

- Hitachi Ltd.

- Northvolt AB

- Solid Power, Inc.

- QuantumScape Battery, Inc

- Farasis Energy Europe GmbH

|

By End User |

By Technology |

By Region |

|

|

|

Related Reports

- Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), By Appl...

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

- North America & Europe Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), By Application (Re...

- North America Residential Boiler Market Size - By Fuel (Natural Gas, Oil, Electric), By Technology (Condensing {Natural ...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Developments and Trends

-

1.3 Strategic Recommendations

-

-

Introduction

-

2.1 Report Objectives

-

2.2 Scope and Definitions

-

2.3 Methodology Overview

-

2.4 Assumptions and Limitations

-

-

Market Overview

-

3.1 Evolution of Battery Technologies

-

3.2 Key Industry Segments and Ecosystem

-

3.3 Role of Advanced Batteries in Modern Energy Infrastructure

-

-

Market Dynamics

-

4.1 Market Drivers

-

4.1.1 Electrification of Transportation

-

4.1.2 Demand for High-Energy Density and Fast-Charging Solutions

-

4.1.3 Growth of Renewable Energy and Grid Storage

-

-

4.2 Market Restraints

-

4.2.1 Supply Chain Challenges (Materials & Rare Earths)

-

4.2.2 Cost and Scalability Issues

-

-

4.3 Opportunities

-

4.3.1 Solid-State and Silicon-Anode Breakthroughs

-

4.3.2 Battery-as-a-Service and Circular Economy Models

-

-

4.4 Challenges

-

4.5 Value Chain and Ecosystem Analysis

-

-

Technology Landscape

-

5.1 Lithium-Ion Batteries (NMC, LFP, NCA)

-

5.2 Solid-State Batteries

-

5.3 Lithium-Sulfur and Lithium-Air

-

5.4 Sodium-Ion and Zinc-Based Batteries

-

5.5 Flow Batteries and Hybrid Chemistries

-

5.6 Innovations in Electrolytes, Cathodes, and Anodes

-

5.7 Advanced Battery Management Systems (BMS)

-

-

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Advanced Li-ion

-

6.1.2 Solid-State

-

6.1.3 Others

-

-

6.2 By Application

-

6.2.1 Electric Vehicles (EVs)

-

6.2.2 Consumer Electronics

-

6.2.3 Grid Storage

-

6.2.4 Aerospace and Defense

-

6.2.5 Industrial and Robotics

-

-

6.3 By Form Factor

-

6.3.1 Pouch

-

6.3.2 Cylindrical

-

6.3.3 Prismatic

-

-

6.4 By End-User Industry

-

6.4.1 Automotive

-

6.4.2 Energy Utilities

-

6.4.3 Consumer Tech

-

6.4.4 Others

-

-

-

Regional Analysis

-

7.1 North America

-

7.2 Europe

-

7.3 Asia-Pacific

-

7.4 Latin America

-

7.5 Middle East & Africa

-

-

Market Size and Forecast (2020–2030)

-

8.1 Global Revenue and Volume Forecast

-

8.2 Regional and Country-Level Projections

-

8.3 Segment-Wise Outlook

-

-

Competitive Landscape

-

9.1 Market Share and Strategic Positioning

-

9.2 Profiles of Key Innovators and Leaders

-

9.2.1 Panasonic

-

9.2.2 CATL

-

9.2.3 QuantumScape

-

9.2.4 Solid Power

-

9.2.5 Samsung SDI

-

9.2.6 Others

-

-

9.3 Investment Trends and M&A Activities

-

-

Regulatory and Sustainability Factors

-

10.1 Global Standards for Advanced Batteries

-

10.2 Safety and Environmental Compliance

-

10.3 ESG and Battery Recycling Policies

-

-

Emerging Trends and Innovation Outlook

-

11.1 Battery-as-a-Service (BaaS)

-

11.2 AI-Driven Battery Optimization

-

11.3 Next-Gen Manufacturing and Gigafactories

-

-

Conclusion and Strategic Recommendations

-

Appendices

-

13.1 Glossary

-

13.2 Research Methodology

-

13.3 References

-

To get a detailed Table of contents/Table of figures/Methodology Please contact our salesperson at chris@marketinsightsresearch.com.

To get a detailed Table of contents/Table of figures/Methodology Please contact our salesperson at chris@marketinsightsresearch.com.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy