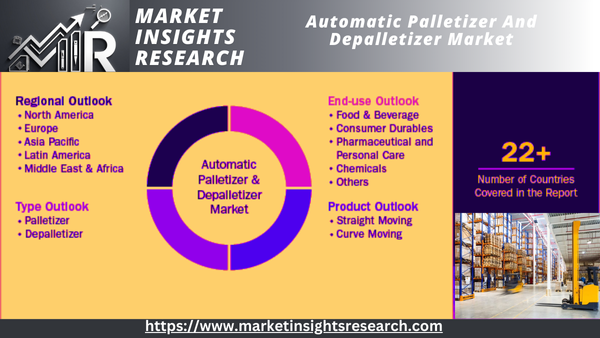

Automatic Palletizer And Depalletizer Market Size, Share & Trends Analysis Report By Type (Palletizer, Depalletizer), By Product (Straight Moving, Curve Moving), By End-use, By Region, And Segment Forecasts

Automatic Palletizer And Depalletizer Market Size, Share & Trends Analysis Report By Type (Palletizer, Depalletizer), By Product (Straight Moving, Curve Moving), By End-use, By Region, And Segment Forecasts

Published Date: April - 2025 | Publisher: MIR | No of Pages: 220 | Industry: Advanced Materials | Format: Report available in PDF / Excel Format

View Details Buy Now 2999 Download Free Sample Ask for Discount Request CustomizationAutomatic Palletizer & Depalletizer Market Size & Trends

The size of the global automatic palletizer and depalletizer market was estimated at USD 1.70 billion in 2024 and is expected to grow at a CAGR of 5.1% during the period from 2025 to 2030. The rising adoption of automation in different industries, along with the rising demand to handle high stock-keeping units (SKUs) effectively, counts, and multiline production operations, is playing a major role in driving the automatic palletizer and depalletizer market. The growth is also driven by the need for efficient operations and enhanced productivity as manufacturers look for innovative ways to improve their production capacity and logistics efficiency.

Download Sample Ask for Discount Request Customization

Palletizers and depalletizers assist in improving the efficiency of a manufacturing unit to load and unload products from and to pallets and thus, assists in improving the plant efficiency as well. A higher accuracy and consistency rate is maintained by this method that reduces the risk of human errors and improves the packaging quality, which is becoming a critical component in a wide range of industries including the booming e-commerce industry. With increasing volumes of online shopping, these automated solutions have become indispensable for efficient handling, sorting, and shipping goods. It aids in minimizing labor, improves speed and accuracy in warehouse operations, and assists with scaling requirements of expanding logistics and e-commerce companies. Such automation plays a crucial role in fulfilling consumer demands for fast deliveries, ultimately driving business growth. Automatic systems may also easily adapt to various product sizes and types, with a greater level of flexibility than traditional palletizing and depalletizing methods.

Regular inventions and ongoing introduction of new products is assisting the entire automatic palletizer and depalletizer market to develop considerably. Technological progress improves packaging line's efficiency, accuracy, and safety, and pulls companies wanting to streamline their processes. In addition, robotic and AI integration is enhancing the versatility and adjustability of the systems, aligning with different requirements of a variety of businesses. The driver of demand behind this technological growth is that organizations are focusing on productivity and value for money within supply chains. Automatic palletizer and depalletizer industry brands offer products which are flexible and open to being accessed by system integrators. These solutions are customized to the requirements, offer hassle-free to integration, and are relative simple to operate. It also ensures sustainability by reducing waste and maximizing warehouse space, which is in line with the existing supply chain obligations.

The automatic palletizers and depalletizers industry growth is limited by high initial investments, which makes the integration of such systems unaffordable for small and medium enterprises (SMEs). Besides, the intricacy involved in implementing such systems in place of or alongside existing production lines without hindering operations represents a major hindrance to the systems' uptake. Inadequate awareness and required skill sets, particularly in the developing nations, represent another barrier to the broadening of the adoption gap. There are, however, bundled growth potential through greater automation in many industries that can enhance the efficiency of supply chains and logistics, eliminate problems to manual labor, and increase effectiveness and productivity. In addition, advances in technologies such as robotics and artificial intelligence make it possible to integrate more advanced, flexible, and effective systems. As companies keep looking for ways to have faster, safer, and more dependable packaging and delivery processes, take-up of such automated systems will increase, bringing in considerable market opportunities.

Report Coverage & Deliverables

PDF report & online dashboard will assist you in knowing

Competitive benchmarking

Historical data & forecasts

Company revenue shares

Regional opportunities

Latest trends & dynamics

Download Sample Ask for Discount Request Customization

Type Insights

The palletizer market segment dominated the market and held 65.6% of the total revenue share in 2024, as they provide an economical solution by automating the stacking and arranging of products on pallets. This greatly accelerates the packaging and storage process and assists in optimizing the warehouse operations. Moreover, ever-increasing focus on workplace safety is also driving the market further. Manual palletizing is prone to cause a serious risk of injuries, which are effectively mitigated by the palletizers so that the work environment is safe. The companies are making an effort to make their operations efficient, which is adding to the importance of automated supply chain systems in global markets. Automated palletizing systems minimize goods flow, eliminate bottlenecks and maximize efficiency of warehouses and distribution centers, thus contributing to market growth. In addition, technological improvements in palletizer type that can be used for different products and packages increased the adaptability and efficiency of the systems. The ability to be highly responsive to changes in the market and needs of the customers further promotes the use of palletizing solutions.

The depalletizer market segment commanded a significant market share in 2024. A depalletizer refers to an automated unit meant to remove products from pallets with high efficiency. This process entails breaking bulk loads into individual units or smaller batches for subsequent handling, processing and packaging. Depalletizers play a crucial role in streamlining the workflow in settings that deal with high volumes of goods, making it easier to transition in the supply chain. The rapid growth rate of e-commerce business has spurred the demand for faster and more efficient logistic solutions, which is essential for enhanced product handling at fulfillment centers. By adopting a depalletizer into operations, the food and beverage, pharmaceutical, and manufacturing industries can boost productivity to a considerable extent. Depalletizers mitigate problems related to manual labor, speed up the unloading process, lower the risk of work-related injury, and enhance general operational efficiency.

End-use Insights

The food & beverage market led the segment, with a share of 35.0% in 2024. The food and beverage sector largely relies on automated systems like palletizing and depalletizing. The palletizers stack food and beverage products on pallets in an efficient manner, ready for storage or distribution. This automation accelerates the packaging line, substantially minimizing opportunities for manual handling and related time and enhanced workplace safety. The systems also provide accurate and stable stacking, improved load stability, prevention of product damage during transportation, and preserve high product integrity. All these are key activities of industry, hence automation forms a major component of it.

The pharmaceutical & personal care industry is anticipated to witness the highest CAGR of 6.4% during the forecast period. In this segment, the depalletizers and palletizers are vital in terms of enhancing efficiency. These are machines that stack or unstack goods automatically on pallets, offering faster and more accurate operations compared to manual methods. Pharmaceutical and personal care production demands high levels of hygiene and accuracy that involve minimal product handling, thus limiting contamination risks and ensuring consistency in product packaging and handling. Palletizing machines need to comply with regulatory needs like GMP, FDA, and ISO to ensure product safety and traceability. This allows for smooth transition between production stages and compliance with industry regulations. All these factors are driving the growth of palletizer and depalletizer market in pharmaceutical & personal care industry.

Product Insights

The straight-moving segment market held the largest share in the global market with a revenue share of 71.6% in 2024. It is a dependable, ergonomic, and structured substitute for manual transport procedures in food and beverages, pharmaceuticals, and other contamination-susceptible consumer products. It maximizes throughput without complicating and is widely applied throughout high-speed production facilities, packaging boxes or cases for shipment and distribution, and stacking unitized packaging. It provides immense advantages, such as enhanced speed and efficiency in palletizing operations. These machines are precision-built and can process different product weights and sizes, maintaining uniformity in pallet constructions. These machines reduce the risk of workplace injury related to manual palletizing and their ease of operation and low maintenance contribute to minimizing operational downtime and enhancing overall productivity.

The curve-breaking segment is expected to register the highest CAGR of 5.8% during the forecast period. It is a curve-moving palletizing system where the products are transported over curved conveyor systems, and palletizing takes place at specific points after the products have moved through the curved course. Compared to straight-moving palletizers, which utilize linear conveyor systems, curve-moving palletizers offer a greater product flow flexibility and can accept more complex layout arrangements within factories. Its key benefit is its effectiveness in maneuvering and placing packages with precision. This system enables smooth processing of various packages and reduces damage risks during palletization. Its curved movement aspect provides smooth changeovers and maximizes space through precise stacking of products tightly and evenly. This leads to improved processing speeds and greatly minimizes chances of errors, improving overall productivity and efficiency of operations.

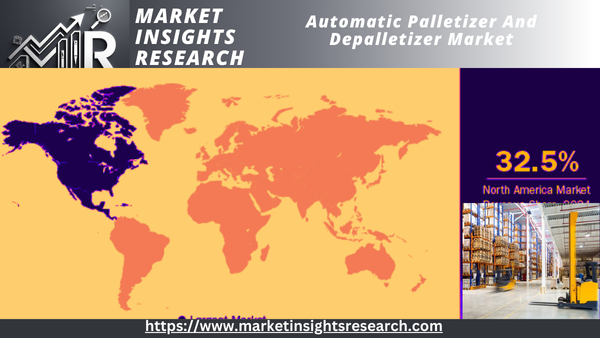

Regional Insights

Download Sample Ask for Discount Request Customization

North America automatic palletizer market led the overall market by way of revenue share of 32.5% in 2024. The North American automatic palletizers and depalletizers market is witnessing huge growth because of rising automation in the manufacturing industries of the region. Demand for such systems is being integrated extensively, emphasis on energy-efficient automated systems. It minimizes reliance on conventional methods, providing consistent and secure operations. These systems also assist critical industries such as food & beverage and pharmaceuticals in adhering to Good Manufacturing Practices (GMP) and FDA regulations, ensuring accurate, sanitary, and safe handling of products. Major players in the market are also investing in research and development to provide innovative products and establish a competitive advantage. Additionally, the increasing food & beverage market, together with the increasing requirement for efficient warehouse operations, is also supporting the growth of the market in the North American region.

U.S. Automatic Palletizer And Depalletizer Market Trends

The U.S. automatic palletizer and depalletizer market will grow at the highest CAGR of 6.3% during the forecasting period. U.S.' automatic and depalletizer market is witnessing high growth because of America's increasing requirement for efficient, faster warehousing, and distribution systems. Enterprises look for efficient means to rationalize their supply chains and the cost of handling materials. These automatic systems hugely improve end use handling operations' safety, accuracy, and productivity. Furthermore, the growth of e-commerce has fueled the demand for improved and quicker packaging and shipping solutions, leading to their increased use.

Europe Automatic Palletizer And Depalletizer Market Trends

The European market of automatic palletizer and depalletizer is expanding significantly with technology and the ever-growing demand for solutions for better warehouses efficiency. European companies are researching into automation palletizing and depalletizing systems in an effort to save costs and drive productivity. The e-commerce firm can process larger orders at largely decreased material handling cost and burden. This comes into play when dealing with companies in pharmaceuticals, groceries, and health products.

The market is heavily impacted by stringent labor safety and regulatory frameworks. They make sure that workplaces meet high safety standards, encouraging implementation of automation technologies to reduce manual handling and prevent workplace accidents. As a result, firms are investing more in such automated systems to meet the regulations, improve operating efficiency, and increase worker safety, thereby fueling market growth in the region.

Asia Pacific Automatic Palletizer And Depalletizer Market Trends

The need for depalletizers and automatic palletizers in Asia Pacific is fueled by the region's surging e-commerce, rising manufacturing operations, and expanding demand for effective logistics solutions. High-speed industrialization and the use of smart manufacturing processes also fuel market growth substantially. China, India, and Japan invest a lot in automation technologies to increase productivity. Several international electronics and automotive original equipment manufacturers have outshored production to regional nations, leading to widespread use of automated solutions in APAC producers. Companies here are also endeavoring to remain competitive globally through investments in automation of manufacturing processes to enhance productivity, product as well as services quality, and consistency in light of increasing worldwide demand. Besides, the growth of the food and beverage industry requires the addition of sophisticated packaging solutions, fueling market expansion further.

Market Key Automatic Palletizer And Depalletizer Company Insights

A few important companies that deal in the industry are ABB Ltd., Mitsubishi Electric Corporation, and KUKA AG, among others.

ABB Ltd. is a world leader in robotics and automation type. The organization provides a broad spectrum of solutions, such as automatic palletizers and depalletizers in the packaging and end-use handling sector. These systems improve efficiency, accuracy, and safety in various industries, such as food and beverage, pharmaceuticals, and consumer goods. ABB Ltd. provides extensive robotics and automation expertise with a high emphasis on innovation and sustainability.

Mitsubishi Electric Corporation is a premier developer and producer of automated industrial solutions. It has a variety of systems in its six business segments titled industrial automation systems, electronic devices, energy and electric systems, information and communication systems, home appliances, and others. The corporation provides services to various sectors such as industrial manufacturing and warehouse & logistics.

Bastian Solutions LLC, Ehcolo AS and DAN-Palletiser A/S are a few of the key emerging market players in the automatic palletizer and depalletizer market.

Bastian Solutions LLC became an important participant in the automatic depalletizer and palletizer business. Bastian Solutions LLC maintains experience in coming up with inventive and effective solutions for various end use industries. The firm stands out through customized solutions for optimization of warehouse operation, enhance productivity, and save operational expenses while demonstrating a great commitment to customer service.

Denmark-based Ehcolo AS became a cutting-edge palletizing and depalletizing solutions company. The firm creates and produces innovative, highly efficient automated systems for dealing with all kinds of goods. Their solutions cater to industries ranging globally and are renowned for their reliability and precision and flexibility, to maximize productivity line efficiencies.

Key Automatic Palletizer And Depalletizer Companies

The following are the leading companies in the automatic palletizer and depalletizer market. These companies collectively hold the largest market share and dictate industry trends.

- Mitsubishi Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- ABB Ltd.

- FANUC Corporation

- Yaskawa Electric Corporation

- KUKA AG

- Krones AG

- Brenton, LLC.

- DAN-Palletiser A/S

- Remtec Automation, LLC.

- Bastian Solutions, LLC

- Ehcolo

- Columbia Machine, Inc.

- Pester pac automation GmbH

Recent Developments

In March 2025, Plus One Robotics showcased its end-to-end palletizing and depalletizing solutions at ProMat 2025. The firm also introduced a new Partner Portal to enable solution providers and system integrators. This step is a testament to its commitment towards promotion of automation and its partner ecosystem strengthening.

In January 2024, ABB Ltd. finalized the acquisition of Sevensense, a Swiss start-up company recognized for its high-level 3D vision navigation style for autonomous mobile robots (AMRs). From 2018, Sevensense has made a reputation for itself in the industrial automation segment. The acquisition is expected to boost the strengths of ABB Ltd. in their automatic palletizing and depalletizing machines.

In May 2023, KUKA AG launched a new KMP 600-S diffDrive mobile platform automated guided vehicle (AGV) system. The system involves a partnership between a KUKA KR IONTEC robot and Mujin inside a cell that optimizes the palletizing and depalletizing of consumer products. The robot's operation inside the cell is accurately controlled by the merger of a Mujin controller and a built-in camera system.

Automatic Palletizer And Depalletizer Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.78 billion |

|

Revenue forecast in 2030 |

USD 2.30 billion |

|

Growth rate |

CAGR of 5.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Type, product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; Japan; China; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Mitsubishi Electric Corporation; Kawasaki Heavy Industries, Ltd.; ABB Ltd.; FANUC Corporation; Yaskawa Electric Corporation; KUKA AG; Krones AG; Brenton, LLC.; DAN-Palletiser A/S; Remtec Automation, LLC.; Bastian Solutions, LLC; Columbia Machine, Inc.; Ehcolo; Pester pac automation GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Download Sample Ask for Discount Request Customization

Global Automatic Palletizer And Depalletizer Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global automatic palletizer and depalletizer market report on the basis of type, product, end-use, and region

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Palletizer

-

Depalletizer

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Straight Moving

-

Curve Moving

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & beverage

-

Consumer Durables

-

Pharmaceutical and Personal Care

-

Chemicals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Related Reports

- Iron & Steel Casting Market - By Material (Iron, Steel), By Process (Sand Casting, Die Casting), By Application (Automot...

- Sodium Carbonate Market - By Type (Natural, Synthetic), By End-Use (Flat Glass, Container Glass, Other Glass, Soaps & De...

- Hybrid Polymer Market Size - By Product (Coating, Sealant & Adhesive, Concrete Additive, Electrode Material, Cleaning So...

- Fluorosurfactants Market - By type (Anionic, Non-Anionic, Cationic, Amphoteric), By Application (Adhesives & Sealants, P...

- Aromatic Solvents Market - By Product (Benzene, Toluene, Xylene), By Application (Pharmaceuticals, Oilfield Chemicals, A...

- Ammonium Nitrate Market - By Product (High Density, Low Density, Solution), By End-user (Agriculture, Mining & Quarrying...

Table of Content

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Automatic Palletizer and Depalletizer Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related Market Outlook

3.2. Industry Value Chain Analysis

3.3. Regulatory Framework

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Challenges

3.4.4. Industry Opportunities

3.5. Industry Analysis Tools

3.5.1. Porter’s Five Forces Analysis

3.5.2. Macro-environmental Analysis

Chapter 4. Automatic Palletizer and Depalletizer Market: Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Automatic Palletizer and Depalletizer Market: Type Movement Analysis & Market Share, 2024 & 2030

4.3. Palletizer

4.3.1. Palletizer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4. Depalletizer

4.4.1. Depalletizer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Automatic Palletizer and Depalletizer Market: Product Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Automatic Palletizer and Depalletizer Market: Product Movement Analysis & Market Share, 2024 & 2030

5.3. Straight moving

5.3.1. Straight-moving Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. Curve-moving

5.4.1. Curve-moving Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Automatic Palletizer and Depalletizer Market: End Use Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Automatic Palletizer and Depalletizer Market: End Use Movement Analysis & Market Share, 2024 & 2030

6.3. Food & Beverage

6.3.1. Food & Beverage Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4. Consumer Durables

6.4.1. Consumer Durables Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5. Pharmaceutical and Personal Care

6.5.1. Pharmaceutical and Personal Care Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6. Chemicals

6.6.1. Chemicals Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7. Others

6.7.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Automatic Palletizer and Depalletizer Market: Regional Estimates & Trend Analysis

7.1. Regional Movement Analysis & Market Share, 2024 & 2030

7.2. North America

7.2.1. North America Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.2.2. U.S.

7.2.2.1. Key Country Dynamics

7.2.2.2. U.S. Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.2.3. Canada

7.2.3.1. Key Country Dynamics

7.2.3.2. Canada Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.2.4. Mexico

7.2.4.1. Key Country Dynamics

7.2.4.2. Mexico Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.3. Europe

7.3.1. Europe Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.3.2. Germany

7.3.2.1. Key Country Dynamics

7.3.2.2. Germany Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.3.3. France

7.3.3.1. Key Country Dynamics

7.3.3.2. France Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.3.4. Italy

7.3.4.1. Key Country Dynamics

7.3.4.2. Italy Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.3.5. Spain

7.3.5.1. Key Country Dynamics

7.3.5.2. Spain Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.3.6. UK

7.3.6.1. Key Country Dynamics

7.3.6.2. UK Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.4.2. Japan

7.4.2.1. Key Country Dynamics

7.4.2.2. Japan Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.4.3. China

7.4.3.1. Key Country Dynamics

7.4.3.2. China Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.4.4. India

7.4.4.1. Key Country Dynamics

7.4.4.2. India Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.4.5. South Korea

7.4.5.1. Key Country Dynamics

7.4.5.2. South Korea Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.4.6. Australia

7.4.6.1. Key Country Dynamics

7.4.6.2. Australia Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.5. Latin America

7.5.1. Latin America Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.5.2. Brazil

7.5.2.1. Key Country Dynamics

7.5.2.2. Brazil Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.5.3. Argentina

7.5.3.1. Key Country Dynamics

7.5.3.2. Argentina Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.6. Middle East & Africa

7.6.1. Middles East & Africa Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.6.2. Saudi Arabia

7.6.2.1. Key Country Dynamics

7.6.2.2. Saudi Arabia Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.6.3. UAE

7.6.3.1. Key Country Dynamics

7.6.3.2. UAE Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

7.6.4. South Africa

7.6.4.1. Key Country Dynamics

7.6.4.2. South Africa Automatic Palletizer and Depalletizer Market Estimates & Forecast, 2018 - 2030 (USD Million)

Chapter 8. Automatic Palletizer and Depalletizer Market - Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company Categorization

8.3. Company Heat Map

8.4. Strategy Mapping

8.4.1. Expansion

8.4.2. Mergers & Acquisition

8.4.3. Partnerships & Collaborations

8.4.4. New Product Launches

8.4.5. Research & Development

8.5. Company Profiles

8.5.1. Mitsubishi Electric Corporation

8.5.1.1. Participant’s Overview

8.5.1.2. Financial Performance

8.5.1.3. Product Benchmarking

8.5.1.4. Recent Developments

8.5.2. Kawasaki Heavy Industries, Ltd.

8.5.2.1. Participant’s Overview

8.5.2.2. Financial Performance

8.5.2.3. Product Benchmarking

8.5.2.4. Recent Developments

8.5.3. ABB Ltd.

8.5.3.1. Participant’s Overview

8.5.3.2. Financial Performance

8.5.3.3. Product Benchmarking

8.5.3.4. Recent Developments

8.5.4. FANUC Corporation

8.5.4.1. Participant’s Overview

8.5.4.2. Financial Performance

8.5.4.3. Product Benchmarking

8.5.4.4. Recent Developments

8.5.5. Yaskawa Electric Corporation

8.5.5.1. Participant’s Overview

8.5.5.2. Financial Performance

8.5.5.3. Product Benchmarking

8.5.5.4. Recent Developments

8.5.6. KUKA AG

8.5.6.1. Participant’s Overview

8.5.6.2. Financial Performance

8.5.6.3. Product Benchmarking

8.5.6.4. Recent Developments

8.5.7. Krones AG

8.5.7.1. Participant’s Overview

8.5.7.2. Financial Performance

8.5.7.3. Product Benchmarking

8.5.7.4. Recent Developments

8.5.8. Brenton, LLC.

8.5.8.1. Participant’s Overview

8.5.8.2. Financial Performance

8.5.8.3. Product Benchmarking

8.5.8.4. Recent Developments

8.5.9. DAN-Palletiser A/S

8.5.9.1. Participant’s Overview

8.5.9.2. Financial Performance

8.5.9.3. Product Benchmarking

8.5.9.4. Recent Developments

8.5.10. Remtec Automation, LLC.

8.5.10.1. Participant’s Overview

8.5.10.2. Financial Performance

8.5.10.3. Product Benchmarking

8.5.10.4. Recent Developments

8.5.11. Bastian Solutions, LLC

8.5.11.1. Participant’s Overview

8.5.11.2. Financial Performance

8.5.11.3. Product Benchmarking

8.5.11.4. Recent Developments

8.5.12. Columbia Machine, Inc.

8.5.12.1. Participant’s Overview

8.5.12.2. Financial Performance

8.5.12.3. Product Benchmarking

8.5.12.4. Recent Developments

8.5.13. Ehcolo

8.5.13.1. Participant’s Overview

8.5.13.2. Financial Performance

8.5.13.3. Product Benchmarking

8.5.13.4. Recent Developments

8.5.14. Pester pac automation GmbH

8.5.14.1. Participant’s Overview

8.5.14.2. Financial Performance

8.5.14.3. Product Benchmarking

8.5.14.4. Recent Developments

List of Tables

Table 1 List of Abbreviations

Table 2 Automatic Palletizer and Depalletizer Market 2018 - 2030 (USD Million)

Table 3 Global Automatic Palletizer and Depalletizer Market Estimates and Forecasts by Type, 2018 - 2030 (USD Million)

Table 4 Global Automatic Palletizer and Depalletizer Market Estimates and Forecasts by Product, 2018 - 2030 (USD Million)

Table 5 Global Automatic Palletizer and Depalletizer Market Estimates and Forecasts by End Use, 2018 - 2030 (USD Million)

Table 6 North America Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 7 North America Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 8 North America Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 9 U.S. Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 10 U.S. Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 11 U.S. Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 12 Canada Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 13 Canada Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 14 Canada Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 15 Mexico Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 16 Mexico Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 17 Mexico Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 18 Europe Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 19 Europe Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 20 Europe Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 21 Germany Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 22 Germany Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 23 Germany Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 24 France Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 25 France Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 26 France Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 27 Italy Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 28 Italy Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 29 Italy Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 30 Spain Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 31 Spain Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 32 Spain Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 33 UK Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 34 UK Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 35 UK Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 36 Asia Pacific Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 37 Asia Pacific Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 38 Asia Pacific Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 39 Japan Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 40 Japan Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 41 Japan Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 42 China Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 43 China Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 44 China Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 45 India Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 46 India Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 47 India Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 48 South Korea Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 49 South Korea Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 50 South Korea Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 51 Australia Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 52 Australia Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 53 Australia Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 54 Latin America Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 55 Latin America Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 56 Latin America Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 57 Brazil Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 58 Brazil Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 59 Brazil Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 60 Argentina Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 61 Argentina Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 62 Argentina Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 63 Middle East & Africa Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 64 Middle East & Africa Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 65 Middle East & Africa Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 66 Saudi Arabia Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 67 Saudi Arabia Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 68 Saudi Arabia Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 69 UAE Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 70 UAE Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 71 UAE Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

Table 72 South Africa Automatic Palletizer and Depalletizer Market by Type, 2018 - 2030 (USD Million)

Table 73 South Africa Automatic Palletizer and Depalletizer Market by Product, 2018 - 2030 (USD Million)

Table 74 South Africa Automatic Palletizer and Depalletizer Market by End Use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market Research Process

Fig. 2 Data Triangulation Techniques

Fig. 3 Primary Research Pattern

Fig. 4 Market Research Approaches

Fig. 5 QFD Modeling for Market Share Assessment

Fig. 6 Information Procurement

Fig. 7 Market Formulation and Validation

Fig. 8 Data Validating & Publishing

Fig. 9 Market Segmentation & Scope

Fig. 10 Automatic Palletizer and Depalletizer Market Snapshot

Fig. 11 Segment Snapshot

Fig. 12 Competitive Landscape Snapshot

Fig. 13 Parent Market Outlook

Fig. 14 Automatic Palletizer and Depalletizer Market Value, 2024 (USD Million)

Fig. 15 Automatic Palletizer and Depalletizer Market - Value Chain Analysis

Fig. 16 Automatic Palletizer and Depalletizer Market - Market Dynamics

Fig. 17 Automatic Palletizer and Depalletizer Market - PORTER’s Analysis

Fig. 18 Automatic Palletizer and Depalletizer Market - PESTEL Analysis

Fig. 19 Automatic Palletizer and Depalletizer Market Estimates & Forecasts, By Type: Key Takeaways

Fig. 20 Automatic Palletizer and Depalletizer Market Share, By Type, 2024 & 2030

Fig. 21 Palletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 22 Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 23 Automatic Palletizer and Depalletizer Market Estimates & Forecasts, By Product: Key Takeaways

Fig. 24 Automatic Palletizer and Depalletizer Market Share, By Product, 2024 & 2030

Fig. 25 Automatic Palletizer and Depalletizer Market Estimates & Forecasts, in Straight-moving, 2018 - 2030 (USD Million)

Fig. 26 Automatic Palletizer and Depalletizer Market Estimates & Forecasts, in Curve-moving, 2018 - 2030 (USD Million)

Fig. 27 Automatic Palletizer and Depalletizer Market Estimates & Forecasts, By End Use: Key Takeaways

Fig. 28 Automatic Palletizer and Depalletizer Market Share, By End Use, 2024 & 2030

Fig. 29 Automatic Palletizer and Depalletizer Market Estimates & Forecasts, in Food & Beverage, 2018 - 2030 (USD Million)

Fig. 30 Automatic Palletizer and Depalletizer Market Estimates & Forecasts, in Consumer Durables, 2018 - 2030 (USD Million)

Fig. 31 Automatic Palletizer and Depalletizer Market Estimates & Forecasts, in Pharmaceutical and Personal Care, 2018 - 2030 (USD Million)

Fig. 32 Automatic Palletizer and Depalletizer Market Estimates & Forecasts, in Chemicals, 2018 - 2030 (USD Million)

Fig. 33 Automatic Palletizer and Depalletizer Market Estimates & Forecasts, in Others, 2018 - 2030 (USD Million)

Fig. 34 Automatic Palletizer and Depalletizer Market Revenue, By Region, 2024 & 2030 (USD Million)

Fig. 35 North America Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 36 U.S. Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 37 Canada Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 38 Mexico Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 39 Europe Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 40 Germany Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 41 France Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 42 Italy Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 43 Spain Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 44 UK Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 45 Asia Pacific Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 46 Japan Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 47 China Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 48 India Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 49 South Korea Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 50 Australia Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 51 Latin America Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 52 Brazil Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 53 Argentina Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 54 Middle East & Africa Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 55 Saudi Arabia Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 56 UAE Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 57 South Africa Automatic Palletizer and Depalletizer Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 58 Key Company Categorization

Fig. 59 Company Market Positioning

Fig. 60 Strategy Mapping

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy