Battery as a Service Market Forecast 2025–2035: Powering the EV Future with Smart, Sustainable Battery Solutions

Published Date: April - 2025 | Publisher: Market Insights Research | No of Pages: 455 | Industry: Automotive | Format: Report available in PDF / Excel Format

View Details Buy Now 2999 Download Sample Ask for Discount Request CustomizationBattery as a Service Market Overview

Battery as a Service (BaaS) is redefining the electric mobility and energy storage landscape by allowing users to lease or subscribe to battery packs rather than purchasing them outright. This model is gaining rapid momentum, especially in the electric vehicle (EV) sector, by enabling quick battery swaps, reducing EV ownership costs, and extending battery lifespan.

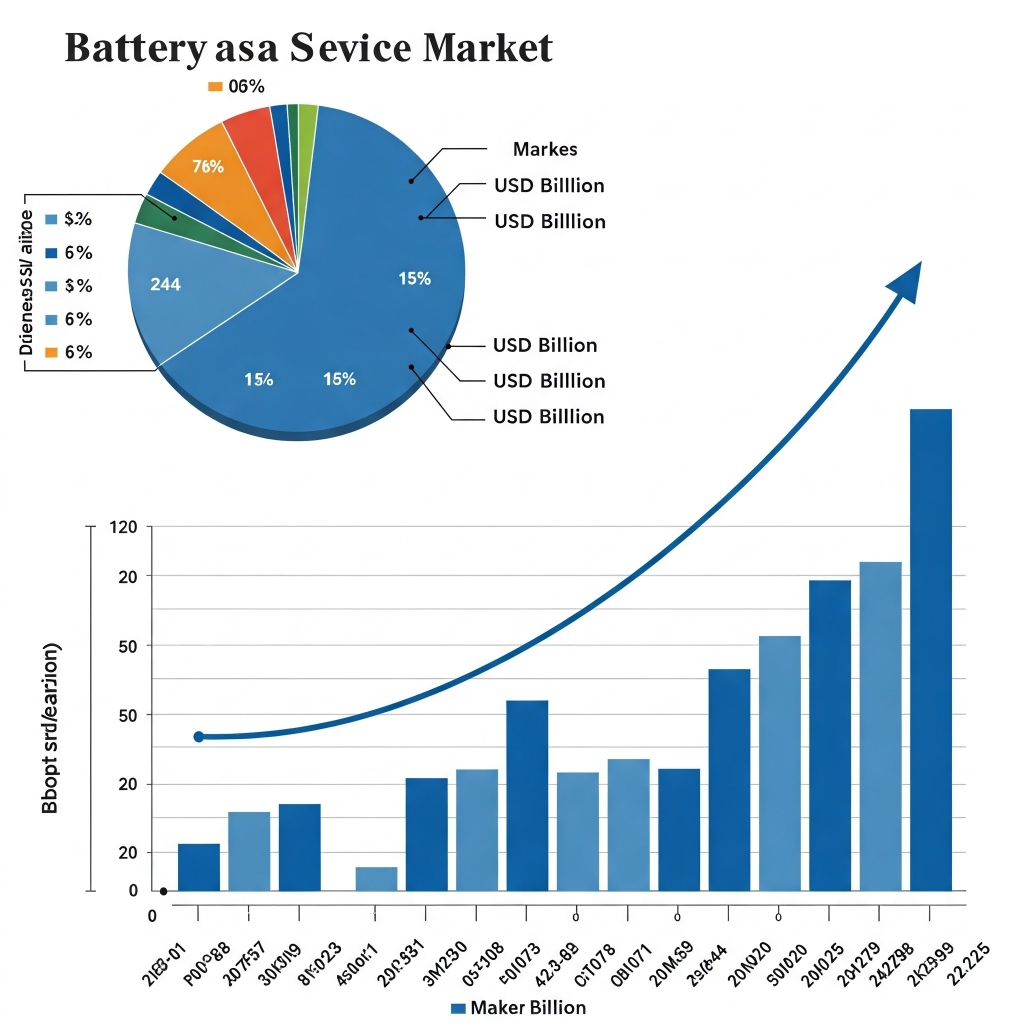

The global Battery as a Service market is projected to reach USD 1.63 billion in 2025 and is anticipated to hit USD 9.20 billion by 2035, expanding at a CAGR of 20.34% over the forecast period. The BaaS model is becoming integral to next-gen mobility ecosystems due to its role in enhancing convenience, supporting circular economies, and optimizing fleet performance.

Download Sample Ask for Discount Request Customization

Market Growth Drivers

Rising EV Adoption and Infrastructure Bottlenecks

With electric vehicle sales surging globally, challenges like long charging times and limited charging infrastructure have become significant barriers. BaaS addresses these issues by offering battery-swapping solutions that allow users to replace depleted batteries with fully charged units in minutes—eliminating downtime and range anxiety.

In China, EV manufacturer NIO has deployed hundreds of battery swap stations where users can exchange batteries in under five minutes. This system is particularly advantageous for fleet operators, ride-hailing services, and logistics firms requiring high vehicle uptime.

Cost Efficiency and Lower Entry Barriers for EV Buyers

Battery packs account for nearly 30–40% of an EV’s cost. BaaS reduces this financial burden by separating battery ownership from vehicle purchase. Through subscription or pay-per-use models, consumers gain access to battery services at lower upfront costs, making EVs more accessible in price-sensitive markets.

Companies like Gogoro and NIO offer flexible leasing models, allowing users to subscribe to battery services tailored to their usage. These models also offer the advantage of continuous access to upgraded battery technologies without replacement hassles.

Market Challenges

High Infrastructure and Capital Investment

The deployment of BaaS networks demands substantial investment. Building battery-swapping stations involves not just land acquisition, but also automation, inventory management, and installation of advanced battery management systems (BMS). These costs are particularly daunting for new entrants and in regions with nascent EV adoption.

While pioneers like NIO and Gogoro have made significant headway, they’ve also faced high operational expenditures in expanding their swap station networks. In areas with low EV penetration, establishing fixed infrastructure may not be economically viable without strong financial or policy backing.

Lack of Standardization Across EV Battery Designs

One of the biggest barriers to scaling BaaS globally is the absence of industry-wide standardization. Battery designs, sizes, chemistries, and connectors differ vastly among EV manufacturers. Without compatibility, universal swapping infrastructure remains a challenge.

China has taken the lead in this direction with NIO and CATL developing swappable formats. However, automakers in Europe and North America remain focused on proprietary battery technologies, limiting cross-brand interoperability and slowing global adoption of BaaS.

Key Market Trends

Growth of Battery Swapping for Two- and Three-Wheelers

Emerging economies are witnessing increased adoption of battery-swapping solutions for electric scooters, motorcycles, and three-wheelers—driven by urban mobility needs and last-mile delivery operations. In India, players like Bounce Infinity, Sun Mobility, and Ola Electric have launched swap stations to improve operational efficiency for daily commuters and fleet operators.

Government policies supporting electrification of two-wheelers and three-wheelers are further fueling the demand for battery-as-a-service models in high-density urban environments.

AI and IoT Integration for Smarter Battery Management

Technological advancements in AI and IoT are enhancing the effectiveness of battery-swapping systems. Smart platforms monitor battery health, forecast maintenance needs, and optimize charging cycles. Companies like NIO have implemented AI-based systems that recommend the optimal battery for each vehicle, reducing wear and improving longevity.

Taiwan’s Gogoro uses IoT-enabled infrastructure to maintain connectivity between vehicles and stations, ensuring efficient operations and seamless customer experience.

Download Sample Ask for Discount Request Customization

Segmentation Analysis

By Service Type

-

Subscription ModelDominates the market due to its fixed cost structure, convenience, and high appeal among commercial EV users. Ideal for fleets, ride-hailing companies, and logistics providers looking for predictable and manageable expenses.

-

Pay-Per-Use ModelOffers flexibility for individual users and small operators who prefer on-demand access without long-term commitment.

Battery as a Service Market Regional Analysis

The Asia-Pacific region dominates the global Battery as a Service (BaaS) market, driven by aggressive government policies, accelerated electric vehicle adoption, and a robust ecosystem of battery-swapping technology providers. Nations such as China, India, and Taiwan have emerged as frontrunners in deploying large-scale BaaS infrastructure, establishing the region as the nucleus of global market expansion.

China stands at the forefront, playing a pivotal role in shaping the BaaS industry. Beyond merely encouraging EV adoption, the Chinese government has introduced strategic regulations, financial incentives, and subsidies specifically tailored to promote battery-swapping networks. This has led to a widespread rollout of battery exchange stations, positioning battery swapping as a viable and competitive alternative to conventional charging.

India and Taiwan are also witnessing rapid growth in BaaS, particularly in the two- and three-wheeler segments. Companies like Gogoro in Taiwan and Sun Mobility in India have developed extensive battery-swapping networks, serving delivery fleets and ride-hailing platforms. These services offer significant advantages in terms of convenience and operational efficiency, making them especially appealing in densely populated urban centers.

The continued success of BaaS in Asia-Pacific is supported by public-private partnerships, favorable policy frameworks, and collaborations with original equipment manufacturers (OEMs). In comparison to North America and Europe, the region benefits from more advanced infrastructure readiness, higher EV penetration, and stronger policy momentum. Asia-Pacific is expected to maintain its leadership position in both market share and technological innovation in the years ahead.

Report Scope for the Global Battery as a Service (BaaS) Market

|

Parameter |

Details |

|

Report Title |

Global Battery as a Service (BaaS) Market Forecast 2025–2035 |

|

Forecast Period |

2025 to 2035 |

|

Base Year |

2024 |

|

Market Size (2025) |

USD 1.63 Billion |

|

Market Size (2035) |

USD 9.20 Billion |

|

CAGR (2025–2035) |

20.34% |

|

Market Segmentation |

By Service Type, Vehicle Type, Application, Region |

|

Service Types Covered |

Subscription Model, Pay-Per-Use Model |

|

Vehicle Types Covered |

Electric Two-Wheelers, Three-Wheelers, Passenger Vehicles, Commercial Vehicles |

|

Applications Covered |

Personal Mobility, Fleet Services, Public Transport, Shared Mobility |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Key Players |

NIO, CATL, Gogoro, Sun Mobility, BYD, Tesla, Aulton, Lithion, Maruti Suzuki, ChargeUp |

|

Growth Drivers |

Rising EV Adoption, Cost-Effective Ownership, Smart Battery Management |

|

Key Challenges |

High Infrastructure Costs, Lack of Standardization |

Download Sample Ask for Discount Request Customization

Battery as a Service Market Recent Developments

In December 2024, global battery manufacturing leader CATL (Contemporary Amperex Technology Co. Ltd.) announced a major advancement in the BaaS sector. Partnering with several automotive manufacturers, CATL co-developed 10 new EV models equipped with swappable batteries. This collaborative initiative aims to revolutionize the EV ecosystem and potentially reduce reliance on traditional fuel stations, replacing a substantial portion with battery swap hubs across China.

In January 2025, Indian automotive giant Maruti Suzuki revealed plans to enhance the country’s EV landscape. The company committed to installing fast-charging points across 100 major cities and is reportedly exploring the launch of a battery leasing model to encourage EV adoption. These efforts are intended to address two major pain points in India’s EV journey—limited charging infrastructure and high battery costs. The unveiling of Maruti’s first electric SUV, the eVX, signals the brand’s serious commitment to electric mobility and its readiness to embrace next-generation energy solutions.

list of key players in the Global Battery as a Service (BaaS) Market

-

Contemporary Amperex Technology Co. Ltd. (CATL)

-

Gogoro Inc.

-

Sun Mobility

-

Tesla Inc.

-

Aulton New Energy

-

Lithion Power Pvt. Ltd.

-

ChargeUp

Battery as a Service Market Segmentation

By Service Type

-

Subscription Model

Fixed monthly or annual payment for battery usage, popular among fleet operators and ride-hailing companies due to predictable costs and continuous access to battery technology.

-

Pay-Per-Use Model

Flexible option ideal for individual users or small fleet operators who pay based on battery usage or number of swaps.

By Vehicle Type

-

Electric Two-Wheelers

-

Electric Three-Wheelers

-

Electric Commercial Vehicles

By Application

-

Personal Mobility

-

Fleet Services (Taxis, Delivery Vehicles, Logistics)

-

Public Transportation

-

Shared Mobility Platforms

By Region

-

Asia-Pacific

-

North America

-

Europe

-

Latin America

Middle East & Africa

Related Reports

- Airbags and Seatbelts Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Airbag Typ...

- India Automotive Lubricant Market – India Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Vehicl...

- E-Drive for Automotive Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Drive Typ...

- Passenger Cars Pumps Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Pump Type (...

- Europe Winter Tire Market By Vehicle Type (Passenger Car; Light Commercial Vehicle; Medium & Heavy Commercial Vehicle), ...

- Saudi Arabia Four-Wheeler Battery Market By Type (Starter Battery, EV Battery), By Vehicle Type (Passenger Car, LCV), By...

Table of Content

Table of Contents

-

Executive Summary

-

Introduction to Battery as a Service (BaaS)

-

Global Market Overview and Forecast (2025–2035)

-

Market Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Market Opportunities

4.4. Industry Challenges -

Key Market Trends

5.1. Rise of Battery Swapping in Two- and Three-Wheelers

5.2. Integration of AI and IoT in Battery Management

5.3. Cost Reduction Strategies for EV Ownership -

Market Segmentation Analysis

6.1. By Service Type (Subscription Model, Pay-Per-Use Model)

6.2. By Vehicle Type (Two-Wheelers, Three-Wheelers, Passenger Vehicles, Commercial Vehicles)

6.3. By Application (Fleet Services, Public Transit, Personal Mobility, Shared Mobility)

6.4. By Region (Asia-Pacific, North America, Europe, Latin America, MEA) -

Regional Market Insights

7.1. Asia-Pacific

7.2. North America

7.3. Europe

7.4. Latin America

7.5. Middle East & Africa -

Competitive Landscape

8.1. Key Players Overview

8.2. Company Profiles

8.3. Strategic Developments and Investments -

Recent Industry Developments

-

Conclusion and Strategic Recommendations

-

Appendix

11.1. Research Methodology

11.2. Glossary and Abbreviations

11.3. Data Sources

List Tables Figures

NA

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy