United States Residential Energy Storage Market

United States Residential Energy Storage Market By Technology (Lithium-Ion Batteries, Lead-Acid Batteries, Flow Batteries, Sodium-Based Batteries), By Installation Type (Wall-Mounted, Floor-Mounted, Modular), By End-User (Single-Family Homes, Multi-Family Homes), By Region, Competition, Forecast and Opportunities, 2019-2029F

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Power | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request Customization| Forecast Period | 2025-2029 |

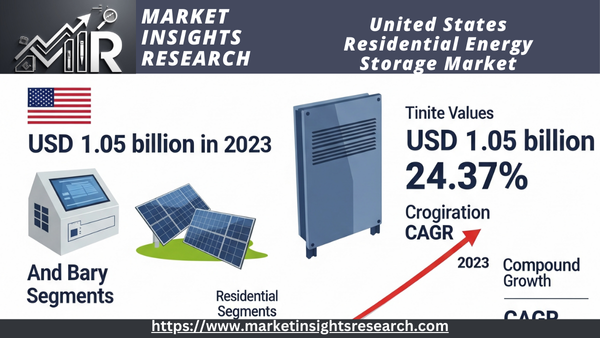

| Market Size (2023) | USD 1.05 billion |

| Market Size (2029) | USD 3.92 billion |

| CAGR (2024-2029) | 24.37% |

| Fastest Growing Segment | Sodium-Based Batteries |

| Largest Market | South US |

Market Overview

In 2023, the United States Residential Energy Storage Market was valued at USD 1.05 billion and is projected to attain USD 3.92 billion by 2029, exhibiting a compound annual growth rate (CAGR) of 24.37% throughout the forecast period. The United States Residential Energy Storage pertains to systems engineered to store electricity for residential use, enabling homeowners to regulate and enhance their energy consumption. These systems generally comprise batteries, inverters, and associated components that accumulate surplus energy produced from renewable sources such as solar panels or during off-peak periods for utilization during peak demand or power outages.

Download Free Sample Ask for Discount Request Customization

Multiple critical factors position the residential energy storage market for significant expansion. The rising utilization of renewable energy sources, particularly solar photovoltaic panels, has escalated the demand for storage solutions capable of capturing and storing excess energy produced during daylight for use during times of diminished sunlight or elevated energy demand. Moreover, progress in battery technology, encompassing enhancements in energy density, efficiency, and cost-effectiveness, has rendered residential energy storage systems more attainable and financially feasible for homeowners. The aspiration for enhanced energy autonomy and robustness, particularly in areas susceptible to power interruptions or characterized by elevated electricity expenses, is further propelling the market's growth. Government incentives, rebates, and supportive policies designed to promote clean energy adoption and diminish carbon footprints further enhance market growth by rendering energy storage solutions more financially appealing. Moreover, technological advancements, including smart grid integration and home energy management systems, augment the functionality and attractiveness of residential energy storage, facilitating increased adoption. The alignment of these factors is anticipated to propel substantial growth in the United States Residential Energy Storage Market, fueled by the demand for dependable, efficient, and sustainable energy solutions in households nationwide.

Principal Market Catalysts

Rising Utilization of Renewable Energy Sources

The rising utilization of renewable energy sources is a key catalyst for expansion in the United States Residential Energy Storage Market. As homeowners and businesses increasingly adopt renewable energy systems, such as solar photovoltaic panels, the demand for efficient storage solutions has intensified. Renewable energy sources frequently generate electricity intermittently; solar panels produce power exclusively during daylight, whereas wind turbines rely on wind conditions. Energy storage systems mitigate this variability by capturing and storing surplus energy when production surpasses consumption, enabling utilization during times of low generation or elevated demand. This ability is essential for optimizing the advantages of renewable energy and guaranteeing a dependable power supply. The decreasing expenses of solar installations and the improving efficiency of photovoltaic systems have propelled the adoption of residential solar energy systems, thereby augmenting the demand for residential energy storage solutions. As an increasing number of households invest in renewable energy, the demand for compatible storage systems to equilibrate energy supply and demand will persist, propelling substantial market growth. Government incentives and policies that promote the adoption of renewable energy also facilitate homeowners' integration of storage solutions with their renewable energy systems. The increasing adoption of renewable energy sources and the corresponding demand for dependable storage solutions are primary drivers of the residential energy storage market's growth.

Download Free Sample Ask for Discount Request Customization

Progress in Battery Technology

Improvements in battery technology are substantially propelling the expansion of the United States Residential Energy Storage Market. Technological advancements have resulted in significant enhancements in battery performance, encompassing elevated energy density, extended longevity, and improved efficiency. These advancements enhance the efficacy of residential energy storage systems in storing and delivering power, thereby augmenting their overall functionality and attractiveness to consumers. Advancements in lithium-ion battery technology have produced batteries that are more compact, lighter, and capable of storing larger quantities of energy than conventional lead-acid batteries. Moreover, decreased production costs have rendered these advanced batteries more economical, thereby enhancing the accessibility of residential energy storage solutions for a wider array of homeowners. The advancement of novel battery chemistries and technologies, including solid-state batteries and flow batteries, offers potential improvements in performance and safety. With the advancement of battery technology, residential energy storage systems will achieve greater efficiency and cost-effectiveness, resulting in increased adoption rates and market expansion. Continuous research and development in battery technology, coupled with competitive market dynamics, will expedite the growth of the residential energy storage market by offering consumers more sophisticated and cost-effective storage solutions.

Download Free Sample Ask for Discount Request Customization

Enhancing Energy Autonomy and Robustness

The increasing focus on energy independence and resilience is a major catalyst for the United States Residential Energy Storage Market. As energy expenses escalate and apprehensions regarding grid dependability intensify, homeowners are pursuing methods to enhance their control over energy consumption and guarantee an uninterrupted power supply. Residential energy storage systems enable homeowners to accumulate electricity for utilization during power outages, peak demand intervals, or periods of elevated electricity costs. This capability improves energy resilience by enabling homeowners to retain power access during grid failures. Moreover, the aspiration for energy autonomy compels homeowners to diminish their dependence on utility companies and manage their energy generation and usage. Energy storage systems, in conjunction with renewable energy sources, empower homeowners to generate and retain their electricity, thus diminishing reliance on external energy sources and alleviating the effects of variable energy prices. The heightened awareness of climate change and environmental concerns further drives the pursuit of energy independence, as homeowners aim to diminish their carbon footprints and endorse sustainable energy practices. The residential energy storage market is anticipated to expand due to the increasing demand for dependable, autonomous, and sustainable energy solutions, necessitated by the desire for improved energy resilience and management.

Principal Market Obstacles

Substantial Initial Expenditures

The substantial initial expenses linked to residential energy storage systems pose a significant obstacle for the United States Residential Energy Storage Market. Notwithstanding technological advancements and declining costs, the initial capital necessary for the acquisition and installation of energy storage systems remains considerable. This initial investment encompasses both the cost of the battery units and installation expenses, including electrical modifications and system integration. For numerous homeowners, especially those with constrained financial means, these expenses can be excessive, hindering the widespread implementation of residential energy storage systems. Moreover, the intricacy of incorporating these systems with current home energy configurations can increase the total cost. Although numerous government incentives and rebates exist to mitigate these expenses, they may not entirely compensate for the initial investment, especially for more sophisticated or higher-capacity systems. The elevated expense of energy storage systems may obstruct new market entrants and impede market growth by delaying adoption rates among prospective customers. To tackle this challenge, continuous endeavors to lower production costs via technological innovations and economies of scale are essential. As technology advances and becomes more economical, it is expected that the initial financial burden will diminish, rendering residential energy storage systems more accessible to a wider demographic.

Constrained Battery Longevity and Efficiency

Restricted battery longevity and performance deficiencies pose considerable obstacles for the United States Residential Energy Storage Market. The efficacy of energy storage systems is intrinsically linked to the performance and durability of the batteries employed within them. Despite advancements in battery technology enhancing performance, concerns persist regarding degradation over time, diminished energy capacity, and efficiency losses. Most residential energy storage batteries possess a limited lifespan, generally spanning from 5 to 15 years, contingent upon the type and usage patterns. As batteries age, their ability to store and discharge energy declines, potentially affecting the overall reliability and efficiency of the storage system. Moreover, variables including temperature extremes, frequent cycling, and inadequate maintenance can expedite battery deterioration. These performance deficiencies may result in elevated replacement expenses and possible interruptions in energy supply for homeowners. Confronting these challenges necessitates ongoing research and development to advance battery technology, augment durability, and prolong lifespan. Innovations like solid-state batteries and advanced chemistries offer potential solutions to these limitations. Nevertheless, until these technologies are broadly accessible and economically feasible, the market must address performance and longevity issues to sustain consumer confidence and promote adoption.

Key Market Trends

Increasing Adoption of Smart Home Integration

The growing implementation of smart home integration is a significant trend in the United States Residential Energy Storage Market. With technological advancements, homeowners are pursuing more refined methods to optimize their energy consumption effectively. Energy storage systems are progressively being incorporated with smart home technologies, including home automation systems, smart thermostats, and energy management software. This integration facilitates real-time oversight and regulation of energy storage systems, enhancing their efficiency according to consumption trends, energy production, and external variables such as meteorological conditions. Smart home integration augments the functionality of energy storage systems by facilitating remote access, automated energy conservation modes, and sophisticated analytics. Homeowners can utilize these features to enhance energy efficiency, decrease expenses, and improve the overall user experience. The integration of energy storage systems with smart grids and demand response programs is increasingly common, facilitating improved alignment with grid demands and enhancing energy stability. The advancement of smart home technology is anticipated to increase the demand for residential energy storage systems that integrate effortlessly with other smart devices, thereby fostering innovation and market expansion.

Download Free Sample Ask for Discount Request Customization

Advancement of Energy Storage Technologies Beyond Lithium-Ion Batteries

The proliferation of energy storage alternatives beyond lithium-ion batteries signifies a notable trend in the United States Residential Energy Storage Market. Although lithium-ion batteries have been the prevailing technology for residential energy storage owing to their superior energy density and performance, there is a growing interest in alternative battery technologies. Emerging technologies, including solid-state batteries, flow batteries, and sodium-ion batteries, are gaining prominence owing to their prospective benefits regarding safety, durability, and ecological effects. Solid-state batteries provide superior energy densities and enhanced safety relative to conventional lithium-ion batteries, whereas flow batteries deliver scalable storage solutions with extended lifespans. Sodium-ion batteries are emerging as a more economical and eco-friendly alternative. As research and development in these alternative technologies progress, they are anticipated to become increasingly commercially viable and competitive, providing various options for residential energy storage. This trend signifies the increasing demand for diverse and flexible energy storage solutions that cater to various consumer requirements and preferences, fostering innovation and diversification within the market.

Growth in Residential Energy Storage for Backup Power Applications

The expansion of residential energy storage for backup power applications is a significant trend in the United States Residential Energy Storage Market. As power outages become more frequent and severe due to extreme weather events, grid instability, and other disruptions, homeowners are increasingly adopting energy storage systems to guarantee a reliable power supply during emergencies. Residential energy storage systems offer a superior solution by supplying backup power to maintain the operation of essential appliances and systems during grid outages. This trend is propelled by increasing consumer awareness of the advantages of energy resilience, alongside advancements in battery technology that augment the reliability and efficacy of backup power systems. Moreover, the growing affordability of energy storage systems renders them more attainable for homeowners aiming to alleviate the risks linked to power outages. Energy storage systems tailored for backup power applications typically incorporate features like automatic transfer switches, high-capacity batteries, and integration with home generators to guarantee uninterrupted operation during outages. The residential energy storage market is anticipated to grow due to the increasing demand for dependable backup power, necessitated by the pursuit of improved energy security and resilience.

Segmental Insights

Technology

In 2023, the Lithium-Ion Batteries segment led the United States Residential Energy Storage Market and is expected to sustain its leadership during the forecast period. Lithium-ion batteries are favored for residential energy storage owing to their enhanced energy density, extended lifespan, and elevated efficiency relative to alternative battery technologies. They provide considerable benefits regarding space efficiency, as they can accumulate substantial energy within a relatively small volume, rendering them suitable for residential settings where space may be constrained. Moreover, advancements in lithium-ion technology have resulted in decreased costs and enhanced performance, thereby increasing their attractiveness to homeowners. Lithium-ion batteries offer dependable and efficient storage solutions, with continuous innovations that reduce costs and enhance performance reinforcing their dominant market position. Alternative battery types, including lead-acid, flow, and sodium-based batteries, possess certain advantages, such as lower initial costs and varied performance characteristics; however, they remain unable to rival the overall performance, efficiency, and cost-effectiveness of lithium-ion batteries. With the increasing demand for residential energy storage and continuous technological advancements, lithium-ion batteries are anticipated to maintain their market dominance due to their established benefits and ongoing enhancements.

Regional Insights

In 2023, the Southern United States became the preeminent region in the United States Residential Energy Storage Market and is anticipated to maintain its superior status during the forecast period. This region's dominance is primarily attributed to elevated solar energy adoption and substantial energy consumption patterns. States such as California, Texas, and Florida have experienced significant expansion in residential solar installations, consequently increasing the demand for energy storage solutions to manage and optimize the utilization of solar-generated electricity. The Southern United States frequently endures power outages caused by severe weather events, including hurricanes and storms, thereby heightening the demand for dependable backup power solutions. The proliferation of residential solar systems, coupled with the urgent demand for backup power in this region, establishes a robust market for energy storage systems. The supportive state-level policies and incentives that promote renewable energy adoption further enhance the South's dominant market position. Furthermore, the elevated temperatures and extended sunlight duration in the Southern United States augment the efficacy of solar power generation, thereby intensifying the demand for integrated energy storage solutions. The South United States is projected to retain its leadership in the residential energy storage market, bolstered by persistent technological advancements and advantageous regulatory frameworks.

Download Free Sample Ask for Discount Request Customization

Recent Developments

- In February 2024, LG announced the development of two variants of its new Enblock E storage system, offering usable energy capacities of 12.4 kilowatt-hours and 15.5 kilowatt-hours. The company highlighted that these two models, measuring 451 millimeters by 330 millimeters, are designed for ease of deployment in compact spaces.

- In September 2023, we presented a summary of the major announcements in energy storage products at the conclusion of the RE+ clean energy expo in Las Vegas, United States, featuring updates from Hithium, Sunwoda, and Power Edison. With over 1,300 exhibitors representing a wide range of clean energy technologies, this four-day event stands as the largest renewable and clean energy conference in North America. It provides a platform for technology companies to unveil their latest innovations and products.

- In May 2024, Schneider Electric unveiled new storage systems designed for microgrids. The company introduced two variants of its Battery Energy Storage System, available in enclosures measuring 7 feet and 20 feet, with power capacities ranging from 60 kilowatts to 500 kilowatts. Schneider Electric’s latest Battery Energy Storage System has been rigorously tested and validated for compatibility with EcoStruxure Microgrid Flex—a standardized, rapid-deployment microgrid solution tailored to enhance resilience, energy efficiency, and sustainability.

Key Market Players

- Tesla, Inc

- LG Energy Solution Ltd

- Schneider Electric SE

- Enphase Energy, Inc

- SunPower Corporation

- Sonnen, Inc

- Panasonic Holdings Corporation

- Vivint, Inc

- Bloom Energy Corporation

- Generac Power Systems, Inc

|

By Technology |

By Installation Type |

By End-user |

By Region |

|

|

|

|

Related Reports

- UK Commercial Boiler Market Size By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity, By Technology (Condensing, Non...

- Residential Electric Boiler Market Size - By Voltage Rating (Low Voltage, Medium Voltage), Industry Analysis Report, Reg...

- Europe Steam Boiler Market - By Capacity, By Fuel (Natural Gas, Oil, Coal), By Technology (Condensing, Non-Condensing), ...

- Electric Boiler Market Size By Voltage Rating (Low, Medium), By Application (Residential, Commercial, Industrial, Food P...

- Europe Boiler Market By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

- Boiler Market Size - By Fuel (Natural Gas, Oil, Coal, Electric), By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 ...

Table of Content

-

Executive Summary

-

1.1 U.S. Market Highlights

-

1.2 Key Trends and Developments

-

1.3 Strategic Recommendations

-

Introduction

-

2.1 Purpose and Scope

-

2.2 Research Methodology

-

2.3 Definitions and Assumptions

-

Market Overview

-

3.1 What is Residential Energy Storage?

-

3.2 Energy Storage in the U.S. Grid Context

-

3.3 Market Structure and Ecosystem

-

Market Dynamics

-

4.1 Drivers

-

4.1.1 Growth in Rooftop Solar Adoption

-

4.1.2 Increasing Grid Outages and Energy Independence Goals

-

4.1.3 Time-of-Use and Net Metering Policies

-

4.2 Restraints

-

4.2.1 High Upfront Cost of Installation

-

4.2.2 Permitting and Interconnection Challenges

-

4.3 Opportunities

-

4.3.1 State Incentives and Federal Support

-

4.3.2 Advancements in Battery Technologies

-

4.4 Challenges

-

4.5 Value Chain and Stakeholder Analysis

-

Technology Landscape

-

5.1 Lithium-Ion Batteries (NMC, LFP)

-

5.2 Flow Batteries and Solid-State Innovations

-

5.3 Battery Management Systems (BMS)

-

5.4 Hybrid Solar + Storage Systems

-

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Lithium-Ion

-

6.1.2 Lead-Acid

-

6.1.3 Others

-

6.2 By Ownership Model

-

6.2.1 Customer-Owned

-

6.2.2 Third-Party Owned (Leased, PPAs)

-

6.3 By Connectivity

-

6.3.1 On-Grid

-

6.3.2 Off-Grid

-

6.4 By Use Case

-

6.4.1 Backup Power

-

6.4.2 Energy Arbitrage

-

6.4.3 Peak Shaving and Load Shifting

-

Regional Market Analysis

-

7.1 California

-

7.2 Texas

-

7.3 New York

-

7.4 Florida

-

7.5 Other States

-

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Volume Forecasts

-

8.2 CAGR by Segment

-

8.3 Scenario-Based Forecast (Base, Optimistic, Conservative)

-

Competitive Landscape

-

9.1 Market Share of Key Players

-

9.2 Company Profiles

-

9.2.1 Product Offerings

-

9.2.2 Strategic Partnerships

-

9.2.3 Recent Developments and Installations

-

Policy and Regulatory Environment

-

10.1 Federal Tax Credits and Storage Eligibility

-

10.2 State-Level Rebates and Incentives (e.g., SGIP California)

-

10.3 Interconnection and Building Code Requirements

-

Consumer Insights

-

11.1 Adoption Trends and Motivations

-

11.2 Pricing Sensitivity and ROI Expectations

-

11.3 Installer and Brand Preferences

-

Innovation and Future Outlook

-

12.1 Integration with Virtual Power Plants (VPPs)

-

12.2 Smart Home Connectivity and AI Optimization

-

12.3 ESG Impact and Decentralized Energy Future

-

Conclusion and Strategic Outlook

-

Appendices

-

14.1 Glossary of Terms

-

14.2 Research Methodology Details

-

14.3 Sources and References

Executive Summary

-

1.1 U.S. Market Highlights

-

1.2 Key Trends and Developments

-

1.3 Strategic Recommendations

Introduction

-

2.1 Purpose and Scope

-

2.2 Research Methodology

-

2.3 Definitions and Assumptions

Market Overview

-

3.1 What is Residential Energy Storage?

-

3.2 Energy Storage in the U.S. Grid Context

-

3.3 Market Structure and Ecosystem

Market Dynamics

-

4.1 Drivers

-

4.1.1 Growth in Rooftop Solar Adoption

-

4.1.2 Increasing Grid Outages and Energy Independence Goals

-

4.1.3 Time-of-Use and Net Metering Policies

-

-

4.2 Restraints

-

4.2.1 High Upfront Cost of Installation

-

4.2.2 Permitting and Interconnection Challenges

-

-

4.3 Opportunities

-

4.3.1 State Incentives and Federal Support

-

4.3.2 Advancements in Battery Technologies

-

-

4.4 Challenges

-

4.5 Value Chain and Stakeholder Analysis

Technology Landscape

-

5.1 Lithium-Ion Batteries (NMC, LFP)

-

5.2 Flow Batteries and Solid-State Innovations

-

5.3 Battery Management Systems (BMS)

-

5.4 Hybrid Solar + Storage Systems

Market Segmentation

-

6.1 By Battery Type

-

6.1.1 Lithium-Ion

-

6.1.2 Lead-Acid

-

6.1.3 Others

-

-

6.2 By Ownership Model

-

6.2.1 Customer-Owned

-

6.2.2 Third-Party Owned (Leased, PPAs)

-

-

6.3 By Connectivity

-

6.3.1 On-Grid

-

6.3.2 Off-Grid

-

-

6.4 By Use Case

-

6.4.1 Backup Power

-

6.4.2 Energy Arbitrage

-

6.4.3 Peak Shaving and Load Shifting

-

Regional Market Analysis

-

7.1 California

-

7.2 Texas

-

7.3 New York

-

7.4 Florida

-

7.5 Other States

Market Size and Forecast (2020–2030)

-

8.1 Revenue and Volume Forecasts

-

8.2 CAGR by Segment

-

8.3 Scenario-Based Forecast (Base, Optimistic, Conservative)

Competitive Landscape

-

9.1 Market Share of Key Players

-

9.2 Company Profiles

-

9.2.1 Product Offerings

-

9.2.2 Strategic Partnerships

-

9.2.3 Recent Developments and Installations

-

Policy and Regulatory Environment

-

10.1 Federal Tax Credits and Storage Eligibility

-

10.2 State-Level Rebates and Incentives (e.g., SGIP California)

-

10.3 Interconnection and Building Code Requirements

Consumer Insights

-

11.1 Adoption Trends and Motivations

-

11.2 Pricing Sensitivity and ROI Expectations

-

11.3 Installer and Brand Preferences

Innovation and Future Outlook

-

12.1 Integration with Virtual Power Plants (VPPs)

-

12.2 Smart Home Connectivity and AI Optimization

-

12.3 ESG Impact and Decentralized Energy Future

Conclusion and Strategic Outlook

Appendices

-

14.1 Glossary of Terms

-

14.2 Research Methodology Details

-

14.3 Sources and References

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy