Electrical Insulation Tape Market Size, Share & Trends Analysis Report By Product (PVC Tapes, Rubber Tapes, Polyester Tapes), By End Use (Electrical & Electronics, Automotive, Aerospace, Construction, Telecommunication), By Region, And Segment Forecasts

Electrical Insulation Tape Market Size, Share & Trends Analysis Report By Product (PVC Tapes, Rubber Tapes, Polyester Tapes), By End Use (Electrical & Electronics, Automotive, Aerospace, Construction, Telecommunication), By Region, And Segment Forecasts

Published Date: April - 2025 | Publisher: MIR | No of Pages: 220 | Industry: advance materials | Format: Report available in PDF / Excel Format

View Details Buy Now 2999 Download Free Sample Ask for Discount Request CustomizationElectrical Insulation Tape Market Trends

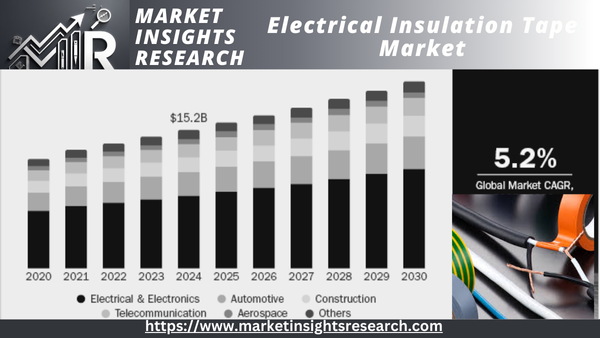

The size of the global electrical insulation tape market was valued at USD 15.23 billion in 2024 and is expected to grow at a CAGR of 5.2% during the period 2025-2030. The worldwide pressure for infrastructure growth, especially in developing economies, is one of the key drivers for the market growth. As nations invest in the development of their power networks, building new structures, and upgrading transport, the need for efficient electrical insulation solutions grows. Electrical insulation tapes play a pivotal role in achieving the safety and efficiency of the electrical installations for these projects.

The growth of the automotive industry, particularly the growing use of electric vehicles (EVs), contributes heavily to the electrical insulation tape market. EVs need sophisticated electrical systems and components, which require high-quality insulation products to provide safety and performance. Electrical insulation tapes find extensive application in EVs for wire harnessing, battery insulation, and building. Global motor vehicle production, including EVs, keeps growing, further driving the demand for electrical insulation tapes.

The expansion of electronic equipment and the miniaturization of parts have led to a greater demand for efficient insulation solutions. Electrical insulation tapes are important in shielding sensitive electronic parts from electrical interference and maintaining device reliability. The expansion of the aerospace industry, along with the advancement of innovative technologies such as 5G and IoT, is calling for high-performance insulation products.

Report Coverage & Deliverables

PDF report & online dashboard will help you understand

- Competitive benchmarking

- Historical data & forecasts

- Company revenue shares

- Regional opportunities

- Latest trends & dynamics

Market Concentration & Characteristics

The market for electrical insulation tapes shows a relatively concentrated pattern, with some key players like 3M, Nitto Denko, and Tesa SE controlling large market shares worldwide. The level of innovation in the market is consistent, as there are constant improvements in adhesive technologies, thermal resistance, and flame retardance. There is growing production of green and halogen-free insulation tapes by manufacturers due to high demand for green products. Product differentiation is mainly influenced by performance characteristics like dielectric strength, temperature resistance, and compatibility with different wire products.

Regulatory effects significantly influence market dynamics, particularly in countries with high green building regulations and environmental certification schemes. Policies supporting sustainable building and carbon emissions reduction are indirectly driving the uptake of electrical insulation tapes. Alternatives like lime and gypsum plasters offer competition, especially in urban markets where convenience and quicker drying are in demand. These alternatives, though, do not usually have the environmental advantages of earthen products, which have a strong presence in the natural building market. Concentration on the end user is mixed, with both residential homebuilders and commercial green building developers interested, but residential uptake, particularly by environmentally conscious consumers, overwhelms the market.

End Use Insights

The electrical & electronics segment dominated the market with the largest revenue share of 52.6% in 2024, driven by rapid advancements in technology and the increasing complexity of electrical systems across various industries. As electronic devices become more compact and powerful, the demand for high-performance insulation materials has surged. Electrical insulation tapes are crucial in ensuring safety, preventing short circuits, and maintaining the efficiency of circuits and components.

The automotive segment is expected to grow at the fastest CAGR of 5.8% over the forecast period, driven by the rising adoption of electric and hybrid vehicles, increasing vehicle electrification, and the growing complexity of automotive electrical systems. As modern vehicles incorporate a higher number of electronic components for functions such as infotainment, safety, navigation, and powertrain control, the demand for reliable insulation materials has surged. Electrical insulation tapes are used extensively for wire harnessing, cable wrapping, and component shielding to ensure optimal performance, safety, and longevity of the vehicle’s electrical systems.

Product Insights

The PVC tapes segment led the market with the largest revenue share of 60.9% in 2024, driven by their excellent electrical insulating properties, flexibility, and durability. These tapes are widely used across residential, commercial, and industrial applications due to their ability to withstand high voltage, resist moisture and abrasion, and maintain adhesion over a wide temperature range. In addition, the growing automotive and aerospace industries are major contributors to the rising consumption of PVC tapes. Their flame-retardant and self-extinguishing properties make them ideal for ensuring safety in electrical circuits and automotive wiring systems. Technological advancements in manufacturing have further enhanced the performance of PVC tapes, such as the development of lead-free and low-VOC variants that align with environmental regulations.

The rubber tapes segment is expected to grow at the fastest CAGR of 5.7% over the forecast period, driven by their enhanced performance in moisture- and weather-exposed environments. These tapes are commonly used in outdoor electrical installations, underground cabling, and harsh industrial settings where resistance to water, UV rays, and ozone is critical. Moreover, the increasing focus on renewable energy infrastructure and smart grid development globally is fueling demand for high-performance materials like rubber tapes, which ensure long-lasting insulation and system reliability.

Regional Insights

The North America electrical insulation tape industry is primarily driven by the region’s established electrical infrastructure and high safety standards. Technological advancements and a strong focus on energy efficiency are pushing demand for premium insulation products in utilities, construction, and industrial automation. The growth of the electric vehicle market, particularly in the U.S. and Canada, is also contributing to rising consumption of heat- and chemical-resistant tapes for battery assemblies and wiring harnesses. Furthermore, a surge in home renovation and smart home projects is increasing the use of electrical insulation products in residential settings. Innovation in flame-retardant and environmentally friendly tapes is encouraged by strict regulatory oversight from agencies like OSHA and the EPA.

U.S. Electrical Insulation Tape Market Trends

The market for electrical insulation tape in the U.S. is driven by a mix of regulatory compliance, infrastructure modernization, and rapid adoption of green energy solutions. Upgrades to the national grid and transmission lines, along with robust investments in electric vehicles and charging stations, are expanding the demand for advanced insulation products. The construction industry's continued growth, coupled with energy-efficient retrofitting of buildings, drives the use of insulation tapes in both commercial and residential sectors. High standards set by ANSI, UL, and NFPA encourage the use of certified, high-performance insulation tapes. In addition, the industrial automation and data center sectors are key consumers due to their need for precise, durable wiring systems.

Asia Pacific Electrical Insulation Tape Market Trends

Asia Pacific electrical insulation tape industry dominated the market with the largest revenue share of about 42.2% in 2024, driven by rapid industrialization and the growing demand for electricity across developing economies such as India, Indonesia, and Vietnam. Rising infrastructure development, particularly in smart grids and renewable energy, contributes to the surge in demand for reliable electrical insulation products. The region is also experiencing significant expansion in the automotive and electronics manufacturing sectors, where insulation tapes are essential for wire harnessing and circuit protection. Government initiatives to enhance energy efficiency and safety standards are pushing the adoption of high-performance insulation products.

China electrical insulation tape industry is driven by its massive manufacturing sector, particularly in electronics, consumer appliances, and electric vehicles (EVs). The country’s focus on advancing its renewable energy capacity, especially solar and wind, has significantly increased the demand for electrical components requiring reliable insulation. Strong government support for the development of EV infrastructure and smart city projects further accelerates market growth. Domestic demand is also spurred by continuous upgrades in transmission and distribution networks. Moreover, China is a leading producer and exporter of electrical insulation tapes, supported by robust supply chains and large-scale production capabilities.

Europe Electrical Insulation Tape Market Trends

Europe electrical insulation tape industry is driven by the region’s strong emphasis on sustainability, energy efficiency, and stringent regulatory frameworks. The EU’s policies toward carbon neutrality and smart infrastructure are encouraging the use of advanced insulation products in power systems and renewable energy installations. Growth in the automotive industry, particularly electric and hybrid vehicles, is significantly influencing demand for high-performance electrical insulation. The presence of well-established automotive and electronics manufacturers in countries like Germany and France fosters steady demand. Europe also sees increased end use of insulation tapes in wind energy and offshore platforms, necessitating highly durable and weather-resistant products.

Germany electrical insulation tape industry is driven by strong regulatory frameworks and environmental compliance, such as those outlined by the DIN and RoHS standards, that prompt innovation in sustainable and halogen-free tape solutions. Ongoing R&D by both multinational and local companies is enhancing the market’s technological edge. Germany’s export-oriented economy supports the production of high-quality insulation tapes for international markets. This combination of engineering excellence and environmental focus positions Germany as a key driver within the European market.

Latin America Electrical Insulation Tape Market Trends

The Latin America electrical insulation tape industry is influenced by increasing electrification and infrastructure development across emerging economies such as South Korea, Argentina, and Chile. Urban expansion and rural electrification programs are promoting the use of electrical insulation products in both public and private sector projects. The growth of industrial sectors such as mining, oil & gas, and manufacturing also supports the demand for durable and cost-effective insulation tapes. Regulatory improvements and increased awareness of electrical safety are gradually driving the adoption of higher-quality products in the region.

Middle East & Africa Electrical Insulation Tape Market Trends

The Middle East & Africa (MEA) electrical insulation tape industry is driven by rapid urbanization, expansion of utility grids, and rising investments in infrastructure and construction. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing major developments in commercial buildings, industrial zones, and residential housing, all requiring reliable electrical insulation solutions. The increasing penetration of renewable energy projects, such as solar power plants in desert regions, is fueling the need for heat- and UV-resistant insulation tapes. In the oil & gas sector, electrical insulation products are essential for safety in harsh operational environments. MEA also benefits from the growing deployment of smart city initiatives and digital infrastructure, leading to more complex and safety-conscious electrical systems.

Key Electrical Insulation Tape Company Insights

Some of the major players in the market are tesa SE and Saint-Gobain.

tesa SE is a leading worldwide producer of adhesive solutions renowned for high-end electrical insulation tapes applied in automobile, electronics, and industrial fields. It presents a variety of products that incorporate PVC insulation tapes, cloth-based electrical tapes, and temperature-resistant solutions used in safe wire bundling, splicing, and insulation. The tapes produced by Tesa are appreciated due to their longevity, fire retardation, and hard adhesion to different conditions in the environment.

Saint-Gobain is a French multinational that produces a variety of products, including advanced products and adhesives, which include electrical insulation tapes. The company, through its Performance Plastics business, produces high-performance insulation tapes based on products like PTFE, glass cloth, and silicone that have broad electrical, aerospace, and industrial end use applications. The tapes provide superior thermal resistance, dielectric strength, and reliability under harsh conditions.

Nitto Denko Corporation and Avery Dennison Corporation are two of the new market entrants in the electrical insulation tape industry.

Nitto Denko Corporation is one of the largest Japanese producers of functional Products, such as a wide variety of electrical insulation tapes. Its product line consists of PVC, polyester, polyimide, and rubber-based tapes for wire harnessing, protection of circuit boards, and thermal management. Nitto's tapes are designed to resist high voltage, temperature, and extreme conditions, thus well suited for automotive, electronics, and energy industries.

Avery Dennison Corporation is a U.S.-based global leader in product science and manufacturing, having a significant presence in pressure-sensitive adhesive products such as electrical insulation tapes. Avery Dennison provides solutions in a spectrum of tapes applied in electrical protection, cable management, and shielding End Uses, particularly automotive and Aerospace. Products by Avery Dennison are engineered for high-temperature application, chemical resistance, and long-term reliability.

Key Electrical Insulation Tape Companies

The following are the leading companies in the global electrical insulation tape market. These companies collectively hold the largest market share and dictate industry trends.

- tesa SE

- Saint-Gobain

- Nitto Denko Corporation

- Avery Dennison Corporation

- 3M

- IPG

- HellermannTyton

- TERAOKA SEISAKUSHO CO., LTD.

- Shurtape Technologies, LLC

- Pidilite Industries Ltd.

Recent Developments

-

In December 2022, Shurtape Technologies, LLC announced its acquisition of Pro Tapes & Specialties, Inc., a tape manufacturer catering to various sectors such as graphic arts, precision die-cutting and fabricating, library and school supplies, retail, general industrial end uses, and custom converting services. This strategic acquisition is expected to strengthen Shurtape’s ability to offer a wider selection of products and improved service capabilities, allowing the company to better address the changing needs of its customers.

Electrical Insulation Tape Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 16.02 billion |

|

Revenue forecast in 2030 |

USD 20.64 billion |

|

Growth rate |

CAGR of 5.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea |

|

Key companies profiled |

tesa SE; Saint-Gobain; Nitto Denko Corporation; Avery Dennison Corporation; 3M; IPG; HellermannTyton; TERAOKA SEISAKUSHO CO., LTD.; Shurtape Technologies, LLC; Pidilite Industries Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Electrical Insulation Tape Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electrical insulation tape market report based on product, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2035)

-

PVC Tapes

-

Rubber Tapes

-

Polyester Tapes

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2035)

-

Electrical & Electronics

-

Automotive

-

Aerospace

-

Construction

-

Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2035)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Related Reports

- Iron Powder Market - By Type (Reduced iron powder, Atomised iron powder, Electrolytic iron powder), By Purity (High puri...

- Thermal Transfer Ribbon Market – By Printing Head Type (Flat Type, Near Head), By Product (Wax Resin Ribbon, Wax Ribbo...

- Iron & Steel Casting Market - By Material (Iron, Steel), By Process (Sand Casting, Die Casting), By Application (Automot...

- Sodium Carbonate Market - By Type (Natural, Synthetic), By End-Use (Flat Glass, Container Glass, Other Glass, Soaps & De...

- Hybrid Polymer Market Size - By Product (Coating, Sealant & Adhesive, Concrete Additive, Electrode Material, Cleaning So...

- Fluorosurfactants Market - By type (Anionic, Non-Anionic, Cationic, Amphoteric), By Application (Adhesives & Sealants, P...

Table of Content

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumption

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook, 2024 (USD Million)

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Electrical Insulation Tape Market Variables, Trends & Scope

3.1. Market Lineage/Ancillary Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Sales Channel Analysis

3.3. Regulatory Framework

3.3.1. Analyst Perspective

3.3.2. Regulations & Standards

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Opportunities

3.4.4. Industry Challenges

3.5. Business Environmental Tools Analysis: Electrical Insulation Tape Market

3.5.1. Porter’s Five Forces Analysis

3.5.1.1. Bargaining Power of Suppliers

3.5.1.2. Bargaining Power of Buyers

3.5.1.3. Threat of Substitution

3.5.1.4. Threat of New Entrants

3.5.1.5. Competitive Rivalry

3.5.2. PESTLE Analysis

3.5.2.1. Political Landscape

3.5.2.2. Economic Landscape

3.5.2.3. Social Landscape

3.5.2.4. Technology Landscape

3.5.2.5. Environmental Landscape

3.5.2.6. Legal Landscape

3.6. Market Disruption Analysis

Chapter 4. Electrical Insulation Tape Market: Product Estimates & Trend Analysis

4.1. Key Takeaways

4.2. Product Movement Analysis & Market Share, 2024 & 2030

4.3. Global Electrical Insulation Tape Market, By Product, 2018 - 2030 (USD Million)

4.4. PVC Tapes

4.4.1. Electrical Insulation Tape Market Estimates And Forecasts, by PVC Tapes 2018 - 2030 (USD Million)

4.5. Rubber Tapes

4.5.1. Electrical Insulation Tape Market Estimates And Forecasts, by Rubber Tapes, 2018 - 2030 (USD Million)

4.6. Polyester Tapes

4.6.1. Electrical Insulation Tape Market Estimates And Forecasts, by Polyester Tapes 2018 - 2030 (USD Million)

4.7. Others

4.7.1. Electrical Insulation Tape Market Estimates And Forecasts, by Others, 2018 - 2030 (USD Million)

Chapter 5. Electrical Insulation Tape Market: End Use Estimates & Trend Analysis

5.1. Key Takeaways

5.2. End Use Movement Analysis & Market Share, 2024 & 2030

5.3. Global Electrical Insulation Tape Market, By End Use, 2018 - 2030 (USD Million)

5.4. Electrical & Electronics

5.4.1. Electrical Insulation Tape Market Estimates And Forecasts, by Electrical & Electronics, 2018 - 2030 (USD Million)

5.5. Automotive

5.5.1. Electrical Insulation Tape Market Estimates And Forecasts, by Automotive, 2018 - 2030 (USD Million)

5.6. Aerospace

5.6.1. Electrical Insulation Tape Market Estimates And Forecasts, by Aerospace, 2018 - 2030 (USD Million)

5.7. Construction

5.7.1. Electrical Insulation Tape Market Estimates And Forecasts, by Construction, 2018 - 2030 (USD Million)

5.8. Telecommunication

5.8.1. Electrical Insulation Tape Market Estimates And Forecasts, by Telecommunication, 2018 - 2030 (USD Million)

5.9. Others

5.9.1. Electrical Insulation Tape Market Estimates And Forecasts, by Others, 2018 - 2030 (USD Million)

Chapter 6. Electrical Insulation Tape Market: Regional Estimates & Trend Analysis

6.1. Key Takeaways

6.2. Regional Market Share Analysis, 2024 & 2030

6.3. North America

6.3.1. North America Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.3.2. North America Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.3.3. North America Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.3.4. U.S.

6.3.4.1. U.S. Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.3.4.2. U.S. Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.3.4.3. U.S. Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.3.5. Canada

6.3.5.1. Canada Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.3.5.2. Canada Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.3.5.3. Canada Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.3.6. Mexico

6.3.6.1. Mexico Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.3.6.2. Mexico Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.3.6.3. Mexico Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.4. Europe

6.4.1. Europe Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.4.2. Europe Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.4.3. Europe Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.4.4. Germany

6.4.4.1. Germany Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.4.4.2. Germany Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.4.4.3. Germany Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.4.5. UK

6.4.5.1. UK Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.4.5.2. UK Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.4.5.3. UK Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.4.6. France

6.4.6.1. France Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.4.6.2. France Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.4.6.3. France Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.4.7. Italy

6.4.7.1. Italy Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.4.7.2. Italy Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.4.7.3. Italy Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.4.8. Spain

6.4.8.1. Spain Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.4.8.2. Spain Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.4.8.3. Spain Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.5. Asia Pacific

6.5.1. Asia Pacific Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.5.2. Asia Pacific Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.5.3. Asia Pacific Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.5.4. China

6.5.4.1. China Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.5.4.2. China Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.5.4.3. China Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.5.5. India

6.5.5.1. India Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.5.5.2. India Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.5.5.3. India Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.5.6. Japan

6.5.6.1. Japan Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.5.6.2. Japan Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.5.6.3. Japan Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.5.7. South Korea

6.5.7.1. South Korea Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.5.7.2. South Korea Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.5.7.3. South Korea Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.6. Central & South America

6.6.1. Central & South America Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.6.2. Central & South America Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.6.3. Central & South America Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

6.7. Middle East & Africa

6.7.1. Middle East & Africa Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.7.2. Middle East & Africa Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

6.7.3. Middle East & Africa Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Chapter 7. Supplier Intelligence

7.1.1. Kraljic Matrix

7.1.2. Engagement Model

7.1.3. Negotiation Strategies

7.1.4. Sourcing Best Practices

7.1.5. Vendor Selection Criteria

Chapter 8. Competitive Landscape

8.1. Key Players, their Recent Developments, and their Impact on Industry

8.2. Competition Categorization

8.3. Company Market Position Analysis

8.4. Company Heat Map Analysis

8.5. Strategy Mapping, 2024

8.6. Company Listing

8.6.1. tesa SE

8.6.1.1. Company Overview

8.6.1.2. Financial Performance

8.6.1.3. Product Benchmarking

8.6.1.4. Strategic Initiatives

8.6.2. Saint-Gobain

8.6.2.1. Company Overview

8.6.2.2. Financial Performance

8.6.2.3. Product Benchmarking

8.6.2.4. Strategic Initiatives

8.6.3. Nitto Denko Corporation

8.6.3.1. Company Overview

8.6.3.2. Financial Performance

8.6.3.3. Product Benchmarking

8.6.3.4. Strategic Initiatives

8.6.4. Avery Dennison Corporation

8.6.4.1. Company Overview

8.6.4.2. Financial Performance

8.6.4.3. Product Benchmarking

8.6.4.4. Strategic Initiatives

8.6.5. 3M

8.6.5.1. Company Overview

8.6.5.2. Financial Performance

8.6.5.3. Product Benchmarking

8.6.5.4. Strategic Initiatives

8.6.6. IPG

8.6.6.1. Company Overview

8.6.6.2. Financial Performance

8.6.6.3. Product Benchmarking

8.6.6.4. Strategic Initiatives

8.6.7. HellermannTyton

8.6.7.1. Company Overview

8.6.7.2. Financial Performance

8.6.7.3. Product Benchmarking

8.6.7.4. Strategic Initiatives

8.6.8. TERAOKA SEISAKUSHO CO., LTD.

8.6.8.1. Company Overview

8.6.8.2. Financial Performance

8.6.8.3. Product Benchmarking

8.6.8.4. Strategic Initiatives

8.6.9. Shurtape Technologies, LLC

8.6.9.1. Company Overview

8.6.9.2. Financial Performance

8.6.9.3. Product Benchmarking

8.6.9.4. Strategic Initiatives

8.6.10. Pidilite Industries Ltd.

8.6.10.1. Company Overview

8.6.10.2. Financial Performance

8.6.10.3. Product Benchmarking

8.6.10.4. Strategic Initiatives

List of Tables

Table 1 Electrical Insulation Tape Market Estimates And Forecasts, by PVC Tapes 2018 - 2030 (USD Million)

Table 2 Electrical Insulation Tape Market Estimates And Forecasts, by Rubber Tapes, 2018 - 2030 (USD Million)

Table 3 Electrical Insulation Tape Market Estimates And Forecasts, by Polyester Tapes 2018 - 2030 (USD Million)

Table 4 Electrical Insulation Tape Market Estimates And Forecasts, by Others, 2018 - 2030 (USD Million)

Table 5 Electrical Insulation Tape Market Estimates And Forecasts, by Electrical & Electronics, 2018 - 2030 (USD Million)

Table 6 Electrical Insulation Tape Market Estimates And Forecasts, by Automotive, 2018 - 2030 (USD Million)

Table 7 Electrical Insulation Tape Market Estimates And Forecasts, by Aerospace, 2018 - 2030 (USD Million)

Table 8 Electrical Insulation Tape Market Estimates And Forecasts, by Construction, 2018 - 2030 (USD Million)

Table 9 Electrical Insulation Tape Market Estimates And Forecasts, by Telecommunication, 2018 - 2030 (USD Million)

Table 10 Electrical Insulation Tape Market Estimates And Forecasts, by Others, 2018 - 2030 (USD Million)

Table 11 North America Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 12 North America Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 13 North America Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 14 U.S. Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 15 U.S. Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 16 U.S. Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 17 Canada Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 18 Canada Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 19 Canada Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 20 Mexico Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 21 Mexico Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 22 Mexico Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 23 Europe Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 24 Europe Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 25 Europe Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 26 Germany Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 27 Germany Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 28 Germany Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 29 UK Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 30 UK Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 31 UK Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 32 France Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 33 France Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 34 France Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 35 Italy Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 36 Italy Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 37 Italy Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 38 Spain Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 39 Spain Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 40 Spain Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 41 Asia Pacific Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 42 Asia Pacific Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 43 Asia Pacific Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 44 China Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 45 China Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 46 China Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 47 India Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 48 India Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 49 India Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 50 Japan Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 51 Japan Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 52 Japan Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 53 South Korea Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 54 South Korea Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 55 South Korea Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 56 Central & South America Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 57 Central & South America Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 58 Central & South America Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

Table 59 Middle East & Africa Electrical Insulation Tape Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Table 60 Middle East & Africa Electrical Insulation Tape Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 61 Middle East & Africa Electrical Insulation Tape Market Estimates And Forecasts, By End Use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Primary Research Process

Fig. 4 Market Research Approaches - Bottom-Up Approach

Fig. 5 Market Research Approaches - Top-Down Approach

Fig. 6 Market Research Approaches - Combined Approach

Fig. 7 Market Snapshot

Fig. 8 Segmental Outlook

Fig. 9 Competitive Outlook

Fig. 10 Electrical Insulation Tape Market - Value Chain Analysis

Fig. 11 Electrical Insulation Tape Market - Sales Channel Analysis

Fig. 12 Market Drivers Impact Analysis

Fig. 13 Market Restraint Impact Analysis

Fig. 14 Industry Analysis - PORTERS

Fig. 15 Industry Analysis - PESTEL by SWOT

Fig. 16 Product: Key Takeaways

Fig. 17 Product: Market Share, 2024 & 2030

Fig. 18 End Use: Key Takeaways

Fig. 19 End Use: Market Share, 2024 & 2030

Fig. 20 Region, 2024 & 2030 (USD Million)

Fig. 21 Regional Marketplace: Key Takeaways

Fig. 22 Kraljic Matrix

Fig. 23 Engagement Model

Fig. 24 Sourcing Best Practices

Fig. 25 Sourcing Best Practices

Fig. 26 Competition Categorization

Fig. 27 Company Market Positioning

Fig. 28 Strategy Mapping, 2024

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy