North America HVAC Services Market Size, Share & Trends Analysis Report By Service (Installation, Maintenance, Repair & Replacement), By Equipment, By End-use (Residential, Commercial, Industrial), By Country, And Segment Forecasts

Published Date: April - 2025 | Publisher: MRA | No of Pages: 210 | Industry: Chemical & Material Research | Format: Report available in PDF / Excel Format

View Details Buy Now 2999 Download Sample Ask for Discount Request CustomizationNorth America HVAC Services Market Trends

Increased urbanization and construction, especially in the residential and commercial sectors, are contributing significantly towards market growth. The increasing number of new residential constructions, commercial business offices, retail hubs, and hotel buildings has created an increased demand for installation, maintenance, and retrofitting services. Moreover, more stringent energy-saving regulations and corporate social responsibility measures are driving the acceptance of new-generation HVAC technologies that minimize carbon footprints and energy expenses.

Download Sample Ask for Discount Request Customization

Also, growing end-user awareness towards energy efficiency and the increasing demand for eco-friendly HVAC solutions are leading to market growth. Technological innovations in HVAC products, such as smart thermostats and IoT devices, which provide higher control and energy efficiency, are further bolstering the market.

Report Coverage & Deliverables

PDF report & online dashboard will enable you to understand

Competitive benchmarking

Historical data & forecasts

Company revenue shares

Regional opportunities

Latest trends & dynamics

Request a Free Sample Copy

The Grand Library - BI Enabled Market Research Database

Market Concentration & Characteristics

The North America HVAC services market is moderately concentrated with a combination of large established service providers and small regional players. Large multinational firms tend to lead the market with a variety of HVAC services catering to residential as well as commercial clients. Meanwhile, local players are important in meeting localized needs, providing specialized services that are customized to meet particular market requirements. These local firms tend to be more agile and responsive, responding rapidly to shifts in customer tastes and local regulations. Expansion of the HVAC services market is significantly influenced by increasing focus on energy efficiency, sustainability, and smart technologies.

Innovations today are more concerned with energy-conserving solutions in the form of smart thermostats, next-generation HVAC products, and devices with IoT support to address escalating consumer demand for environmentally friendly as well as money-saving options. The regulatory market in North America, with such agencies as the Environmental Protection Agency (EPA) implementing requirements for the usage of refrigerant and energy conserving, drives the market largely. Service providers need to make sure their solutions meet these changing regulations, especially as requirements around refrigerants and energy usage become tighter. North America HVAC Services Industry Dynamics

Further, HVAC service companies are adapting to green building regulations and sustainability laws to provide environmentally friendly solutions that meet strict energy efficiency requirements. Competition in the market is still intense, with firms distinguishing themselves through total service contracts, 24/7 emergency repair services, and customer-focused maintenance programs. With time, competition is likely to become more heated, with a strong focus on innovation, customer service excellence, and sustainability-informed solutions.

Drivers, Opportunities & Restraints

One of the main drivers is increasing temperatures in consequence of global warming, demanding more air conditioning and energy-efficient HVAC systems. Government regulations and incentives to consume energy-efficient products also increase the demand for the market.

Restraints to the expansion of the HVAC Services market are the exorbitant initial installation costs of sophisticated systems, which discourage some consumers from embracing new technologies. Furthermore, a lack of skilled labor and technicians in the HVAC sector may result in delays and higher service charges.

The increased need for green building activities provides tremendous growth opportunities for HVAC services with emphasis on energy efficiency and sustainability. Further, the emergence of smart homes and building management systems with more automation provides growth avenues for HVAC services providing intelligent solutions. Finally, growth in the residential and commercial building construction markets again provides immense opportunities for HVAC service companies.

But there exist chances in the North America HVAC services market with technology advancements like IoT and AI for real-time monitoring and predictive maintenance. With industries focusing more on sustainability and complying with tighter emissions regulations, manufacturers have an increased opportunity to innovate and design cost-saving and efficient solutions.

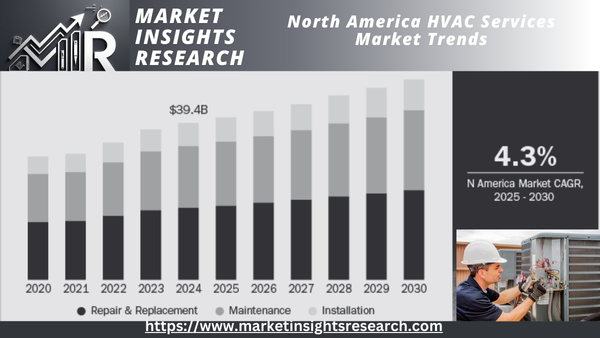

Service Insights

The repair & replacement category led the market in 2024 and held 46.2% market share in 2024 as a result of having an extensive installed base of older HVAC equipment within residential, commercial, and industrial buildings.

When HVAC equipment is near the end of its lifespan, companies and home owners look for economical repair alternatives or simply replace the systems in order to make the equipment more energy-efficient and compliant with current regulations. Also, extreme weather patterns, such as severe winters and hot summer heat waves, bring forward the demand for emergency maintenance and system upgrades, making for a consistent demand for repair and replacement. The installation service segment, however, is the most rapidly growing sub-segment, as a result of the growing number of new installations, especially in the residential and commercial markets, where energy-efficient and sophisticated HVAC systems are being newly installed to address changing building codes and sustainability requirements.

Improvements in zoning systems, variable refrigerant flow (VRF) technology, and smart thermostats have resulted in a trend toward advanced HVAC solutions that need professional installation. Further, strict building regulations and energy efficiency standards, like those established by the U.S. Department of Energy (DOE) and the Environmental Protection Agency (EPA), are driving the adoption of high-performance HVAC systems, further fueling the installation services market growth.

Equipment Insights

The heat pump market led in 2024 with a 21.4% market share in 2024 as it is energy efficient and can perform both heating and cooling, hence being an ideal option for both commercial and residential purposes.

Government incentives and state-level initiatives for decarbonization in favor of increased electrified heating adoption are further driving market growth. Furthermore, developments in dual-fuel hybrid heat pumps and cold-climate heat pump technologies are rendering such systems increasingly practical across a wider temperature range, driving adoption across residential and commercial markets. The air conditioning segment is predicted to witness tremendous growth during the forecast period as a result of rising demand for cooling solutions based on rising temperatures, particularly in countries with intense summer climates, and the developing trend of household and commercial cooling systems.

Moreover, HVAC service companies are witnessing growing demand for retrofits and refrigerant replacement, as older AC equipment is being retired in favor of units that meet low-GWP refrigerant standards. The trend toward ductless mini-split systems and zoning-based cooling solutions is also broadening the market, especially in residential and light commercial markets.

End-use Insights

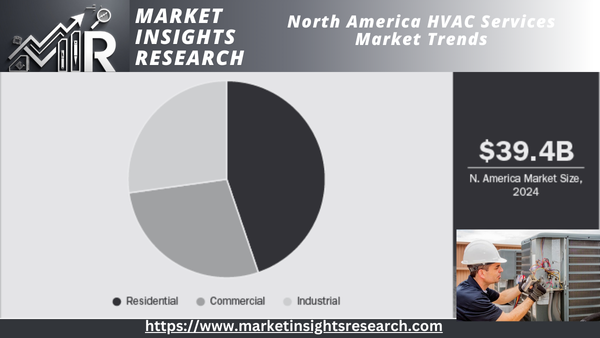

The residential market took the lead in 2024 with a 44.8% market share in 2024 driven by the increasing use of HVAC systems in residences for comfort, indoor air quality, and energy efficiency.

As homeownership rates have increased, along with remodeling activities, especially in suburbs and cities, the need for heating, cooling, and air cleaning systems has risen. Furthermore, the expanding smart home and connected HVAC appliance trend, including smart thermostats and sensors, has raised demand for sophisticated installation and maintenance services. Seasonal climate extremes-severe winters and scorching summers-also are responsible for year-round demand for HVAC solutions for residential buildings. North America HVAC Services Market Share by End-use, 2024 (%)

Commercial buildings are increasingly focusing on energy-efficient HVAC solutions to lower operational expenses and achieve green building certifications like LEED certification. Commercial establishments are also embracing intelligent HVAC systems that have remote monitoring capabilities and automated temperature control, thus improving operational effectiveness. Demand in this segment is fueled by modernization, equipment replacement, and maintenance contracts for ensuring safety and energy compliance standards.

Country Insights

Download Sample Ask for Discount Request Customization

U.S. HVAC Services Market Trends

The U.S. HVAC services market is anticipated to witness strong growth at a significant CAGR of 4.1% during the forecast period.

The driving forces for the HVAC Services market in the U.S. include the energy-efficient demand for systems, both from consumer demand and government incentives for energy conservation. The rise in construction of commercial spaces and residential homes, as well as heightened emphasis on indoor air quality, also drives demand for HVAC services. Additionally, improvements in technology, including smart thermostats and more energy-efficient HVAC systems, are helping fuel growth in the market.

Mexico HVAC Services Market Trends

Mexico's HVAC services market is expected to expand at a CAGR of 4.8% during the forecast period as a result of the increasing use of energy-efficient systems driven by consumer awareness as well as government incentives.

Mexico's growing construction and real estate markets also are key factors driving the demand for HVAC services. Moreover, the rise in temperatures and the necessity of more effective cooling systems for both residential and commercial buildings are pushing the demand for HVAC solutions in Mexico.

Most Important North America HVAC Service Company Insights

Few of the major players present in the market are Lennox International Inc. and Trane.

Lennox International Inc. is a worldwide supplier of climate control solutions for heating, cooling, and refrigeration. The organization boasts a solid distribution system and a widespread presence in the world. The company provides HVAC services including preventative maintenance, planned replacement programs, and installation.

Trane, now Trane Technologies since March 2020, is an HVAC and refrigeration systems company. Trane sells a vast range of heating and cooling products, including air conditioners, heat pumps, gas furnaces. Additionally, the firm provides a range of HVAC system-related services, ranging from rental services, parts support, advanced controls, to energy management solutions, integrated HVAC services, and HVAC system maintenance and monitoring.

Key North America HVAC Service Companies

- DAIKIN INDUSTRIES, Ltd.

- Trane

- Lennox International, Inc.

- Carrier

- Johnson Controls

- Air Mechanical Services LLC

- EMCOR Group Inc.

- Ferguson Enterprises, LLC

- Honeywell International Inc.

- Canada HVAC

- UNITED BUILDING SOLUTIONS

North America HVAC Services Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 40.87 billion |

|

Revenue forecast in 2030 |

USD 50.36 billion |

|

Growth rate |

CAGR of 4.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, equipment, end-use, country |

|

Country scope |

U.S.; Canada; Mexico |

|

Key companies profiled |

DAIKIN INDUSTRIES, Ltd.; Trane; Lennox International, Inc.; Carrier; Johnson Controls; Air Mechanical Services LLC; EMCOR Group Inc.; Ferguson Enterprises, LLC; Honeywell International Inc.; Canada HVAC; UNITED BUILDING SOLUTIONS. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Download Sample Ask for Discount Request Customization

North America HVAC Services Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America HVAC services market report based on service, equipment, end-use, and region

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Installation

-

Maintenance

-

Repair & Replacement

-

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Heat Pump

-

Furnace

-

Boilers

-

Air Purifier

-

Dehumidifier

-

Air Handling Units

-

Ventilation Fans

-

Air Conditioning

-

Chillers

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Related Reports

- Ammonium Nitrate Market - By Product (High Density, Low Density, Solution), By End-user (Agriculture, Mining & Quarrying...

- Glycerol Market Size - By Product Type (Crude, Refined), By Source (Biodiesel, Fatty Acids, Fatty Alcohols, Soap Industr...

- Flat Glass Market - By Product (Basic Float, Laminated, Insulating, Tempered), By Application (Automotive [OEM, Aftermar...

- Electrical Steel Market - By Product (Grain Oriented, Non-Grain-Oriented), By Application (Large Power Transformers, Dis...

- Lithium Cobalt Oxide Market - By Grade (Industrial, Battery), Application (Consumer electronic, Electric vehicle, Medica...

- Conductive Polymers Market – By Conduction Mechanism (Composites Inherently Conductive Polymers, Conducting Polymer), ...

Table of Content

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased Database

1.4.2. GVR’s Internal Database

1.4.3. Secondary Sources

1.4.4. Third Party Perspective

1.4.5. Information Analysis

1.5. Information Analysis

1.5.1. Data Analysis Models

1.5.2. Market Formulation & Data Visualization

1.5.3. Data Validation & Publishing

1.6. Research Scope and Assumptions

1.6.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. North America HVAC Services Market Variables, Trends, & Scope

3.1. Market Concentration & Growth Prospect Mapping

3.2. Industry Value Chain Analysis

3.3. Technology Analysis

3.4. Regulatory Framework

3.5. Vendor Matrix

3.6. Market Dynamics

3.6.1. Market Drivers Analysis

3.6.2. Market Restraints Analysis

3.6.3. Market Opportunity Analysis

3.6.4. Market Challenge Analysis

3.7. North America HVAC Services Market Analysis Tools

3.7.1. Porter’s Analysis

3.7.1.1. Bargaining power of the suppliers

3.7.1.2. Bargaining power of the buyers

3.7.1.3. Threats of substitution

3.7.1.4. Threats from new entrants

3.7.1.5. Competitive rivalry

3.7.2. PESTEL Analysis

3.7.2.1. Political landscape

3.7.2.2. Economic and Social Landscape

3.7.2.3. Technological landscape

3.7.2.4. Environmental landscape

3.7.2.5. Legal landscape

3.8. Economic Mega Trend Analysis

Chapter 4. North America HVAC Services Market: Service Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. North America HVAC Services Market: Service Movement Analysis, 2024 & 2030 (USD Million)

4.3. Installation

4.3.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4. Maintenance

4.4.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5. Repair & Replacement

4.5.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. North America HVAC Services Market: Equipment Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. North America HVAC Services Market: End Use Movement Analysis, 2024 & 2030 (USD Million)

5.3. Heat Pump

5.3.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. Furnace

5.4.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. Boilers

5.5.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.6. Air Purifier

5.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.7. Dehumidifier

5.7.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.8. Air Handling Units

5.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.9. Ventilation Fans

5.9.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.10. Air Conditioning

5.10.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.11. Chillers

5.11.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.12. Others

5.12.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. North America HVAC Services Market: End Use Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. North America HVAC Services Market: End Use Movement Analysis, 2024 & 2030 (USD Million)

6.3. Residential

6.3.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4. Commercial

6.4.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5. Industrial

6.5.1. Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. North America HVAC Services Market: Country Estimates & Trend Analysis

7.1. U.S.

7.1.1. U.S. HVAC Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.1.2. U.S. HVAC Services Market Estimates and Forecasts by Service, 2018 - 2030 (USD Million)

7.1.3. U.S. HVAC Services Market Estimates and Forecasts by End Use, 2018 - 2030 (USD Million)

7.1.4. U.S. HVAC Services Market Estimates and Forecasts by Equipment, 2018 - 2030 (USD Million)

7.2. Canada

7.2.1. Canada HVAC Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.2.2. Canada HVAC Services Market Estimates and Forecasts by Service, 2018 - 2030 (USD Million)

7.2.3. Canada HVAC Services Market Estimates and Forecasts by End Use, 2018 - 2030 (USD Million)

7.2.4. Canada HVAC Services Market Estimates and Forecasts by Equipment, 2018 - 2030 (USD Million)

7.3. Mexico

7.3.1. Mexico HVAC Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.3.2. Mexico HVAC Services Market Estimates and Forecasts by Service, 2018 - 2030 (USD Million)

7.3.3. Mexico HVAC Services Market Estimates and Forecasts by End Use, 2018 - 2030 (USD Million)

7.3.4. Mexico HVAC Services Market Estimates and Forecasts by Equipment, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis by Key Market Participants

8.2. Company Categorization

8.3. Company Market Positioning

8.4. Company Market Share Analysis, 2024

8.5. Company Heat Map Analysis, 2024

8.6. Strategy Mapping

8.7. Company Profiles

8.7.1. DAIKIN INDUSTRIES, Ltd.

8.7.1.1. Participant’s Overview

8.7.1.2. Financial Performance

8.7.1.3. Product Benchmarking

8.7.1.4. Strategic Initiatives

8.7.2. Trane

8.7.2.1. Participant’s Overview

8.7.2.2. Financial Performance

8.7.2.3. Product Benchmarking

8.7.2.4. Strategic Initiatives

8.7.3. Lennox International, Inc.

8.7.3.1. Participant’s Overview

8.7.3.2. Financial Performance

8.7.3.3. Product Benchmarking

8.7.3.4. Strategic Initiatives

8.7.4. Carrier

8.7.4.1. Participant’s Overview

8.7.4.2. Financial Performance

8.7.4.3. Product Benchmarking

8.7.4.4. Strategic Initiatives

8.7.5. Johnson Controls

8.7.5.1. Participant’s Overview

8.7.5.2. Financial Performance

8.7.5.3. Product Benchmarking

8.7.5.4. Strategic Initiatives

8.7.6. Air Mechanical Services LLC

8.7.6.1. Participant’s Overview

8.7.6.2. Financial Performance

8.7.6.3. Product Benchmarking

8.7.6.4. Strategic Initiatives

8.7.7. EMCOR Group Inc.

8.7.7.1. Participant’s Overview

8.7.7.2. Financial Performance

8.7.7.3. Product Benchmarking

8.7.7.4. Strategic Initiatives

8.7.8. Ferguson Enterprises, LLC

8.7.8.1. Participant’s Overview

8.7.8.2. Financial Performance

8.7.8.3. Product Benchmarking

8.7.8.4. Strategic Initiatives

8.7.9. Honeywell International Inc.

8.7.9.1. Participant’s Overview

8.7.9.2. Financial Performance

8.7.9.3. Product Benchmarking

8.7.9.4. Strategic Initiatives

8.7.10. Canada HVAC

8.7.10.1. Participant’s Overview

8.7.10.2. Financial Performance

8.7.10.3. Product Benchmarking

8.7.10.4. Strategic Initiatives

8.7.11. UNITED BUILDING SOLUTIONS

8.7.11.1. Participant’s Overview

8.7.11.2. Financial Performance

8.7.11.3. Product Benchmarking

8.7.11.4. Strategic Initiatives

List Tables Figures

List of Tables

Table 1. North America HVAC Services Market Estimates and Forecasts, by Service, 2018 - 2030 (USD Million)

Table 2. North America HVAC Services Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million)

Table 3. North America HVAC Services Market Estimates and Forecasts, by Equipment, 2018 - 2030 (USD Million)

Table 4. U.S. HVAC Services Market Estimates and Forecasts, by Service, 2018 - 2030 (USD Million)

Table 5. U.S. HVAC Services Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million)

Table 6. U.S. HVAC Services Market Estimates and Forecasts, by Equipment, 2018 - 2030 (USD Million)

Table 7. Canada HVAC Services Market Estimates and Forecasts, by Service, 2018 - 2030 (USD Million)

Table 8. Canada HVAC Services Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million)

Table 9. Canada HVAC Services Market Estimates and Forecasts, by Equipment, 2018 - 2030 (USD Million)

Table 10. Mexico HVAC Services Market Estimates and Forecasts, by Service, 2018 - 2030 (USD Million)

Table 11. Mexico HVAC Services Market Estimates and Forecasts, by End Use, 2018 - 2030 (USD Million)

Table 12. Mexico HVAC Services Market Estimates and Forecasts, by Equipment, 2018 - 2030 (USD Million)

Table 13. Recent Developments & Impact Analysis, By Key Market Participants

Table 14. Company Market Share, 2024

Table 15. Company Heat Map Analysis, 2024

Table 16. Key Companies: Mergers & Acquisitions

Table 17. Key Companies: Partnerships & Collaborations

Table 18. Key Companies: Product Launches

Table 19. Key Companies: Expansion

List of Figures

Fig. 1 Market Segmentation & Scope

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot

Fig. 8 Competitive Landscape Snapshot

Fig. 9 Penetration and Growth Prospect Mapping

Fig. 10 North America HVAC Services Market - Value chain analysis

Fig. 11 North America HVAC Services Market Dynamics

Fig. 12 North America HVAC Services Market: PORTER’s Analysis

Fig. 13 North America HVAC Services Market: PESTEL Analysis

Fig. 14 North America HVAC Services Market, By Service: Key Takeaways

Fig. 15 North America HVAC Services Market: Service Movement Analysis & Market Share, 2024 & 2030

Fig. 16 North America HVAC Services Market Estimates & Forecasts, By Installation, 2018 - 2030 (USD Million)

Fig. 17 North America HVAC Services Market Estimates & Forecasts, By Maintenance, 2018 - 2030 (USD Million)

Fig. 18 North America HVAC Services Market Estimates & Forecasts, By Repair & Replacement, 2018 - 2030 (USD Million)

Fig. 19 North America HVAC Services Market, By End Use: Key Takeaways

Fig. 20 North America HVAC Services Market: End Use Movement Analysis & Market Share, 2024 & 2030

Fig. 21 North America HVAC Services Market Estimates & Forecasts, in Residential, 2018 - 2030 (USD Million)

Fig. 22 North America HVAC Services Market Estimates & Forecasts, in Commercial, 2018 - 2030 (USD Million)

Fig. 23 North America HVAC Services Market Estimates & Forecasts, in Industrial, 2018 - 2030 (USD Million)

Fig. 24 North America HVAC Services Market, By Equipment: Key Takeaways

Fig. 25 North America HVAC Services Market: Equipment Movement Analysis & Market Share, 2024 & 2030

Fig. 26 North America HVAC Services Market Estimates & Forecasts, in Heat Pump, 2018 - 2030 (USD Million)

Fig. 27 North America HVAC Services Market Estimates & Forecasts, in Furnace, 2018 - 2030 (USD Million)

Fig. 28 North America HVAC Services Market Estimates & Forecasts, in Boilers, 2018 - 2030 (USD Million)

Fig. 29 North America HVAC Services Market Estimates & Forecasts, in Air Purifier, 2018 - 2030 (USD Million)

Fig. 30 North America HVAC Services Market Estimates & Forecasts, in Dehumidifier, 2018 - 2030 (USD Million)

Fig. 31 North America HVAC Services Market Estimates & Forecasts, in Air Handling Units, 2018 - 2030 (USD Million)

Fig. 32 North America HVAC Services Market Estimates & Forecasts, in Ventilation Fans, 2018 - 2030 (USD Million)

Fig. 33 North America HVAC Services Market Estimates & Forecasts, in Air Conditioning, 2018 - 2030 (USD Million)

Fig. 34 North America HVAC Services Market Estimates & Forecasts, in Chillers, 2018 - 2030 (USD Million)

Fig. 35 North America HVAC Services Market Estimates & Forecasts, in Others, 2018 - 2030 (USD Million)

Fig. 36 U.S. HVAC Services Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 37 Canada HVAC Services Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 38 Mexico HVAC Services Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 39 Key Company Categorization

Fig. 40 Company Market Positioning

Fig. 41 Strategic Framework

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy