Global X-Ray Vehicle Scanner Market Forecast (2025–2035) by Geographic Scope, Detection Capability (Metal, Explosives), Technology (Transmission X-Ray, Backscatter X-Ray), Product Type (Fixed, Portable Scanners), Application (Airport Security, Customs & Border Control), and End-User (Government Agencies, Airport Operators)

Global X-Ray Vehicle Scanner Market Forecast (2025–2035) by Geographic Scope, Detection Capability (Metal, Explosives), Technology (Transmission X-Ray, Backscatter X-Ray), Product Type (Fixed, Portable Scanners), Application (Airport Security, Customs & Border Control), and End-User (Government Agencies, Airport Operators)

Published Date: April - 2025 | Publisher: Market Insights Research | No of Pages: 240 | Industry: Machinery & Equipments | Format: Report available in PDF / Excel Format

View Details Buy Now 2999 Download Free Sample Ask for Discount Request CustomizationGlobal X-Ray Vehicle Scanner Market Forecast (2025–2035) by Geographic Scope, Detection Capability (Metal, Explosives), Technology (Transmission X-Ray, Backscatter X-Ray), Product Type (Fixed, Portable Scanners), Application (Airport Security, Customs & Border Control), and End-User (Government Agencies, Airport Operators)

X-Ray Vehicle Scanner Market Insights

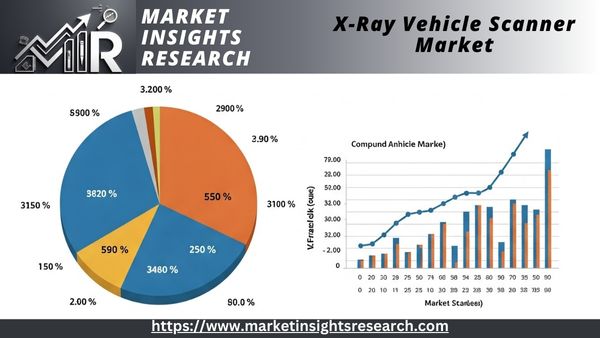

The global X-Ray vehicle scanner market is projected to be valued at approximately USD 550 million in 2025 and is expected to reach nearly USD 1.4 billion by 2035, growing at a compound annual growth rate (CAGR) of 10.3% from 2026 to 2035.

To get key market trends

This rapid growth is being driven by increasing global investments in national security, the modernization of border infrastructure, and technological advancements in automated threat detection.

As security threats become more sophisticated and border control demands intensify, governments and private entities are turning to high-resolution X-Ray vehicle scanners for efficient non-intrusive inspection of cars, trucks, cargo containers, and other vehicles. These systems offer detailed internal imaging, allowing customs and security agents to detect concealed contraband, weapons, explosives, and smuggled goods without having to physically open or disassemble vehicles.

New developments in artificial intelligence and machine learning are revolutionizing the performance of these systems. Next-generation X-Ray scanners now feature intelligent image analysis algorithms that can automatically highlight anomalies, recognize contraband shapes, and even learn from historical inspection data. As a result, inspection throughput has improved significantly, with border crossings and cargo terminals reporting up to a 40% reduction in average vehicle processing time.

The demand for mobile X-Ray scanning solutions is also rising sharply. Unlike fixed installations, mobile scanners offer enhanced deployment flexibility, making them highly suitable for rapid-response scenarios, temporary checkpoints, or remote locations where permanent infrastructure may not exist. These mobile systems, often mounted on trucks or trailers, are being widely adopted by border agencies, defense forces, and emergency services for operations requiring quick setup and mobility.

Beyond border security, X-Ray vehicle scanners are finding critical applications in civil aviation, seaport logistics, public infrastructure protection, and major event security. In airports, they support secure ground transportation and facility screening, while in seaports and logistics hubs, they help speed up customs clearance, reduce cargo dwell time, and ensure compliance with global trade standards. Law enforcement and private security firms are also using these scanners to enhance surveillance at sports arenas, concerts, and political events, especially in response to rising geopolitical tensions and public safety risks.

In parallel, the push for sustainable and low-radiation scanning technologies is gaining momentum. Manufacturers are developing eco-conscious scanner models that optimize radiation exposure levels while maintaining image clarity. These advancements align with stricter international safety regulations and growing public awareness around radiation control in high-traffic environments.

The market outlook for the next decade is optimistic, especially as smart city initiatives, infrastructure upgrades, and global security partnerships continue to gain traction. Investments from both defense budgets and commercial logistics operators are expected to drive innovation, expand deployment, and unlock new opportunities in regions previously underserved by advanced scanning technologies.

With an evolving threat landscape and the rising volume of cross-border movement and global trade, the X-Ray vehicle scanner market is positioned to play a crucial role in next-generation security infrastructure—bridging safety, efficiency, and technological sophistication.

X-Ray Vehicle Scanner Market Key Takeaways

Regional Overview (2025)

In 2025, North America remained the leading region in the global X-ray vehicle scanner market, contributing approximately 32% to overall revenue. This dominance is attributed to the region's large-scale investment in border security and technological modernization of customs operations. Asia Pacific followed closely with a 31% share, driven by rising geopolitical tensions and increased government funding for port and transportation infrastructure. Europe accounted for 21%, fueled by the expansion of intra-regional security measures. Latin America and the Middle East & Africa contributed 9% and 7%, respectively. Notably, Asia Pacific is projected to grow at the fastest rate through 2035, supported by ongoing smart border initiatives and rising demand for mobile and fixed scanning systems in high-traffic trade zones.

Market by Scanner Type

Fixed X-ray vehicle scanners held the largest market share in 2025, comprising around 44% of total global revenue. These systems are integral to permanent border checkpoints, airports, and seaports. However, mobile X-ray scanners are gaining momentum and are projected to expand at a CAGR of 9.1% through 2035, due to their versatility, portability, and rapid deployment capabilities—especially in temporary or remote locations where infrastructure is limited.

Industry Applications

While the chemical industry continued to be a significant end-user segment, accounting for 38% of scanner usage due to strict safety regulations, the pharmaceutical sector emerged as the fastest-growing application area. With increasing global concerns around the illegal transportation of controlled substances and the need for secure medical supply chains, pharmaceutical scanning applications are expected to grow at a CAGR of 10.5% through 2035.

Security Focus and Drivers

Growing concerns around terrorism, smuggling, and cross-border crime are driving adoption across all regions. Investments in national defense, customs modernization, and smart city security solutions are accelerating demand for X-ray vehicle scanners, particularly in North America and Asia Pacific.

Technology Influence

Innovations in imaging software, AI-driven threat recognition, and real-time anomaly detection are significantly enhancing scanner performance. Integration of deep learning models allows systems to automatically flag suspicious objects, reducing reliance on human interpretation and speeding up the inspection process.

X-Ray Vehicle Scanner Market Dynamics

Market Overview

The X-ray vehicle scanner market has experienced strong global momentum in recent years, propelled by heightened security threats, increased global mobility, and the growing demand for automated inspection technologies. These scanners have become indispensable in preventing illegal trafficking, deterring terrorism, and enhancing transportation safety. Governments, defense bodies, and private operators are actively adopting X-ray vehicle scanning systems to strengthen surveillance and secure critical infrastructure.

According to new market estimates, the global X-ray vehicle scanner industry is expected to reach USD 3.5 billion by 2035, with robust growth projected across government and commercial sectors. The systems are being widely deployed at border crossings, high-security facilities, seaports, and event venues, where real-time vehicle screening is critical to public safety and efficient operations.

Report Scope

|

Parameter |

Details |

|

Report Title |

X-Ray Vehicle Scanner Market Report (2025–2035) |

|

Forecast Period |

2025 to 2035 |

|

Base Year for Estimation |

2024 |

|

Historical Data |

2019 to 2023 |

|

Estimated Market Size (2025) |

USD 550 Million |

|

Projected Market Size (2035) |

USD 1.4 Billion |

|

CAGR (2026–2035) |

10.3% |

|

Geographic Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Segments Covered |

Technology, Product Type, Application, End-User, Detection Capability, Region |

|

Research Methodology |

Primary Research, Industry Publications, Regulatory Data, Vendor Interviews |

|

Analysis Tools Used |

SWOT, PESTLE, Porter’s Five Forces, Competitive Benchmarking |

|

Objective |

Analyze growth trends, identify opportunities, and evaluate competitive landscape |

What are the growth opportunities in this market?

Download Sample Ask for Discount Request Customization

Key Market Drivers

-

National Security Imperatives

Increasing global instability and organized crime have pushed border control authorities to invest heavily in vehicle inspection systems. X-ray scanners are pivotal in non-intrusively detecting concealed weapons, drugs, and human trafficking activities—without halting border flow. -

Tech-Driven Efficiency

Advances in image resolution, 3D imaging, and AI-enhanced detection algorithms are enabling faster and more precise scans. This has improved throughput rates at checkpoints and reduced false alarms, making the systems more efficient and cost-effective. -

Rising Demand from Aviation and Customs

Global aviation hubs are increasingly integrating vehicle scanners to monitor support vehicles and service trucks entering secure areas. Additionally, customs agencies are using them to expedite clearance processes, cut delays, and enforce trade compliance.

Key Players in the X-Ray Vehicle Scanner Market

-

Smiths Detection Inc.

-

Leidos Holdings, Inc.

-

Nuctech Company Limited

-

Astrophysics Inc.

-

Rapiscan Systems (Subsidiary of OSI Systems)

-

VOTI Detection Inc.

-

Adani Systems Inc.

-

L3Harris Technologies, Inc.

-

Gilardoni S.p.A.

-

Vidisco Ltd.

Market Restraints

-

High Capital and Operational Costs

The initial investment required to procure and install advanced X-ray systems can be prohibitive, especially for smaller nations or institutions. Maintenance and calibration also require ongoing costs, which may deter widespread deployment in budget-sensitive environments. -

Privacy and Data Compliance Issues

As these systems can reveal detailed imagery of vehicle contents, privacy concerns are on the rise. Implementing data protection measures and ensuring compliance with global privacy regulations such as GDPR is becoming a growing challenge for system operators. -

Regulatory Complexities

Regulatory approvals for new installations, particularly in sensitive or residential areas, can delay project timelines. Strict radiation safety standards may further complicate deployment, especially in countries with rigid public health frameworks.

Market Opportunities

-

Expansion in Logistics and Freight Monitoring

With global trade volumes rising, especially in e-commerce and cross-border shipping, logistics hubs and freight terminals are investing in X-ray vehicle scanners to improve cargo visibility and reduce transit risks. Integration with supply chain management systems presents new growth avenues. -

Smart Cities and Infrastructure Upgrades

Emerging smart city projects are incorporating vehicle scanners into urban security systems. Municipal governments are integrating scanners at key entry points to enhance perimeter defense and automate law enforcement workflows. -

Adoption in Non-Traditional Areas

Beyond customs and airports, the adoption of scanners is expanding into public parking lots, stadiums, industrial facilities, and critical event zones—providing new opportunities for scalable and mobile solutions.

Download Sample Ask for Discount Request Customization

Market Challenges

-

Integration with Legacy Infrastructure

Many existing border and inspection systems are outdated, lacking the compatibility required for seamless integration with new scanner technologies. This creates operational inefficiencies and requires additional investment in system upgrades or replacements. -

Shortage of Skilled Operators

Operating X-ray vehicle scanners requires specialized training. In many regions, a lack of skilled personnel can limit the effectiveness and safety of system use. Governments and private firms will need to invest in workforce development to scale implementation. -

False Positives and Human Intervention Needs

Despite improvements in software and detection capabilities, false positives still occur, requiring manual review. This slows inspection speed and can reduce confidence in fully autonomous operation.

Recent Developments

-

April 2024 – Nuctech Company Limited launched a new AI-powered backscatter scanner capable of automated threat detection in real-time. The system integrates thermal imaging and 3D reconstruction to improve detection accuracy at high-traffic border crossings.

-

February 2024 – Smiths Detection announced a strategic partnership with a European defense ministry to deploy mobile vehicle scanning units at high-risk facilities. The partnership includes AI software updates and post-deployment training support.

-

October 2023 – Leidos Holdings, Inc. secured a $135 million contract with the U.S. Customs and Border Protection agency to enhance scanning infrastructure at ports of entry, focusing on multi-energy X-ray platforms and real-time analytics integration.

-

August 2023 – Rapiscan Systems introduced a lightweight, deployable X-ray scanner model tailored for pop-up event security, capable of full vehicle scanning within two minutes using automated threat flagging.

X-Ray Vehicle Scanner Market Report Segmentation

By Technology

-

Transmission X-Ray

-

Backscatter X-Ray

By Product Type

-

Fixed X-Ray Scanners

-

Portable/Mobile X-Ray Scanners

By Application

-

Airport Security

-

Customs and Border Control

-

Seaport Security

-

Law Enforcement

-

Event Security

By End-User

-

Government Agencies

-

Military & Defense

-

Airport Operators

-

Seaport Authorities

-

Private Security Firms

By Detection Capability

-

Metal Detection

-

Explosives Detection

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

Related Reports

- Mining Pump Market Size - By Pump Type (Centrifugal Pump, Dewatering Pumps, Slurry Pumps, Multi-Stage Pumps, Diaphragm P...

- Industrial Pumps Market Size - By Pump Type (Centrifugal Pumps, Positive Displacement Pumps, Diaphragm Pumps, Gear Pumps...

- Asia Pacific Asphalt Mixing Plants Market Size - By Capacity (Below 50T/H, 50-150T/H, 150-300T/H and Above 300T/H), By T...

- Respiratory Protective Equipment Market Size - By Product (Air Purifying Respirator, Supplied Air Respirator) By Applica...

- Cryogenic Equipment Market Size - By Product (Tanks, Valves, Vaporizers, Pumps, Pipe), By Cryogen (Nitrogen, Oxygen, Nat...

- Europe Industrial Heat Pump Market Size – By Product, By Capacity (< 500 kW, 500 kW to 2 MW, 2 MW - 5 MW, > 5 MW), By ...

Table of Content

Table of Contents

-

Executive Summary

-

Research Methodology

-

Market Overview

-

Market Dynamics

-

Drivers

-

Restraints

-

Opportunities

-

Challenges

-

-

Technological Trends

-

Market Segmentation

-

By Technology

-

By Product Type

-

By Application

-

By End-User

-

By Detection Capability

-

By Region

-

-

Regional Analysis

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

-

Competitive Landscape

-

Market Share Analysis

-

Company Profiles

-

Strategic Initiatives

-

-

Future Outlook

-

Appendix

Will be Available in the sample /Final Report. Please ask our sales Team.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy