Sterile Bioprocess Filtration Market Size, Share & Trends Analysis Report By Product (Membrane Filters, Cartridge Filters), By Workflow (Upstream, Aseptic Filling), By Material (PES, PVDF), By End Use, By Region, And Segment Forecasts, 2025 - 2030

Published Date: April - 2025 | Publisher: MRA | No of Pages: 220 | Industry: healthcare | Format: Report available in PDF / Excel Format

View Details Buy Now 2999 Download Sample Ask for Discount Request CustomizationSterile Bioprocess Filtration Market Trends

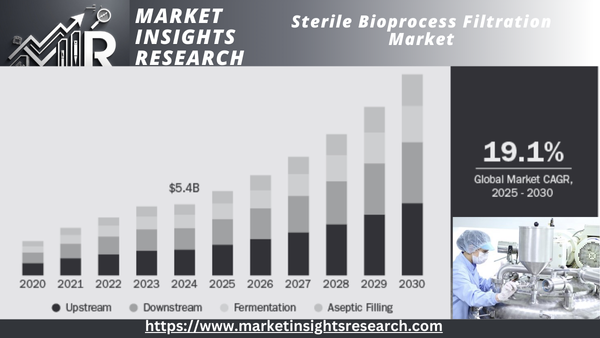

The size of the global sterile bioprocess filtration market in 2024 was estimated to be USD 5.43 billion and is projected to reach a CAGR of 19.10% between 2025 and 2030. It is being spurred by higher demand for biopharmaceuticals, tightening regulatory requirements, and advances in filtration technology. Use of single-use filtration units and increased manufacture of biologics further accelerate market growth.

Download Sample Ask for Discount Request Customization

The emphasis on process efficiency, product safety, and contamination control also drives the need for high-performance filtration solutions. R&D investments, technological advancements, and the increasing focus on personalized medicine drive market growth. Firms invest in innovation, strategic alliances, and capacity increases to address changing industry needs. With advancing bioprocessing, sterile filtration solutions continue to be critical to maintaining compliance, product integrity, manufacturing efficiency optimization, and positioning the market for long-term growth.

In addition, the growth of biologics production is creating the need for sterile filtration solutions because biopharma companies are investing in newer production plants to address the increasing demand for monoclonal antibodies, cell and gene therapies, and recombinant proteins. Sterility in large-scale production is important for regulatory, purity of product, and efficiency of operation. The trend towards continuous and high-throughput bioprocessing also demands more dependable filtration systems to limit the risk of contamination and ensure yield optimization. The growing usage of single-use filtration technologies also boosts flexibility, cuts costs, and decreases the risk of cross-contamination. As pharmaceutical companies and CMOs keep expanding their biologics production on a large scale, demand for high-performance sterile filtration solutions will grow exponentially.

Report Coverage & Deliverables

PDF report & online dashboard will assist you with

Competitive benchmarking

Historical trends & projections

Company share of revenue

Opportunities by region

New trends & dynamics

Request a Free Sample Copy

The Grand Library - BI Enabled Market Research Database

Key Industry Trends Changing Sterilizing Filtration

The sterile filtration environment is changing with a strong emphasis on process intensification to enhance efficiency and minimize production costs. Biopharmaceutical companies incorporate advanced filtration technology to simplify workflows, increase scalability, and maximize resource utilization. This change is motivated by increasing demand for biologics and the requirement for increased throughput in sterile processing.

Another significant trend revolutionizing the sector is the greater use of single-use systems within sterile filtration. These products bring more flexibility, reduce contamination dangers, and have lower operating expenditures, rendering them extremely favored among biomanufacturing applications. With the transition of the sector toward continuous and modular bioprocessing, single-use filtration becomes vital in safeguarding sterility while enhancing efficiency in the process.

Finally, regulatory compliance is also an important driver of sterile filtration trends. With strict regulations like the EU GMP Annex 1, companies invest in sophisticated validation methods and integrity testing in order to fulfill sterility requirements. As regulatory environments continue to change, companies have to balance innovation and compliance to keep efficiency while ensuring product safety.

Embrace of Single-Use Technologies

The increased need for flexible and efficient bioprocessing options has resulted in the extensive use of single-use sterile filtration systems. SUTs differ from conventional stainless-steel filtration systems in that they do not require cleaning, sterilization, and validation between batches of production. This helps to significantly decrease downtime, improve operational efficiency, and enable biopharmaceutical manufacturers to scale up or change production processes rapidly. The advent of biologics, cell and gene therapies, and personalized medicine has also increased the trend toward single-use systems, as they offer more flexibility in multi-product manufacturing environments.

One of the main benefits of single-use filtration systems is that they can reduce the risk of contamination. Conventional filtration systems need thorough cleaning processes, which raise the risk of cross-contamination if not validated. Conversely, single-use filters are sterilized beforehand and thrown away once used, providing a contamination-free process. This is especially vital for high-value biologics, where even minor contamination can result in major financial losses. Furthermore, the removal of cleaning chemicals and water consumption supports efforts for sustainability, such that single-use technologies are an environmentally friendly choice.

With the biopharmaceutical sector growing, investments in single-use filtration technologies are on the increase, fueled by their cost benefits, ease of deployment, and capacity to drive manufacturing flexibility. Regulatory bodies also focus more on sterility, product safety, and process efficiency, promoting the use of single-use filtration technologies. Contract manufacturing organizations (CMOs) are also integrating such technologies to service multiple customers with different production requirements. With ongoing developments in filtration materials and design, single-use technologies will likely be the dominant force in future bioprocessing, providing increased flexibility, enhanced contamination control, and simplified operations in sterile filtration applications.

Market Concentration & Characteristics

The sterile bioprocess filtration industry is marked by moderate to high innovation intensity driven by advancements in membrane technologies, automation, and single-use filtration systems. Continuous R&D investments increase filtration efficiency, sterility assurance, and process scalability. Furthermore, incorporating smart monitoring systems and sustainability-driven designs defines the next generation of filtration solutions. With rising demand for biologics, cell and gene therapies, and personalized medicine, innovation remains a major driver of market competitiveness and long-term growth.

The sterile bioprocess filtration market is also defined by moderate merger and acquisition activity among the top players. Top players make acquisitions of niche filtration technology companies to build capabilities, strengthen competitive positions, and address changing biopharma requirements. M&A strategies also assist companies in growing global footprints, enhancing regulatory compliance, and driving innovation due to the increasing biologics and personalized medicine markets.

Sterile Bioprocess Filtration Industry Dynamics

The bioprocess filtration industry for sterile applications is also under intense regulatory oversight because of strict quality, safety, and compliance requirements specified by regulatory agencies such as the FDA and EMA. Companies need to achieve sterility, product integrity, and process validation, necessitating ongoing innovation and rigorous compliance with changing biopharmaceutical regulations.

The sterile bioprocess filtration sector has an exponential degree of product expansion, fueled by advances in membrane filtration, single-use systems, and automated filtration technologies. Increasing demand for biopharmaceuticals and regulatory compliance drive the development of high-efficiency, contamination-free filtration solutions. Firms are constantly innovating to improve scalability, sterility assurance, and process optimization, as a result, creating a diverse and swiftly evolving product profile.

Regional growth is a major driver with moderate to high growth in the sterile bioprocess filtration market, driven by growing biopharmaceutical production, regulatory development, and investment in infrastructure. Emerging economies are seeing growing uptake of cutting-edge filtration technologies, whereas mature regions emphasize technology development and capacity increase, which leads to overall market growth. For example, in May 2022, Merck put €440 million (USD 476.47 million) to work in building out membrane and filtration manufacturing capacity in Ireland by growing the capability in Carrigtwohill and opening a new facility in the Blarney Business Park at Cork.

Product Insights

The membrane filters segment held the largest market share in terms of revenue of 31.46% in 2024. The increase is mainly driven by the increased need for sterile filtration in biopharmaceutical production, especially vaccine production, monoclonal antibodies, and cell culture applications. Strict regulatory requirements and ongoing innovation in membrane technology have also contributed to increased adoption. As contamination control and process efficiency gain greater importance, membrane filters continue to be vital in sterile bioprocess filtration, fueling continued market growth.

The cartridge filters segment is expected to expand at the highest CAGR through the forecast period, driven by growing demand for high-efficiency filtration in biopharmaceutical production. The segment is being helped by advancements in filter technology, increased use of single-use systems, and rigorous regulatory demands for sterility. Also, the growing production of vaccines and biologics fuels the demand for cost-efficient and scalable filtration solutions. With the industry focusing increasingly on process efficiency and contamination management, cartridge filters are expected to see high growth.

Workflow Insights

The upstream segment accounted for the highest revenue of 36.22% in 2024. The expansion is fueled by rising demand for effective filtration solutions for cell culture, fermentation, and media preparation. Increased manufacturing of biologics, monoclonal antibodies, and vaccines have driven the downstream demand for upstream sterile filtration in bioprocessing. Also driving market growth have been advancements in single-use filters and regulatory recommendations for contamination controls. With a greater emphasis in the future being placed on the innovation of biopharmaceuticals and reducing process inefficiency, the upstream segment will remain in the prime position for many years to come.

The aseptic filling segment is expected to register the highest CAGR of 21.11% growth during the forecast period due to the expanding focus on drug production without any contamination. The rise in demand for biologics, vaccines, and sterile injectables, along with compliance with stringent regulatory standards, is fueling adoption. Improved automated aseptic processing and higher adoption of single-use technologies also drive its growth. As biopharmaceutical manufacturing grows, aseptic filling remains essential to maintain product sterility and safety.

Material Insights

The polyethersulfone (PES) segment had the largest revenue share of 36.98% in 2024. The growth is attributed to PES's excellent chemical and thermal stability, high flow rates, and robust membrane integrity, which suit it for biopharmaceutical filtration. Its extensive use in critical applications, such as vaccine sterilization, monoclonal antibodies, and other biologics, also enhances its market position. Also, growing R&D spends in biologics and strict regulatory conditions for ensuring sterility have driven demand for PES-based filtration products. With a growing biopharmaceutical industry and improved membrane technology, PES is set to continue leading the market in the next few years.

The polyvinylidene fluoride (PVDF) segment is projected to exhibit the highest CAGR of 20.26% during the forecast period. This is fueled by its superior chemical resistance, thermal stability at high temperatures, and aggressive mechanical properties, which make it well-suited for sterile bioprocess filtration. Growing use in biopharmaceutical manufacturing and vaccine production and demand for high-performance filter materials further drive its growth. Moreover, developments in membrane technology and regulatory requirements for sterility assurance are driving PVDF's market penetration. With the growth of the biopharmaceutical sector, PVDF-based filtration products will have substantial adoption and growth potential.

End Use Insights

Biotechnology & biopharmaceutical firms had the highest revenue share of 49.49% in 2024 due to increased demand for biologics, vaccines, and innovative therapeutics. Growing investments in R&D, along with strict regulations for sterility assurance, have promoted the use of high-performance filtration technologies. In addition, increased interest in cell and gene therapies as well as increasing investments in building more biopharmaceutical manufacturing plants have only contributed to increasing their market stronghold. As innovation within biologics keeps picking up speed, these firms will be likely to hold a position of dominance within the sterile bioprocess filtration market.

The CMOs & CROs segment is anticipated to register the fastest growth rate over the forecast period, buoyed by the increasing outsourcing of biopharmaceutical manufacturing and research activities. Growing demand for cost-efficient production, regulatory compliance, and advanced expertise has spurred contract services adoption. Increasing pipeline of biologics, gene therapies, and personalized medicines further propels market growth. While biopharma organizations concentrate on scalability and efficiency, CMOs & CROs will be at the forefront of developing sterile bioprocess filtration solutions.

Competitive Scenario Insights

The sterile bioprocess filtration industry is extremely competitive, with a combination of dominant players, rising companies, and innovators driving market growth. Well-established industry players like Merck KGaA, Danaher Corporation (Pall Corporation & Cytiva), Sartorius AG, Thermo Fisher Scientific, and 3M control the market with large product portfolios, international presence, and ongoing investments in cutting-edge filtration technologies. These players concentrate on strategic mergers, acquisitions, and partnerships to strengthen their market position and increase their technological prowess.

New entrants and niche biotech companies are also gaining market by developing focused filtration solutions, single-use products, and automation-based bioprocess filtration systems. Repligen Corporation, Meissner Filtration Products, and Asahi Kasei Corporation are capitalizing on innovation to provide customized, high-performance filtration solutions addressing changing biopharmaceutical requirements. Startups and small companies emphasize affordable, scalable, and sustainable filtration technologies to rival industry leaders.

Competitive Scenario Insights

The industry is experiencing ongoing innovation with companies making investments in next-generation membrane filtration, nanofiber-based filters, and intelligent monitoring systems to improve process efficiency and sterility assurance. Also, heightened regulatory oversight and rising demand for biologics are forcing companies to create high-purity, contamination-free filtration solutions. Organizations have to focus on R&D, strategic alliances, and local growth as competition increases to gain a competitive advantage.

Regional Insights

Download Sample Ask for Discount Request Customization

North America sterile bioprocess filtration market registered the largest revenue share of 35.99% in 2024. This is spurred by the existence of top-tier biopharmaceutical companies, sophisticated healthcare facilities, and stringent regulatory guidelines. The region is supported by increased R&D spend, fast adaptation of cutting-edge filtration technologies, and mounting production of biologics. Further, rising adoption of single-use filtration systems and stringent sterility requirements from the FDA also fuel market growth. Key companies continue to make investments in technology developments and capacity increases, reinforcing North America's leadership in the global sterile bioprocess filtration market.

U.S. Sterile Bioprocess Filtration Market Trends

The U.S. sterile bioprocess filtration market is anticipated to increase owing to the increase in biopharmaceutical manufacturing, enhanced R&D spending, and strict regulations by the FDA. Increased usage of single-use filtration systems, technological improvements, and increased biologics manufacturing facilities are additional drivers fueling market growth, as demand for high-performing sterile filtration solutions remains strong.

Europe Sterile Bioprocess Filtration Market Trends

The European sterile bioprocess filtration market is anticipated to expand due to the increasing need for biologics, biosimilars, and cell and gene therapies, as well as the strict European Medicines Agency (EMA) regulatory norms. Higher investment in biopharmaceutical production, growth in contract manufacturing organizations (CMOs), and use of single-use filtration technologies also fuel growth in the market. Improvements in filtration systems, automation, and contamination control solutions improve process efficiency to further ensure continued regional market growth.

The UK sterile bioprocess filtration market is projected to grow immensely due to increased biopharmaceutical investments, increased biologics production, and robust regulatory compliance. Rising use of single-use filtration systems and innovative filtration technologies also fuels market growth, providing greater sterility, efficiency, and scalability in bioprocessing.

France sterile bioprocess filtration market will grow, spurred by growth in biopharmaceutical manufacturing, government support of biotechnology, and strict regulatory requirements. The growing acceptance of cutting-edge filtration technologies will also fuel market development and innovation.

The German sterile bioprocess filtration market is anticipated to grow steadily, supported by a robust biopharmaceutical industry, sophisticated manufacturing capabilities, and stringent regulatory requirements. The increasing penetration of single-use filtration technologies also further fuels market growth and innovation.

Asia Pacific Sterile Bioprocess Filtration Market Trends

Asia Pacific sterile bioprocess filtration market will continue to experience the fastest growth in the forecast period with increased production of biopharmaceuticals, expanding research and development expenses, and advancing healthcare infrastructure. Enhanced government policies, presence of nascent biotech companies, and uptake of single-use bioprocess technologies also contribute significantly to accelerating growth in the market. Decreasing costs of manufacture and enhanced demands for biosimilars and biologics also place Asia Pacific as the central hub of bioprocessing development and innovations in sterile filtration.

The Chinese sterile bioprocess filtration market is anticipated to grow exponentially due to fast-paced biopharmaceutical growth, rising government investments, and growing demand for biologics. Developments in filtration technologies and single-use systems also boost market growth and innovation.

Japan sterile bioprocess filtration market is anticipated to expand during the forecast period, fueled by the development of biopharmaceutical manufacturing, robust regulatory compliance, and growing use of single-use filtration technologies. These drivers underpin the nation's growing biologics and biosimilar industries.

The Indian sterile bioprocess filtration market is anticipated to expand during the forecast period due to increased biopharmaceutical production, growing government initiatives, and rising R&D spending. The growth of single-use filtration technologies and biosimilar production even boosts the expansion of the market.

The Middle East and African market for sterile bioprocess filtration is seeing substantial growth in its pharmaceutical and biotech sectors. Nations such as Saudi Arabia are investing in the production of local pharmaceuticals, moving from import-oriented models to local manufacturing. This trend creates a demand for sterile filtration technologies necessary to maintain product safety and efficacy within the region.

The Saudi Arabian sterile bioprocess filtration market will grow steadily throughout the forecast period due to increased investments in the manufacturing of biopharmaceuticals, healthcare initiatives by the government, and growing demand for biologics. The increasing use of cutting-edge filtration technologies also contributes to market growth.

Key Sterile Bioprocess Filtration Company Insights

Many companies in the sterile bioprocess filtration industry are aiming for product approvals and launches to strengthen their market position. In addition, companies are undertaking regional expansions and collaborations to increase manufacturing capacity and share technologies to develop efficient sterile bioprocess filtration.

Key Sterile Bioprocess Filtration Companies

The following are the leading companies in the sterile bioprocess filtration market. These companies collectively hold the largest market share and dictate industry trends.

- Sartorius AG

- 3M Purification

- Danaher

- Repligen Corporation

- Merck KGaA

- Cellab

- Medela

- Thermo Fisher Scientific Inc.

- Meissner Filtration Products Incorporation

- DrM, Dr. Muller AG

Sterile Bioprocess Filtration Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.45 billion |

|

Revenue forecast in 2030 |

USD 15.45 billion |

|

Growth rate |

CAGR of 19.10% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, workflow, material, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Sartorius AG; 3M Purification; Danaher; Repligen Corporation; Merck KGaA; Cellab; Medela; Thermo Fisher Scientific Inc.; Meissner Filtration Products Incorporation; DrM, Dr. Muller AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Download Sample Ask for Discount Request Customization

Global Sterile Bioprocess Filtration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global sterile bioprocess filtration market report based on product, workflow, material, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Membrane Filters

-

Depth Filters

-

Cartridge Filters

-

Capsule Filters

-

Filtration Accessories

-

Other Sterile Filters

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream

-

Downstream

-

Fermentation

-

Aseptic Filling

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyethersulfone (PES)

-

Polyvinylidene Fluoride (PVDF)

-

Polytetrafluoroethylene (PTFE)

-

Nylon

-

Other Materials

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical & Biotechnology Companies

-

CMOs & CROs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Related Reports

- Pet Sitting Services Market – By Service (In-home Pet Sitting Services, Drop-in Visits, Boarding Services, Daycare Ser...

- Veterinary Video Endoscopes Market – By Product (Equipment, PACS Software), Animal Type (Small, Large), Application (D...

- Pet Herbal Supplements Market – By Product Type (Multivitamins & Minerals, Omega 3 Fatty Acids), Application (Digestiv...

- Equine Artificial Insemination Market Size - By Component (Services, Semen [Fresh, Chilled, Frozen], Equipment, Reagents...

- Veterinary Pharmacovigilance Market – By Solution (Software, Services {Core Services, Consulting Services}), Animal Ty...

- Veterinary Assistive Reproduction Technology Market – By Type (Service, Semen, Instruments), Technology (Artificial In...

Table of Content

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Product

1.2.2. Workflow

1.2.3. Material

1.2.4. End use

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

1.10.1. Objective 1

1.10.2. Objective 2

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Sterile Bioprocess Filtration Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Growing adoption of single-use systems

3.2.1.2. Expansion of biologics manufacturing

3.2.2. Market restraint analysis

3.2.2.1. High operational costs

3.3. Industry Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Analysis

Chapter 4. Product Business Analysis

4.1. Product Segment Dashboard

4.2. Global Sterile Bioprocess Filtration Market Product Movement Analysis

4.3. Global Sterile Bioprocess Filtration Market Size & Trend Analysis, by Product, 2018 to 2030 (USD Million)

4.4. Membrane Filters

4.4.1. Membrane filters market estimates and forecasts 2018 - 2030 (USD Million)

4.5. Depth Filters

4.5.1. Depth filters market estimates and forecasts 2018 - 2030 (USD Million)

4.6. Cartridge Filters

4.6.1. Cartridge filters market estimates and forecasts 2018 - 2030 (USD Million)

4.7. Capsule Filters

4.7.1. Capsule filters market estimates and forecasts 2018 - 2030 (USD Million)

4.8. Filtration Accessories

4.8.1. Filtration accessories market estimates and forecasts 2018 - 2030 (USD Million)

4.9. Other Sterile Filters

4.9.1. Other sterile filters market estimates and forecasts 2018 - 2030 (USD Million)

Chapter 5. Workflow Business Analysis

5.1. Workflow Segment Dashboard

5.2. Global Sterile Bioprocess Filtration Market Workflow Movement Analysis

5.3. Global Sterile Bioprocess Filtration Market Size & Trend Analysis, by Workflow, 2018 to 2030 (USD Million)

5.4. Upstream

5.4.1. Upstream market estimates and forecasts 2018 - 2030 (USD Million)

5.5. Downstream

5.5.1. Downstream market estimates and forecasts 2018 - 2030 (USD Million)

5.6. Fermentation

5.6.1. Fermentation market estimates and forecasts 2018 - 2030 (USD Million)

5.7. Aseptic Filling

5.7.1. Aseptic filling market estimates and forecasts 2018 - 2030 (USD Million)

Chapter 6. Material Business Analysis

6.1. Material Segment Dashboard

6.2. Global Sterile Bioprocess Filtration Market Material Movement Analysis

6.3. Global Sterile Bioprocess Filtration Market Size & Trend Analysis, by Material, 2018 to 2030 (USD Million)

6.4. Polyethersulfone (PES)

6.4.1. Polyethersulfone (PES) market estimates and forecasts 2018 - 2030 (USD Million)

6.5. Polyvinylidene Fluoride (PVDF)

6.5.1. Polyvinylidene fluoride (PVDF) market estimates and forecasts 2018 - 2030 (USD Million)

6.6. Polytetrafluoroethylene (PTFE)

6.6.1. Polytetrafluoroethylene (PTFE) market estimates and forecasts 2018 - 2030 (USD Million)

6.7. Nylon

6.7.1. Nylon market estimates and forecasts 2018 - 2030 (USD Million)

6.8. Other Membranes

6.8.1. Other membranes market estimates and forecasts 2018 - 2030 (USD Million)

Chapter 7. End Use Business Analysis

7.1. End Use Segment Dashboard

7.2. Global Sterile Bioprocess Filtration Market End Use Movement Analysis

7.3. Global Sterile Bioprocess Filtration Market Size & Trend Analysis, by End Use, 2018 to 2030 (USD Million)

7.4. Biopharmaceutical and Biotechnology Companies

7.4.1. Biopharmaceutical and biotechnology companies market estimates and forecasts 2018 - 2030 (USD Million)

7.5. CMOs & CROs

7.5.1. CMOs & CROs market estimates and forecasts 2018 - 2030 (USD Million)

7.6. Academic & Research Institutes

7.6.1. Academic & research institutes market estimates and forecasts 2018 - 2030 (USD million)

Chapter 8. Regional Business Analysis

8.1. Regional Market Share Analysis, 2024 & 2030

8.2. Regional Market Dashboard

8.3. Market Size & Forecasts Trend Analysis, 2018 to 2030:

8.4. North America

8.4.1. North America market estimates and forecasts 2018 - 2030 (USD Million)

8.4.2. U.S.

8.4.2.1. Key country dynamics

8.4.2.2. Competitive scenario

8.4.2.3. U.S. market estimates and forecasts 2018 - 2030 (USD Million)

8.4.3. Canada

8.4.3.1. Key country dynamics

8.4.3.2. Competitive scenario

8.4.3.3. Canada market estimates and forecasts 2018 - 2030 (USD Million)

8.4.4. Mexico

8.4.4.1. Key country dynamics

8.4.4.2. Competitive scenario

8.4.4.3. Mexico market estimates and forecasts 2018 - 2030 (USD Million)

8.5. Europe

8.5.1. Europe market estimates and forecasts 2018 - 2030 (USD Million)

8.5.2. UK

8.5.2.1. Key country dynamics

8.5.2.2. Competitive scenario

8.5.2.3. UK market estimates and forecasts 2018 - 2030 (USD Million)

8.5.3. Germany

8.5.3.1. Key country dynamics

8.5.3.2. Competitive scenario

8.5.3.3. Germany market estimates and forecasts 2018 - 2030 (USD Million)

8.5.4. France

8.5.4.1. Key country dynamics

8.5.4.2. Competitive scenario

8.5.4.3. France market estimates and forecasts 2018 - 2030 (USD Million)

8.5.5. Italy

8.5.5.1. Key country dynamics

8.5.5.2. Competitive scenario

8.5.5.3. Italy market estimates and forecasts 2018 - 2030 (USD Million)

8.5.6. Spain

8.5.6.1. Key country dynamics

8.5.6.2. Competitive scenario

8.5.6.3. Spain market estimates and forecasts 2018 - 2030 (USD Million)

8.5.7. Norway

8.5.7.1. Key country dynamics

8.5.7.2. Competitive scenario

8.5.7.3. Norway market estimates and forecasts 2018 - 2030 (USD Million)

8.5.8. Sweden

8.5.8.1. Key country dynamics

8.5.8.2. Competitive scenario

8.5.8.3. Sweden market estimates and forecasts 2018 - 2030 (USD Million)

8.5.9. Denmark

8.5.9.1. Key country dynamics

8.5.9.2. Competitive scenario

8.5.9.3. Denmark market estimates and forecasts 2018 - 2030 (USD Million)

8.6. Asia Pacific

8.6.1. Asia Pacific market estimates and forecasts 2018 - 2030 (USD Million)

8.6.2. Japan

8.6.2.1. Key country dynamics

8.6.2.2. Competitive scenario

8.6.2.3. Japan market estimates and forecasts 2018 - 2030 (USD Million)

8.6.3. China

8.6.3.1. Key country dynamics

8.6.3.2. Competitive scenario

8.6.3.3. China market estimates and forecasts 2018 - 2030 (USD Million)

8.6.4. India

8.6.4.1. Key country dynamics

8.6.4.2. Competitive scenario

8.6.4.3. India market estimates and forecasts 2018 - 2030 (USD Million)

8.6.5. Australia

8.6.5.1. Key country dynamics

8.6.5.2. Competitive scenario

8.6.5.3. Australia market estimates and forecasts 2018 - 2030 (USD Million)

8.6.6. South Korea

8.6.6.1. Key country dynamics

8.6.6.2. Competitive scenario

8.6.6.3. South Korea market estimates and forecasts 2018 - 2030 (USD Million)

8.6.7. Thailand

8.6.7.1. Key country dynamics

8.6.7.2. Competitive scenario

8.6.7.3. Thailand market estimates and forecasts 2018 - 2030 (USD Million)

8.7. Latin America

8.7.1. Latin America market estimates and forecasts 2018 - 2030 (USD Million)

8.7.2. Brazil

8.7.2.1. Key country dynamics

8.7.2.2. Competitive scenario

8.7.2.3. Brazil market estimates and forecasts 2018 - 2030 (USD Million)

8.7.3. Argentina

8.7.3.1. Key country dynamics

8.7.3.2. Competitive scenario

8.7.3.3. Argentina market estimates and forecasts 2018 - 2030 (USD Million)

8.8. MEA

8.8.1. MEA market estimates and forecasts 2018 - 2030 (USD Million)

8.8.2. South Africa

8.8.2.1. Key country dynamics

8.8.2.2. Competitive scenario

8.8.2.3. South Africa market estimates and forecasts 2018 - 2030 (USD Million)

8.8.3. Saudi Arabia

8.8.3.1. Key country dynamics

8.8.3.2. Competitive scenario

8.8.3.3. Saudi Arabia market estimates and forecasts 2018 - 2030 (USD Million)

8.8.4. UAE

8.8.4.1. Key country dynamics

8.8.4.2. Competitive scenario

8.8.4.3. UAE market estimates and forecasts 2018 - 2030 (USD Million)

8.8.5. Kuwait

8.8.5.1. Key country dynamics

8.8.5.2. Competitive scenario

8.8.5.3. Kuwait market estimates and forecasts 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Company Categorization

9.2. Strategy Mapping

9.3. Company Position Analysis, 2024

9.4. Company Profiles/Listing

9.4.1. Sartorious AG

9.4.1.1. Company overview

9.4.1.2. Financial performance

9.4.1.3. Product benchmarking

9.4.1.4. Strategic initiatives

9.4.2. 3M Purification

9.4.2.1. Company overview

9.4.2.2. Financial performance

9.4.2.3. Product benchmarking

9.4.2.4. Strategic initiatives

9.4.3. Danaher

9.4.3.1. Company overview

9.4.3.2. Financial performance

9.4.3.3. Product benchmarking

9.4.3.4. Strategic initiatives

9.4.4. Repligen Corporation

9.4.4.1. Company overview

9.4.4.2. Financial performance

9.4.4.3. Product benchmarking

9.4.4.4. Strategic initiatives

9.4.5. Merck KGaA

9.4.5.1. Company overview

9.4.5.2. Financial performance

9.4.5.3. Product benchmarking

9.4.5.4. Strategic initiatives

9.4.6. Cellab

9.4.6.1. Company overview

9.4.6.2. Financial performance

9.4.6.3. Product benchmarking

9.4.6.4. Strategic initiatives

9.4.7. Medela

9.4.7.1. Company overview

9.4.7.2. Financial performance

9.4.7.3. Product benchmarking

9.4.7.4. Strategic initiatives

9.4.8. Thermo Fisher Scientific Inc.

9.4.8.1. Company overview

9.4.8.2. Financial performance

9.4.8.3. Product benchmarking

9.4.8.4. Strategic initiatives

9.4.9. Meissner Filtration Products Incorporation

9.4.9.1. Company overview

9.4.9.2. Financial performance

9.4.9.3. Product benchmarking

9.4.9.4. Strategic initiatives

9.4.10. DrM, Dr. Muller AG

9.4.10.1. Company overview

9.4.10.2. Financial performance

9.4.10.3. Product benchmarking

9.4.10.4. Strategic initiatives

List Tables Figures

List of Tables

Table 1 List of abbreviation

Table 2 North America sterile bioprocess filtration market, by country, 2018 - 2030 (USD Million)

Table 3 North America sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 4 North America sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 5 North America sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 6 North America sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 7 U.S. sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 8 U.S. sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 9 U.S. sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 10 U.S. sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 11 Canada sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 12 Canada sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 13 Canada sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 14 Canada sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 15 Mexico sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 16 Mexico sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 17 Mexico sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 18 Mexico sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 19 Europe sterile bioprocess filtration market, by country, 2018 - 2030 (USD Million)

Table 20 Europe sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 21 Europe sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 22 Europe sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 23 Europe sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 24 Germany sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 25 Germany sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 26 Germany sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 27 Germany sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 28 UK sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 29 UK sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 30 UK sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 31 UK sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 32 France sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 33 France sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 34 France sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 35 France sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 36 Italy sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 37 Italy sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 38 Italy sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 39 Italy sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 40 Spain sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 41 Spain sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 42 Spain sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 43 Spain sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 44 Denmark sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 45 Denmark sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 46 Denmark sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 47 Denmark sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 48 Sweden sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 49 Sweden sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 50 Sweden sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 51 Sweden sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 52 Norway sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 53 Norway sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 54 Norway sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 55 Norway sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 56 Asia Pacific sterile bioprocess filtration market, by country, 2018 - 2030 (USD Million)

Table 57 Asia Pacific sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 58 Asia Pacific sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 59 Asia Pacific sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 60 Asia Pacific sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 61 China sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 62 China sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 63 China sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 64 China sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 65 Japan sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 66 Japan sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 67 Japan sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 68 Japan sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 69 India sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 70 India sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 71 India sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 72 India sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 73 South Korea sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 74 South Korea sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 75 South Korea sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 76 South Korea sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 77 Australia sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 78 Australia sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 79 Australia sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 80 Australia sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 81 Thailand sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 82 Thailand sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 83 Thailand sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 84 Thailand sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 85 Latin America sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 86 Latin America sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 87 Latin America sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 88 Latin America sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 89 Brazil sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 90 Brazil sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 91 Brazil sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 92 Brazil sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 93 Argentina sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 94 Argentina sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 95 Argentina sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 96 Argentina sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 97 MEA sterile bioprocess filtration market, by country, 2018 - 2030 (USD Million)

Table 98 MEA sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 99 MEA sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 100 MEA sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 101 MEA sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 102 South Africa sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 103 South Africa sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 104 South Africa sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 105 South Africa sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 106 Saudi Arabia sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 107 Saudi Arabia sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 108 Saudi Arabia sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 109 Saudi Arabia sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 110 UAE sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 111 UAE sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 112 UAE sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 113 UAE sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

Table 114 Kuwait sterile bioprocess filtration market, by product, 2018 - 2030 (USD Million)

Table 115 Kuwait sterile bioprocess filtration market, by workflow, 2018 - 2030 (USD Million)

Table 116 Kuwait sterile bioprocess filtration market, by material, 2018 - 2030 (USD Million)

Table 117 Kuwait sterile bioprocess filtration market, by end use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD product & servicing for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Parent market outlook

Fig. 9 Sterile bioprocess filtration market driver impact

Fig. 10 Sterile bioprocess filtration market restraint impact

Fig. 11 Sterile bioprocess filtration market: Product outlook and key takeaways

Fig. 12 Sterile bioprocess filtration market: Product movement analysis

Fig. 13 Membrane filters market estimates and forecast, 2018 - 2030

Fig. 14 Depth filters market estimates and forecast, 2018 - 2030

Fig. 15 Cartridge filters market estimates and forecast, 2018 - 2030

Fig. 16 Capsule filters market estimates and forecast, 2018 - 2030

Fig. 17 Other sterile filters market estimates and forecast, 2018 - 2030

Fig. 18 Filtration accessories market estimates and forecast, 2018 - 2030

Fig. 19 Sterile bioprocess filtration market: Workflow outlook and key takeaways

Fig. 20 Sterile bioprocess filtration market: Workflow movement analysis

Fig. 21 Upstream market estimates and forecast, 2018 - 2030

Fig. 22 Downstream market estimates and forecast, 2018 - 2030

Fig. 23 Fermentation market estimates and forecast, 2018 - 2030

Fig. 24 Aseptic filling market estimates and forecast, 2018 - 2030

Fig. 25 Sterile bioprocess filtration market: Material outlook and key takeaways

Fig. 26 Sterile bioprocess filtration market: Material movement analysis

Fig. 27 Polyethersulfone (PES) market estimates and forecast, 2018 - 2030

Fig. 28 Polyvinylidene fluoride (PVDF) market estimates and forecast, 2018 - 2030

Fig. 29 Polytetrafluoroethylene (PTFE) market estimates and forecast, 2018 - 2030

Fig. 30 Nylon market estimates and forecast, 2018 - 2030

Fig. 31 Other membranes market estimates and forecast, 2018 - 2030

Fig. 32 Sterile bioprocess filtration market: End use outlook and key takeaways

Fig. 33 Sterile bioprocess filtration market: End use movement Analysis

Fig. 34 Academic & research institutes market estimates and forecasts, 2018 - 2030

Fig. 35 Biopharmaceutical - biotechnology companies market estimates and forecasts, 2018 - 2030

Fig. 36 CMOs & CROs laboratories market estimates and forecasts, 2018 - 2030

Fig. 37 Global sterile bioprocess filtration market: Regional outlook and key takeaways

Fig. 38 Global sterile bioprocess filtration market: Regional movement analysis

Fig. 39 North America market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 40 U.S. market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 41 Canada market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 42 Mexico market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 43 Europe market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 44 UK market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 45 Germany market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 46 France market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 47 Italy market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 48 Spain market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 49 Denmark market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 50 Sweden market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 51 Norway market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 52 Asia Pacific market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 53 China market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 54 Japan market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 55 India market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 56 Thailand market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 57 South Korea market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 58 Australia market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 59 Latin America market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 60 Brazil market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 61 Argentina market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 62 Middle East and Africa market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 63 South Africa market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 64 Saudi Arabia market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 65 UAE market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 66 Kuwait market estimates and forecasts, 2018 - 2030 (USD Million)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy