Saudi Arabia Spare Parts Market By Vehicle Type (Passenger Car, Commercial Vehicle), By Component Type (Tires, Batteries, Air Filter, Brake Shoe, Spark Plugs, Brake Pad, Brake Caliper, and other) By Service Channel {(DIFM (Do it for Me), OE (Delegating), and DIY (Do it Yourself)}, By Region, Competi

Saudi Arabia Spare Parts Market By Vehicle Type (Passenger Car, Commercial Vehicle), By Component Type (Tires, Batteries, Air Filter, Brake Shoe, Spark Plugs, Brake Pad, Brake Caliper, and other) By Service Channel {(DIFM (Do it for Me), OE (Delegating), and DIY (Do it Yourself)}, By Region, Competition, Forecast & Opportunities, 2017- 2027F

Published Date: April - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Automotive | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request CustomizationSaudi Arabia Spare Parts Market size

Download Sample Ask for Discount Request Customization

Saudi Arabia spare parts market had a value of USD 4,732.85 million in 2021 and is predicted to expand at a CAGR of 6.24% over the forecast period.

Saudi Arabia spare parts market is led by the several factors including the customization of the vehicle that is increasing the demand of the spare parts in the aftermarket. The climate of Saudi Arabia is extremely hot during summer seasons because of which the drivers maintain the air condition on due to which the components get heated up easily and have to get replaced at a certain time span. All these factors are anticipated to propel the Saudi Arabia spare parts market in the next couple of years. The income earned in a specific year by way of sales of parts and chief components, which find application in the replacement market, and for the conversion of a motor vehicle, has been included in the purview of the spare part market, but not consumables and accessories.

Spare parts are the vital part in the vehicles without which any vehicle remains incomplete.

In Saudi Arabia, spare parts' sales have grown over the last few years because the sales of the commercial and passenger vehicles have also grown in Saudi Arabia. COVID-19 affected all industries negatively and the sales declined for all markets in Saudi Arabia. With the easing of COVID-19 restrictions in recent months all markets have begun to recover and have experienced growth in the sales. The economic growth of small and medium scale enterprises is likely to propel the Saudi Arabia spare parts market.

Vehicle Customization

Saudi Arabia has witnessed an increase in the demand for spare parts over the years because more and more people began making performance upgrades on their cars by modifying and enhancing their vehicles' appearance. The demand for vehicle modifications has risen over the past few years, especially among the youth of Saudi Arabia due to reasons like increasing the torque of the engine or enhancing the horsepower, led lighting changes to alter cabin and dash illumination to various colors, giant upgrade, window rinsing to remove harsh light, etc. The rising trend of vehicle customization in Saudi Arabia is increasing the demand for spare parts components in the country.

Growing Awareness of Vehicle Safety

As per the World Health Organization (WHO), 12,317 individuals lost their lives in road traffic collisions in Saudi Arabia in 2020, which comprised 9.19% of all deaths. The country's adjusted death rate stands at 36.13 per 100,000, as per the information. Vehicles carrying faulty replacement parts are among the major reasons for such a high death rate. If vehicle components like brake pads, brake shoes, headlamps, etc. are replaced on a regular basis, a significant amount of deaths can be prevented. Moreover, owners of fleets have started installing brake pads with wear sensors in their vehicles to ensure safety in such situations. Demand for spare parts in Saudi Arabia is being fuelled by the nation's enhanced awareness of auto safety.

Expanding Sales and Distribution Network

Because of a deficiency of manufacturing facilities for vehicles and a reliance on imports, the Saudi spare parts market is made up mainly of replacement market. Manufacturers of automotive spare parts components appoint local distributors in Saudi Arabia to coordinate the demand for their products. They are a proper intermediary between the manufacturer of the automotive spare parts component and the end-user. For example, tires maker Bridgestone chose Al-Talayi Company Limited to be its sole Saudi Arabian distributor. Among others, Hankook Tire chose Bin-Shihon Group of Companies, Pirelli chose United Yousef M.Naghi Co. Ltd, and Goodyear Tire and Rubber Company chose Al Rashed Tires Co. as their distributor. The spare parts components' distributors are continually being added to by the producers of spare parts.

Harsh Climate Leading to Increased Replacement Ratio

Saudi Arabia has very hot weather, and the country's average high temperature is higher than 100 °F (38 °C). The nation is also covered in a 34% sand blanket. The soil becomes more porous due to a lack of vegetation in the country's sandy areas, leading to increased sandstorm activity, and also increasing temperatures during the summer. Therefore, on the journey, the vehicle air conditioners are usually switched on. Regular use of continuous air conditioners reduces the lifespan of air conditioners and components that comprise them, making car part replacement more frequent. Further, due to sandstorms, filter elements like air filters and oil filters have to be replaced often. The harsh weather has resulted in a rise in the frequency of replacement of spare parts components, thus propelling the Saudi Arabia spare parts market.

Market Segmentation

Download Sample Ask for Discount Request Customization

The Saudi Arabia market is divided by vehicle type, component type, service channel, and region. Based on vehicle type, the market is divided into passenger car and commercial vehicle. Under vehicle type, the passenger car segment was the dominant segment with a total of 57.07% share in the year 2021, out of the commercial vehicles. Based on component type, the market is classified into tire, batteries, air filter, brake shoe, spark plugs, brake pad, brake caliper, and others. Based on service channel, the market is segmented into DIFM (Do it for Me), OE (Delegating), and DIY (Do it Yourself). Today, car customization is becoming trendy among young people in the Saudi Arabia as they can customize the car as per their preference, thus the spare part demand is increasing in the aftermarket. Because of this, the Saudi Arabia spare part market is increasing year on year.

Key Market Players

- Robert Bosch GmbH

- DENSO Corporation

- ZF Friedrichshafen AG

- Toyota Boshoku Corporation

- Magna International Inc.

- Valeo

- Hyundai Mobis

- A Mazda Motor Corporation

- Faurecia SE

- Lear Corporation

Company Profiles

|

Attribute |

Details |

|

Market size value in 2021 |

USD4,732.85 Million |

|

Revenue Forecast in 2027 |

USD6,792.59 Million |

|

Growth Rate |

6.24% |

|

Base Year |

2021 |

|

Historical Years |

2017 – 2021 |

|

Estimated Year |

2022 |

|

Forecast Period |

2023 – 2027 |

|

Quantitative Units |

Revenue in USD Million, Volume in Thousand Units, and CAGR for 2017-2021 and 2023-2027 |

|

Report Coverage |

Revenue forecast, volume forecast, company share, competitive landscape, growth factors, and trends |

|

Segments Covered |

· By Vehicle Type · By Component Type · By Service Channel · By Region ·  By Company |

|

Region Scope |

Northern and Central Region, Western Region, Southern Region, Eastern Region |

|

Key Companies Profiled |

Continental AG, Michelin Group, Bridgestone Corporation, The Goodyear Tire & Rubber Company, GS Yuasa International Ltd, Robert Bosch GmbH, 3M Company, Denso Corporation, The Yokohama Rubber Co., Ltd., Hankook & Company Co., Ltd. |

|

Customization Scope |

10% free report customization with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/pdf format on special request) |

Related Reports

- India Automotive Lubricant Market – India Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Vehicl...

- E-Drive for Automotive Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Drive Typ...

- Passenger Cars Pumps Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Pump Type (...

- Europe Winter Tire Market By Vehicle Type (Passenger Car; Light Commercial Vehicle; Medium & Heavy Commercial Vehicle), ...

- Saudi Arabia Four-Wheeler Battery Market By Type (Starter Battery, EV Battery), By Vehicle Type (Passenger Car, LCV), By...

- Saudi Arabia Tire Market By Vehicle Type (Passenger Car, Light Commercial Vehicle, Medium & Heavy Commercial Vehicle, Tw...

Table of Content

Here’s a suggested Table of Contents (TOC) for a report or document on the Saudi Arabia Spare Parts Market:

Table of Contents

-

Executive Summary

1.1 Overview

1.2 Key Findings

1.3 Market Outlook -

Introduction

2.1 Objective of the Report

2.2 Scope of the Study

2.3 Methodology -

Market Overview

3.1 Definition and Classification of Spare Parts

3.2 Industry Lifecycle

3.3 Market Structure and Supply Chain -

Saudi Arabia Automotive Industry Overview

4.1 Automotive Market Trends

4.2 Vehicle Population and Types

4.3 Role of Spare Parts in Automotive Maintenance -

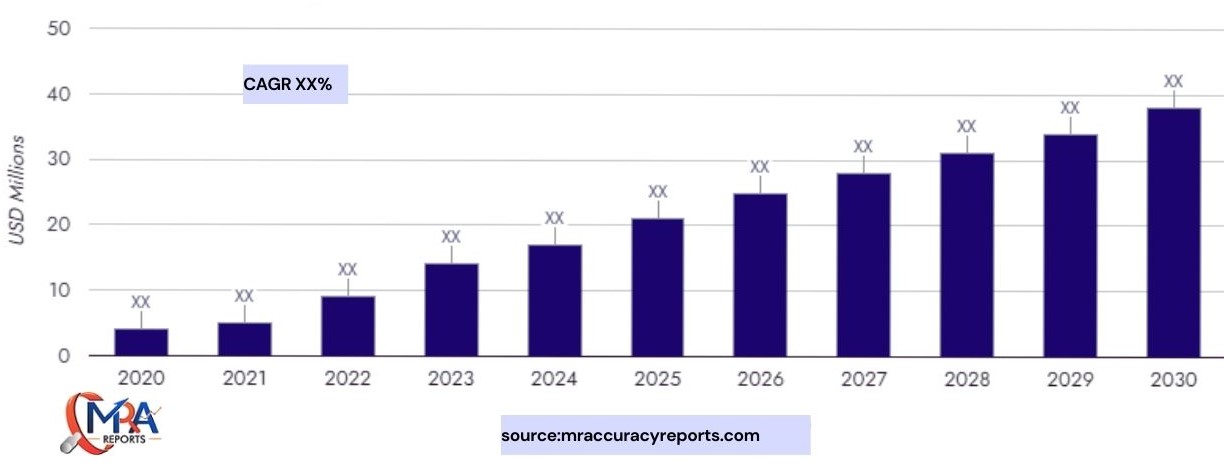

Market Size and Forecast (2020–2030)

5.1 Historical Market Size

5.2 Current Market Size

5.3 Market Forecast by Revenue and Volume -

Market Segmentation

6.1 By Product Type-

Engine Components

-

Electrical Parts

-

Suspension & Brakes

-

Transmission Parts

-

Others

6.2 By Vehicle Type

-

Passenger Cars

-

Commercial Vehicles

-

Two-Wheelers

6.3 By Distribution Channel

-

OEM (Original Equipment Manufacturer)

-

Aftermarket

-

Online Platforms

6.4 By Region

-

Riyadh

-

Jeddah

-

Dammam

-

Other Regions

-

-

Regulatory Framework and Import Policies

7.1 Customs Duties and Tariffs

7.2 Saudi Standards, Metrology and Quality Organization (SASO)

7.3 Vision 2030 Impact -

Competitive Landscape

8.1 Market Share Analysis

8.2 Profiles of Key Players

8.3 Recent Developments -

Consumer Behavior and Demand Drivers

9.1 Price Sensitivity

9.2 Brand Preference

9.3 Maintenance Culture -

Opportunities and Challenges

10.1 Growth Opportunities

10.2 Industry Challenges

10.3 Technology Trends (e.g., EV Parts Demand) -

Strategic Recommendations

11.1 Entry Strategies for New Players

11.2 Expansion Strategies for Existing Companies -

Appendices

12.1 Glossary

12.2 Data Sources

12.3 Abbreviations

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy