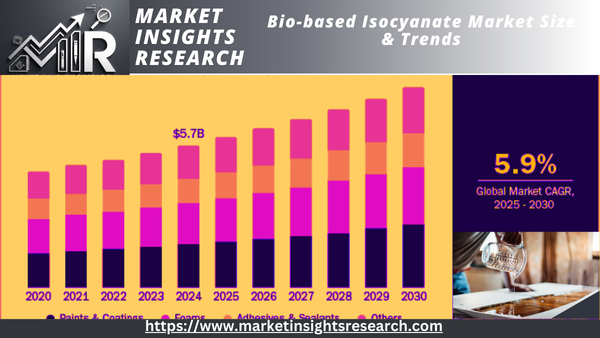

Bio-based Isocyanate Market Size, Share & Trends Analysis Report By Application (Foams, Adhesives & Sealants, Paints & Coatings), By Region (North America, Europe), And Segment Forecasts, 2025 - 2030

Published Date: April - 2025 | Publisher: MRA | No of Pages: 239 | Industry: bulk-chemicals | Format: Report available in PDF / Excel Format

View Details Buy Now 2999 Download Sample Ask for Discount Request CustomizationBio-based Isocyanate Market Size & Trends

The growth of the global bio-based isocyanate industry is being spurred by mounting consumer and regulatory demand for green and sustainable products. Governments across the globe are enforcing strict policies to limit carbon emissions and promote the use of bio-based chemicals instead of petrochemical-based ones. This has opened up great opportunities for bio-based isocyanates, which find wide application in coatings, adhesives, sealants, and elastomers. Growing awareness of industries regarding the advantages offered by bio-based products, such as lower ecological footprint and better product performance, also contributes to market growth.

Download Sample Ask for Discount Request Customization

Technological advancements in bio-based chemical technologies are also a significant factor fueling the growth of the market. Advances in processing bio-based feedstocks and the creation of low-cost production processes have enhanced the scalability and economic viability of bio-based isocyanates. In addition, partnerships among industry stakeholders and research organizations are promoting the innovation of new applications and products, further accelerating the market's growth. These advancements in technology support global sustainability trends, and as such, bio-based isocyanates have become a desirable option for several end-use industries.

The second major driver is the increasing demand for bio-based polyurethanes in industries like automotive, construction, and furniture. In the automotive industry, for example, manufacturers are using more and more bio-based materials to achieve sustainability targets without compromising on performance. The construction industry is also experiencing a transition towards sustainable materials for insulation, flooring, and other purposes. The multifunctionality of bio-based isocyanates in these industries, combined with their durability and functionality improvement potential, is strongly driving market demand.

Report Coverage & Deliverables

PDF report & online dashboard will assist you in understanding

Competitive benchmarking

Historical data & forecasts

Company revenue shares

Regional opportunities

Latest trends & dynamics

Order a Free Sample Copy

The Grand Library - BI Enabled Market Research Database

Drivers, Opportunities & Restraints

Increasing emphasis on diminishing dependence on non-renewable resources is a major driver of the bio-based isocyanate market. Governments and institutions across the globe are incentivizing the application of bio-based materials with incentives and subsidies, urging industries to shift towards greener alternatives. Growing demand for environmentally friendly products, particularly in industries like automotive, packaging, and construction, has also accelerated the use of bio-based isocyanates. Moreover, improvements in biotechnology and bio-refining processes have simplified the production of bio-based isocyanates with improved properties, enhancing their competitiveness against petroleum-based alternatives. This aligns with global sustainability ambitions, spurring increased uptake across sectors.

The market has substantial growth potential owing to continued innovation in bio-based polymer technology and expanding availability of renewable raw materials. Advances in utilisation of agricultural waste and conversion of lignocellulosic biomass are anticipated to improve the cost competitiveness and scale of bio-based isocyanate manufacturing. Additionally, the increasing trend of green building and sustainable manufacturing in different industries provides a window of opportunity for manufacturers to diversify their product lines with bio-based products. Further, unexplored markets in emerging economies, where industrialization and environmental regulations are taking root, provide a profitable ground for market growth.

Although it has a high potential, the global bio-based isocyanate market has challenges like higher production costs relative to traditional isocyanates. Short supply of raw materials and the difficulty in processing bio-based substitutes add additional limitations to market expansion. Moreover, a lack of awareness regarding bio-based isocyanates in developing economies and reluctance to accept new materials in established industries can also limit market penetration. Competitive pricing by established petroleum-based isocyanates is also a hindrance, particularly for price-sensitive applications in emerging markets.

Application Insights

The paints & coatings segment dominated the highest revenue share of more than 31.0% in 2024. The flourishing construction and automotive sectors are driving the use of bio-based isocyanates. Paints and coatings are critical in these sectors, and the growing emphasis on sustainability and green building efforts has created an upsurge in demand for bio-based alternatives. Likewise, the development of bio-based isocyanate technology has improved the performance of coatings and paints by enhancing their durability, chemical resistance, and adhesion, making them a good substitute for conventional products.

The foams segment is expected to grow substantially at a CAGR of 5.8% during the forecast period. One of the major drivers is the growing use of bio-based foams in the automotive industry. Manufacturers are being urged to minimize car weight to achieve better fuel consumption and emissions reduction. Bio-based foams in vehicle interiors, seats, and cushioning are a light-weight, sustainable answer. The trend is especially strong in electric cars, where cutting weight is important to optimize battery performance and mileage.

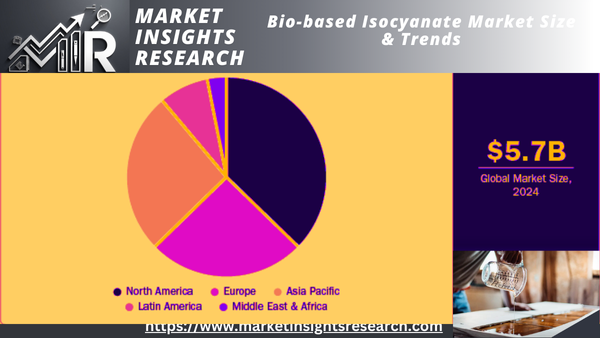

Regional Insights

Download Sample Ask for Discount Request Customization

The North America bio-based isocyanate market accounted for the largest revenue share of 37.4% in 2024. The growth of the market is fuelled by rising environmental awareness and the growing need for green solutions in various industries. With consumers and companies shifting their focus toward lowering their carbon footprint, the use of bio-based products, such as isocyanates, is finding increasing traction. North American governments and regulatory agencies are also enforcing tough environmental regulations to lower emissions and eliminate petroleum-derived chemicals, thus providing a supportive environment for the development of bio-based isocyanates.

U.S. Bio-based Isocyanate Market Trends

The American automotive sector is a key driver of demand for bio-based isocyanates. With the nation moving towards cleaner transportation options, automakers are increasingly adopting bio-based materials for vehicle interiors, seats, and other parts to minimize vehicle weight and enhance fuel efficiency. This is most evident in the increased production of electric vehicles (EVs), where the light weight and environmentally friendly characteristics of bio-based isocyanates align with manufacturers' sustainability objectives.

Asia Pacific Bio-based Isocyanate Market Trends

Construction is one of the key regional growth drivers, driven by urbanization and large-scale infrastructure developments. Demand for energy-efficient and green building materials, including bio-based foams used for insulation, is increasing as nations implement green building programs to achieve energy conservation targets. Likewise, the Asia Pacific automotive industry is also playing a major role in driving market growth. With enhanced production of automobiles and heavy focus on light-weight, fuel-efficient construction, bio-based isocyanates are used extensively in automotive interiors, seats, and cushioning.

China bio-based isocyanate market is anticipated to grow over the forecast period. China's dedication to carbon emission reduction and sustainable development has resulted in tighter environmental regulations. Such policies promote the use of green materials by industries, and subsequently, demand for bio-based isocyanates. The quick development of industries like automotive, construction, and furniture in China has created the demand for polyurethane products that employ isocyanates. Bio-based isocyanates provide a renewable solution compared to conventional petrochemical-based solutions, meeting the industrial growth and environmental objectives of the country.

Europe Bio-based Isocyanate Market Trends

Increased demand for energy-efficient products and constant innovation in bio-based raw materials are driving growth of the Europe bio-based isocyanate market. Government policies and incentives favoring renewable resources also encourage the use of bio-based isocyanates, providing tremendous growth opportunities for regional manufacturers.

Latin America Bio-based Isocyanate Market Trends

Growing consumer demand for the eco-friendliness of products is forcing manufacturers to use bio-based solutions to meet this need. Government policies promoting the utilization of renewable resources and production of bio-based chemicals are also fueling the growth of the market. Increasing availability of bio-based feedstocks and improvement in production technologies further increase the prospects for the adoption of bio-based isocyanates in Latin America, stimulating the growth of the Latin America bio-based isocyanate market.

Key Bio-based Isocyanate Company Insights

Some of the key players operating in the market include BASF and Covestro.

BASF's portfolio includes bio-based polyols and isocyanates, such as its "Impranil" line, which are based on renewable sources and applied in coatings, adhesives, and sealants. These are part of the company's overall sustainability efforts, with a goal to lower environmental footprint while fulfilling the performance needs of industries such as automotive, construction, and furniture.

Covestro is a leading global manufacturer of high-performance materials with a strong emphasis on innovation and sustainability. The company is heavily engaged in the bio-based isocyanate business, providing a variety of eco-friendly products that serve multiple industries, such as automotive, construction, and furniture. Covestro's bio-based isocyanates, for example, Desmodur eco, are produced from renewable raw materials and help to minimize the carbon footprint of polyurethane applications.

Key Bio-based Isocyanate Companies

The following are the leading companies in the bio-based isocyanate market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Dow Chemical

- Covestro

- Wanhua Chemical

- Huntsman

- Bayer MaterialScience

- Mitsui Chemicals

- Sinochem International Corporation

Bio-based Isocyanate Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.07 billion |

|

Revenue forecast in 2030 |

USD 8.09 billion |

|

Growth rate |

CAGR of 5.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

BASF; Dow Chemical; Covestro; Wanhua Chemical; Huntsman; Bayer MaterialScience; Mitsui Chemicals; Sinochem International Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Download Sample Ask for Discount Request Customization

Global Bio-based Isocyanate Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global bio-based isocyanate market report based on application, and region

Download Sample Ask for Discount Request Customization

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Foams

-

Adhesives & Sealants

-

Paints & Coatings

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Related Reports

- Iron & Steel Casting Market - By Material (Iron, Steel), By Process (Sand Casting, Die Casting), By Application (Automot...

- Sodium Carbonate Market - By Type (Natural, Synthetic), By End-Use (Flat Glass, Container Glass, Other Glass, Soaps & De...

- Hybrid Polymer Market Size - By Product (Coating, Sealant & Adhesive, Concrete Additive, Electrode Material, Cleaning So...

- Fluorosurfactants Market - By type (Anionic, Non-Anionic, Cationic, Amphoteric), By Application (Adhesives & Sealants, P...

- Aromatic Solvents Market - By Product (Benzene, Toluene, Xylene), By Application (Pharmaceuticals, Oilfield Chemicals, A...

- Ammonium Nitrate Market - By Product (High Density, Low Density, Solution), By End-user (Agriculture, Mining & Quarrying...

Table of Content

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Information Analysis

1.3.2. Market Formulation & Data Visualization

1.3.3. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Market Variables, Trends, and Scope

3.1. Global Bio-based Isocyanate Market Outlook

3.2. Value Chain Analysis

3.2.1. Raw Material Outlook

3.2.2. Manufacturing/Technology Outlook

3.2.3. Sales Channel Analysis

3.3. Price Trend Analysis

3.3.1. Factors Influencing Prices

3.4. Regulatory Framework

3.4.1. Standards & Compliances

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Challenges Analysis

3.5.4. Market Opportunity Analysis

3.6. Porter’s Five Forces Analysis

3.6.1. Bargaining Power of Suppliers

3.6.2. Bargaining Power of Buyers

3.6.3. Threat of Substitution

3.6.4. Threat of New Entrants

3.6.5. Competitive Rivalry

3.7. PESTLE Analysis

3.7.1. Political

3.7.2. Economic

3.7.3. Social Landscape

3.7.4. Technology

3.7.5. Environmental

3.7.6. Legal

Chapter 4. Bio-based Isocyanate Market: Supplier Portfolio Analysis

4.1. List of Raw Material Suppliers

4.2. Portfolio Analysis/Kraljic Matrix

4.3. Engagement Model

4.4. List of Raw Material Suppliers

4.5. Negotiating Strategies

4.6. Sourcing Best Practices

Chapter 5. Bio-based Isocyanate Market: Application Estimates & Trend Analysis

5.1. Bio-based Isocyanate Market: Resin Movement Analysis, 2023 & 2030

5.2. Foams

5.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

5.3. Adhesives & Sealants

5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

5.4. Paints & Coatings

5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

5.5. Others

5.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Chapter 6. Bio-based Isocyanate Market: Regional Estimates & Trend Analysis

6.1. Regional Analysis, 2023 & 2030

6.2. North America

6.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.2.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.2.3. U.S.

6.2.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.2.3.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.2.4. Canada

6.2.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.2.4.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.2.5. Mexico

6.2.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.2.5.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.3. Europe

6.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.3.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.3.3. Germany

6.3.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.3.3.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.3.4. UK

6.3.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.3.4.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.3.5. France

6.3.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.3.5.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.3.6. Italy

6.3.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.3.6.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.3.7. Spain

6.3.7.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.3.7.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.4. Asia Pacific

6.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.4.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.4.3. China

6.4.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.4.3.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.4.4. India

6.4.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.4.4.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.4.5. Japan

6.4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.4.5.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.5. Latin America

6.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.5.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.5.3. Brazil

6.5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.5.3.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.5.4. Argentina

6.5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.5.4.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.6. Middle East & Africa

6.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.6.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.6.3. Saudi Arabia

6.6.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.6.3.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

6.6.4. South Africa

6.6.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.6.4.2. Market estimates and forecasts, by Application, 2018 - 2030 (USD Million) (Kilotons)

Chapter 7. Competitive Landscape

7.1. Recent Developments by Key Market Participants

7.2. Company Categorization

7.3. Company Market Positioning Analysis, 2024

7.4. Vendor Landscape

7.4.1. List of Key Distributors & Channel Partners

7.4.2. List of End Use

7.5. Strategy Mapping

7.6. Company Profiles/Listing

7.6.1. BASF

7.6.1.1. Company Overview

7.6.1.2. Financial Performance

7.6.1.3. Product Benchmarking

7.6.2. Dow Chemical

7.6.2.1. Company Overview

7.6.2.2. Financial Performance

7.6.2.3. Product Benchmarking

7.6.3. Covestro

7.6.3.1. Company Overview

7.6.3.2. Financial Performance

7.6.3.3. Product Benchmarking

7.6.4. Wanhua Chemical

7.6.4.1. Company Overview

7.6.4.2. Financial Performance

7.6.4.3. Product Benchmarking

7.6.5. Huntsman

7.6.5.1. Company Overview

7.6.5.2. Financial Performance

7.6.5.3. Product Benchmarking

7.6.6. Bayer MaterialScience

7.6.6.1. Company Overview

7.6.6.2. Financial Performance

7.6.6.3. Product Benchmarking

7.6.7. Mitsui Chemicals

7.6.7.1. Company Overview

7.6.7.2. Financial Performance

7.6.7.3. Product Benchmarking

7.6.8. Sinochem International Corporation

7.6.8.1. Company Overview

7.6.8.2. Financial Performance

7.6.8.3. Product Benchmarking

List of Tables

Table 1 Bio-based Isocyanate market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 2 Foams Bio-based Isocyanate market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 3 Adhesives & Sealants Bio-based Isocyanate market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 4 Paints & Coatings Bio-based Isocyanate market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 5 Others Bio-based Isocyanate market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 6 North America Bio-based Isocyanate market estimates & forecast, 2018 - 2030 (USD Million) (Kilotons)

Table 7 North America Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 8 U.S. Bio-based Isocyanate market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 9 U.S. Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 10 Canada Bio-based Isocyanate market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 11 Canada Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 12 Mexico Bio-based Isocyanate market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 13 Mexico Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 14 Europe Bio-based Isocyanate market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 15 Europe Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 16 Germany Bio-based Isocyanate market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 17 Germany Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 18 UK Bio-based Isocyanate market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 19 UK Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 20 France Bio-based Isocyanate market estimates & forecast, 2018 - 2030 (USD Million) (Kilotons)

Table 21 France Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 22 Asia Pacific Bio-based Isocyanate market estimates & forecast, 2018 - 2030 (USD Million) (Kilotons)

Table 23 Asia Pacific Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 24 China Bio-based Isocyanate market estimates & forecast, 2018 - 2030 (USD Million) (Kilotons)

Table 25 China Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 26 India Bio-based Isocyanate market estimates & forecast, 2018 - 2030 (USD Million) (Kilotons)

Table 27 India Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 28 India Bio-based Isocyanate market estimates & forecasts by End-use, 2018 - 2030 (USD Million) (Kilotons)

Table 29 Japan Bio-based Isocyanate market estimates & forecast, 2018 - 2030 (USD Million) (Kilotons)

Table 30 Japan Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 31 Latin America Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 32 Latin America Bio-based Isocyanate market estimates & forecasts by End-use, 2018 - 2030 (USD Million) (Kilotons)

Table 33 Brazil Bio-based Isocyanate market estimates & forecast, 2018 - 2030 (USD Million) (Kilotons)

Table 34 Brazil Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 35 Argentina Bio-based Isocyanate market estimates & forecast, 2018 - 2030 (USD Million) (Kilotons)

Table 36 Argentina Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 37 Middle East & Africa Bio-based Isocyanate market estimates & forecast, 2018 - 2030 (USD Million) (Kilotons)

Table 38 Middle East & Africa Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 39 Saudi Arabia Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

Table 40 South Africa Bio-based Isocyanate market estimates & forecasts by Application, 2018 - 2030 (USD Million) (Kilotons)

List Tables Figures

List of Figures

Fig. 1 Market segmentation

Fig. 2 Information procurement

Fig. 3 Data analysis models

Fig. 4 Market formulation and validation

Fig. 5 Data validating & publishing

Fig. 6 Market snapshot

Fig. 7 Segmental outlook - Application

Fig. 8 Competitive Outlook

Fig. 9 Bio-based Isocyanate market outlook, 2018 - 2030 (USD Million) (Kilotons)

Fig. 10 Value chain analysis

Fig. 11 Market dynamics

Fig. 12 Porter’s Analysis

Fig. 13 PESTEL Analysis

Fig. 14 Bio-based Isocyanate market, by Application: Key takeaways

Fig. 15 Bio-based Isocyanate market, by Application: Market share, 2024 & 2030

Fig. 16 Bio-based Isocyanate market: Regional analysis, 2024

Fig. 17 Bio-based Isocyanate market, by region: Key takeaways

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy