Saudi Arabia Battery Market

Saudi Arabia Battery Market By Technology (Lithium-Ion Batteries, Lead-Acid Batteries, Flow Batteries, Sodium-Based Batteries), By Life Span (1-5 years, 5-15 Years, 15-20 Years, More Than 20 Years), By End-User (Energy Storage Systems, Automotive, Electronic Devices, Healthcare, Others), By Region, Competition, Forecast and Opportunities, 2019-2029F

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

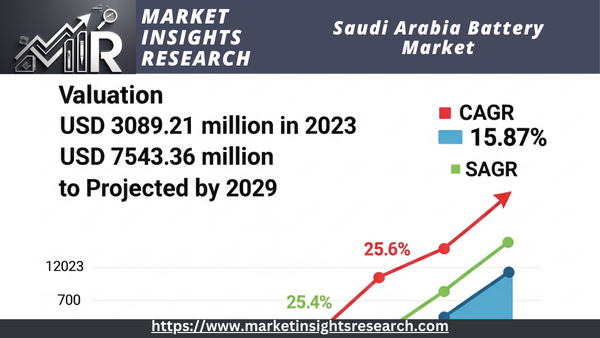

| Market Size (2023) | USD 3089.21 million |

| Market Size (2029) | USD 7543.36 million |

| CAGR (2024-2029) | 15.87% |

| Fastest Growing Segment | Sodium-Based Batteries |

| Largest Market | Riyadh Region |

Market Overview

The Saudi Arabia Battery Market was valued at USD 3,089.21 million in 2023 and is projected to attain USD 7,543.36 million by 2029, reflecting a compound annual growth rate (CAGR) of 15.87% during the forecast period.

Download Free Sample Ask for Discount Request Customization

Key Market Drivers

Increasing Demand for Renewable Energy Storage

The focus on renewable energy sources is a key catalyst for the Saudi Arabia Battery Market. Saudi Arabia's Vision 2030 initiative underscores the nation's dedication to diversifying its energy portfolio and diminishing dependence on fossil fuels. To facilitate this transition, there is a substantial effort to incorporate renewable energy sources, including solar and wind, into the national grid. Batteries are pivotal in this transition by offering vital energy storage functions, enabling the retention of surplus energy produced during peak generation and its later utilization during low generation periods. This capability is essential for maintaining a stable and dependable energy supply, given that renewable energy sources are intrinsically intermittent. The implementation of extensive energy storage systems is essential for regulating these variations and improving the overall efficacy of renewable energy initiatives. Moreover, enhancements in battery technologies, including increased energy density and extended lifespans, have rendered these systems more feasible and economically viable for extensive applications. The rising investment in renewable energy infrastructure, bolstered by governmental incentives and regulatory frameworks, amplifies the demand for batteries. As Saudi Arabia enhances its renewable energy capacity, the demand for efficient and reliable storage solutions will increase, advancing the Saudi Arabia Battery Market.

Rapid Adoption of Electric Vehicles

The swift proliferation of electric vehicles (EVs) is substantially propelling the expansion of the Saudi Arabia Battery Market. The Saudi government has acknowledged the necessity of mitigating greenhouse gas emissions and fostering sustainable transportation, resulting in the implementation of diverse policies and incentives to enhance the adoption of electric vehicles. This transition is bolstered by initiatives to establish a comprehensive electric vehicle infrastructure, encompassing charging stations and battery recycling facilities. With the rise in electric vehicles on the road, there is a corresponding increase in the demand for high-performance batteries capable of delivering the requisite power and range for these vehicles. The progression of battery technologies, especially in lithium-ion and solid-state batteries, has improved the performance attributes of electric vehicle batteries, such as increased energy density, expedited charging times, and extended longevity. This technological advancement enhances the allure of electric vehicles for consumers, expediting their adoption. The government's emphasis on minimizing the transportation sector's carbon footprint and fostering domestic electric vehicle manufacturing capabilities enhances the demand for batteries. The expansion of the electric vehicle market catalyzes advancements in the battery sector, thereby augmenting the overall market size.

Download Free Sample Ask for Discount Request Customization

Technological Advancements in Battery Technologies

Technological advancements in battery technologies are a primary catalyst for the Saudi Arabia Battery Market, affecting both the efficacy and acceptance of energy storage solutions across diverse applications. Recent advancements in battery technology, encompassing enhancements in energy density, charging efficiency, and battery longevity, have markedly improved the performance of batteries utilized in consumer electronics, industrial applications, and energy storage systems. Innovations like lithium-ion batteries, solid-state batteries, and flow batteries provide enhanced performance attributes relative to conventional battery technologies, featuring increased energy densities, expedited charging durations, and extended operational lifetimes. These advancements enhance the efficiency and reliability of energy storage systems while simultaneously lowering the overall cost of battery technologies. Consequently, consumers and enterprises are progressively embracing these advanced batteries for their energy requirements. Current advancements in battery technology, propelled by private sector funding and academic inquiry, are expanding the limits of feasibility, resulting in enhanced efficiency and cost-effectiveness. This technological advancement facilitates the expansion of the Saudi Arabia Battery Market by rendering sophisticated energy storage solutions more attainable and attractive for diverse applications. With the emergence of new technologies and the evolution of existing ones, the market will experience improved performance and heightened adoption rates.

Key Market Challenges

High Cost of Advanced Battery Technologies

A significant challenge confronting the Saudi Arabia Battery Market is the elevated expense linked to advanced battery technologies. Innovations like lithium-ion, solid-state, and flow batteries provide considerable performance benefits compared to conventional technologies, yet they entail a greater cost. The initial capital investment needed for these advanced battery systems can be considerable, posing a significant obstacle for both consumers and businesses contemplating their adoption. The elevated expense is ascribed to multiple factors, including the intricacy of manufacturing processes, the price of raw materials, and the necessity for specialized components. Lithium-ion batteries depend on rare and costly materials, including lithium, cobalt, and nickel, which elevate the overall expense of the batteries. Moreover, the research and development necessary to enhance battery performance and efficiency contributes to the costs. In Saudi Arabia, where the energy market is still developing and the integration of advanced technologies is increasing, the elevated cost of batteries may dissuade prospective investors and consumers. Despite anticipated advantages from economies of scale and technological innovations that could ultimately lower expenses, the prevailing elevated price continues to pose a considerable barrier. To address this challenge, ongoing innovation in battery technology is essential to reduce costs, alongside strategic partnerships and investments focused on enhancing manufacturing efficiencies and minimizing dependence on costly raw materials. Government incentives and support programs can significantly alleviate the financial burden on consumers and businesses.

Limited Recycling and Disposal Infrastructure

A notable challenge for the Saudi Arabia Battery Market is the inadequate infrastructure for battery recycling and disposal. With the rising utilization of batteries in diverse applications, there is an escalating demand for efficient recycling and disposal systems to manage battery waste and alleviate environmental consequences. Improper disposal of batteries, especially those with hazardous substances, can result in environmental pollution and health hazards. The establishment of a comprehensive battery recycling infrastructure in Saudi Arabia remains nascent. The absence of established recycling facilities and protocols results in numerous used batteries potentially being inadequately processed or recycled, which raises environmental and safety issues. The lack of rigorous regulations and guidelines for battery disposal intensifies the problem. Efficient recycling and disposal are crucial for recovering and reusing valuable materials from used batteries, thereby decreasing the demand for new raw materials and mitigating environmental impact. The establishment of a resilient recycling infrastructure necessitates significant investment and collaboration among governmental bodies, industry participants, and waste management entities. Implementing extensive recycling initiatives, instituting explicit regulations, and enhancing awareness regarding appropriate disposal methods are essential measures in tackling this issue. In the absence of these measures, the expansion of the Saudi Arabia Battery Market may be impeded by environmental and regulatory issues related to battery waste.

Download Free Sample Ask for Discount Request Customization

Key Market Trends

Surge in Electric Vehicle Adoption

A significant trend in the Saudi Arabian battery market is the increase in electric vehicle (EV) adoption. The Saudi Arabian government has made considerable progress in advancing sustainable transportation within its Vision 2030 initiative, which seeks to diminish the nation’s dependence on fossil fuels and decrease carbon emissions. This commitment encompasses offering incentives for electric vehicle acquisitions, investing in EV infrastructure, including charging stations, and fostering the establishment of local EV manufacturing capabilities. With the growing prevalence of electric vehicles, there is a concomitant surge in the demand for high-performance batteries that can provide the necessary power and range for these vehicles. Advancements in battery technologies, such as enhanced energy density, expedited charging times, and extended operational lifespans, are essential in facilitating this trend. The increase in electric vehicle adoption stimulates advancements in battery technologies and promotes additional investments in research and development. The enhancement of EV infrastructure promotes the extensive adoption of electric vehicles, generating a positive feedback loop that increases demand for batteries. This trend highlights the dynamic evolution of the Saudi Arabia Battery Market as it responds to the increasing demands of the electric vehicle sector, establishing itself as a significant contributor to the global shift towards sustainable transportation solutions.

Advancements in Battery Technologies

Progress in battery technologies signifies a notable trend in the Saudi Arabia Battery Market. Ongoing advancements in battery technologies are enhancing energy storage solutions across diverse applications. Recent advancements encompass improvements in lithium-ion batteries, the advent of solid-state batteries, and innovations in flow battery systems. These advancements provide multiple advantages, including enhanced energy density, expedited charging capabilities, and extended lifespans, which are essential for addressing the escalating demands of consumer electronics and energy storage systems. The advancement of novel materials and manufacturing techniques is further decreasing the total cost of batteries, rendering them more accessible and appealing for a wider array of applications. As technology advances, there is an increased emphasis on developing more efficient, reliable, and eco-friendly battery solutions. These innovations enhance the performance of current battery systems and facilitate the emergence of new applications and market segments. The progression of battery technologies is expected to persist, propelled by continuous research and development initiatives, alongside heightened investment from both private and public sectors. This trend underscores the dynamic characteristics of the Saudi Arabia Battery Market and its potential for expansion and evolution.

Expansion of Renewable Energy Integration

The integration of renewable energy is a significant trend impacting the Saudi Arabia Battery Market. Saudi Arabia aims to diversify its energy portfolio and diminish reliance on fossil fuels, thereby prioritizing the incorporation of renewable energy solutions, including solar and wind power, into the national grid. Batteries are essential in this integration, offering storage solutions that facilitate the efficient utilization of renewable energy. Batteries maintain a stable and reliable energy supply by storing surplus energy produced during peak generation periods, even when renewable energy output is diminished. This capability is crucial for managing the sporadic nature of renewable energy sources and improving overall grid stability. The Saudi government's dedication to investing in renewable energy infrastructure and fostering technological innovations in energy storage is propelling the growth of this trend. As the nation progresses in the development and implementation of renewable energy projects, the demand for sophisticated battery systems to facilitate these initiatives will increase. This trend underscores the growing significance of batteries in fulfilling Saudi Arabia's sustainability objectives and enhancing the utilization of renewable energy resources. The continuous advancements in energy storage technologies and infrastructure are anticipated to propel growth in the Saudi Arabia Battery Market, in accordance with the overarching goals of the Vision 2030 initiative.

Download Free Sample Ask for Discount Request Customization

Segmental Insights

Technology

In 2023, the Saudi Arabia Battery Market was primarily dominated by lithium-ion batteries, a trend anticipated to persist during the forecast period. Lithium-ion batteries have become the predominant technology segment owing to their exceptional performance characteristics, including elevated energy density, extended lifespan, and rapid charging capabilities relative to alternative battery types. These attributes render lithium-ion batteries exceptionally suitable for various applications, encompassing consumer electronics, electric vehicles, and energy storage systems. Their capacity to provide dependable and efficient power renders them a favored option for both residential and commercial uses in Saudi Arabia. Although lead-acid batteries, flow batteries, and sodium-based batteries possess specific applications, they do not rival the extensive benefits provided by lithium-ion technology. Lead-acid batteries, while economical, possess inferior energy density and reduced longevity, thereby constraining their competitiveness in high-demand applications. Flow batteries and sodium-based batteries, although promising, remain nascent technologies characterized by elevated costs and limited adoption. The ongoing progress in lithium-ion battery technology, along with declining costs and enhanced availability, solidifies its preeminent status in the Saudi Arabia Battery Market. With the increasing demand for advanced energy storage solutions, especially due to the proliferation of electric vehicles and the integration of renewable energy, lithium-ion batteries are anticipated to retain their dominant position owing to their established efficiency and performance advantages.

Regional Insights

In 2023, the Riyadh region established itself as the preeminent entity in the Saudi Arabia Battery Market and is projected to sustain this leadership throughout the forecast period. Riyadh, the capital and a principal economic and political hub of Saudi Arabia, generates substantial demand for battery technologies across multiple sectors. The region's significant infrastructure development, along with swift urbanization and economic expansion, generates a considerable market for advanced battery solutions. Riyadh's status as a center for commercial, residential, and industrial activities promotes significant adoption of batteries for energy storage systems, electric vehicles, and consumer electronics. The region's strategic significance in executing government initiatives like Vision 2030, which prioritizes sustainability and technological progress, enhances its supremacy in the battery market. Although regions like the Eastern Province, Jeddah, and Makkah also impact the market, Riyadh's pivotal role in economic and infrastructure development guarantees its status as the principal catalyst for battery demand. Continued investments in renewable energy initiatives, technological advancements, and urban development in Riyadh are anticipated to maintain and possibly elevate its dominant status in the Saudi Arabia Battery Market. The region is poised to maintain its leadership in battery adoption and utilization, underscoring its strategic importance within the national and regional framework.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In June 2024, NextSource Materials Inc. is pleased to provide an update on its global anode expansion strategy, highlighting positive outcomes from a technical and economic study for the proposed construction of a battery anode facility (BAF) in the Kingdom of Saudi Arabia. The company also announces the initiation of a strategic partner process to evaluate funding proposals for the battery anode facilities both in the Middle East and worldwide.

- In July 2024, Sungrow Power Supply Co. Ltd., a Chinese provider of photovoltaic inverters and energy storage systems, reached an agreement with Saudi Arabia's Algihaz Holding to supply up to 7.8 gigawatt-hours of battery storage for a project in the Kingdom. The batteries, incorporating Sungrow's PowerTitan 2.0 technology, will be installed in Najran, Madaya, and Khamis Mushait.

- In July 2024, Pravaig, a Bengaluru-based electric vehicle startup, introduced two models of electric SUVs and is also involved in battery manufacturing. The Saudi India Venture Studio, a Saudi government-backed investment firm, is focused on accelerating and transforming the electric automotive industry in Saudi Arabia.

Key Market Players

- Middle East Battery Company

- GENERAL MOTORS COMPANY

- Battery Systems Inc

- Exide Technologies S.A.S

- KORE Power, Inc

- Samsung Sdi Co., Ltd

- Panasonic Holdings Corporation

- BYD Company Ltd

- Northvolt AB

- AESC Group Ltd

|

By Technology |

By Life Span |

By End-user |

By Region |

|

|

|

|

Related Reports

- Industrial Boiler Market Size - By Product (Fire-Tube, Water-Tube), By Capacity, By Application (Food Processing, Pulp &...

- Commercial Boiler Market - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non-Conde...

- Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), By Appl...

- Industrial Electric Boiler Market - By Voltage Rating (Low Voltage, Medium Voltage), By Capacity (< 10 MMBtu/hr, 10-50 M...

- Biomass Boiler Market - By Feedstock (Woody Biomass, Agricultural Waste, Industrial Waste, Urban Residue), By Product (S...

- Asia Pacific Electric Boiler Market Size - By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 ...

Table of Content

-

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Trends and Opportunities

-

1.3 Strategic Recommendations

-

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Methodology Overview

-

2.3 Definitions and Assumptions

-

Market Overview

-

3.1 Battery Market Landscape in Saudi Arabia

-

3.2 Role in Energy Storage, Automotive, and Industrial Sectors

-

3.3 Supply Chain and Ecosystem Overview

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Vision 2030 and Renewable Energy Push

-

4.1.2 Growth in Electric Vehicles and Consumer Electronics

-

4.2 Restraints

-

4.2.1 Import Dependence and Supply Limitations

-

4.3 Opportunities

-

4.3.1 Localization and Manufacturing Initiatives

-

4.3.2 Smart Grid and Energy Storage Applications

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

-

Technology Landscape

-

5.1 Lithium-ion Batteries

-

5.2 Lead-acid Batteries

-

5.3 Nickel-based and Other Chemistries

-

5.4 Battery Recycling and Second-Life Technologies

-

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Primary (Non-rechargeable)

-

6.1.2 Secondary (Rechargeable)

-

6.2 By Application

-

6.2.1 Automotive (ICE and EV)

-

6.2.2 Consumer Electronics

-

6.2.3 Industrial Equipment

-

6.2.4 Renewable Energy Storage

-

6.2.5 Telecom and Backup Power

-

6.3 By Sales Channel

-

6.3.1 OEMs

-

6.3.2 Aftermarket

-

Regional and City-Wise Analysis

-

7.1 Riyadh

-

7.2 Jeddah

-

7.3 Dammam

-

7.4 Other Key Cities

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Volume Forecast

-

8.2 Forecast by Battery Type and Application

-

8.3 Market Growth Analysis

-

Competitive Landscape

-

9.1 Market Share Overview

-

9.2 Profiles of Leading Players

-

9.2.1 Local Manufacturers

-

9.2.2 Global Brands in Saudi Market

-

9.3 Key Strategic Developments

-

Regulatory Framework

-

10.1 Import Regulations and Tariffs

-

10.2 Saudi Standards, Metrology, and Quality Organization (SASO) Guidelines

-

10.3 Government Support for Energy Storage and EV Batteries

-

Consumer and Industry Trends

-

11.1 Adoption Drivers by Sector

-

11.2 Price Sensitivity and Brand Preferences

-

11.3 EV Battery Demand Trends

-

Innovation and Strategic Outlook

-

12.1 Public-Private Partnerships in Battery Production

-

12.2 Technology Localization and R&D Focus

-

12.3 Outlook for Battery Integration in Smart Cities

-

Conclusion and Strategic Recommendations

-

Appendices

-

14.1 Glossary

-

14.2 Research Methodology

-

14.3 Sources and References

Executive Summary

-

1.1 Market Snapshot

-

1.2 Key Trends and Opportunities

-

1.3 Strategic Recommendations

Introduction

-

2.1 Report Objectives and Scope

-

2.2 Methodology Overview

-

2.3 Definitions and Assumptions

Market Overview

-

3.1 Battery Market Landscape in Saudi Arabia

-

3.2 Role in Energy Storage, Automotive, and Industrial Sectors

-

3.3 Supply Chain and Ecosystem Overview

Market Dynamics

-

4.1 Drivers

-

4.1.1 Vision 2030 and Renewable Energy Push

-

4.1.2 Growth in Electric Vehicles and Consumer Electronics

-

-

4.2 Restraints

-

4.2.1 Import Dependence and Supply Limitations

-

-

4.3 Opportunities

-

4.3.1 Localization and Manufacturing Initiatives

-

4.3.2 Smart Grid and Energy Storage Applications

-

-

4.4 Challenges

-

4.5 Porter’s Five Forces Analysis

Technology Landscape

-

5.1 Lithium-ion Batteries

-

5.2 Lead-acid Batteries

-

5.3 Nickel-based and Other Chemistries

-

5.4 Battery Recycling and Second-Life Technologies

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Primary (Non-rechargeable)

-

6.1.2 Secondary (Rechargeable)

-

-

6.2 By Application

-

6.2.1 Automotive (ICE and EV)

-

6.2.2 Consumer Electronics

-

6.2.3 Industrial Equipment

-

6.2.4 Renewable Energy Storage

-

6.2.5 Telecom and Backup Power

-

-

6.3 By Sales Channel

-

6.3.1 OEMs

-

6.3.2 Aftermarket

-

Regional and City-Wise Analysis

-

7.1 Riyadh

-

7.2 Jeddah

-

7.3 Dammam

-

7.4 Other Key Cities

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Volume Forecast

-

8.2 Forecast by Battery Type and Application

-

8.3 Market Growth Analysis

Competitive Landscape

-

9.1 Market Share Overview

-

9.2 Profiles of Leading Players

-

9.2.1 Local Manufacturers

-

9.2.2 Global Brands in Saudi Market

-

-

9.3 Key Strategic Developments

Regulatory Framework

-

10.1 Import Regulations and Tariffs

-

10.2 Saudi Standards, Metrology, and Quality Organization (SASO) Guidelines

-

10.3 Government Support for Energy Storage and EV Batteries

Consumer and Industry Trends

-

11.1 Adoption Drivers by Sector

-

11.2 Price Sensitivity and Brand Preferences

-

11.3 EV Battery Demand Trends

Innovation and Strategic Outlook

-

12.1 Public-Private Partnerships in Battery Production

-

12.2 Technology Localization and R&D Focus

-

12.3 Outlook for Battery Integration in Smart Cities

Conclusion and Strategic Recommendations

Appendices

-

14.1 Glossary

-

14.2 Research Methodology

-

14.3 Sources and References

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy