Polymer Nanocomposites Market

Polymer Nanocomposites Market - By Polymer (Polypropylene, Polyamide, Epoxy Resin, Polyethylene), By Nanomaterials (Nano-oxides, Nanoclays, Nanofibers, Carbon Nanotubes), By End-User Industry & Forecast, 2024-2032

Published Date: May - 2025 | Publisher: MRA | No of Pages: 240 | Industry: Chemical | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request CustomizationPolymer Nanocomposites Market Size

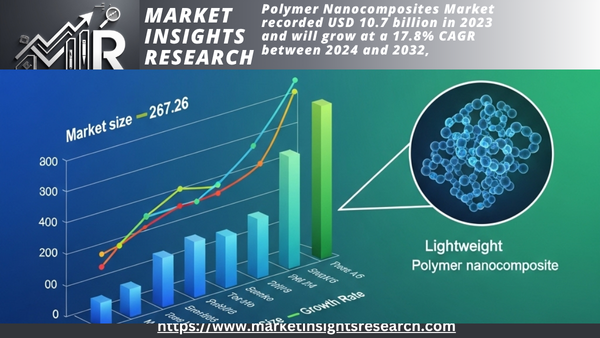

Polymer Nanocomposites Market recorded USD 10.7 billion in 2023 and will grow at a 17.8% CAGR between 2024 and 2032, propelled by increasing demand from end-use industries such as automotive, aerospace, electronics, and packaging for lightweight, durable materials. Technological progress in nanotechnology, polymer science, and manufacturing processes has enabled the development of advanced nanocomposites with superior properties. These advancements drive innovation, enhancing the performance and versatility of polymer nanocomposites, thus fueling their adoption across diverse applications and expanding the market size.

Download Free Sample Ask for Discount Request Customization

For instance, in November 2023, Celanese introduced innovative polyamides enhancing electric vehicle (EV) performance and flame resistance in battery and powertrain applications. These new polyamides, including the Frianyl PA W-Series, cater to EV component manufacturers, enabling the production of robust battery components. This development is likely to drive demand for polymer nanocomposites in the growing EV sector, further expanding the market and encouraging continued innovation in material science.

Key Market Trends & InsightsPolymer Nanocomposites Market

1. Accelerating Demand Across High-Performance Industries

-

Automotive Lightweight nanocomposites improve fuel efficiency while maintaining strength (carbon nanotube-reinforced polymers gaining traction)

-

Aerospace Nanoclay and graphene-enhanced composites for aircraft components requiring high strength-to-weight ratios

-

Electronics Conductive polymer nanocomposites enabling flexible circuits and EMI shielding

2. Breakthroughs in Material Science Driving Innovation

-

Hybrid nanocomposites combining multiple nanofillers (e.g., graphene + nanoclay) for synergistic properties

-

Self-healing nanocomposites with microencapsulated healing agents for automotive and aerospace applications

-

Smart nanocomposites with sensing capabilities for structural health monitoring

3. Sustainability Becoming a Core Market Driver

-

Bio-based nanocomposites using natural fibers/nanocellulose gaining prominence

-

Recyclable nanocomposite formulations addressing end-of-life concerns

-

Nanocomposite barriers reducing food packaging waste through enhanced preservation

4. Healthcare Applications Emerging as High-Growth Segment

-

Antimicrobial nanocomposites for medical devices and hospital surfaces

-

Drug-eluting nanocomposites for controlled release implants

-

Dental nanocomposites with superior wear resistance and aesthetics

5. Asia-Pacific Dominating Market Growth

-

China leading in production capacity and consumption

-

India emerging as R&D hub for cost-effective nanocomposites

-

Japan and Korea aredriving advanced material innovations

6. Manufacturing Technology Advancements

-

3D printing nanocomposites enabling complex geometries

-

In-situ polymerization improving nanoparticle dispersion

-

AI-assisted material design accelerating development cycles

7. Regulatory and Safety Considerations

-

Nanomaterial safety regulations impacting commercialization timelines

-

REACH compliance becoming critical for European market access

-

Standardization efforts for nanocomposite testing methods

8. Competitive Landscape Evolution

-

Material giants (BASF, DuPont, SABIC) expanding nanocomposite portfolios

-

Startups focusing on niche applications like wearable tech

-

Vertical integration isincreasing among nanomaterial suppliers

| Report Attribute | Details |

|---|---|

| Base Year | 2023 |

| Polymer Nanocomposites Market Size in 2023 | USD 10.7 Billion |

| Forecast Period | 2024-2032 |

| Forecast Period 2024-2032 CAGR | 17.8% |

| 2032 Value Projection | USD 46.5 Billion |

| Historical Data for | 2021–2023 |

| No. of Pages | 300 |

| Tables, Charts & Figures | 534 |

| Segments covered | By Polymer Type, By Nanomaterials |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

Download Free Sample Ask for Discount Request Customization

What are the growth opportunities in this market?

The polymer nanocomposites industry is experiencing robust growth due to a heightened emphasis on sustainability and continuous investments in research and development. As industries prioritize eco-friendly solutions, manufacturers are innovating new product formulations to meet these demands. This focus on being environmentally friendly leads to the creation of better polymer nanocomposites, which helps the market grow in different areas and highlights the need to consider the environment when making materials.

For instance, in November 2022, Roboze introduced a bio-based polyamide for eco-friendly, high-performance 3D printing. This innovative technopolymer utilizes a bio-based matrix strengthened with natural fibers, enhancing sustainability and performance. This launch will drive market growth by attracting eco-conscious manufacturers and promoting further advancements in sustainable nanocomposite technologies.

Though the market is thriving, it encounters barriers such as high manufacturing costs and stringent regulatory requirements. However, high production costs reflect the complexity and sophistication of the production processes, that ensure top-notch quality. Similarly, stringent regulatory requirements underscore the industry's commitment to safety and environmental stewardship, ensuring the development of reliable and sustainable materials. Addressing these challenges necessitates innovative solutions and collaborative efforts, propelling the industry toward greater efficiency and compliance.

Polymer Nanocomposites Market Trends

The use of polymer nanocomposites in 3D printing and the increasing need for sustainable materials are key trends driving the growth of the polymer nanocomposites industry. By combining advanced materials with additive manufacturing techniques, manufacturers can produce complex structures with enhanced mechanical properties. Moreover, the growing emphasis on sustainability prompts the development of eco-friendly nanocomposites, meeting the needs of environmentally conscious industries and consumers and fueling further market expansion.

For instance, in October 2023, Evonik and Lehvoss introduced Luvosint PA613 9711 CF, a fiber-reinforced polyamide for selective laser sintering (SLS). Developed collaboratively, it combines Evonik's PA613 base polymer with carbon fiber reinforcement. This development highlights the growing trend toward high-performance, lightweight materials in advanced manufacturing techniques like SLS. It will drive demand for polymer nanocomposites, promoting innovation and expanding their applications in industries requiring durable and efficient 3D printing solutions.

Download Free Sample Ask for Discount Request Customization

Polymer Nanocomposites Market Analysis

Learn more about the key segments shaping this market

The polyamide segment garnered USD 4.2 billion in 2023 and will register USD 17.9 billion by 2032 due to its exceptional mechanical properties, thermal stability, and widespread applications across the automotive, aerospace, and electronics industries. Enhanced with nanomaterials, polyamide nanocomposites offer superior strength, are lightweight, and improve performance, driving demand. Additionally, the growing emphasis on fuel efficiency and emission reduction in vehicles further boosts the adoption of polyamide nanocomposites, ensuring their leading market share in the coming years.

Learn more about the key segments shaping this market

The nanoclays segment was worth USD 4.8 billion in 2023 and is expected to grow at a rate of 18.3% each year from 2024 to 2032, because they are affordable, easy to work with, and greatly improve the strength and protective qualities of plastics. Widely used in the packaging, automotive, and construction industries, nanoclays improve the durability, thermal stability, and flame resistance of materials. Their environmental advantages, like being recyclable and using less material, are increasing demand and helping nanoclays stay a leading choice in the polymer nanocomposites market.

Are you in search of data specific to a specific region?

North America achieved USD 4.3 million in 2023 and will expand at an 18% CAGR from 2024 to 2032, driven by significant investments in research and development, advanced manufacturing capabilities, and strong demand from the automotive, aerospace, and packaging industries. The region's well-established infrastructure, coupled with stringent environmental regulations, drives the adoption of high-performance materials. Additionally, the presence of key market players and collaborations between industry and academia foster innovation. The robust growth in these sectors will position North America as a major contributor to the polymer nanocomposites industry.

Download Free Sample Ask for Discount Request Customization

Polymer Nanocomposites Market Share

RTP Company, Unitika Ltd., Evonik Industries, Mineral Technologies, Inc., Hybrid Plastics, Inc., Thermo Fisher Scientific, 3M, Asahi Kasei, and Nanophase are expanding their market presence in polymer nanocomposites through robust research and development initiatives. They focus on creating innovative formulations that enhance material performance and meet evolving industry demands. By leveraging their expertise and resources, these companies develop tailored solutions for diverse applications across the automotive, aerospace, electronics, and packaging sectors, strengthening their foothold in the market.

Moreover, strategic partnerships, collaborative ventures, and acquisitions serve as integral components in the market expansion endeavors of these firms. Through alliances with research institutions, industry pioneers, and technology suppliers, they acquire access to state-of-the-art technologies and invaluable market intelligence. These partnerships help create new nanocomposite products, speed up how quickly they can launch these products, and allow them to enter new markets, which strengthens their competitive edge in the polymer nanocomposites industry.

Market Outlook

Researchers project the polymer nanocomposites market to grow at a compound annual growth rate (CAGR) of 18-22% through 2030.

-

Replacement of traditional materials in transportation

-

Electronics miniaturization trends

-

Sustainable material development

-

Healthcare sector innovations

Key Challenges

-

High production costs of quality-controlled nanocomposites

-

Complex processing requirements

-

Long-term durability data requirements

Polymer Nanocomposites Market Companies

Prominent players operating in the polymer nanocomposites industry include

- 3M

- Arkema

- Asahi Kasei

- BYK-Chemie

- Evonik Industries

- Hybrid Plastics, Inc.

- Mineral Technology, Inc.

- Nanophase Technologies Corporation

- Nanoshell

- RTP Company

- Thermo Fisher Scientific

- Unitika Ltd

Polymer Nanocomposites Industry News

In April 2024, NYCOA unveiled NXTamid L, a plasticizer-free long-chain polyamide, positioned as a sustainable alternative to PA11 and PA12. This innovation underscores NYCOA's commitment to eco-friendly materials.

In January 2022, Solvay launched Omnix, a new high-quality polyamide material for home appliances, which is made with at least 33% recycled content, including 70% recycled resin, while ensuring that the production process is reliable and secure.

The polymer nanocomposites market research report includes in-depth coverage of the industry, with estimates and forecasts in terms of revenue and volume (USD Million) (Tons) from 2024 to 2032 for the following segments

Click here to Buy Section of this Report

Market, By Polymer

- Polyamide

- Polypropylene

- Epoxy resin

- Polyethylene

- Others

Market, By Nanomaterials

- Nanoclays

- Nano-oxides

- Nanofiber

- Carbon nanotubes

- Others

By End User Industry

- Automotive & aerospace

- Electricals & Electronics

- Packaging

- Biomedical

- Paints & Coatings

- Others

The above information is provided for the following regions and countries

- North America

- U.S.

- Canada

- Europe

- Germany

- Spain

- UK

- Italy

- France

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

- MEA

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Related Reports

- Glycerol Market Size - By Product Type (Crude, Refined), By Source (Biodiesel, Fatty Acids, Fatty Alcohols, Soap Industr...

- Flat Glass Market - By Product (Basic Float, Laminated, Insulating, Tempered), By Application (Automotive [OEM, Aftermar...

- Electrical Steel Market - By Product (Grain Oriented, Non-Grain-Oriented), By Application (Large Power Transformers, Dis...

- Lithium Cobalt Oxide Market - By Grade (Industrial, Battery), Application (Consumer electronic, Electric vehicle, Medica...

- Conductive Polymers Market – By Conduction Mechanism (Composites Inherently Conductive Polymers, Conducting Polymer), ...

- Dimethyl Terephthalate Market - By Form (Solid, Liquid), Grade (Technical, Reagent, Pure, Synthesis), Application, End u...

Table of Content

Table of Content

Report Content

Chapter 1 Methodology & Scope

1.1 Market scope & definition

1.2 Base estimates & calculations

1.3 Forecast calculation

1.4 Data sources

1.4.1 Primary

1.4.2 Secondary

1.4.2.1 Paid sources

1.4.2.2 Public sources

Chapter 2 Executive Summary

2.1 Industry 360-degree synopsis

Chapter 3 Industry Insights

3.1 Industry ecosystem analysis

3.1.1 Key manufacturers

3.1.2 Distributors

3.1.3 Profit margins across the industry

3.2 Industry impact forces

3.2.1 Growth drivers

3.2.1.1 Rising product demand in end-use industry

3.2.1.2 Increasing R&D activities related to nanotechnology across the world

3.2.1.3 Superior product characteristics compared to synthetic polymers

3.2.2 Market challenges

3.2.2.1 High price of the product

3.2.2.2 Stringent government regulations related to nanomaterials Market opportunity

3.2.3 Market opportunities

3.2.3.1 New opportunities

3.2.3.2 Growth potential analysis

3.3 Raw material landscape

3.3.1 Manufacturing trends

3.3.2 Technology evolution

3.3.2.1 Sustainable manufacturing

3.3.2.1.1 Green practices

3.3.2.1.2 Decarbonization

3.3.3 Sustainability in raw materials

3.3.4 Pricing trends (USD/Ton)

3.3.4.1 North America

3.3.4.2 Europe

3.3.4.3 Asia Pacific

3.3.4.4 Latin America

3.3.4.5 Middle East & Africa

3.4 Regulations & market impact

3.5 Porter’s analysis

3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

4.1 Company market share analysis

4.2 Competitive positioning matrix

4.3 Strategic outlook matrix

Chapter 5: Market Size and Forecast, By Polymer, 2021-2032 (USD Million, Kilo Tons)

5.1 Key trends

5.2 Epoxy resin

5.3 Polyamide

5.4 Polyethylene

5.5 Polypropylene

5.6 Others

Chapter 6: Market Size and Forecast, By Nanomaterials, 2021-2032 (USD Million, Kilo Tons)

6.1 Key trends

6.2 Nanoclays

6.3 Carbon nanotubes

6.4 Nanofiber

6.5 Nano-oxides

6.6 Others

Chapter 7: Market Size and Forecast, By End User Industry, 2021-2032 (USD Million, Kilo Tons)

7.1 Key trends

7.2 Automotive & aerospace

7.3 Electricals & Electronics

7.4 Packaging

7.5 Biomedical

7.6 Paints & Coatings

7.7 Others

Chapter 8: Market Size and Forecast, By Region, 2021-2032 (USD Million, Kilo Tons)

8.1 Key trends

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.3 Europe

8.3.1 Germany

8.3.2 UK

8.3.3 France

8.3.4 Italy

8.3.5 Spain

8.3.6 Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.2 India

8.4.3 Japan

8.4.4 South Korea

8.4.5 Australia

8.4.6 Rest of Asia Pacific

8.5 Latin America

8.5.1 Brazil

8.5.2 Mexico

8.5.3 Argentina

8.5.4 Rest of Latin America

8.6 MEA

8.6.1 Saudi Arabia

8.6.2 UAE

8.6.3 South Africa

8.6.4 Rest of MEA

Chapter 9 Company Profiles

9.1 Arkema

9.2 RTP Company

9.3 Unitika Ltd

9.4 Evonik Industries

9.5 Mineral Technology, Inc.

9.6 Hybrid Plastics, Inc.

9.7 Thermo Fisher Scientific

9.8.3 M

9.9 Asahi Kasei

9.10 Nanophase Technologies Corporation

9.11 Nanoshel

9.12 BYK-Chemie

- 3M

- Arkema

- Asahi Kasei

- BYK-Chemie

- Evonik Industries

- Hybrid Plastics, Inc.

- Mineral Technology, Inc.

- Nanophase Technologies Corporation

- Nanoshell

- RTP Company

- Thermo Fisher Scientific

- Unitika Ltd

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy