India Airbag Market By Vehicle Type (Hatchback, SUV/MPV, Sedan, LCV), By Airbag Type (Front Airbag, Knee Airbag, Side Airbag, and Curtain Airbag), By Demand Category (OEM and Replacement), By Region, Competition, Forecast & Opportunities

India Airbag Market By Vehicle Type (Hatchback, SUV/MPV, Sedan, LCV), By Airbag Type (Front Airbag, Knee Airbag, Side Airbag, and Curtain Airbag), By Demand Category (OEM and Replacement), By Region, Competition, Forecast & Opportunities, 2018- 2028F

Published Date: May - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Automotive | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request CustomizationIndia Airbag Market size

Download Sample Ask for Discount Request Customization

Indian airbag market generated a value of USD921.91 million in the year 2022 and the market is expected to grow at a CAGR of 30.98% during the forecast period.

For the safety purpose of the riders, automobile industry has increased the number of airbags in the vehicle. In India, the increasing passenger car production and stringent government policies are driving the growth of the Indian airbag market.

An airbag is the core vehicle safety technology. Airbags are constructed such that in case of a collision, the airbags can deploy fast and deflate fast as well. The components of an airbag include a flexible fabric bag, an airbag cushion, an impact sensor, and an inflation module. Airbags are also referred to by the name supplementary restraint system (SRS) where the material utilized for the construction of the airbag is nylon. In cars, airbags are filled and stowed behind different components of the interior, i.e., dashboard for front airbags and inside the steering wheel. The airbags deploy using the forces that are felt in a collision, alteration in the velocity of the vehicle during collision by which the occupants of the vehicle experience high deceleration and g-forces to open up the airbag. There are two sensors in the car like gyroscopes and accelerometers that are mounted around the vehicle and can be utilized to measure the magnitude and direction of the g-force during the crash. To track the abrupt change in the vehicle for the airbag, an airbag control module (ACM) serves as a miniature computer that continuously tracks information from the sensors.

Strict Government Policies

Currently, there are two compulsory airbags for all cars. One for the driver's seat and another one for the front co-passenger. India's government made the installation of airbag in driver seats in the eight-seater vehicle mandatory from July 2019. The Ministry of Road Transport and Highways issued the notification about the compulsory provision of airbags for the front-seat passenger in a vehicle. The Indian government has made these airbags mandatory in cars to minimize the effect of side and front impacts on the occupants of both, front and rear seats. The Government of India mandated it in 2019 for eight-seater cars to have six airbags. In order to provide the maximum safety of passengers in all segments, the automobile manufacturers are fitting two side curtain/tubes airbags and two side torso airbags protecting all outboard passengers. There are numerous cars in the current market which do not provide airbags for the front passenger in their budget segments like Wagon-R, S-Presso, Maruti Suzuki Alto, Datsun Redi-GO, Hyundai Santro, and cars like Mahindra Bolero, are being retailed without a side airbag in the base variant. This configuration is expected to alter in the near future to meet the new regulations for manufacturers.

Increasing Safety Concerns Among the Customers

The Indian airbag market has been very dynamic in the recent past, with the awareness of the customers towards safety increasing in the last few years. The customers are eager to spend on safer and technology-based vehicles for the application of passive safety systems. Customers are willing to pay a premium for a new safety system in vehicles as well as additional safety features. Based on government reports, road accidents taking place on Indian national highways (NHs) is a sum of 1,16,496 including expressways, in 2020, with a death toll of 47,984, and based on a World Bank report, about 415 individuals perish in road accidents daily in India and 10% of road crash fatalities across the world are reported from India. National Highway Traffic Safety Administration (NHTSA) has released studies in 2020, through which front airbags lower driver deaths by 29% and deaths of front-seat passengers by 32%. All these are altering the mindset of the buyer of the car in India and thus, have an impact on the auto manufacturers for fitting the airbags in the car for the front and for rear seats and curtain sides. Shown technology has an important role to play in shaping purchase of safety features. Trustworthiness, comfort, and safety also have an impact on consumer purchase choice, leading to increasing consumer awareness towards vehicle security, hence driving the market growth.

Market Segmentation

Download Sample Ask for Discount Request Customization

The Indian airbag market is segmented by airbag type, vehicle type, and demand category. By airbag type, the market includes front, side, curtain, and knee airbags. By vehicle type, it's divided into passenger cars, light commercial vehicles, and heavy commercial vehicles. Demand is categorized into OEM (Original Equipment Manufacturer) and replacement.

Detailed Segmentation

-

By Airbag Type

- Front Airbags These are the most common, installed in the steering wheel and front side of the passenger to protect the chest and head.

- Side Airbags Located in the doors or seats to protect occupants from side impacts.

- Curtain Airbags Deployed from the roof to protect the heads and shoulders of passengers in the event of a side or rear impact.

- Knee Airbags Deployed in the floor area to protect the knees of the front passengers.

-

By Vehicle Type

- Passenger Cars This segment dominates the market due to higher production and sales, and the inclusion of more airbags in passenger vehicles compared to other types.

- Light Commercial Vehicles (LCV) Increasingly incorporating airbags for driver safety.

- Heavy Commercial Vehicles (HCV) Also showing growth in airbag adoption.

-

By Demand Category

- OEM (Original Equipment Manufacturer) Airbags installed during the vehicle manufacturing process.

- Replacement Airbags replaced after accidents or due to wear and tear.

-

By Vehicle Type (Specific Examples)

- Hatchback A significant share of the market, especially in the entry-level segment.

- SUV/MPV A fast-growing segment, driven by consumer preference for versatile and spacious vehicles with advanced safety features.

- Sedan Still popular, especially among premium buyers.

Key Trends

- Government Regulations Mandatory airbag requirements in vehicles are driving market growth.

- Safety Awareness Increasing consumer awareness about vehicle safety features is boosting demand for airbags.

- Technological Advancements The development of new airbag technologies is leading to more diverse and advanced airbag systems.

Key players

Toyoda Gosei Minda India Private Limited,

Autoliv India Private Limited,

Rane TRW Steering Systems Limited,

Ashimori India Private Limited

Denso International India Pvt. Ltd.,

Bosch Limited,

Continental India Private Limited,

Daicel Chiral Technologies India Private Limited

Company Profiles

|

Attribute |

Details |

|

Market size value in 2022 |

USD921.91 Million |

|

Revenue Forecast in 2028 |

USD7271.82 Million |

|

Growth Rate |

30.98% |

|

Base Year |

2022 |

|

Historical Years |

2018 – 2022 |

|

Estimated Year |

2023 |

|

Forecast Period |

2023 – 2028 |

|

Quantitative Units |

Revenue in USD Million, Volume in Units, and CAGR for 2018-2022 and 2023-2028 |

|

Report Coverage |

Revenue forecast, volume forecast, company share, competitive landscape, growth factors, and trends |

|

Segments Covered |

· By Vehicle Type · By Airbag Type · By Demand Category · By Region ·  By Company |

|

Region Scope |

East, South, North, West. |

|

Key Companies Profiled |

Toyoda Gosei Minda India Private Limited, Autoliv India Private Limited, Rane TRW Steering Systems Limited, Takata India Private Limited, Mobis India Limited, Ashimori India Private Limited, Denso International India Pvt. Ltd., Bosch Limited, Continental India Private Limited, and Daicel Chiral Technologies India Private Limited |

|

Customization Scope |

10% free report customization with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/pdf format on special request) |

Related Reports

- Australia Automotive Coolant Market – Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Vehicle Ty...

- Catalytic Converter Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Vehicle Type...

- Saudi Arabia Automotive Battery Market – Industry Size, Share, Trends, Opportunity, and Forecast, Segmented by Type (S...

- India Brakepad Market –Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Vehicle Type (Passenger C...

- Automotive Oxygen Sensor Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Sensor ...

- Automotive Induction Motor Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type ...

Table of Content

Here's a sample Table of Contents (TOC) for a market research report on the India Airbag Market:

Table of Contents: India Airbag Market Report

-

Executive Summary

1.1. Market Highlights

1.2. Key Findings

1.3. Recommendations -

Introduction

2.1. Scope of the Report

2.2. Research Methodology

2.3. Market Definitions & Assumptions -

Market Overview

3.1. Industry Background

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. Regulatory Framework

3.4. Value Chain Analysis

3.5. Porter’s Five Forces Analysis -

India Airbag Market Landscape

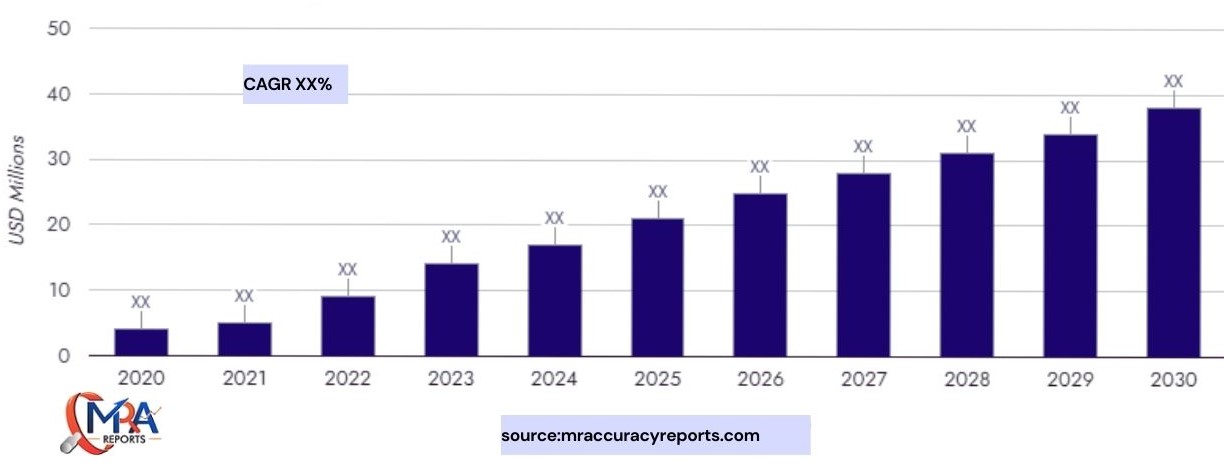

4.1. Market Size & Forecast (Value & Volume, 2020–2030)

4.2. Market Penetration by Vehicle Type

4.3. Pricing Analysis

4.4. Technology Trends -

Segmentation Analysis

5.1. By Airbag Type

5.1.1. Front Airbags

5.1.2. Side Airbags

5.1.3. Knee Airbags

5.1.4. Curtain Airbags

5.2. By Vehicle Type

5.2.1. Passenger Cars

5.2.2. Commercial Vehicles

5.2.3. Two-Wheelers (if applicable)

5.3. By Sales Channel

5.3.1. OEM

5.3.2. Aftermarket -

Regional Analysis

6.1. North India

6.2. South India

6.3. West India

6.4. East India -

Competitive Landscape

7.1. Market Share Analysis

7.2. Company Profiles

7.2.1. Autoliv Inc.

7.2.2. Toyoda Gosei Co., Ltd.

7.2.3. ZF Friedrichshafen AG

7.2.4. Rane TRW Steering Systems

7.2.5. Takata Corporation (now Joyson Safety Systems)

7.2.6. Others -

Recent Developments & Strategic Initiatives

8.1. Mergers & Acquisitions

8.2. Product Launches

8.3. Partnerships and Collaborations -

Market Forecast and Outlook (2025–2030)

9.1. Future Trends

9.2. Demand Projections

9.3. Investment Opportunities -

Appendix

10.1. Glossary of Terms

10.2. Data Sources

10.3. Research Methodology

10.4. About the Authors

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy