Smart Labelling in Logistics Market

Smart Labelling in Logistics Market Size - By Component (Hardware, Software, Services), By Product (RFID Labels, NFC Labels, Electronic Shelf Labels (ESL)), By Deployment Type (Cloud-based, On-premises), By Company Size, By Application & Forecast, 2024 - 2032

Published Date: May - 2025 | Publisher: MIR | No of Pages: 240 | Industry: Packaging | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request CustomizationSmart Labelling in Logistics Market Size

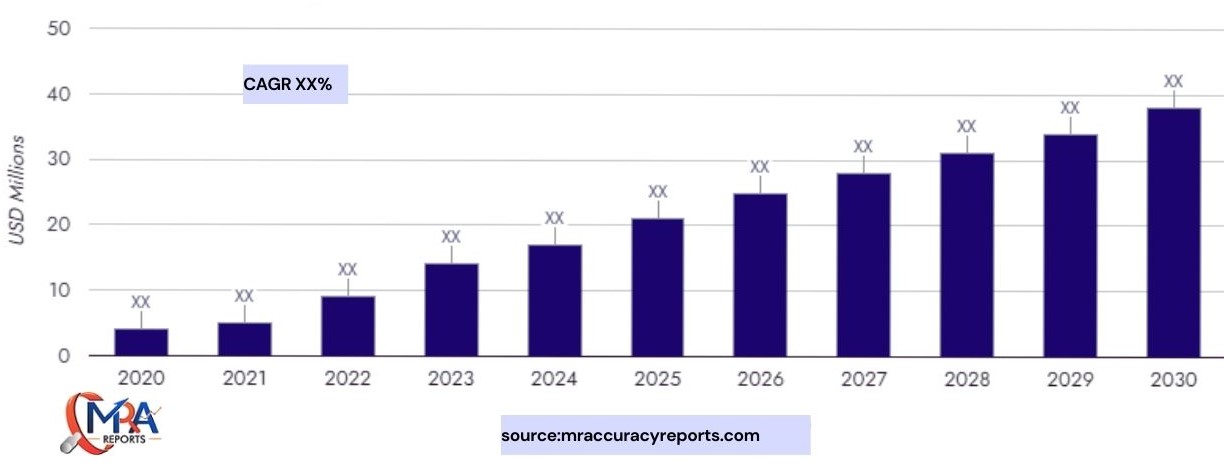

Smart Labelling in Logistics Market was valued at USD 7 billion in 2023 and is anticipated to grow at a CAGR of over 5% between 2024 and 2032.

To get key market trends

Think of thisPallets, crates, and a sea of goods abound in your warehouse. How do you remember all of them? Now enter the amazing realm of Radio Frequency Identification (RFID) technology, where little tags serve as digital super heroes. Attached to your goods, pallets, or containers are RFID tags. Like small data passports, they are crammed with information. And now here is the magicFrom any angle—including through walls and boxes—RFID readers can scan these tags. Your products might be considered as having a superpower as they let you precisely where they are, anytime you need to know. In your warehouse, this real-time superpower ensures seamless operation of everything. You may view precisely what you have, where it is, and its movement. It's like having an eagle-eyed inventory tracker on hand around-the-clock ensuring everything is in the correct location at the correct moment. There is no more running about looking for missing goods or handling erroneous deliveries. Instant product identification made possible by RFID saves time, money, and a great deal of worry by allowing you identify your items. RFID also lets you bid manual labor and mistakes farewell. The tags track your inventory with exact accuracy, so doing all the heavy work for you. It's like commanding a digital army that works nonstop to ensure everything goes without a hitch. RFID's beauty doesn't stop there. It also allows you to examine your supply chain—never before possible. You can spot trends, predict behavior, and make better inventory management choices. Having this knowledge helps you to simplify your processes and expand your company, therefore acting as a data superpower.

| Report Attribute | Details |

|---|---|

| Base Year | 2023 |

| Smart Labelling in Logistics Market Size in 2023 | USD 7 Billion |

| Forecast Period | 2024 - 2032 |

| Forecast Period 2024 - 2032 CAGR | 5% |

| 2032 Value Projection | USD 11.15 Billion |

| Historical Data for | 2021 - 2023 |

| No. of Pages | 210 |

| Tables, Charts & Figures | 305 |

| Segments covered | Component, Product, Deployment Type, Company Size, Application |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Thanks to real-time monitoring made possible by the Internet of Things (IoT), the logistics industry is changing through flawless data exchanges. Sensors and smart tags among other IoT-enabled devices give essential data on the state, location, and general condition of goods all across the supply chain. This integration lowers downtime and increases asset use, hence improving predictive maintenance. IoT helps to proactively solve problems, optimize routes, and assure product quality by measuring environmental variables including temperature and humidity. Increasing IoT integration enhances the responsiveness, transparency, and efficiency of the logistics ecosystem, thereby improving customer happiness and operational excellence finally.

Using RFID and IoT smart labeling technologies in logistics can result in significant expenses covering the cost of purchasing, configuring, and integrating RFID tags, readers, and IoT sensors with the existing IT infrastructure. Additional outlay covers staff training, ongoing maintenance, and software development. The inability of small enterprises to pay these upfront expenses could limit the general acceptance of these technologies. Furthermore, companies could struggle to justify the expenditure given the potential long-term benefits of improved supply chain visibility and higher efficiency should the Return on Investment (ROI) be delayed.

Smart Labelling in Logistics Market Trends

Hello There! Pay attentionblockchain technology is significantly helping the field of logistics flourish. It keeps track of every movement your goods makes, like a very safe vault. Everyone engaged shares this elegant ledger, hence no funny business is hidden. It notes everything, including where your items originated and where they are now headed. This implies no more lost goods and no more guessing whether what you are getting is the actual thing. And more still! Blockchain simplifies tracking of your data so you may know where it is at every stage. Perfect for your waiting for that new gadget! Still, that's not all. Blockchain is also enabling businesses to comply with regulations and resolve any conflicts more amiably. For openness and responsibility, it serves as almost a magic wand. Companies are riding the blockchain train to create absolutely reliable supply chains. One amazing application using blockchain to provide everyone from the shipper to the client a clear view of what's happening is TradeLens. It's like your items' GPS! Now you have it. By allowing supply chains to be more open, safe, and efficient, blockchain is transforming logistics For customers as well as companies, this changes everything.

Omnichannel retailing and online purchasing are exploding, and it's altering our access to products. Deliveries fast, dependable, and adaptable are what people demand, hence logistics firms are raising their standards. Smart technology—including smart labels—is being sought after by them in order to track packages in real time, better route planning, and inventory control. They are also connecting several technologies to enable either same-day or next-day delivery. A seamless operating supply chain is absolutely vital in this whole omnichannel age, when consumers are buying everywhere from their phones to actual locations. Logistics firms must thus continually inventing and improving their offerings. Consider Amazon here. They simply lavishly spent money on their logistical arrangement. To manage the rush of online orders they get and speed deliveries, they are creating new warehouses including smart devices and RFID technologies.

Smart Labelling in Logistics Market Analysis

Learn more about the key segments shaping this market

Based on component, the market is divided into hardware, software and services. The hardware segment dominates the market and is expected to reach over USD 5.11 billion by 2032.

- Hardware in the context of smart labelling in the logistics smart labelling industry refers to the tools and components needed to implement innovative solutions. IoT sensors, barcode printers, readers, and RFID tags are few of the crucial hardware components. RFID tags and IoT sensors provide essential information on the location, state, and movement of products, therefore enabling real-time tracking and data collecting.

- By producing labels scanned by barcode readers, barcode printers guarantee accurate data collecting and inventory control. These hardware components lower mistake rates, improve operational performance, and raise supply chain visibility. Companies trying to leverage smart labelling technology for improved decision-making and simplified logistics have to make strong hardware investments.

Learn more about the key segments shaping this market

Based on application, the market is categorized into inventory management, asset tracking, parcel tracking & delivery, and cold chain monitoring. The parcel tracking & delivery segment is the fastest growing segment with a CAGR of over 6% between 2024 and 2032.

- Modern logistics requires parcel delivery and tracking to ensure that the shipments are efficiently tracked and controlled from the point of dispatch to the point of final delivery. Parcels are tagged and tracked in real-time using technologies, such as the RFID, GPS, and IoT, providing supply chain stakeholders information into their position and condition.

- This makes it possible to provide clients with timely information and precise delivery estimates. Cutting-edge tracking technologies minimize losses/theft, minimize delays, and optimize delivery routes. Moreover, they facilitate proactive problem-solving by promptly recognizing and resolving possible issues. Effective parcel tracking and delivery systems improve customer satisfaction by guaranteeing delivery processes that are transparent, dependable, and timely.

Looking for region specific data?

In 2023, North America took the lead in the global smart labelling market for logistics, claiming over 36% of the market share. The United States is a major player in this market, thanks to its advanced technologies and high adoption rates of innovative solutions. U.S.-based businesses are at the forefront of using blockchain, IoT, and RFID technologies to enhance supply chain visibility and efficiency. The country's thriving e-commerce sector also drives the need for robust logistics solutions, which is boosting the growth of smart labelling. Regulatory guidelines in the U.S. encourage the use of advanced labelling to improve compliance and traceability. Major IT companies and logistics providers in the U.S. are heavily investing in research and development to create cutting-edge labelling technologies. This leadership role fosters innovation in the smart labelling industry and helps set global standards.

China's vast industrial and e-commerce sectors are propelling the country's rapid advancement in the smart labelling market. RFID and IoT technology adoption is accelerated by the government's insistence on digital transformation and smart logistics infrastructure. China is a major player in this market as Chinese businesses are aggressively investing in automation and intelligent supply chain solutions to increase efficiency and satisfy the needs of global trade.

Japan plays a significant role in the smart labelling business owing to its emphasis on innovation and precision. Leading developers of innovative RFID and sensor technologies are Japanese businesses. The use of smart labelling systems is driven by the nation's emphasis on effective logistics and quality control. Furthermore, smart labelling contributes to improved supply chain visibility and traceability, which benefits Japan's robust automotive and electronics industries.

South Korea is a major player in the smart labelling sector, with a focus on technological integration and smart logistics. The nation's cutting-edge IT infrastructure facilitates the widespread use of IoT, RFID, and AI-driven logistics solutions. South Korean businesses are strengthening their position in the international market by utilizing these technologies to increase real-time tracking and inventory management, minimize costs, and streamline the supply chain.

Smart Labelling in Logistics Market Share

With a combined share of more than 20%, Honeywell International Inc. and Zebra Technologies hold in the market is noteworthy. Key participant in the smart labelling market, Honeywell offers a spectrum of cutting-edge solutions improving logistics processes. It offers dependable solutions to improve inventory control, increase operational efficiency, and ensure compliance with barcode scanners, mobile computers, and RFID devices. Smart labeling solutions developed by Honeywell improve supply chain visibility and traceability, therefore enabling real-time data capture. Its innovative approach enables businesses to better use resources, lower mistakes, and simplify processes, thereby raising customer satisfaction and output in logistical operations.

Zebra Technologies is particularly adept in offering innovative smart labelling solutions for supply chains and logistics uses. It offers a whole spectrum of tools including barcode printers, RFID readers, and location technologies. Using Zebra's products, companies may improve operational efficiency, inventory accuracy, asset tracking and management. Emphasizing data visibility and connection helps companies to simplify processes and reduce costs while also addressing changing customer needs in a competitive market. Modern smart labeling technologies developed by Zebra Technologies are transforming worldwide logistics activities.

Smart Labelling in Logistics Market Companies

Major players operating in the smart labelling in logistics industry are

- Avery Dennison

- Honeywell International Inc.

- Impinj

- Oracle Corporation

- Sato Holdings

- Smartrac N.V.

- Zebra Technologies

Smart Labelling in Logistics Industry News

- In September 2023, DHL and IBM partnered to integrate blockchain technology into DHL's smart labelling solutions. The objective of this collaboration is to transform supply chain management by enhancing transparency, security, and traceability throughout logistical processes. DHL improves data integrity and visibility using blockchain, enabling stakeholders to trace shipments securely, confirm authenticity, and expedite customs procedures. The key industry issues including operational inefficiencies, regulatory compliance, and counterfeit prevention are addressed by this integration. By implementing blockchain technology, DHL is demonstrating its dedication to innovation in logistics and establishing new benchmarks for efficiency and trust in international supply chains.

- In September 2021, Avery Dennison obtained the How2Recycle® mark for RFID paper hang tags, making it the first and only pre-qualified smart labels provider. How2Recycle has assigned the label based on several aspects, including applicable law, sortation (MRF package flow), collection (access to recycling), reprocessing (technical recyclability), and end markets. This development is the result of many years of research and development conducted by Avery Dennison Smartrac to create a special blend of materials, adhesives, and inlay construction. This allows RFID labels to be recycled with other paper-based materials and can be combined with any other residential recycling stream.

The smart labelling in logistics market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD billion) from 2021 to 2032, for the following segments

Click here to Buy Section of this Report

Market, By Component

- Hardware

- Software

- Service

Market, By Product

- RFID labels

- NFC labels

- Electronic Shelf Labels (ESL)

- Others

Market, By Deployment Type

- Cloud-based

- On-premises

Market,

By Company

Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

Market, By Application

- Inventory management

- Asset tracking

- Parcel tracking and delivery

- Cold chain monitoring

- Others

The above information is provided for the following regions and countries

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

Related Reports

- Palletizer Market Size - By Type (Robotic Palletizers, Conventional Palletizers, Automated Palletizers, Manual Palletize...

- Temperature Controlled Packaging Solutions Market Size - By Type (Passive Systems, Active Systems), By Product (Insulate...

- Laminated Labels Market Size - By Material Type (Polyester, Polypropylene, Vinyl), By Composition (Lamination layer, Fac...

- Bottled Water Processing Market Size - By Type (Purified Water, Sparkling Water, Spring Water, Mineral Water), By Packag...

- Ceramic Packaging Market Size - By Material (Alumina Ceramic, Silicon Nitride, Zirconia,) By Application (Consumer Elect...

- Antimicrobial Packaging Market Size - By Material (Plastic, BioPolymer, Paper & Paperboard) Packaging Type (Bags, Pouche...

Table of Content

-

Executive Summary

1.1. Market Overview

1.2. Key Findings

1.3. Market Outlook -

Introduction

2.1. Definition and Scope

2.2. Research Methodology

2.3. Assumptions and Limitations -

Market Dynamics

3.1. Drivers

3.2. Restraints

3.3. Opportunities

3.4. Challenges

3.5. Regulatory Landscape

3.6. Supply Chain Analysis

3.7. Porter’s Five Forces Analysis -

Smart Labelling Market by Type

4.1. RFID Labels

4.2. Barcode Labels

4.3. QR Code Labels

4.4. NFC Labels

4.5. Electronic Shelf Labels

4.6. Others -

Smart Labelling Market by Application

5.1. Inventory and Asset Management

5.2. Real-Time Tracking

5.3. Warehouse Management

5.4. Cold Chain Monitoring

5.5. Shipment Verification

5.6. Others -

Smart Labelling Market by End-User Industry

6.1. Transportation & Logistics

6.2. Retail & E-commerce

6.3. Food & Beverage

6.4. Healthcare & Pharmaceuticals

6.5. Manufacturing

6.6. Others -

Competitive Landscape

7.1. Overview of Key Players

7.2. Company Profiles

7.2.1. Avery Dennison Corporation

7.2.2. Zebra Technologies

7.2.3. Smartrac N.V.

7.2.4. Honeywell International Inc.

7.2.5. Checkpoint Systems, Inc.

7.2.6. SATO Holdings Corporation

7.2.7. Identiv, Inc.

7.2.8. Others -

Regional Analysis

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. Middle East & Africa -

Market Forecast and Trends (2024–2030)

9.1. Historical Market Size

9.2. Forecast Market Size

9.3. Emerging Trends

9.4. Technology Outlook -

Conclusion & Recommendations

-

Appendix

11.1. Glossary of Terms

11.2. List of Abbreviations

11.3. References

11.4. Research Methodology Details

Will be Available in the sample /Final Report. Please ask our sales Team.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy