Circular Polymer Market Size

Circular Polymer Market - By Polymer (Polyethylene Terephthalate (PET), Polyethylene, Polypropylene, Polyvinyl Chloride (PVC)) and Application (Packaging, Building & Construction, Automotive, Electrical & Electronics, Agriculture) & Forecast, 2024 - 2032

Published Date: May - 2025 | Publisher: MRA | No of Pages: 240 | Industry: Chemical | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request CustomizationCircular Polymer Market Size

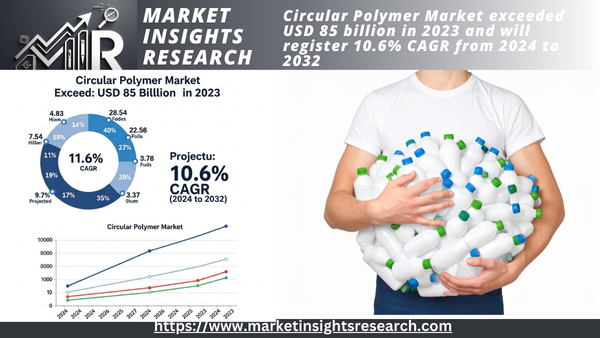

The market for circular polymers surpassed USD 85 billion in 2023 and is expected to grow at a 10.6% CAGR from 2024 to 2032 as a result of growing emphasis on resource efficiency and waste management.

Download Free Sample

Industries are placing a greater emphasis on waste reduction and resource utilization tactics as a result of growing concerns about environmental sustainability and the availability of finite resources. The shift to effective resource management across several industries, including consumer goods, packaging, and manufacturing, is driving the need for round polymers.

| Report Attribute | Details |

|---|---|

| Base Year | 2023 |

| Circular Polymer Market Size in 2023 | USD 85.1 Billion |

| Forecast Period | 2024 - 2032 |

| Forecast Period 2024 - 2032 CAGR | 10.6% |

| 2032 Value Projection | USD 211 Billion |

| Historical Data for | 2021–2023 |

| No. of Pages | 260 |

| Tables, Charts & Figures | 175 |

| Segments covered | Polymer, Application |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What prospects for expansion exist in this market?

For instance, Exxon Mobil Chemical's Baytown, Texas facility, which has been in operation since December 2022, processes 80 million pounds of plastic trash yearly, supporting a circular economy, according to the company's website. By 2027, we want to increase our advanced recycling capability worldwide to over a billion pounds annually.

The market for circular polymer packaged items has increased as a result of growing consumer awareness of sustainability, which has had a substantial impact on purchasing behavior. Customers are actively searching for eco-friendly substitutes since they are aware of the negative effects plastic waste has on the environment. Manufacturers are using circular polymers in packaging solutions in response to shifting consumer preferences and the increasing need for long-lasting products. Companies that emphasize environmental sustainability and use circular polymers in their packaging are becoming more well-liked by consumers who care about the environment, which is driving market expansion.

For instance, in its polypropylene facility in La Porte, Texas, Total Energies converted plastic waste materials into circular polymers for the first time in October 2023. One of the biggest polypropylene facilities in the world, it creates certified sustainable polymers for a range of uses, including food packaging.

However, concerns regarding the performance and purity of recycled polymers are impeding the market. Variations in recycled polymers' material characteristics and processing techniques can result in irregularities that don't always satisfy the exacting specifications of the final application. This restriction prevents the widespread use of ring polymers in various product categories and industries where performance requirements are critical.

Circular Polymer Market Trends

The circular economy, which prioritizes reuse, recycling, and regeneration of materials, is gaining popularity worldwide. Industries are adopting circular business models to reduce waste and increase resource efficiency. Circular polymers enable closed-loop plastic recycling, eliminating the need for new materials and minimizing environmental effects.

For example, in May 2024, Dow and Free Point Eco-Systems Supply and Trading LLC committed to producing roughly 65,000 tons of certified circular plastic waste pyrolysis oil per year. Dow uses it in its US Gulf Coast factories to produce new, high-quality, comparable polymers.

Circular Polymer Market Analysis

Download Free Sample

Learn more about the important segments that shape this industry.

PET's versatility and recyclability make it a popular choice for various applications, resulting in an 11.3% CAGR from 2024 to 2032. Recycled PET (r-PET) is now widely employed in the creation of new bottles, packaging materials, textiles, and automobile parts. The focus on sustainability further fuels the high demand for PET, which is known for its light, robust, and clear qualities. PET recycling technology innovations, such as chemical recycling, improve r-PET's quality and purity, making it ideal for high-performance applications.

Learn more about the important segments that shape this industry.

The packaging segment is expected to grow at an 11.5% CAGR from 2024 to 2032, driven by the urgent need to manage plastic waste and increase sustainability. Circular polymers are employed in packaging solutions because they have a low environmental impact while remaining functional and efficient. The transition to sustainable packaging is visible in various industries, including food and beverage, consumer goods, and pharmaceuticals. Brands are exploring eco-friendly packaging choices to suit consumer demand and regulatory restrictions. Circular polymers, particularly r-PET and other recycled materials, provide a viable alternative by producing high-quality, long-lasting, and recyclable packaging.

Are you in search of information specific to a particular region?

Asia Pacific generated roughly US$59 billion in 2023 and will expand at an 11% CAGR from 2024 to 2032, supported by strong government programs promoting sustainability and recycling. Major countries like China, Japan, and India are making significant investments in advanced recycling technology and the circular economy. Rapid industrialization, urbanization, and consumer environmental awareness are driving up demand for recycled polymers. Furthermore, collaboration between large corporations and municipalities to produce environmentally friendly products and effective waste management systems promotes market growth.

Circular Polymer Market Share

Players in the industry are concentrating on creating biodegradable materials, improving recycling technology, and establishing strategic alliances. They make investments in cutting-edge methods to turn garbage into recyclable polymers, encourage sustainable production, and work with partners along the value chain to advance the circular economy and lessen its negative effects on the environment.

Additionally, many companies are integrating bio-based polymers and renewable raw materials into their product offerings. To lessen the carbon impact, they place a strong emphasis on ecological design and life cycle. To ensure compliance, encourage the adoption of circular economy ideas in the polymer business, and promote sustainable practices, these leaders also support international efforts and regulatory frameworks.

Circular Polymer Market Companies

Major players operating in the circular polymer industry include

- Dow Chemical Company

- BASF SE

- LyondellBasell Industries

- SABIC

- Borealis AG

- Covestro AG

- Eastman Chemical Company

- Ineos Group

- Braskem

- ExxonMobil Chemical

Circular Polymer Industry News

- In March 2024, Dow and P&G joined forces in a development agreement to pioneer a new recycling technology. Their goal is to transform hard-to-recycle plastic packaging into high-quality recycled polyethylene with minimal greenhouse gas emissions. Leveraging their patented technologies and expertise, they aim to develop an innovative dissolution process.

The circular polymer market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue and volume (USD Million) (kilotons) from 2018 to 2032, for the following segments

Click here to Buy Section of this Report

By Polymer

- Polyethylene terephthalate (PET)

- Polyethylene

- Polypropylene

- Polyvinyl Chloride (PVC)

- Others

By Application

- Packaging

- Building & Construction

- Automotive

- Electrical & Electronics

- Agriculture

- Others

The above information is provided on a regional and country basis for the following

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Poland

- Belgium

- Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Indonesia

- Malaysia

- Latin America (LATAM)

- Mexico

- Brazil

- Middle East & Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

Related Reports

- Hybrid Polymer Market Size - By Product (Coating, Sealant & Adhesive, Concrete Additive, Electrode Material, Cleaning So...

- Fluorosurfactants Market - By type (Anionic, Non-Anionic, Cationic, Amphoteric), By Application (Adhesives & Sealants, P...

- Aromatic Solvents Market - By Product (Benzene, Toluene, Xylene), By Application (Pharmaceuticals, Oilfield Chemicals, A...

- Ammonium Nitrate Market - By Product (High Density, Low Density, Solution), By End-user (Agriculture, Mining & Quarrying...

- Glycerol Market Size - By Product Type (Crude, Refined), By Source (Biodiesel, Fatty Acids, Fatty Alcohols, Soap Industr...

- Flat Glass Market - By Product (Basic Float, Laminated, Insulating, Tempered), By Application (Automotive [OEM, Aftermar...

Table of Content

Table of Content

Report Content

Chapter 1 Methodology & Scope

1.1 Market scope & definition

1.2 Base estimates & calculations

1.3 Forecast calculation

1.4 Data sources

1.4.1 Primary

1.4.2 Data Mining sources

1.4.2.1 Paid sources

1.4.2.2 Public sources

Chapter 2 Executive Summary

2.1 Market 360º synopsis, 2021-2032

2.2 Business trends

2.3 Regional trends

2.4 Polymer trends

2.5 Application trends

2.6 Regional trends

Chapter 3 Market Industry Insights

3.1 Industry ecosystem analysis

3.1.1 Key manufacturers

3.1.2 Distributors

3.1.3 Profit margins across the industry

3.2 Industry impact forces

3.2.1 Growth drivers

3.2.1.1 Rising awareness among various industries to use recycled materials to reduce their carbon footprints

3.2.1.2 Increasing adoption of recyclable materials in the packaging industry is driving the market

3.2.1.3 Favorable initiatives to promote recycled plastics

3.2.2 Market challenges

3.2.2.1 Inclination toward the use of virgin plastics over recycled polymers

3.2.3 Market opportunity

3.2.3.1 New opportunities

3.2.3.2 Growth potential analysis

3.3 Raw material landscape

3.3.1 Manufacturing trends

3.3.2 Technology evolution

3.3.2.1 Sustainable manufacturing

3.3.2.1.1 Green practices

3.3.2.1.2 Decarbonization

3.3.3 Sustainability in raw materials

3.3.4 Pricing trends (USD/Ton)

3.3.4.1 North America

3.3.4.2 Europe

3.3.4.3 Asia Pacific

3.3.4.4 Latin America

3.3.4.5 Middle East & Africa

3.4 Regulations & market impact

3.5 Porter’s analysis

3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

4.1 Introduction

4.2 Company market share, 2023

4.2.1 Company market share, by region, 2023

4.2.1.1 North America

4.2.1.2 Europe

4.2.1.3 Asia Pacific

4.2.1.4 Latin America

4.2.1.5 Middle East & Africa

4.3 Competitive analysis of major market players

4.4 Competitive positioning matrix

4.5 Strategic outlook matrix

Chapter 5: Market Estimates & Forecast, By Polymer, 2021-2032 (USD Million) (Tons)

5.1 Key Trends

5.2 PET

5.3 Polyethylene

5.4 Polypropylene

5.5 PVC

5.6 Others

Chapter 6: Market Estimates & Forecast, By Application, 2021 - 2032 (USD Million) (Tons)

6.1 Key Trends

6.2 Packaging

6.3 Building & Construction

6.4 Automotive

6.5 Electrical & Electronics

6.6 Agriculture

6.7 Others

Chapter 7: Market Estimates & Forecast, By Region, 2021-2032 (USD Million) (Tons)

7.1 Key trends, by region

7.2 North America

7.2.1 U.S.

7.2.2 Canada

7.3 Europe

7.3.1 Germany

7.3.2 UK

7.3.3 France

7.3.4 Spain

7.3.5 Italy

7.3.6 Russia

7.4 Asia Pacific

7.4.1 China

7.4.2 India

7.4.3 Japan

7.4.4 South Korea

7.4.5 Indonesia

7.4.6 Australia

7.4.7 Malaysia

7.5 Latin America

7.5.1 Brazil

7.5.2 Mexico

7.5.3 Argentina

7.6 MEA

7.6.1 South Africa

7.6.2 Saudi Arabia

7.6.3 UAE

Chapter 8: Company Profiles

8.1 Total Energies

8.2 Circular Polymers

8.3 Quality Circular Polymers

8.4 KW Plastics

8.5 Advanced Circular Polymers

8.6 Borealis

8.7 Veolia

8.8 ExxonMobil

8.9 SABIC

8.10 PlastiCycle Corp

8.11 Dow

8.12 The Shakti Plastic Industries

8.13 ALBA Group

8.14 BASF SE

8.15 Banyan

- Dow Chemical Company

- BASF SE

- LyondellBasell Industries

- SABIC

- Borealis AG

- Covestro AG

- Eastman Chemical Company

- Ineos Group

- Braskem

- ExxonMobil Chemical

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy